Business

Prairie provinces and Newfoundland and Labrador see largest increases in size of government

From the Fraser Institute

By Jake Fuss and Grady Munro

A recent study found that Canada has experienced one of the largest increases in the size of government of any advanced country over the last decade. But within Canada, which provinces have led the way?

The size of government refers to the extent to which resources within the economy are controlled and directed by the government, and has important implications for economic growth, living standards, and economic freedom—the degree to which people are allowed to make their own economic choices.

Too much of anything can be harmful, and this is certainly true regarding the size of government. When government grows too large it begins to take on roles and resources that are better left to the private sector. For example, rather than focusing on core functions like maintaining the rule of law or national defence, a government that has grown too large might begin subsidizing certain businesses and industries over others (i.e. corporate welfare) in order to pick winners and losers in the market. As a result, economic growth slows and living standards are lower than they otherwise would be.

One way to measure the size of government is by calculating total general government spending as a share of the economy (GDP). General government spending refers to spending by governments at all levels (federal, provincial, and municipal), and by measuring this as a share of gross domestic product (GDP) we can compare across jurisdictions of different sizes.

A recent study compared the size of government in Canada as a whole with that of 39 other advanced economies worldwide, and found that Canada experienced the second-largest increase in the size of government (as a share of the economy) from 2014 to 2024. In other words, since 2014, governments in Canada have expanded their role within the economy faster than governments in virtually every other advanced country worldwide—including all other countries within the Group of Seven (France, Germany, Italy, Japan, the United Kingdom, and the United States). Moreover, the study showed that Canada as a whole has exceeded the optimal size of government (estimated to fall between 24 and 32 per cent of GDP) at which a country can maximize their economic growth. Beyond that point, growth slows and is lower than it otherwise would be.

However, Canada is a decentralized country and provinces vary as to the extent to which governments direct overall economic activity. Using data from Statistics Canada, the following charts illustrate which provinces in Canada have the largest size of government and which have seen the largest increases since 2014.

The chart above shows total general government spending as a share of GDP for all ten provinces in 2023 (the latest year of available provincial data). The size of government in the provinces varies considerably, ranging from a high of 61.4 per cent in Nova Scotia to a low of 30.0 per cent in Alberta. There are geographical differences, as three Atlantic provinces (Nova Scotia, Prince Edward Island, and New Brunswick) have the largest governments while the three western-most provinces (Alberta, Saskatchewan, and British Columbia) have the smallest governments. However, as of 2023, all provinces except Alberta exceeded the optimal size of government—which again, is between 24 and 32 per cent of the economy.

To show which provinces have experienced the greatest increase in the size of government in recent years, the second chart shows the percentage point increase in total general government spending as a share of GDP from 2014 to 2023. It should be noted that this is measuring the expansion of the federal government’s role in the economy—which has been substantial nationwide—as well as growth in the respective provincial and municipal governments.

The increases in the size of government since 2014 are largest in four provinces: Newfoundland and Labrador (10.82 percentage points), Alberta (7.94 percentage points), Saskatchewan (7.31 percentage points), and Manitoba (7.17 percentage points). These are all dramatic increases—for perspective, in the study referenced above, Estonia’s 6.66 percentage point increase in its size of government was the largest out of 40 advanced countries.

The remaining six provinces experienced far lower increases in the size of government, ranging from a 2.74 percentage point increase in B.C. to a 0.44 percentage point increase in Quebec. However, since 2014, every province in Canada has seen government expand its role within the economy.

Over the last decade, Canada has experienced a substantial increase in the size of total government. Within the country, Newfoundland and Labrador and the three Prairie provinces have led the way in growing their respective governments.

Alberta

Alberta government records $8.3 billion surplus—but the good times may soon end

From the Fraser Institute

By Tegan Hill

According to last week’s fiscal update, the Smith government recorded a $8.3 billion surplus in 2024/25—$8 billion more than what the government projected in its original 2024 budget. But the good times won’t last forever.

Due largely to population growth, personal income tax revenue exceeded budget projections by $500 million. Business tax revenue exceeded budget expectations by $1.1 billion. And critically, thanks to relatively strong oil prices, resource revenue (e.g. oil and gas royalties) saw a $4.7 billion jump.

The large budget surplus is good news, particularly as it will be used to pay down government debt (which taxpayers must ultimately finance) and to invest for the future. But again, the good times could soon be over.

