Business

The dollar is down — and so are your wages

By Dan McTeague

As president of Canadians for Affordable Energy, I’ve had the privilege of calling the public’s attention to ongoing energy-related public policy issues which drive up the cost of living in this country. In that same vein, I’d like to call your attention to another matter which is making our lives more expensive. It is, functionally, a significant tax on all economic activity, but one which no political party ran on and none of our representatives in parliament voted for.

I’m speaking of the weakness of the Canadian dollar.

At the time of writing it takes 138 Canadian pennies to purchase a single American Greenback. That matters because most commodities which we consume are priced in U.S. dollars. So when I work on CAE’s gas price predictions — a project we’ve undertaken to help save Canadians money in a very concrete way — I have to continually multiply the commodity price of gasoline and diesel by 1.38 (or whatever the difference is at that moment) to get the cost in Canadian dollars.

The fact of the matter is, our diminished dollar functions as a drag on our economy, decreasing our purchasing power and raising the cost of doing business across the board.

Now, I know that there’s a common counterargument here, which is that a weak Loonie makes Canadian sourced goods and produce more attractive abroad. And that’s not wrong, but there are a few problems with the idea.

First, it’s less true in the highly integrated global economy of the 21st century than it’s been in the past. Maybe some of our farmers will make more money selling livestock and crops across the border, but they’re also spending a lot more on equipment and even phosphate-based fertilizers, which Canada imports to the tune of billions per year, particularly from the U.S.

Second, it’s short sighted. While it might bring about some benefits to exporters, especially in the short term, the lower the dollar falls, and the longer it remains low, the slower our economy is going to run. In the long run, a depressed Loonie is going to harm all of us.

So what is to be done to recover some value and get our currencies closer to parity? Well, one thing we could do is unleash the Canadian energy juggernaut.

Our country has been blessed with abundant natural resources, especially oil and natural gas, but the Trudeau-Carney Liberals who have been running the country since 2015 have bent over backwards to appeal to the Keep-it-in-the-Ground Net-Zero activists in their base. They’ve pushed legislation like Bill C-69, the “no new pipelines act;” Bill C-48, the Oil Tanker Moratorium Act which significantly reduces our ability to export our natural resources; and Bill C-59, which bans businesses from touting the environmental positives of their work if it doesn’t meet a government-approved standard.

They’ve enacted the so-called Clean Fuel Standard, which requires fuel suppliers to reduce the carbon intensity of their products, elevating the cost to the consumer. And then there’s the whole bait-and-switch they’ve pulled on the Carbon Tax, zeroing out the public-facing Consumer Tax, while doubling down on the Industrial Carbon Tax.

Talk about a drag on the economy!

It shouldn’t be this way. The oil and gas industry is Canada’s “golden goose,” in the memorable phrase of economists Philip Cross and Jack Mintz, which drives “exports, productivity, incomes, and government revenue.” They are, in short, the backbone of our economy.

At a time when that economy is faltering, we should be doing everything we can to grease the wheels, to pump up production, and get things humming again.

A stronger dollar will mean a healthier, more affordable Canada. Let’s make it happen.

Business

Trump Warns Beijing Of ‘Countermeasures’ As China Tightens Grip On Critical Resources

From the Daily Caller News Foundation

Despite their strategic significance, the U.S. imports 80% of the rare earths it consumes, primarily from China, which dominates global production and controls roughly 92% of the world’s refining capacity.

President Donald Trump on Friday threatened China with a massive tariff hike and hinted his upcoming summit with Chinese President Xi Jinping could be canceled as a result of Beijing’s latest escalation in trade hostilities.

China ramped up its economic pressure campaign this week, first by imposing new export controls Thursday on rare earth minerals critical to the production of vehicles, weapons systems, and other advanced technologies. On Friday, Beijing escalated further, announcing new port fees on American ships and launching an antitrust investigation into U.S. tech giant Qualcomm.

In response to what he described as “great trade hostility,” Trump said there was “no reason” to meet with Xi in South Korea later this month.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“Dependent on what China says about the hostile ‘order’ that they have just put out, I will be forced, as President of the United States of America, to financially counter their move. For every Element that they have been able to monopolize, we have two,” the president posted on Truth Social.

Trump announced later on Friday that the U.S. would impose a 100% tariff on China starting Nov. 1, in addition to existing levies, and implement export controls on “any and all critical software.” He added that the tariffs could go into effect sooner, “depending on any further actions or changes taken by China.”

Despite their strategic significance, the U.S. imports 80% of the rare earths it consumes, primarily from China, which dominates global production and controls roughly 92% of the world’s refining capacity.

Under the new rules, foreign suppliers must obtain Beijing’s approval to export any product made with Chinese rare-earth processing technology or containing rare-earth materials that comprise as little as 0.1% of the item’s value. The restrictions also extend to the export of technology used in rare-earth mining, smelting, and magnet manufacturing, and add five more rare-earth elements to China’s existing control list.

Trump warned that Beijing’s move could “clog” global markets and “make life difficult for virtually every country in the world.”

“I have always felt that they’ve been lying in wait, and now, as usual, I have been proven right! There is no way that China should be allowed to hold the World “captive,” but that seems to have been their plan for quite some time,” the president wrote.

“But the U.S. has Monopoly positions also, much stronger and more far reaching than China’s. I have just not chosen to use them, there was never a reason for me to do so — UNTIL NOW!” Trump said.

The Chinese Transport Ministry also said it will begin collecting port fees on vessels owned by U.S. companies or individuals — and even those built in America — starting Oct. 14. The rollout overlaps with Washington’s plan to impose new charges on large Chinese vessels docking at U.S. ports the same day.

