Daily Caller

The Silly Peak Oil Debate Rages On

From the Daily Caller News Foundation

“What the Outlook underscores is that the fantasy of phasing out oil and gas bears no relation to fact,” said OPEC Secretary General Haitham Al Ghais

Analysts and professionals in the global energy space have long debated the prospects for reaching peak demand for crude oil. It is an issue that has long sparked debate, some of which becomes emotional among highly invested stakeholders on one side or the other.

In recent years, such stakeholders risk developing cases of whiplash when considering the competing perspectives about this “peak oil” matter published by OPEC and the International Energy Agency (IEA).

IEA has spent the last 12 months predicting an earlier advent of the peak oil phenomenon than pretty much any other experts envision, saying it will come about sometime in this decade, no later than 2030. Not surprisingly, the agency’s analysts doubled down on that projection in its most recent monthly Oil Market Report.

In a section titled “When the Music Stops,” the IEA focused on short-term factors like slowing demand growth in China, where oil consumption has declined year-over-year for the past four months. Noting that Chinese demand growth has slowed to an estimated 180,000 barrels per day (bpd) across 2024, the agency leaned on that data point as a reason to lower its estimated global demand growth to 800,000 bpd.

The same section also pointed to the isolated slowing of U.S. gasoline-deliveries growth in June — a factoid that could simply be statistical noise — as support for its annual growth forecast. But a slowdown in crude demand growth is no surprise, given that economic growth has been slowing throughout 2024. This direct cause-and-effect phenomenon has been a consistent aspect of oil markets across history. It is also a short-term factor whose impact will ultimately be diminished by subsequent events.

In contrast, OPEC’s projections over the past year regarding near-term global demand growth and the anticipated peak in oil demand have reached diametrically opposite conclusions. Last summer, the cartel projected global growth in crude demand for 2024 would be a robust 2.25 million bpd. Slowing economic growth has led OPEC’s analysts to lower that initial prediction over the past two months, but only to 2.1 million bpd — more than double that of both IEA and the U.S. Energy Information Administration (EIA).

Where the concept of peak oil demand is concerned, OPEC has held to an even more oil-bullish stance, stating its projections do not see that threshold being reached anytime during its projection timeframe through 2050. In its annual Global Outlook published last week, OPEC sees oil demand growing by that year to 120 million bpd, a rise of 18 million bpd from current levels.

“What the Outlook underscores is that the fantasy of phasing out oil and gas bears no relation to fact,” said OPEC Secretary General Haitham Al Ghais in the forward to the report.

Al Ghais also pointed out the fact that: “Over the past year, there has been further recognition that the world can only phase in new energy sources at scale when they are genuinely ready, economically competitive, acceptable to consumers and with the right infrastructure in place.” This undeniable reality means that projections of oil demand in the transportation sector being crushed by alternatives like EVs and hydrogen cars are almost certainly overly optimistic. The rapidly faltering market demand for EVs strongly supports that likelihood.

Al Ghais also contends that a “realistic view of demand growth expectations necessitates adequate investments in oil and gas, today, tomorrow, and for many decades into the future.” That contention stands in contrast to the IEA report released in May, 2021, in which IEA Director Fatih Birol urged an immediate halt in all new investments in the finding and development of new oil resources in order to fight climate change. By August of that year, Biral was comically urging oil companies to increase their oil production in order to help re-balance an undersupplied global market.

Episodes like that have led many to question whether IEA bases its projections related to oil markets on data or on wishful thinking. The validity of such questions was only reinforced when Birol announced early this year that the agency’s mission was being expanded into outright advocacy for promoting the energy transition.

So, who is right? We’ll find out in 2030, but the smart money is on the group with billions riding on the answer.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Daily Caller

‘Almost Sounds Made Up’: Jeffrey Epstein Was Bill Clinton Plus-One At Moroccan King’s Wedding, Per Report

From the Daily Caller News Foundation

Former President Bill Clinton personally asked to bring Jeffrey Epstein and Ghislaine Maxwell as guests to the Moroccan King Mohammed VI’s 2002 wedding, a move that unsettled Clinton’s own aides, the New York Post reported Thursday.

