Business

To Build BIG THINGS Canada Needs to Rid Itself of BIG BARRIERS

From Energy Now

By Deidra Garyk

We find ourselves at the intersection of energy reality and sustainability. The convergence means the way we do business globally is morphing. Some see opportunity in the most unlikely of places, while others only see obstacles.

A new report by the Public Policy Forum entitled Build Big Things: A playbook to turbocharge investment in major energy, critical minerals and infrastructure projects makes a case for why Canada should find the opportunities and how we can do that.

Analysis done by Calgary’s own economist and professor Trevor Tombe identified that Canada’s real GDP per capita growth from 2015 to 2024 was 1.4 percent. This puts us in second-last position among OECD countries.

Canada also took the penultimate spot among OECD countries for the time it takes to get a construction permit. As the graph shows, this isn’t a partisan problem; therefore, it can’t be corrected with a partisan solution. Although, noticeably, we have slipped further over the last few years. For multinational corporations that can invest anywhere, Canada’s ease of doing business appeal is not attractive, and that hampers our ability to build big things.

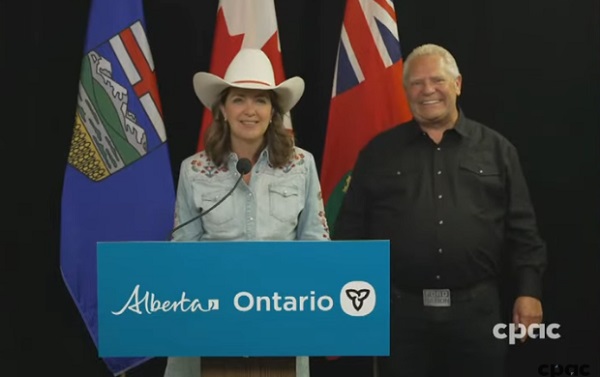

Fortunately, some jurisdictions are doing something about unnecessarily burdensome regulations. Alberta’s Red Tape Reduction initiative has removed over 200,000 regulations for net savings of $3 billion, a number tallied by the businesses impacted, not government. These are duplicative or archaic rules that added limited to no protections and removing them has not exacerbated risks. Work is still ongoing to ensure the balance is right.

BC is also fast-tracking projects, recognizing the need to build to remain a modern society. By shifting energy development permitting to the BC Energy Regulator, project timelines have improved.

The regulatory barriers affect more than traditional energy development. A new mining project in Canada can take anywhere from 15 to 25 years from application to operation. Energy, mining and infrastructure projects go through three to six years of federal regulatory review processes, in addition to provincial reviews. This is unacceptable if Canada is to meet the resource demands of the future.

The Report makes the case that, “[p]rioritizing nation-building projects such as ports, rail and roads is essential to strengthening internal economic linkages, enhancing export competitiveness and ensuring supply chains remain resilient and globally competitive.”

It goes on to cite, “barriers to success that include: burdensome regulatory processes and permitting procedures; insufficient financial supports and difficulty accessing capital, particularly in the crucial, high-risk development stages before getting to FID; inadequate infrastructure such as roads, bridges and ports; and a persistent lack of capacity and capital among Indigenous groups to participate fully as partners in new projects.”

There’s waning interest from the public in shrill anti-resource activism that puts their current lives and livelihoods at risk. Average weekly earnings in Alberta haven’t changed over the last ten years. Canada is one of the most indebted countries in the world, including subnational and consumer debt. This means that we are not as easily able to strategically act to deal with issues or embrace opportunities.

The report offers four strategic pillars for action:

- Co-ordinated financing: Align public and private funding sources to support priority projects and close investment gaps. Governments should not always aim to be the first or primary source of funding. The most effective role for public financing is often in de-risking projects,

- Efficient and effective regulations: Reconfigure regulatory and permitting processes to get to “yes” much more quickly, providing clearer timelines, improved efficiency and effectiveness, greater certainty, enhanced environmental performance, and a more strategic role for economic regulators across jurisdictions.

- Enabling critical infrastructure: Take a systems-level approach to planning to ensure that foundational infrastructure and skilled labour are in place to support future growth.

- Increasing Indigenous economic participation: Strengthen partnerships between project proponents, government institutions and Indigenous rights-holders to support meaningful Indigenous involvement in major projects, including through improved access to capital, stronger ownership opportunities and continuous capacity building.

Canadians must define who we are and who we want to be, on our own terms. We must change the mindset from fear to opportunity and be proud to be producers of primary materials. We need a kick in the pants to move towards taking calculated risks rather than running away, hoping for security because of our fears. We must build big things.

Deidra Garyk is the Founder and President of Equipois:ability Advisory, a consulting firm specializing in sustainability solutions. Over 20 years in the Canadian energy sector, Deidra held key roles, where she focused on a broad range of initiatives, from sustainability reporting to fostering collaboration among industry stakeholders through her work in joint venture contracts.

Outside of her professional commitments, Deidra is an energy advocate and a recognized thought leader. She is passionate about promoting balanced, fact-based discussions on energy policy, and sustainability. Through her research, writing, and public speaking, Deidra seeks to advance a more informed and pragmatic dialogue on the future of energy.

Business

Government distorts financial picture with definition of capital

“The government is acting fast and loose with the definition of ‘capital. Handing out corporate welfare shouldn’t be considered ‘capital.’

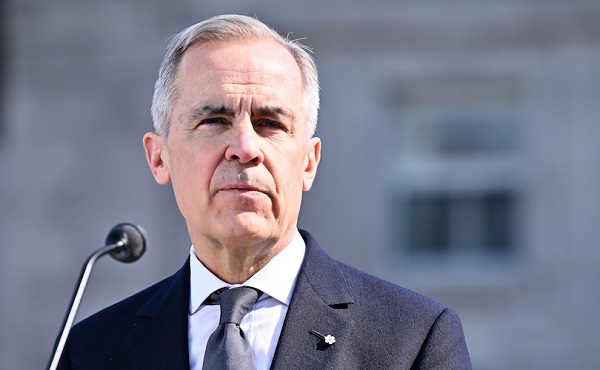

The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to focus on reducing debt rather than distorting the financial picture by watering down the definition of “capital” spending, as noted by the Parliamentary Budget Officer.

“The PBO shows the government is inappropriately expanding the definition of ‘capital’ spending,” said Franco Terrazzano, CTF Federal Director. “The reality is taxpayers need to cut through Carney’s budget spin and look at one number: How fast is the debt is going up?”

The Carney government announced it’s separating operating and capital spending in its budget. It also released its criteria for what it would consider capital spending.

The PBO’s analysis found that “Finance Canada’s definition and categories expand the scope of capital investment beyond the current treatment of capital spending in the Public Accounts of Canada.”

The PBO added that “based on our initial assessment, we find that the scope is overly expansive and exceeds international practice such as that adopted by the United Kingdom.”

“The government is acting fast and loose with the definition of ‘capital,’” Terrazzano said. “Handing out corporate welfare shouldn’t be considered ‘capital.’

“Regardless of the spending category, more debt means more interest payments and that’s what taxpayers need to focus on to hold the government accountable.”

The PBO’s Economic and Fiscal Outlook projects this year’s “deficit to increase sharply to $68.5 billion.” Debt interest charges will cost taxpayers $55.3 billion this year. That means that paying interest on the federal debt will cost each Canadian about $1,300 this year.

“The government is trying to muddy the water with its accounting nonsense,” Terrazzano said. “The government should stop focusing on cutting the numbers and instead focus on cutting the debt.

“Taxpayers will need to cut through all the accounting noise from the government and focus on one question: Is the debt going up or down?”

Business

Canada Post is failing Canadians—time to privatize it

From the Fraser Institute

By Jake Fuss and Alex Whalen

In the latest chapter of a seemingly never-ending saga, Canada Post workers are on strike again for the second time in less than a year, after the federal government allowed the Crown corporation to close some rural offices and end door-to-door deliveries. These postal strikes are highly disruptive given Canada Post’s near monopoly on letter mail across the country. It’s well past time to privatize the organization.

From 2018 to the mid-point of 2025, Canada Post has lost more than $5.0 billion, and it ran a shortfall of $407 million in the latest quarter alone. Earlier this year, the federal government loaned Canada Post $1.034 billion—a substantial sum of taxpayer money—to help keep the organization afloat.

As a Crown corporation, Canada Post operates at the behest of the federal government and faces little competition in the postal market. Canadians have nowhere to turn if they’re unhappy with service quality, prices or delivery times, particularly when it comes to “snail mail.”

Consequently, given its near-monopoly over the postal market, Canada Post has few incentives to keep costs down or become profitable because the government (i.e. taxpayers) is there to bail it out. The lack of competition also means Canada Post lacks incentives to innovate and improve service quality for customers, and the near-monopoly prohibits other potential service providers from entering the letter-delivery market including in remote areas. It’s clearly a failing business that’s unresponsive to customer needs, lacks creativity and continuously fails to generate profit.

But there’s good news. Companies such as Amazon, UPS, FedEx and others deliver more than two-thirds of parcels in the country. They compete for individuals and businesses on price, service quality and delivery time. There’s simply no justification for allowing Canada Post to monopolize any segment of the market. The government should privatize Canada Post and end its near-monopoly status on letter mail.

What would happen if Ottawa privatized Canada Post?

Well, peer countries including the Netherlands, Austria and Germany privatized their postal services two decades ago. Prices for consumers (adjusted for inflation) fell by 11 per cent in Austria, 15 per cent in the Netherlands and 17 per cent in Germany.

Denmark has taken it a step further and plans to end letter deliveries altogether. The country has seen a steep 90 per cent drop in letter volumes since 2000 due to the rise of global e-commerce and online shopping. In other words, the Danes are adapting to the times rather than continuing to operate an archaic business model.

In light of the latest attempt by the Canadian Union of Postal Workers to shakedown Canadian taxpayers, it’s become crystal clear that Canada Post should leave the stone age and step into the twenty-first century. A privately owned and operated Canada Post could follow in the footsteps of its European counterparts. But the status quo will only lead to further financial ruin, and Canadians will be stuck with the bill.

-

Crime2 days ago

Crime2 days agoThe Bureau Exclusive: Chinese–Mexican Syndicate Shipping Methods Exposed — Vancouver as a Global Meth Hub

-

Crime2 days ago

Crime2 days agoCanadian Sovereignty at Stake: Stunning Testimony at Security Hearing in Ottawa from Sam Cooper

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy Sentencing: Lich and Barber escape prison terms but will spend months in house arrest

-

Alberta1 day ago

Alberta1 day agoSheriffs shut down Olds drug house

-

Haultain Research1 day ago

Haultain Research1 day agoInclusion and Disorder: Unlearned Lessons from Palestinian Protests

-

Business1 day ago

Business1 day agoFinance Minister ducks deficit questions, talks down to critics, and rebrands reckless spending as ‘transparency’.

-

Business18 hours ago

Business18 hours agoCanada Post is failing Canadians—time to privatize it

-

Alberta1 day ago

Alberta1 day ago‘Visionary’ Yellowhead Pipeline poised to launch Alberta into the future