The president also noted that Beijing’s timing was “especially inappropriate,” noting that it coincides with the peace deal he helped broker between Israel and Hamas to bring the two-year conflict to an end.

Automotive

Governments continue to support irrational ‘electric vehicle’ policies

From the Fraser Institute

Another day, another electric vehicle (EV) fantasy failure. The Quebec government is “pulling the plug” on its relationship with the Northvolt EV battery company (which is now bankrupt), and will try to recoup some of its $270 million loss on the project. Quebec’s “investment” was in support of a planned $7 billion “megaproject” battery manufacturing facility on Montreal’s South Shore. (As an aside, what normal people would call gambling with taxpayer money, governments call “investments.” But that’s another story.)

Anyway, for those who have not followed this latest EV-burn out, back in September 2023, the Legault government announced plans to “invest” $510 million in the project, which was to be located in Saint-Basile-le-Grand and McMasterville. The government subsequently granted Northvolt a $240 million loan guarantee to buy the land for the plant, then injected another $270 million directly into Northvolt. According to the Financial Post, “Quebec has lost $270 million on its equity investment… but still had a senior secured loan tied to the land acquired to build the plant, which totals nearly $260 million with interest and fees.” In other words, Quebec taxpayers lost big.

But Northvolt is just the latest in a litany of failure by Canadian governments and their dreams of an EV future free of dreaded fossil fuels. I know, politicians say that it’s a battle against climate change, but that’s silly. Canada is such a small emitter of greenhouse gases that nothing it could do, including shutting down the entire national economy, would significantly alter the trajectory of the climate. Anything Canada might achieve would be cancelled out by economic growth in China in a matter of weeks.

So back to the litany of failed or failing EV-dream projects. To date (from about 2020) it goes like this: Ford (2024), Umicore battery (2024), Honda (2025),General Motors CAMI (2025), Lion Electric (2025), Northvolt (2025). And this does not count projects still limping along after major setbacks such as Stellantis and Volkswagen.

One has to wonder how many tombstones of dead EV fantasy projects will be needed before Canada’s climate-obsessed governments get a clue: people are not playing. Car buyers are not snapping up these vehicles as government predicted; the technologies and manufacturing ability are not showing up as government predicted; declining cost curves are not showing up as government predicted; taxpayer-subsidized projects keep dying; the U.S. market for Canada’s EV tech that government predicted has been Trumped out of existence (e.g. the Trump administration has scrapped EV mandates and federal subsidies for EV purchases); and government is taking the money for all these failed predictions from Canadian workers who can’t afford EVs. It really is a policy travesty.

And yet, like a bad dream, Canada’s governments (including the Carney government) are still backing an irrational policy to force EVs into the marketplace. For example, Ottawa stills mandates that all new light-duty vehicle sales be EVs by 2035. This despite Canadian automakers earnest pleas for the government to scrap the mandate.

Canada’s EV policy is quickly coming to resemble something out of dysfunctional-heroic fiction. We are the Don Quixotes, tilting futilely at EV windmills, and Captain Ahabs, trying to slay the dreaded white whale of fossil-fuelled transportation with our EV harpoons. Really, isn’t it time governments took a look at reality and cut their losses? Canada’s taxpayers would surely appreciate the break.

-

Alberta22 hours ago

Alberta22 hours agoFact, fiction, and the pipeline that’s paying Canada’s rent

-

Business2 days ago

Business2 days agoCall for Federal Inquiry as Pressure Mounts for Release of Buried Report on Buddhist Land Transactions in PEI

-

Energy1 day ago

Energy1 day ago“It is intellectually dishonest not to acknowledge the … erosion of trust among global customers in Canada’s ability to deliver another oil pipeline.”

-

Energy1 day ago

Energy1 day agoIn the halls of Parliament, Ellis Ross may be the most high-profile advocate of Indigenous-led development in Canada.

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoEfforts to halt Harry Potter event expose the absurdity of trans activism

-

International1 day ago

International1 day agoIsraeli government approves Gaza ceasefire

-

Crime1 day ago

Crime1 day agoFlorida teens credited for averting school shooting plot in Washington state

-

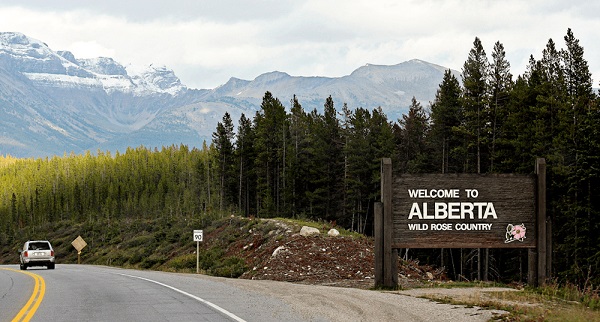

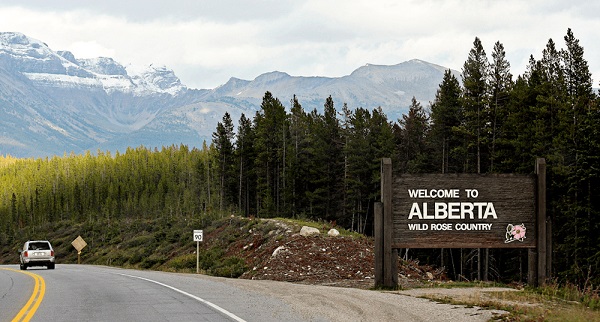

Alberta22 hours ago

Alberta22 hours agoAlberta Is Where Canadians Go When They Want To Build A Better Life