Clinton requested permission to include Epstein and Maxwell at the royal wedding in Rabat despite neither having any official relationship with the Moroccan royal family, the Post reported. Sources told the outlet that Clinton’s request was viewed internally as inappropriate and has quietly circulated in Democratic circles for more than two decades.

“[Clinton] brought them as guests to a king’s wedding. I mean, it almost sounds made up,” one source familiar with the matter told the outlet. “How many times in your life have you been invited as a guest of a guest at a wedding?”

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Clinton traveled to Morocco with Epstein and Maxwell aboard Epstein’s private jet, dubbed the “Lolita Express,” according to the Post. Chelsea Clinton attended separately, and then-Sen. Hillary Clinton remained in Washington due to her schedule.

“[Former First Lady] Hillary [Clinton] was in the Senate, so she couldn’t go. Chelsea very much wanted to go, and the president very much wanted to go,” a second person told the outlet. “The idea that they would take [Epstein] was a head-scratcher. But nonetheless, the Clinton office moved forward and made this request … to bring these two guests, and that’s what happened.”

Once in Rabat, Clinton, Epstein and Maxwell were seated with King Mohammed VI during the black-tie wedding dinner, sources said. At one point, Chelsea Clinton requested a group photograph that included her father, Epstein and Maxwell.

Maxwell is currently serving a 20-year federal prison sentence for sex trafficking conspiracy and related offenses. Epstein died in jail in 2019 while awaiting trial on federal sex trafficking charges. Their crimes were not publicly known at the time of the wedding.

The Clintons continue to downplay the extent of their past relationship with Epstein, maintaining that they cut off contact with him in 2005, three years before he pleaded guilty to state sex crimes in Florida.

Clinton spokesman Angel Ureña previously told the outlet that Clinton took four trips aboard Epstein’s jet between 2002 and 2003 and denied that Clinton ever visited Epstein’s private island or residences.

“I don’t know how many times we need to say there was travel more than 20 years ago before he was cut off. Apparently, we need to one more time. But nice try,” Ureña said, according to the outlet.

Neither of the sources quoted by the New York Post said they believed Clinton was aware of Epstein trafficking or sexually abusing children, but did say the ex-president is downplaying his former links to both Epstein and Maxwell.

The Clinton Foundation did not respond to the Daily Caller News Foundation’s request for comment.

Both Bill and Hillary are scheduled to give depositions in January to the House Oversight and Government Reform Committee about their ties to Epstein. The Oversight Committee subpoenaed the Clintons in August, and Committee Chairman James Comer said that if the Clintons didn’t appear for depositions scheduled for Dec. 17 and 18 or arrange to appear for questioning in early January, then contempt charges would be pursued.

Photos released by Oversight Committee Democrats in December show Epstein with prominent figures, including President Donald Trump, Bill Clinton, Microsoft co-founder Bill Gates and Steve Bannon.

The Department of Justice is expected to release a new trove of documents related to the Epstein investigation Friday.

Automotive

Ford’s EV Fiasco Fallout Hits Hard

From the Daily Caller News Foundation

I’ve written frequently here in recent years about the financial fiasco that has hit Ford Motor Company and other big U.S. carmakers who made the fateful decision to go in whole hog in 2021 to feed at the federal subsidy trough wrought on the U.S. economy by the Joe Biden autopen presidency. It was crony capitalism writ large, federal rent seeking on the grandest scale in U.S. history, and only now are the chickens coming home to roost.

Ford announced on Monday that it will be forced to take $19.5 billion in special charges as its management team embarks on a corporate reorganization in a desperate attempt to unwind the financial carnage caused by its failed strategies and investments in the electric vehicles space since 2022.

