Business

Quebecers want feds to focus on illegal gun smuggling not gun confiscation

The Canadian Taxpayers Federation released new Leger polling showing that half of Quebecers say the most effective way to reduce gun crime is to crack down on illegal gun smuggling from the United States, not a federal gun ban and confiscation.

“Law enforcement experts say the best way to make Canada safer is to stop illegal gun smuggling and Quebecers say exactly the same thing,” said Nicolas Gagnon, CTF Quebec Director. “It makes no sense to pour hundreds of millions into a confiscation that only takes guns from lawfully licensed gun owners.”

In 2020, the federal government launched its policy to confiscate thousands of so-called “assault-style” firearms from licensed gun owners. Ottawa recently announced a pilot project in Cape Breton to start taking firearms from individual owners.

The Leger poll asked Quebecers what they think is the most effective way to reduce gun crime. Results of the poll show:

- 51 per cent say introducing tougher measures to stop the illegal smuggling of guns into Canada from the United States

- 37 per cent say banning the sale and ownership of many different makes and models of guns along with a government buyback program

- Six per cent say neither of these options

- Seven per cent do not know

The results of the polls arrived as recorded remarks from Public Safety Minister Gary Anandasangaree made headlines in September.

In a leaked audio recording, the minister suggested the confiscation program is being pushed in part because of voters in Quebec, while also expressing doubt that local police services have the resources to enforce it.

Police organizations have long warned Ottawa’s confiscation program is misguided. The RCMP union says it “diverts extremely important personnel, resources, and funding away from addressing the more immediate and growing threat of criminal use of illegal firearms.”

The program was first estimated to cost $200 million. Just providing compensation for the banned guns, not including administrative costs, could cost up to $756 million, according to the Parliamentary Budget Officer.

Premiers of Alberta and Saskatchewan have both publicly said that they would not cooperate with Ottawa’s gun ban. Premier François Legault has stayed silent on this issue.

“Quebecers have been clear: the real problem is illegal gun smuggling, not law-abiding firearms owners,” said Gagnon. “The police have also made it clear the gun confiscation will waste money that could be used to stop criminals from committing gun crimes.

“Legault needs to stand up for Quebec taxpayers and refuse to help implement Ottawa’s costly and ineffective confiscation scheme. The federal government needs to drop this plan and focus its resources on intercepting illegal guns at the border: that’s how you actually make communities safer.”

Business

Emission regulations harm Canadians in exchange for no environmental benefit

From the Fraser Institute

By Julio Mejía and Elmira Aliakbari

The PBO estimates that the CFR will decrease Canada’s economic output by up to 0.3 per cent—or approximately $9.0 billion—in 2030. For context, that’s more than the entire output of Prince Edward Island in 2024, so the effects are roughly equivalent to wiping out the economy of a whole province.

The Carney government recently announced changes to the Clean Fuel Regulations (CFR), signalling stricter carbon content rules for gasoline and diesel—though few details were provided. While the prime minister expressed confidence that the changes will strengthen the Canadian economy, in reality, the CFR is designed to increase fuel prices in exchange for negligible environmental benefits. If the government is serious about prioritizing the wellbeing of Canadians, it shouldn’t tinker with the CFR—it should eliminate it.

The CFR, which came into effect in July 2023, aims to reduce greenhouse gas (GHG) emissions by requiring a gradual reduction in the carbon content of gasoline and diesel. By 2030, fuels must contain 15 per cent fewer GHG per unit of energy than in 2016. Those who don’t meet the target must buy compliance credits, which raises their costs. Ultimately, these costs are all passed on to Canadians at the pump.

According to a recent study by the Parliamentary Budget Officer (PBO), the CFR is expected to increase fuel prices by up to 17 cents per litre for gasoline and 16 cents for diesel by 2030. These costs will be added on top of already high, policy-driven fuel costs. In 2023, for example, the average price of gasoline in Canada was 157.3 Canadian cents per litre, compared to just 129.4 cents per litre in the United States—a 21 per cent difference, mainly the result of fuel taxes in Canada.

As fuel prices rise due to the CFR, the costs of running tractors, powering machinery, and producing and transporting goods and services will all increase, setting off ripple effects across our economy. The PBO estimates that the CFR will decrease Canada’s economic output by up to 0.3 per cent—or approximately $9.0 billion—in 2030. For context, that’s more than the entire output of Prince Edward Island in 2024, so the effects are roughly equivalent to wiping out the economy of a whole province.

Of course, increases in fuel prices also mean more pressure to household budgets. The PBO estimates that in 2030, the average Canadian household will incur $573 in additional costs because of the changes to the CFR, and lower-income households will bear a disproportionately larger burden because they spend more of their budget on energy.

The policy’s uneven impact across provinces is particularly significant for lower-income regions. For example, households in Nova Scotia and P.E.I.—two of the provinces with the lowest median household incomes—are expected to bear average annual costs of $635 and $569, respectively. In contrast, families in Ontario and British Columbia—two of the provinces with higher median household incomes—will pay less, $495 and $384 per year, respectively. Simply put, the CFR imposes more costs on those who make less.

To make matters worse, the expected environmental benefits of the CFR are negligible. Even if it delivers its full projected reduction of 26 million tonnes of GHG emissions by 2030, that represents only “two weeks of greenhouse gas emissions from the Canadian economy,” according to the federal government.

