National

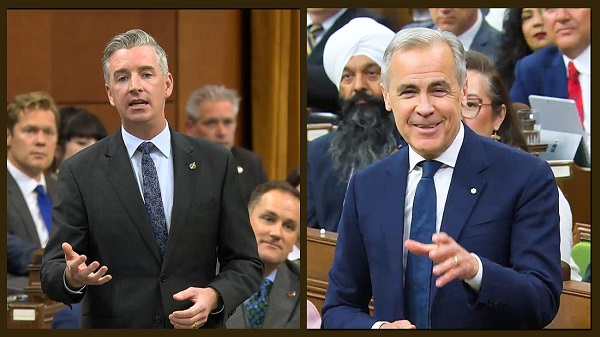

Question Period : Barrett vs. Carney Clash Over Offshore Investments

Dan Knight

Dan Knight

Prime Minister faces questions over blind trust and past ties to tax havens, as Conservatives demand greater financial transparency on day one of the 45th Parliament.

On the very first day of the 45th Parliament, Canadians witnessed a spectacle that was as revealing as it was disturbing. Conservative MP Michael Barrett stood up and did what any responsible representative should do: he asked Prime Minister Mark Carney to come clean about his offshore investments and potential conflicts of interest. But instead of facing the music, Carney pulled a classic elitist maneuver—he hid behind his House Leader, who delivered a canned response full of platitudes and devoid of substance.

This wasn’t just a missed opportunity for transparency; it was a calculated evasion. Carney, the former banker who helped Brookfield Asset Management establish funds in Bermuda and the Cayman Islands, is now Canada’s Prime Minister. And when pressed about whether any of his investments were previously held in tax havens, he couldn’t even muster the courage to answer for himself. Instead, he let a subordinate deflect with talk of “stringent ethics guidelines” and “economic priorities.” Meanwhile, Canadians are struggling to afford basic necessities, and they deserve to know if their leader is playing by the same rules—or any rules at all.

Barrett—one of the few people in Ottawa actually doing his job—didn’t hold back. As Shadow Minister for Ethics and Accountable Government, he called out Prime Minister Mark Carney for what appears to be a massive financial shell game. The accusation? That Carney, during his time as a high-flying executive at Brookfield Asset Management, helped funnel billions into offshore tax havens—Bermuda, the Caymans, you name it—and then conveniently tucked those assets away in a so-called “blind trust” right before stepping into public office.

Barrett’s message was simple and devastating: “Canadians are lined up at food banks in record numbers. They can’t pay their rent, but they are paying their taxes.” Meanwhile, the guy running their government may have spent years helping billionaires avoid paying theirs. Barrett demanded straight answers: Were any of Carney’s current holdings, now supposedly out of sight, previously parked in these offshore tax shelters? And what exactly was he sitting on when he walked into that first cabinet meeting?

The allegations stem from Carney’s role as chairman of Brookfield from 2020 to January 2025, where he co-chaired funds worth $25 billion registered in Bermuda and a $5 billion fund in the Cayman Islands, according to CBC News reports. These arrangements, which reportedly allowed Brookfield to avoid $5.3 billion in taxes, have drawn scrutiny amid Canada’s economic challenges, including rising food bank usage and housing affordability issues.

In response, the Liberal government House Leader defended Carney, dismissing Barrett’s questions as “hypotheticals and conjured scenarios.” “The Prime Minister has followed all the rules even before they were required,” the House Leader stated, emphasizing that Carney’s blind trust complies with Canada’s “stringent ethics guidelines.” The response pivoted to the government’s agenda, citing efforts to create “the strongest economy in the G7,” reduce taxes, and build new homes, while accusing the opposition of “digging dirt on day one.” The House Leader’s retort, “Shame on them,” drew murmurs of support from Liberal benches.

Undeterred, Barrett doubled down, arguing that Canadians “don’t want an explanation on how to bend over backwards to fit through ethical loopholes.” He called for assurance that Carney’s actions go “above just the basic minimum standard,” referencing a decade of perceived Liberal ethical lapses. “Can he stand up and assure Canadians that none of the funds he had previously were held in offshore tax havens?” Barrett asked, pressing for specifics on Carney’s financial holdings.

The Liberal response reiterated Carney’s compliance, with the House Leader asserting, “Canada has among the most stringent ethics guidelines in the world… The Prime Minister is busy creating opportunity for Canada, standing up in a trade war against the United States.” The deflection, focusing on economic priorities and dismissing the opposition’s probe as a distraction, left Barrett’s core questions unanswered, fueling Conservative claims of evasion.