Cancelled is the Ford F-150 Lightning, the full-size electric pickup that few could afford and fewer wanted to buy, along with planned introductions of a second pricey pickup and fully electric vans and commercial vehicles. Ford will apparently keep making its costly Mustang Mach-E EV while adjusting the car’s features and price to try to make it more competitive. There will be a shift to making more hybrid models and introducing new lines of cheaper EVs and what the company calls “extended range electric vehicles,” or EREVs, which attach a gas-fueled generator to recharge the EV batteries while the car is being driven.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“The $50k, $60k, $70k EVs just weren’t selling; We’re following customers to where the market is,” Farley said. “We’re going to build up our whole lineup of hybrids. It’s gonna be better for the company’s profitability, shareholders and a lot of new American jobs. These really expensive $70k electric trucks, as much as I love the product, they didn’t make sense. But an EREV that goes 700 miles on a tank of gas, for 90% of the time is all-electric, that EREV is a better solution for a Lightning than the current all-electric Lightning.”

It all makes sense to Mr. Farley, but one wonders how much longer the company’s investors will tolerate his presence atop the corporate management pyramid if the company’s financial fortunes don’t turn around fast.

To Ford’s and Farley’s credit, the company has, unlike some of its competitors (GM, for example), been quite transparent in publicly revealing the massive losses it has accumulated in its EV projects since 2022. The company has reported its EV enterprise as a separate business unit called Model-E on its financial filings, enabling everyone to witness its somewhat amazing escalating EV-related losses since 2022:

• 2022 – Net loss of $2.2 billion

• 2023 – Net loss of $4.7 billion

• 2024 – Net loss of $5.1 billion

Add in the company’s $3.6 billion in losses recorded across the first three quarters of 2025, and you arrive at a total of $15.6 billion net losses on EV-related projects and processes in less than four calendar years. Add to that the financial carnage detailed in Monday’s announcement and the damage from the company’s financial electric boogaloo escalates to well above $30 billion with Q4 2025’s damage still to be added to the total.

Ford and Farley have benefited from the fact that the company’s lineup of gas-and-diesel powered cars have remained strongly profitable, resulting in overall corporate profits each year despite the huge EV-related losses. It is also fair to point out that all car companies were under heavy pressure from the Biden government to either produce battery electric vehicles or be penalized by onerous federal regulations.

Now, with the Trump administration rescinding Biden’s harsh mandates and canceling the absurdly unattainable fleet mileage requirements, Ford and other companies will be free to make cars Americans actually want to buy. Better late than never, as they say, but the financial fallout from it all is likely just beginning to be made public.

- David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

Business20 hours ago

Business20 hours agoCanada Hits the Brakes on Population

-

Crime8 hours ago

Crime8 hours agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Business2 days ago

Business2 days agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

Energy2 days ago

Energy2 days agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Frontier Centre for Public Policy22 hours ago

Frontier Centre for Public Policy22 hours agoCanada Lets Child-Porn Offenders Off Easy While Targeting Bible Believers

-

International2 days ago

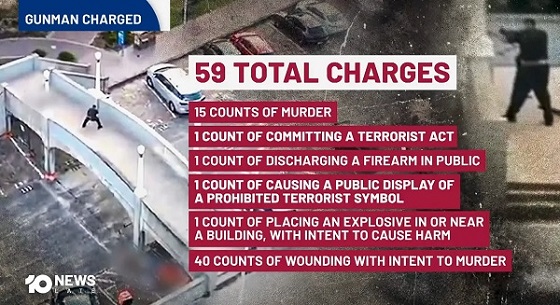

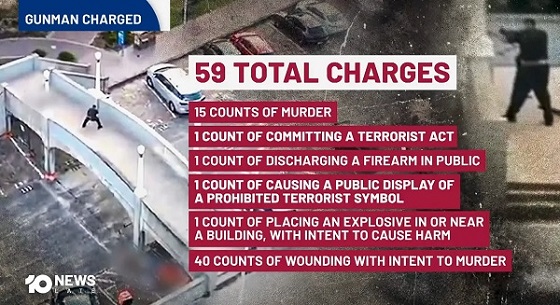

International2 days agoBondi Beach Shows Why Self-Defense Is a Vital Right

-

Crime2 days ago

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat