Energy

Texas oil and natural gas industry continues to break records

From The Center Square

By

Texas’ oil and natural gas industry broke new production records in May, continuing a trend in recent months and years.

Texas’ production of oil, natural gas, and natural gas liquids (NGLs), refinery activity and exports reached new record highs last month, according to a new analysis published by the Texas Oil & Gas Association (TXOGA).

The industry produced a record-high 5.7 million barrels per day (mb/d) of crude oil in Texas, a record 32.5 billion cubic feet per day (bcf/d) of natural gas marketed production and 3.5 mb/d of NGLs, according to estimates made by TXOGA’s Chief Economist Dean Foreman, Ph.D.

This is after the Texas oil and natural gas industry established new monthly records in March, according to U.S. Energy Information Administration (EIA) and U.S. International Trade Commission data. In March, Texas reported a record-high NGL field production of 3.7 million mb/d – the highest on record in history – more than doubling in-state consumption, according to the data.

Crude oil production topped 5.6 mb/d; natural gas marketed production topped 32.3 bcf/d. Texas refinery activities also reach a record-high net production of 5.5 mb/d.

Texas’ production of oil and natural gas is unparalleled. No other state is producing the volume that Texas is.

This is after Texas’ petroleum products exports exceeded 4 million barrels per day for the first time in history last December.

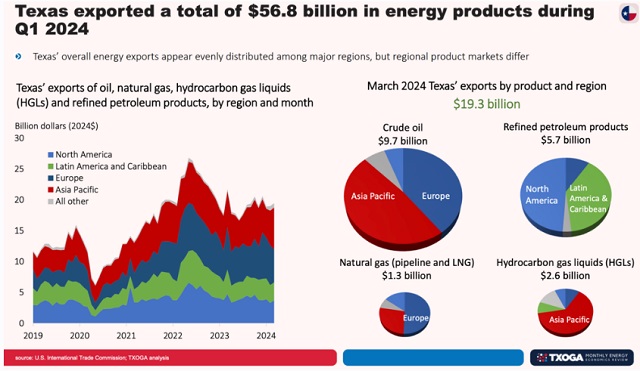

Since then, the Texas oil and natural gas industry has sustained five consecutive months of exporting petroleum products of more than 4 million barrels per day. In the first quarter of 2024, Texas exported nearly $57 billion worth of petroleum products.

The majority of LNG exports went to European and Asia Pacific countries; the majority of crude oil and hydrocarbon gas liquids were exported to Asia Pacific countries, according to the data.

Foreman said that Texas’ record-setting performance has continued “on the heels of remarkable productivity gains,” with rig productivity in May increasing by more than 20% year-over-year, according to EIA estimates. “As a result, Texas has continued to gain market share amid U.S. oil and natural gas production through the first half of 2024. U.S. energy security increasingly depends on Texas, and Texas has stepped up like none other.”

Projections for June show Texas’ production remains historically strong, holding at 5.7 mb/d of crude oil, 3.6 mb/d of NGLs, and 32.4 bcf/d of natural gas marketed production, according to Foreman’s estimates.

In the first half of 2024, Texas produced an estimated nearly 43% of all domestically produced crude oil and more than 28% of all domestic natural gas marketed production, according to TXOGA estimates.

Thermal and dispatchable sources of energy, primarily natural gas, are generating the majority of electricity Texans use through Texas’ grid managed by the Electric Reliability Council of Texas (ERCOT). During Winter Storm Heather, from Jan. 13-16, thermal and dispatchable sources generated as much as 95% of ERCOT’s electricity.

During another high demand period, from March 21-22, thermal and dispatchable sources, primarily natural gas, generated over 90% of ERCOT’s electricity for nine consecutive hours, averaging 91.8% of the region’s power, according to ERCOT and EIA data.

“These new records are a testament to Texas’ role as a national and global energy leader,” TXOGA President Todd Staples said. “Amidst growing global instability and energy demand that is expected to nearly double by 2050, oil and natural gas continue to serve as the bedrock of our energy mix, providing affordable reliable energy to meet our state, nation, and the world’s needs.”

Business

Looks like the Liberals don’t support their own Pipeline MOU

From Pierre Poilievre

Alberta

They never wanted a pipeline! – Deputy Conservative Leader Melissa Lantsman

From Melissa Lantsman

Turns out the anti-development wing of the Liberal Party never stopped running the show.

Today, we’ll see if the Liberals vote for the pipeline they just finished bragging about.

Spoiler: they won’t. Because with the Liberals, the announcements are real, but the results never are.

-

espionage1 day ago

espionage1 day agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

Opinion2 days ago

Opinion2 days agoThe day the ‘King of rock ‘n’ roll saved the Arizona memorial

-

Focal Points2 days ago

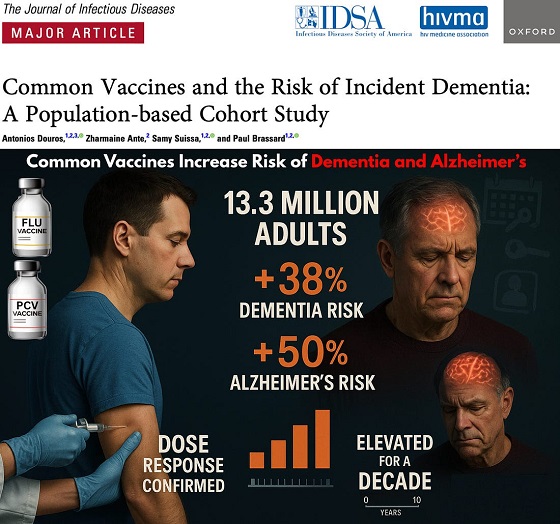

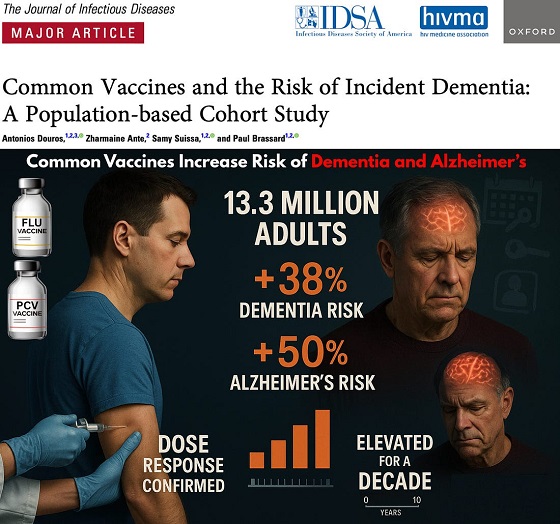

Focal Points2 days agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

Health1 day ago

Health1 day agoCDC Vaccine Panel Votes to End Universal Hep B Vaccine for Newborns

-

Business1 day ago

Business1 day agoCanada invests $34 million in Chinese drones now considered to be ‘high security risks’

-

Agriculture1 day ago

Agriculture1 day agoCanada’s air quality among the best in the world

-

Business1 day ago

Business1 day agoThe EU Insists Its X Fine Isn’t About Censorship. Here’s Why It Is.