Business

Rise of Canadian Fentanyl ‘Superlabs’ Marks Shift in Chinese-Driven Global Drug Trade

Sam Cooper

Sam Cooper

Elevated production levels in Canada—particularly from highly sophisticated fentanyl “super laboratories,” such as the type dismantled by the Royal Canadian Mounted Police in October 2024—pose a mounting concern.

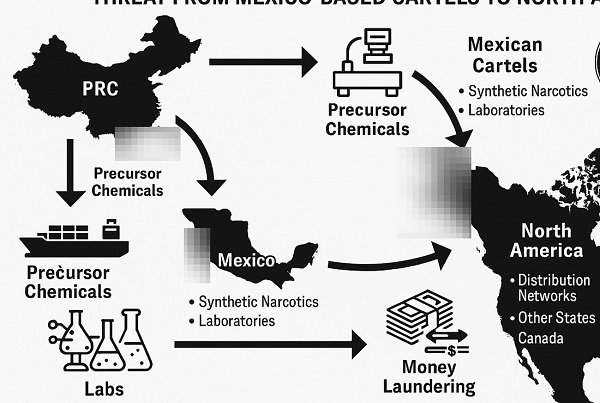

A rising convergence of Chinese state-linked chemical suppliers, Mexican drug cartels, Chinese narcotics cash brokers operating across North America, and the emergence of Canadian fentanyl “super laboratories” has triggered new concerns for United States national security agencies, according to the latest threat assessment from the Drug Enforcement Administration.

The 2025 National Drug Threat Assessment, released Thursday, describes the crisis as a transnational system driven by industrial-scale synthetic drug production and laundering networks stretching from Guangdong to Sinaloa to Vancouver. While Mexican cartels remain the dominant traffickers of fentanyl and methamphetamine into the United States, the DEA names Canada for the first time as a growing supply-side threat.

Elevated production levels in Canada—particularly from highly sophisticated fentanyl “super laboratories,” such as the type dismantled by the Royal Canadian Mounted Police in October 2024—pose a mounting concern.

The laboratory was uncovered in Falkland, British Columbia—a remote, mountainous region roughly midway between Vancouver and Calgary. While Royal Canadian Mounted Police officials released few details, law enforcement sources in both Canada and the United States confirmed to The Bureau that the raid was triggered by intelligence from the DEA.

According to these sources, the site forms part of a broader criminal convergence involving Chinese, Mexican, and Iranian networks operating across British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, and Quebec. The Bureau’s sources indicate that the Falkland facility was connected to Chinese chemical exporters sanctioned by the United States Treasury, Iranian threat actors, and operatives from Mexican drug cartels.

The 80-page DEA assessment emphasizes that while fentanyl flows from Canada remain smaller in volume compared to Mexico, the potential for Canadian production to scale quickly is a major concern. United States officials warn that law enforcement crackdowns in Mexico could prompt traffickers to shift operations northward, where precursor chemical controls and policing pressures are widely seen as more permissive.

The fallout from the Falkland raid continues to expand. Investigations in British Columbia’s Lower Mainland are probing chemical importers tied to methamphetamine and fentanyl precursor shipments from China. Authorities are examining companies suspected of misrepresenting the commercial purpose and origin of these dual-use chemicals.

One case highlighted by the DEA underscores the scale and sophistication of cartel-linked financial operations. A multi-billion-dollar smuggling and laundering scheme—spanning petroleum, methamphetamine, and heroin—was discovered involving Mexico’s state-owned oil company, Petróleos Mexicanos. The criminal network, according to the report, funneled stolen crude oil into the United States and sold it to American energy firms using trade-based money laundering mechanisms. It was linked to senior figures in multiple cartels, including Sinaloa, the Jalisco New Generation Cartel, La Familia Michoacana, and the Gulf Cartel.

“The investigation has determined that this black-market petroleum smuggling operation is the primary means by which the transnational criminal organization funds its networks,” the DEA report states. “It is estimated that Mexico is losing tens of billions in tax revenue annually, while simultaneously costing the United States oil and gas companies billions of dollars annually due to a decline in petroleum imports and exports during this same period.”

Officials describe the petroleum scheme as a major financial lifeline for cartel power, and say investigations are now expanding to examine American facilitators and corporate enablers.

The DEA further outlines how Chinese and Mexican actors evade international chemical controls through mislabeling, transshipment via third countries, and freight forwarding chains—some knowingly complicit, others unwittingly exploited. Precursor shipments often arrive in the United States or Canada under false declarations, before being diverted to clandestine laboratories in Mexico.

Distribution methods include air cargo, maritime freight, land couriers, and even border tunnels. Once drugs enter the United States, they are routed through interstate highways and distributed to urban markets by street-level dealers, many of whom are recruited through encrypted channels such as Snapchat and Telegram.