This entire exchange isn’t just about one question or one day—it’s part of a much larger and very necessary effort by Conservatives to expose something Canadians are starting to see with painful clarity: Mark Carney is not one of them. He’s not scraping to make rent. He’s not standing in a food bank line. He’s not worried about carbon taxes or grocery bills. He’s a Davos man, parachuted into the Prime Minister’s Office by the same Liberal elite that gave us Justin Trudeau. Different face. Same contempt.

Barrett’s takedown of Carney over offshore tax havens hit a nerve, and rightly so. According to Canadians for Tax Fairness, this country loses a jaw-dropping $30 billion every year to offshore tax avoidance. That’s money that working Canadians pay so the elite can squirrel away their wealth in places like Bermuda and the Cayman Islands. And Carney? He helped orchestrate it. As a top dog at Brookfield Asset Management, he didn’t just benefit from the system—he helped design it. And if that wasn’t enough, under his leadership, Brookfield moved its headquarters from Toronto to New York. In the middle of growing trade tensions with President Trump’s America. That’s not leadership—it’s betrayal.

And how does Carney justify all this? With the most nauseating phrase in the English language: “It was legal.” Oh, well, as long as the loopholes were big enough to drive a luxury yacht through, I guess we’re fine. He claims these “tax-efficient” strategies helped pensioners and that his blind trust protects him from conflicts. Right. Because what better way to gain public trust than hiding your financial interests in a vault and telling voters, “Just trust me”?

Barrett and the Conservatives aren’t buying it—and neither should you. They’re calling for real reform, tougher disclosure rules, and an end to the wink-wink, nudge-nudge ethics games that the Liberals have been playing for a decade. Carney delayed his financial disclosures during his leadership run? Of course he did. That’s not transparency. That’s strategy. And Canadians know it.

Even the so-called experts are noticing the shift. One analyst noted Barrett’s attacks are landing with voters because they’re the ones who are actually suffering. Meanwhile, the Liberals want to pivot to their so-called “economic wins.” Great. Tell that to the family paying $7 for lettuce or the trucker trying to fuel his rig with gas prices through the roof.

As Parliament gets underway, we’re heading into a full-blown war over ethics and economic justice. And the question for Carney is simple: Is he going to answer for his record—or is he going to keep hiding behind the same smug Liberal arrogance that Canadians are sick and tired of?

The people are watching. The mask is off. And Mark Carney has a choice: come clean—or be dragged into the sunlight.

Business

Carney’s Deficit Numbers Deserve Scrutiny After Trudeau’s Forecasting Failures

From the Frontier Centre for Public Policy

By Conrad Eder

Frontier Centre for Public Policy study reveals a decade of inflated Liberal forecasts—a track record that casts a long shadow over Carney’s first budget

The Frontier Centre for Public Policy has released a major new study revealing that the Trudeau government’s federal budget forecasts from 2016 to 2025 were consistently inaccurate and biased — a record that casts serious doubt on the projections in Prime Minister Mark Carney’s first budget.

Carney’s 2025–26 federal budget forecasts a $78.3-billion deficit — twice the size projected last year and four times what was forecast in Budget 2022. But if recent history is any guide, Canadians have good reason to question whether even this ballooning deficit reflects fiscal reality.

The 4,000-word study, Measuring Federal Budgetary Balance Forecasting Accuracy and Bias, by Frontier Centre policy analyst Conrad Eder, finds that forecast accuracy collapsed after the Trudeau government took office:

- Current-year forecasts were off by an average of $22.9 billion, or one per cent of GDP.

- Four-year forecasts missed the mark by an average of $94.4 billion, or four per cent of GDP.

- Long-term projections consistently overstated Canada’s fiscal health, showing a clear optimism bias.

Eder’s analysis shows that every three- and four-year forecast under Trudeau predicted a stronger financial position than what actually occurred, masking the true scale of deficits and debt accumulation. The study concludes that this reflects a systemic optimism bias, likely rooted in political incentives: short-term optics with no regard to long-term consequences.

“With Prime Minister Carney now setting Canada’s fiscal direction, it’s critical to assess his projections in light of this track record,” said Eder. “The pattern of bias and inaccuracy under previous Liberal governments gives reason to doubt the credibility of claims that deficits will shrink over time. Canadians deserve fiscal forecasts that are credible and transparent — not political messaging disguised as economic planning.”

The study warns that persistent optimism bias erodes fiscal accountability, weakens public trust and limits citizens’ ability to hold government to account — a threat to both economic sustainability and democratic transparency.

Business

Here’s what pundits and analysts get wrong about the Carney government’s first budget

From the Fraser Institute

By Jason Clemens and Jake Fuss

Under the new budget plan, this wedge between what the government collects in revenues versus what is actually spent on programs will rise to 13.0 per cent by 2029/30. Put differently, slightly more than one in every eight dollars sent to Ottawa will be used to pay interest on debt for past spending.