Given that GHG emissions cross all borders regardless of where they originate, in a broader perspective, that reduction represents just 0.04 per cent of projected global emissions by 2030. So, Canadians are being asked to pay a material price for a measure that will have virtually no environmental impact.

Toughening regulations on carbon content for gas and diesel won’t benefit Canadians, in fact, it will do the opposite. The CFR places a real financial burden on Canadian households while delivering no meaningful environmental benefit. When a policy’s costs vastly outweigh its benefits, the answer isn’t to adjust it, it’s to scrap it.

Julio Mejía

Business

US government buys stakes in two Canadian mining companies

From the Fraser Institute

Prime Minister Mark Carney recently visited the White House for meetings with President Donald Trump. In front of the cameras, the mood was congenial, with both men complimenting each other and promising future cooperation in several areas despite the looming threat of Trump tariffs.

But in the last two weeks, in an effort to secure U.S. access to key critical minerals, the Trump administration has purchased sizable stakes in in two Canadian mining companies—Trilogy Metals and Lithium Americas Corp (LAC). And these aggressive moves by Washington have created a dilemma for Ottawa.

Since news broke of the investments, the Carney government has been quiet, stating only it “welcomes foreign direct investment that benefits Canada’s economy. As part of this process, reviews of foreign investments in critical minerals will be conducted in the best interests of Canadians.”

In the case of LAC, lithium is included in Ottawa’s list of critical minerals that are “essential to Canada’s economic or national security.” And the Investment Canada Act (ICA) requires the government to scrutinize all foreign investments by state-owned investors on national security grounds. Indeed, the ICA specifically notes the potential impact of an investment on critical minerals and critical mineral supply chains.

But since the lithium will be mined and processed in Nevada and presumably utilized in the United States, the Trump administration’s investment will likely have little impact on Canada’s critical mineral supply chain. But here’s the problem. If the Carney government initiates a review, it may enrage Trump at a critical moment in the bilateral relationship, particularly as both governments prepare to renegotiate the Canada-U.S.-Mexico Agreement (CUSMA).

A second dilemma is whether the Carney government should apply the ICA’s “net benefits” test, which measures the investment’s impact on employment, innovation, productivity and economic activity in Canada. The investment must also comport with Canada’s industrial, economic and cultural policies.

Here, the Trump administration’s investment in LAC will likely fail the ICA test, since the main benefit to Canada is that Canadian investors in LAC have been substantially enriched by the U.S. government’s initiative (a week before the Trump administration announced the investment, LAC’s shares were trading at around US$3; two days after the announcement, the shares were trading at US$8.50). And despite any arguments to the contrary, the ICA has never viewed capital gains by Canadian investors as a benefit to Canada.

Similarly, the shares of Trilogy Minerals surged some 200 per cent after the Trump administration announced its investment to support Trilogy’s mineral exploration in Alaska. Again, Canadian shareholders benefited, yet according to the ICA’s current net benefits test, that’s irrelevant.

But in reality, inflows of foreign capital augment domestic savings, which, in turn, provide financing for domestic business investment in Canada. And the prospect of realizing capital gains from acquisitions made by foreign investors encourages startup Canadian companies.

So, what should the Carney government do?

In short, it should revise the ICA so that national security grounds are the sole basis for approving or rejecting investments by foreign governments in Canadian companies. This may still not sit well in Washington, but the prospect of retaliation by the Trump administration should not prevent Canada from applying its sovereign laws. However, the Carney government should eliminate the net benefits test, or at least recognize that foreign investments that enrich Canadian shareholders convey benefits to Canada.

These recent investments by the Trump administration may not be unique. There are hundreds of Canadian-owned mining companies operating in the U.S. and in other jurisdictions, and future investments in some of those companies by the U.S. or other foreign governments are quite possible. Going forward, Canada’s review process should be robust while recognizing all the benefits of foreign investment.

-

Energy23 hours ago

Energy23 hours agoMinus Forty and the Myth of Easy Energy

-

Uncategorized23 hours ago

Uncategorized23 hours agoNew report warns WHO health rules erode Canada’s democracy and Charter rights

-

Business3 hours ago

Business3 hours agoEmission regulations harm Canadians in exchange for no environmental benefit

-

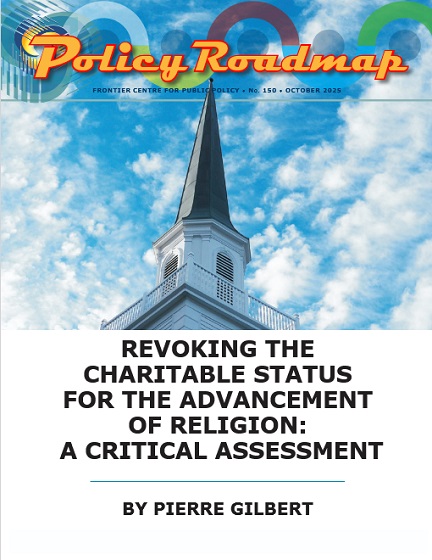

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoOttawa Should Think Twice Before Taxing Churches

-

Alberta1 day ago

Alberta1 day agoBusting five myths about the Alberta oil sands

-

Business1 day ago

Business1 day agoUS government buys stakes in two Canadian mining companies

-

Crime21 hours ago

Crime21 hours agoFrance stunned after thieves loot Louvre of Napoleon’s crown jewels

-

Courageous Discourse49 mins ago

Courageous Discourse49 mins agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears