Daily Caller

‘Proud Feminist’ Justin Trudeau Distraught That Americans Didn’t Vote For ‘First Woman President’

From the Daily Caller News Foundation

By Jason Cohen

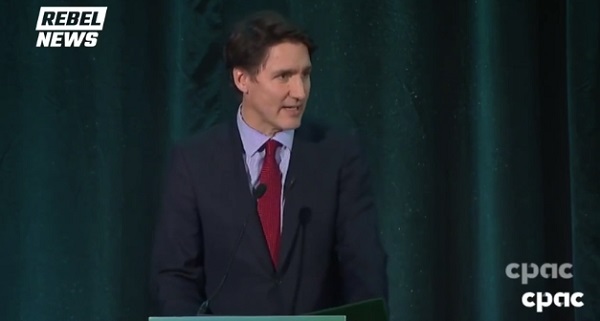

Canadian Prime Minister Justin Trudeau expressed sadness Tuesday about Vice President Kamala Harris’ loss to President-elect Donald Trump.

Trump defeated Harris with 312 electoral votes and won the popular vote with just under 50% of the total, according to the Cook Political Report. Trudeau, at an Equal Voice Foundation event, said women are “under attack” in the wake of America’s 2024 presidential election results, according to the National Post, a Canadian newspaper.

WATCH:

“We were supposed to be on a steady, if difficult sometimes, march towards progress. And yet, just a few weeks ago, the United States voted for a second time to not elect its first woman president,” Trudeau said. “Everywhere, women’s rights and women’s progress is under attack. Overtly, and subtly. But I want you to know that I am, and always will be, a proud feminist. You will always have an ally in me, and in my government.”

Over 25% of Canadians view Trump positively, while only 23% view Trudeau positively, according to a recent Abacus Data poll shared with the Toronto Star.

The Canadian government is beefing up its border security apparatus after Trump in November threatened to levy a 25% tariff on all products from Canada and Mexico unless they do more to limit the flow of illegal immigration and drugs entering the United States. Trudeau subsequently met with Trump at his Mar-a-Lago residence and his government has described the additional steps it is taking to bolster immigration enforcement.

“We got, I think, a mutual understanding of what they’re concerned about in terms of border security,” Minister of Public Safety Dominic LeBlanc, who accompanied Trudeau to Mar-a-Lago, said of the meeting in an interview with Canadian media. “All of their concerns are shared by Canadians and by the government of Canada.”

“We talked about the security posture currently at the border that we believe to be effective, and we also discussed additional measures and visible measures that we’re going to put in place over the coming weeks,” LeBlanc continued. “And we also established, Rosemary, a personal series of rapport that I think will continue to allow us to make that case.”

Daily Caller

Is Ukraine Peace Deal Doomed Before Zelenskyy And Trump Even Meet At Mar-A-Lago?

From the Daily Caller News Foundation

As Ukraine and the U.S. try one more time to reach agreement on terms for a peace deal to end the war with Russia, questions remain about whether a resolution is still possible after multiple stalled rounds of negotiations.

President Volodymyr Zelenskyy of Ukraine is set to meet with President Donald Trump at Mar-a-Lago on Sunday to discuss the current proposal for ending the war. The terms and language of the proposed deal have undergone substantial revisions since it was first presented in November, largely due to objections from Ukraine and other European powers.

Despite multiple rounds of peace negotiations fizzling out over the past year, foreign policy and defense experts told the Daily Caller News Foundation that Trump still has a chance to make peace if he can convince Putin that the cost of waging war outweighs the benefits, but that it’s unlikely any of the parties will leave the table satisfied.

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“The President’s team sees that stark reality, but also envisions a golden future for Ukraine once the fighting stops—a prosperous, strong, independent nation could rise from the ashes we see today,” Morgan Murphy, former Trump White House official and current Republican Senate candidate in Alabama, told the DCNF. “To get there will take a deal that likely leaves all parties—Ukraine, Russia, and Europe—unhappy when they leave the negotiation table.”

While Russia has signaled some willingness to make compromises, most recently saying it would accept Ukrainian European Union membership, Putin has so far not agreed to any ceasefire in the interim. U.S. officials previously told the DCNF that they resolved “90%” of the issues between Russia and Ukraine in the new deal, but stopped short of elaborating on the outstanding issues.

Zelenskyy expressed cautious optimism about his ongoing talks with Trump’s team in an X post on Christmas Day, but emphasized that a few “sensitive issues” still need to be worked out. While those points of contention weren’t specifically named, Ukraine has long objected to any territorial concessions to Russia and has sought additional security guarantees from the U.S. and European allies.

It is important if we succeed in organizing what we discussed today with President Trump’s envoys. Some documents, as I see it, are nearly ready, and some documents are fully prepared. Of course, there is still work to be done on sensitive issues. But together with the American… pic.twitter.com/kCmrNOaQBQ

— Volodymyr Zelenskyy / Володимир Зеленський (@ZelenskyyUa) December 25, 2025

A number of foreign policy experts, including those who spoke to the Daily Caller News Foundation, warn that excessive concessions to Moscow could embolden U.S. adversaries around the world, including China.

“A rushed or weak settlement would do real damage to U.S. national security,” Carrie Filipetti, executive director of the Vandenberg Coalition, told the DCNF. “It would tell Putin that aggression pays and signal to adversaries like China that borders and sovereignty are negotiable. That is not peace, it is an invitation for the next crisis.”

Putin has continued to strike Ukraine relentlessly during ongoing talks, mainly targeting critical energy infrastructure. Despite Putin’s continued push to win militarily in Ukraine, Heather Nauert, a former U.S. State Department spokesperson, told the DCNF that his actions come less from a position of strength and more from desperation to quickly end the war before he is forced to concede.

“While Putin likely still thinks he can win, his actions are those of someone who is increasingly desperate,” Nauert told the DCNF. “With Vladimir Putin, you don’t get peace because you ask nicely; you get peace when he sees he can’t improve his position by continuing to wage his war. History shows that Moscow only takes negotiations seriously when the pressure is real and sustained.”

Despite projecting resolve publicly, Moscow has paid a staggering price for its war in Ukraine, with various estimates putting casualties among Kremlin forces at no fewer than 600,000. Russia has nevertheless made slow but steady gains on the battlefield, including taking the town of Siversk on Tuesday.

Putin’s government expected a short conflict and swift victory after the initial invasion of Ukraine. But Russian forces were repelled decisively in the 2022 assault on Kyiv, leading to multiple counter-offensives from Ukraine and the resulting protracted war.

Ukraine has held its ground at great cost to itself, needing significant support from the U.S. and Europe. The U.S. has spent over $180 billion on Ukraine since the war began in 2022, and Trump recently signed a bill allocating $800 million of support for Ukraine over the next two years.

Ukraine is dead set on gaining better future security guarantees from the U.S. in exchange for any peace, and U.S. officials previously told the DCNF that the new provisions offer guarantees that function similarly to NATO’s Article 5, promising mutual defense if one is attacked.

“I am not sure he can cut that deal without a commitment to Ukraine, by the U.S. and our allies, that we will stand behind them until a satisfactory peace deal can be made,” Bruce Carlson, retired U.S. Air Force general and former director of the National Reconnaissance Office, told the DCNF. “In recent negotiations with the Ukrainians and other allies [Trump] has made some compromises. Now, with a very confident Putin, he will have to re-sell this new and modified deal.”

Daily Caller

US Halts Construction of Five Offshore Wind Projects Due To National Security

From the Daily Caller News Foundation

Interior Secretary Doug Burgum leveled the Trump administration’s latest broadside at the struggling U.S. offshore wind industry on Monday, ordering an immediate suspension of activities at the five big wind projects currently in development.

“Today we’re sending notifications to the five large offshore wind projects that are under construction that their leases will be suspended due to national security concerns,” Burgum told Fox Business host Maria Bartiromo. “During this time of suspension, we’ll work with the companies to try to find a mitigation. But we completed the work that President Trump has asked us to do. The Department of War has come back conclusively that the issues related to these large offshore wind programs have created radar interference that creates a genuine risk for the U.S.”