Another network detailed in the report illustrates a continent-wide money laundering system anchored by the Chinese underground banking model, with a central hub operating out of New York City. Drug proceeds from across the United States are funneled through marijuana cultivation fronts using nominee owners, casino laundering, and mortgage fraud. Sources familiar with Canadian enforcement files told The Bureau this laundering model mirrors, and is connected to, operations in Vancouver and Toronto, where Triad-linked criminal networks manage shell companies and real estate portfolios.

The report also outlines the extensive involvement of Chinese organized crime groups in illicit cannabis production—particularly in regions where recreational marijuana is legalized or poorly regulated. These groups now dominate marijuana cultivation and distribution in both Canada and the United States. They are producing what the DEA calls the most potent marijuana in the history of trafficking, with tetrahydrocannabinol content averaging between 25 and 30 percent.

These networks rely on a logistics model that spans the continent. Domestically grown cannabis is transported across the United States in personal vehicles, tractor-trailers, and rental trucks. Criminal groups move product from jurisdictions such as British Columbia, California, Ontario, Maine, Oklahoma and Oregon into other states and provinces. High-THC cannabis is also in high demand in international markets such as the United Kingdom, France, and Spain, with overseas shipments typically dispatched via air cargo or container shipping from Canadian ports.

The Bureau has reported extensively on how Triads and individuals linked to Chinese foreign influence efforts have acquired numerous residential and industrial and agricultural properties in British Columbia and Ontario—many of which were converted into covert cannabis grow operations. These properties are routinely purchased in cash, registered under nominee names, and later tied to underground banking flows. According to sources with access to United States enforcement files, the laundering architecture is identical to systems used to recycle fentanyl and methamphetamine profits through bulk cash pickups, informal transfer networks, and false invoicing in international trade.

Seizure statistics underscore the increasing scale and complexity of the fentanyl crisis. In 2024, United States authorities intercepted more than 61 million fentanyl pills, many disguised as prescription pharmaceuticals. Xylazine, a veterinary sedative, remains the most common fentanyl adulterant. But a new, far more powerful veterinary anesthetic—medetomidine—is now being detected in seized drug supplies. The Drug Enforcement Administration flags this trend as extremely dangerous, noting that medetomidine may be 200 to 300 times more potent than xylazine, posing life-threatening risks to drug users and first responders alike.

New data obtained by The Bureau illustrates the geography of fentanyl’s impact across the United States. A study analyzing overdose fatalities from 2018 to 2022, using data from the Centers for Disease Control and Prevention, identifies Ohio as one of the states hardest hit by the synthetic opioid epidemic. The research, conducted by Georgia-based Bader Scott Injury Lawyers, found that Ohio averaged 40.8 overdose deaths per 100,000 residents—nearly 50 percent above the national average of 27.5. The state recorded an average of 4,795 overdose deaths per year during the five-year study period, peaking at 5,397 in 2021.

West Virginia had the highest overdose fatality rate, with an average of 65.9 deaths per 100,000 people, followed by Delaware, Tennessee, Kentucky, and Maryland. Other states in the top ten included Louisiana, Pennsylvania, New Mexico, and Connecticut—all experiencing relentless waves of synthetic opioid deaths.

“These states have been particularly hard-hit by the opioid epidemic, facing challenges with prescription painkillers, heroin, and increasingly, synthetic opioids like fentanyl,” the study concludes. “A combination of socioeconomic factors, healthcare access limitations, and geographic challenges has created perfect conditions for this crisis across these regions.”

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

Business

Feds pull the plug on small business grants to Minnesota after massive fraud reports

The Small Business Administration is moving to freeze grant money flowing into Minnesota after explosive allegations of large-scale fraud tied to state oversight failures, with SBA Administrator Kelly Loeffler signaling an immediate crackdown following recent independent reporting.

In a series of comments shared publicly by conservative commentator Benny Johnson, Loeffler said the agency is “cutting off and clawing back” SBA grants to the state while investigators dig deeper into what she described as a rapidly expanding fraud network.

Johnson wrote that Loeffler told him she was “disgusted and sickened” after reviewing footage from YouTuber Nick Shirley, whose on-the-ground reporting in Minnesota highlighted what he said were sham daycare and learning centers collecting millions in public funds despite showing little or no sign of legitimate operations.

According to Johnson, Loeffler blamed the situation on Democrat Gov. Tim Walz, accusing his administration of refusing to enforce basic rules governing small businesses and allowing fraud to flourish unchecked.

Johnson said Loeffler told him SBA investigators were able to identify roughly half a billion dollars in suspected fraud within days of focusing on Minnesota, calling the operation an “industrial-scale crime ring” that ripped off American taxpayers.

“Pending further review, SBA is freezing all grant funding to the state in order to stop the rampant waste of taxpayer dollars and uncover the full depth of fraud,” Loeffler said, according to Johnson’s account, adding that the total scope of the scheme remains unknown and could reach into the billions.