Recall, the Alberta government incurred a $17.0 billion budget deficit just a few years ago in 2020/21. And it wasn’t only due to COVID—until the recent string of surpluses, the government ran deficits almost every year since 2008/09, racking up significant amounts of debt, which still largely persists today. As a result, provincial government debt interest payments cost each Albertan $658 in 2024/25. Moreover, in February’s budget, the Smith government projected more deficits over the next three years.

Generally, Alberta’s fiscal fortunes follow the price of oil. Over the past decade, for example, resource revenue has been as low as $2.8 billion in 2015/16, while oil prices slumped to $US45.00 per barrel, and as high as $25.2 billion in 2022/23, when oil prices jumped to $US89.69 per barrel.

Put simply, resource revenue volatility fuels Alberta’s boom-and-bust cycle. In 2025/26, the West Texas Intermediate oil price will be a projected $US68.00 per barrel with projected resource revenue falling by $4.9 billion year-over-year.

But oil prices don’t need to dictate Alberta’s fiscal fortune. Indeed, if the Smith government restrains its spending, it can avoid deficits even when resource revenues fall.

There are plenty of ways to rein in spending. For instance, the government spends billions of dollars in subsidies (a.k.a. corporate welfare) to select industries and businesses in Alberta every year despite a significant body of research that shows these subsidies fail to generate widespread economic benefit. Eliminating these subsidies is a clear first step to deliver significant savings.

The budget surplus is undoubtedly positive for Albertans, but the good times could soon come to an end. To avoid deficits and debt accumulation moving forward, the Smith government should rein in spending.

Banks

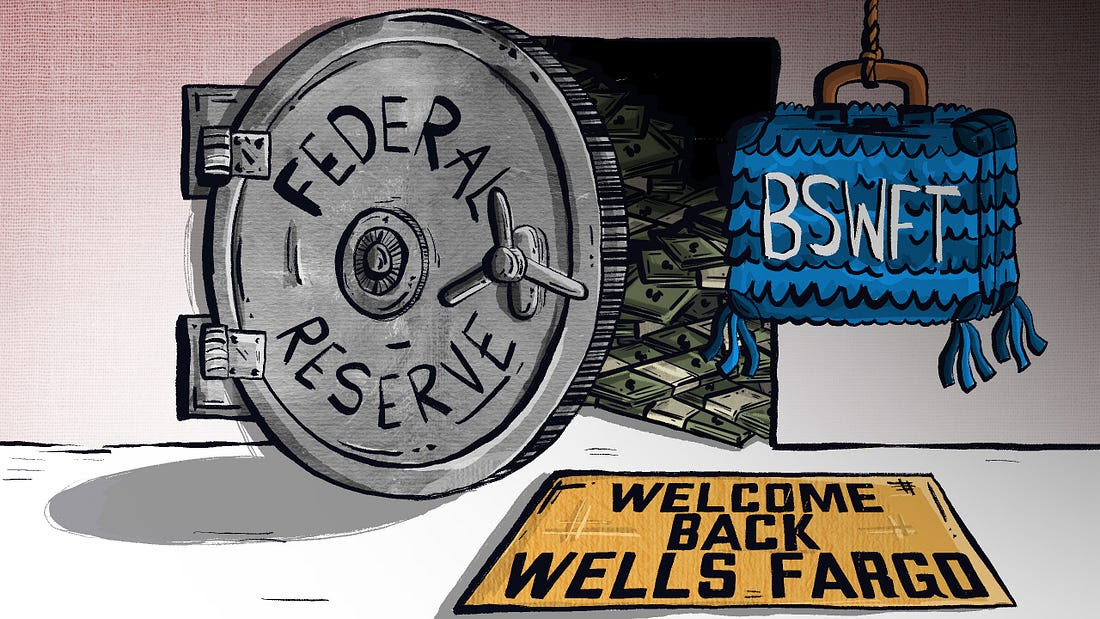

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

-

Business2 days ago

Business2 days agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party

-

Business2 days ago

Business2 days agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

International1 day ago

International1 day agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Business1 day ago

Business1 day agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

MxM News1 day ago

MxM News1 day agoUPenn strips Lia Thomas of women’s swimming titles after Title IX investigation

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report

-

Energy1 day ago

Energy1 day agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It

-

Crime23 hours ago

Crime23 hours agoBryan Kohberger avoids death penalty in brutal killing of four Idaho students