Predictably, reaction to Burgum’s order was immediate, with opponents of offshore wind praising the move, and industry supporters slamming it. In Semafor’s energy-related newsletter on Tuesday, energy and climate editor Tim McDowell quotes an unnamed ex-Energy Department official as claiming, “the Pentagon and intelligence services, which are normally sensitive to even extremely low-probability risks, never flagged this as a concern previously.” (RELATED: Trump Admin Orders Offshore Wind Farm Pauses Over ‘National Security Risks’)

Yet, a simple 30-second Google search finds a wealth of articles going back to as early as October 2014 discussing ways to mitigate the long-ago identified issue of interference with air defense radars by these enormous windmills, some of which are taller than the Eiffel Tower. It is a simple fact that the issue was repeatedly raised during the Biden Administration’s mad rush to speed these giant windmill operations into the construction phase by cutting corners in the permitting process.

In May, 2024, the Bureau of Ocean Energy Management’s (BOEM) own analysis related to the Atlantic Shores South project contains a detailed discussion of the potential impacts and suggests multiple ways to mitigate for them. An Oct. 29, 2024 memo of understanding between BOEM and the Biden Department of Defense calls for increased collaboration between the two departments as a response to concerns from members of Congress and others related to these very long-known potential impacts.

The Georgia Tech Research Institute published a study dated June 6, 2022 detailing “Radar Impacts, Potential Mitigation, from Offshore Wind Turbines.” That study was in fact commissioned by the National Academies of Sciences, Engineering, and Medicine (NASEM), a private non-profit that functions as an advisory group to the federal government.

Oh.

A report published in February 2024 by International Defense Security & Technology, Inc. describes the known issues thusly:

“Wind turbines can create clutter on radar screens in a number of ways. First, the metal towers and blades of wind turbines can reflect radar signals. This can create false returns on radar screens, which can make it difficult to detect and track real targets.

“Second, the rotating blades of wind turbines can create a Doppler effect on radar signals. This can cause real targets to appear to be moving at different speeds than they actually are. This can also make it difficult to track real targets.”

The simple Google search I conducted returns hundreds of articles dating all the way back to 2006 related to this long-known yet unresolved issue that could present a very real threat to national security. The fact that the Biden administration, in its religious zeal to speed these enormous offshore industrial projects into the construction phase, chose to downplay and ignore this threat in no way obligates his successor in office to commit the same dereliction of duty.

Some wind proponents are cynically raising concerns that a future Democratic administration could use this example as justification for cancelling oil and gas projects. It’s as if they’ve all forgotten about the previous four years of the Autopen presidency, which featured Joe Biden’s Day 1 order cancelling the 80% completed Keystone XL pipeline, a year-long moratorium on LNG export permitting, an attempt to set aside more than 200 million acres of the U.S. offshore from future leasing, and too many other destructive moves to detail here.

Again, a simple web search reveals that experts all over the world believe this is a real problem. If so, it needs to be addressed as a matter of national security. Burgum is intent on doing that. All half-baked talking points aside, this really isn’t complicated.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

Business2 days ago

Business2 days agoDark clouds loom over Canada’s economy in 2026

-

Business2 days ago

Business2 days agoThe Real Reason Canada’s Health Care System Is Failing

-

Business2 days ago

Business2 days agoFederal funds FROZEN after massive fraud uncovered: Trump cuts off Minnesota child care money

-

Addictions1 day ago

Addictions1 day agoCoffee, Nicotine, and the Politics of Acceptable Addiction

-

Opinion1 day ago

Opinion1 day agoGlobally, 2025 had one of the lowest annual death rates from extreme weather in history

-

International13 hours ago

International13 hours agoTrump confirms first American land strike against Venezuelan narco networks

-

Business13 hours ago

Business13 hours agoHow convenient: Minnesota day care reports break-in, records gone

-

Business13 hours ago

Business13 hours agoThe great policy challenge for governments in Canada in 2026