The Carney government’s much-anticipated first budget landed on Nov. 4. There’s been much discussion by pundits and analysts on the increase in the deficit and borrowing, the emphasis on infrastructure spending (broadly defined), and the continued activist approach of Ottawa. There are, however, several critically important aspects of the budget that are consistently being misstated or misinterpreted, which makes it harder for average Canadians to fully appreciate the consequences and costs of the budget.

One issue in need of greater clarity is the cost of Canada’s indebtedness. Like regular Canadians and businesses, the government must pay interest on federal debt. According to the budget plan, total federal debt will reach an expected $2.9 trillion in 2029/30. For reference, total federal debt stood at $1.0 trillion when the Trudeau government took office in 2015. The interest costs on that debt will rise from $53.4 billion last year to an expected $76.1 billion by 2029/30. Several analyses have noted this means federal interest costs will rise from 1.7 per cent of GDP to 2.1 per cent.

These are all worrying statistics about the indebtedness of the federal government. However, they ignore a key statistic—interest costs as a share of revenues. When the Trudeau government took office, interest costs consumed 7.5 per cent of revenues. This means taxpayers were foregoing 7.5 per cent of the resources they sent to Ottawa (in terms of spending on actual programs) because these monies were used to pay interest on debt accumulated from previous spending.

Under the new budget plan, this wedge between what the government collects in revenues versus what is actually spent on programs will rise to 13.0 per cent by 2029/30. Put differently, slightly more than one in every eight dollars sent to Ottawa will be used to pay interest on debt for past spending. This is one way governments get into financial problems, even crises, by continually increasing the share of revenues consumed by interest payments.

A second and fairly consistently misrepresented aspect of the budget pertains to large spending initiatives such as Build Canada Homes and Build Communities Strong Fund. The former is meant to increase the number of new homes, particularly affordable homes, being built annually and the latter is intended to provide funding to provincial governments (and through them, municipalities) for infrastructure spending. But few analysts question whether or not these programs will produce actual new spending for homebuilding or simply replace or “crowd-out” existing spending by the private sector.

Let’s first explore the homebuilding initiative. At any point in time, there are a limited number of skilled workers, raw materials, land, etc. available for homebuilding. When the federal government, or any government, initiates its own homebuilding program, it directly competes with private companies for that skilled labour (carpenters, electricians, etc.), raw materials (timber, concrete, etc.) and the land needed for development. Put simply, government homebuilding crowds out private-sector activity.

Moreover, there’s a strong argument that the crowding out by government results in less homebuilding than would otherwise be the case, because the incentives for private-sector homebuilding are dramatically different than government incentives. For example, private firms risk their own wealth and wellbeing (and the wellbeing of their employees) so they have very strong incentives to deliver homes demanded by people on time and at a reasonable price. Government bureaucrats and politicians, on the other hand, face no such incentives. They pay no price, in terms of personal wealth or wellbeing if homes, are late, not what consumers demand, or even produce less than expected. Put simply, homebuilding by Ottawa could easily result in less homes being built than if government had stayed out of the way of entrepreneurs, businessowners and developers.

Similarly, it’s debatable that infrastructure spending by Ottawa—specifically, providing funds to the provinces and municipalities—results in an actual increase in total infrastructure spending. There are numerous historical examples, including reports by the auditor general, detailing how similar infrastructure spending initiatives by the federal government were plagued by mismanagement. And in many circumstances, the provinces simply reduced their own infrastructure spending to save money, such that the actual incremental increase in overall infrastructure spending was negligible.

In reality, some of the major and large spending initiatives announced or expanded in the Carney government’s first budget, which will accelerate the deterioration of federal finances, may not deliver anything close to what the government suggests. Canadians should understand the real risks and challenges in these federal spending initiatives, along with the debt being accumulated, and the limited potential benefits.

-

Justice1 day ago

Justice1 day agoCarney government lets Supreme Court decision stand despite outrage over child porn ruling

-

Daily Caller2 days ago

Daily Caller2 days agoUS Eating Canada’s Lunch While Liberals Stall – Trump Admin Announces Record-Shattering Energy Report

-

Business1 day ago

Business1 day agoCarney’s budget spares tax status of Canadian churches, pro-life groups after backlash

-

COVID-191 day ago

COVID-191 day agoFreedom Convoy leader Tamara Lich to appeal her recent conviction

-

Business2 days ago

Business2 days agoPulling back the curtain on the Carney government’s first budget

-

Energy2 days ago

Energy2 days agoEby should put up, shut up, or pay up

-

Business2 days ago

Business2 days agoThe Liberal budget is a massive FAILURE: Former Liberal Cabinet Member Dan McTeague

-

Daily Caller1 day ago

Daily Caller1 day agoUN Chief Rages Against Dying Of Climate Alarm Light