Business

Potential For Abuse Embedded In Bill C-5

From the National Citizens Coalition

By Peter Coleman

“The Liberal government’s latest economic bill could cut red tape — or entrench central planning and ideological pet projects.”

On the final day of Parliament’s session before its September return, and with Conservative support, the Liberal government rushed through Bill C-5, ambitiously titled “One Canadian Economy: An Act to enact the Free Trade and Labour Mobility in Canada Act and the Building Canada Act.”

Beneath the lofty rhetoric, the bill aims to dismantle interprovincial trade barriers, enhance labour mobility, and streamline infrastructure projects. In principle, these are worthy goals. In a functional economy, free trade between provinces and the ability of workers to move without bureaucratic roadblocks would be standard practice. Yet, in Canada, decades of entrenched Liberal and Liberal-lite interests, along with red tape, have made such basics a pipe dream.

If Bill C-5 is indeed wielded for good, and delivers by cutting through this morass, it could unlock vast, wasted economic potential. For instance, enabling pipelines to bypass endless environmental challenges and the usual hand-out seeking gatekeepers — who often demand their cut to greenlight projects — would be a win. But here’s where optimism wanes, this bill does nothing to fix the deeper rot of Canada’s Laurentian economy: a failing system propped up by central and upper Canadian elitism and cronyism. Rather than addressing these structural flaws of non-competitiveness, Bill C-5 risks becoming a tool for the Liberal government to pick more winners and losers, funneling benefits to pet progressive projects while sidelining the needs of most Canadians, and in particular Canada’s ever-expanding missing middle-class.

Worse, the bill’s broad powers raise alarms about government overreach. Coming from a Liberal government that recently fear-mongered an “elbows up” emergency to conveniently secure an electoral advantage, this is no small concern. The lingering influence of eco-radicals like former Environment Minister Steven Guilbeault, still at the cabinet table, only heightens suspicion. Guilbeault and his allies, who cling to fantasies like eliminating gas-powered cars in a decade, could steer Bill C-5’s powers toward ideological crusades rather than pragmatic economic gains. The potential for emergency powers embedded in this legislation to be misused is chilling, especially from a government with a track record of exploiting crises for political gain – as they also did during Covid.

For Bill C-5 to succeed, it requires more than good intentions. It demands a seismic shift in mindset, and a government willing to grow a spine, confront far-left, de-growth special-interest groups, and prioritize Canada’s resource-driven economy and its future over progressive pipe dreams. The Liberals’ history under former Prime Minister Justin Trudeau, marked by economic mismanagement and job-killing policies, offers little reassurance. The National Citizens Coalition views this bill with caution, and encourages the public to remain vigilant. Any hint of overreach, of again kowtowing to hand-out obsessed interests, or abuse of these emergency-like powers must be met with fierce scrutiny.

Canadians deserve a government that delivers results, not one that manipulates crises or picks favourites. Bill C-5 could be a step toward a freer, stronger economy, but only if it’s wielded with accountability and restraint, something the Liberals have failed at time and time again. We’ll be watching closely. The time for empty promises is over; concrete action is what Canadians demand.

Let’s hope the Liberals don’t squander this chance. And let’s hope that we’re wrong about the potential for disaster.

Peter Coleman is the President of the National Citizens Coalition, Canada’s longest-serving conservative non-profit advocacy group.

Business

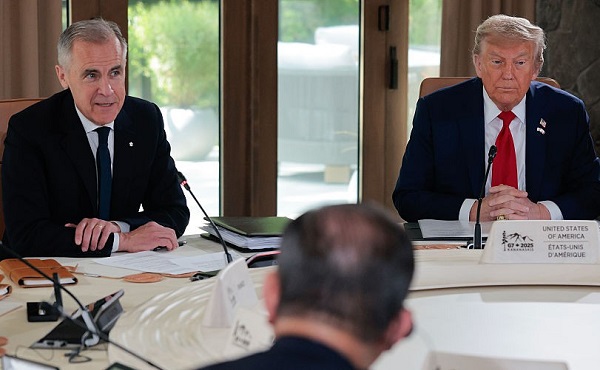

Trump announces end to trade negotiations with Canada over costly digital service tax

From LifeSiteNews

Donald Trump made the announcement Friday, citing frustration with Canadian tariffs on U.S. dairy products and its newly-enacted digital services tax.

U.S. President Donald Trump announced Friday an immediate halt to trade negotiations with Canada, citing frustration with Canadian tariffs on U.S. dairy products and its newly-enacted digital services tax.

Starting June 28, Canada’s digital services tax imposes a 3 percent tax on revenue from “[c]ertain digital services that rely on engagement, data, and content contributions of Canadian users” and “[c]ertain sales or licensing of Canadian user data.”

The Albany Times Union notes that the tax would apply to companies such as Amazon, Google, Meta, Uber, and Airbnb, but most critically from an American perspective “will apply retroactively, leaving U.S. companies with a $2 billion U.S. bill due at the end of the month.”

On Friday afternoon, Trump took to Truth Social to declare, “We have just been informed that Canada, a very difficult Country to TRADE with, including the fact that they have charged our Farmers as much as 400% Tariffs, for years, on Dairy Products, has just announced that they are putting a Digital Services Tax on our American Technology Companies, which is a direct and blatant attack on our Country.”