The controversy gained national traction after Shirley posted video of himself visiting multiple facilities, including a South Minneapolis site known as the Quality Learning Center, which he reported was approved for federal aid for up to 99 children but appeared inactive during normal business hours.

The center’s sign, Shirley noted, even misspelled the word “learning” as “learing.”

In the footage, a woman inside the building is heard shouting “Don’t open up,” falsely claiming Shirley and his colleague were Immigration and Customs Enforcement agents.

After the video circulated, Rep. Tom Emmer, a Republican, publicly demanded answers from Walz, questioning how such facilities were approved for millions in taxpayer funding.

Shirley’s reporting followed earlier investigations, including a November report by City Journal alleging that members of Minnesota’s Somali community had sent millions of dollars in stolen taxpayer funds overseas, with some of that money reportedly ending up in the hands of Al-Shabaab, a U.S.-designated terrorist organization.

While Walz’s administration has insisted it takes fraud seriously, the SBA’s decision to halt grant funding marks one of the most aggressive federal responses yet, underscoring how rapidly a local scandal has escalated into a national reckoning over oversight, enforcement, and accountability in Minnesota.

Business

Stripped and shipped: Patel pushes denaturalization, deportation in Minnesota fraud

FBI Director Kash Patel issued a blunt warning over the weekend as federal investigators continue unraveling a sprawling fraud operation centered in Minnesota, saying the hundreds of millions already uncovered represent “just the tip of a very large iceberg.”

In a lengthy statement posted to social media, Patel said the Federal Bureau of Investigation had quietly surged agents and investigative resources into the state well before the scandal gained traction online. That effort, he said, led to the takedown of an estimated $250 million fraud scheme that stole federal food aid intended for vulnerable children during the COVID pandemic.

According to Patel, the investigation exposed a network of sham vendors, shell companies, and large-scale money laundering operations tied to the Feeding Our Future case. Defendants named by the FBI include Abdiwahab Ahmed Mohamud, Ahmed Ali, Hussein Farah, Abdullahe Nur Jesow, Asha Farhan Hassan, Ousman Camara, and Abdirashid Bixi Dool, each charged with offenses ranging from wire fraud to conspiracy and money laundering.

Patel also said Abdimajid Mohamed Nur and others were charged in a separate attempt to bribe a juror with $120,000 in cash. He noted that several related cases have already resulted in guilty pleas, prison sentences of up to 10 years, and nearly $48 million in restitution orders.

Despite those outcomes, Patel warned the case is far from finished.

“The FBI believes this is just the tip of a very large iceberg,” he said, adding that investigators will continue following the money and that the probe remains ongoing. Patel further confirmed that many of those convicted are being referred to immigration authorities for possible denaturalization and deportation proceedings where legally applicable.

The renewed focus follows a viral video circulated by independent journalist Nick Shirley, which appeared to show multiple childcare and learning centers operating as empty or nonfunctional storefronts. The footage sparked immediate backlash from Republicans, including Vice President JD Vance.

House Majority Whip Tom Emmer accused Minnesota Gov. Tim Walz of sitting idle while massive sums were stolen from taxpayers. Walz addressed the allegations during a November press conference, before the full scope of the fraud became public, saying the scandal “undermines trust in government” and threatens programs meant to help vulnerable residents.

“If you’re committing fraud, no matter where you come from or what you believe, you are going to go to jail,” Walz said at the time.

Authorities say the alleged schemes date back to at least 2015, beginning with overbilling Minnesota’s Child Care Assistance Program and later expanding into Medicaid-funded disability and housing programs. One such housing initiative, aimed at helping seniors and disabled residents secure stable housing, was shut down earlier this year after officials cited what they described as large-scale fraud.

The fallout has already reached the federal level. Last month, President Trump announced the suspension of Temporary Protected Status for Somali nationals, arguing that Minnesota had become a hub for organized welfare fraud and money laundering activity.

-

Haultain Research1 day ago

Haultain Research1 day agoSweden Fixed What Canada Won’t Even Name

-

Business1 day ago

Business1 day agoWhat Do Loyalty Rewards Programs Cost Us?

-

Business22 hours ago

Business22 hours agoLand use will be British Columbia’s biggest issue in 2026

-

Energy23 hours ago

Energy23 hours agoWhy Japan wants Western Canadian LNG

-

Business20 hours ago

Business20 hours agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud

-

Business19 hours ago

Business19 hours agoStripped and shipped: Patel pushes denaturalization, deportation in Minnesota fraud

-

Energy11 hours ago

Energy11 hours agoRulings could affect energy prices everywhere: Climate activists v. the energy industry in 2026

-

International11 hours ago

International11 hours agoChina Stages Massive Live-Fire Encirclement Drill Around Taiwan as Washington and Japan Fortify