“They are obviously copying the European Union, which has done the same thing, and is currently under discussion with us, also,” the president continued. “Based on this egregious Tax, we are hereby terminating ALL discussions on Trade with Canada, effective immediately. We will let Canada know the Tariff that they will be paying to do business with the United States of America within the next seven day period. Thank you for your attention to this matter!”

🚨 HUGE: Trump announces IMMEDIATE END to trade negotiations with Canada’s. Tariffs to be announced within 7 days.

📸 Screenshot says it all 👇 pic.twitter.com/v0SefdB2MM— John-Henry Westen (@JhWesten) June 27, 2025

The United States currently imposes a 25 percent tariff on goods deemed not compliant with the United States-Mexico-Canada Agreement (USMCA), the trade agreement Trump negotiated in his first term to replace NAFTA; a 10 percent tariff on USMCA non-compliant energy products; and a 10 percent tariff on USMCA non-compliant potash.

Politico reports that Trump and Canadian Prime Minister Mark Carney had previously set a July 16 deadline for a new trade agreement, under which it was hoped that existing tariffs would be lifted. Instead, onlookers are now bracing to see what new tariff rates will be.

The tariffs on Canada are part of the Trump administration’s broader series of varying tariffs on most other nations (which have been adjusted, lifted, and delayed at various points over the past several months). Supporters say the trade war is necessary to make international trade fairer and spur a return of domestic manufacturing; opponents argue they increase costs on American consumers and small businesses.

Business

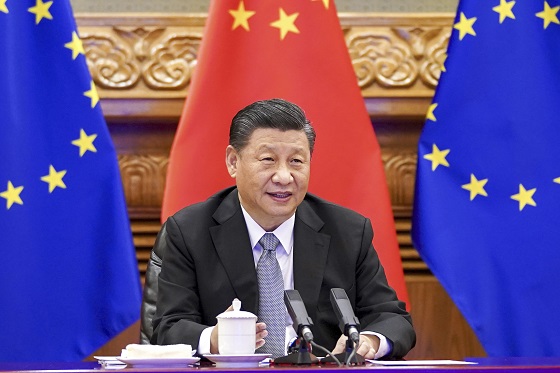

China still squeezing rare-earth exports despite U.S. pact

Quick Hit:

Weeks after agreeing to ease restrictions, China continues to stall rare-earth magnet exports, causing Western manufacturers to scramble for critical components and raising fears that Beijing is weaponizing its supply chain leverage.

Key Details:

- Applications for rare-earth magnet exports are being delayed or denied despite a U.S.-China agreement to resume trade.

- Western firms report that supply remains critically low, with some forced to redesign products or ship components by air to avoid shutdowns.

- China’s approval process demands sensitive commercial data, fueling concerns of industrial espionage and political pressure.

Diving Deeper:

Despite pledging to ease export restrictions on rare-earth magnets in a deal with the United States earlier this month, China continues to strangle the flow of these critical components, leaving Western industries on edge and trade tensions simmering.

Western companies say the situation has barely improved since China’s Ministry of Commerce promised to accelerate export license approvals. In practice, approvals remain rare, applications take weeks to process, and many are outright rejected. The bottleneck is hitting manufacturers hard—particularly automakers and electronics producers—who rely on China’s near-monopoly of the world’s most powerful rare-earth magnets.

“It’s hand to mouth—the normal supply-chain scrambling that you have to do,” said Lisa Drake, Ford’s VP of industrial planning for EVs. Though she acknowledged some improvement, she made clear the shortages are forcing operational gymnastics to avoid production halts.

The restrictions stem from export controls Beijing implemented in April, shortly after President Donald Trump imposed heavy tariffs on Chinese goods. While China claimed the license system was meant to regulate military-use exports, the real-world effect has been a sharp drop in rare-earth magnet shipments to the U.S.—down 93% in May compared to last year.

Although the White House announced that China had agreed to resume exports in exchange for reduced U.S. restrictions on certain American goods, the ground reality tells a different story. Export licenses are now limited to six months, and applicants must submit highly sensitive commercial details—such as magnet integration designs and buyer contacts—raising red flags for many Western firms. When companies decline to provide such data, licenses are often denied or stalled for 45 days or more.

“Yes, the export restrictions have been paused on paper. However, ground reality is completely different,” said Neha Mukherjee of Benchmark Mineral Intelligence, citing chronic bureaucratic delays.

Chinese officials claim they’ve approved “a certain number” of licenses, but industry insiders say approvals favor large, state-backed magnet companies. Smaller Chinese producers are suffering under the export squeeze and some are trying to collaborate with foreign buyers to bypass restrictions—such as promoting less-powerful magnets not subject to the controls.

However, these substitutes are often inadequate for high-performance applications like automotive motors, AI servers, and defense systems. Some manufacturers have begun redesigning their products, while others are resorting to expensive airfreight to keep assembly lines alive. As one U.S. importer put it, “These are the things you don’t hear about, how much money it is taking to keep these factories running, you know, limping along.”

Meanwhile, Europe is growing more vocal. Germany’s top industry association recently called on its government to challenge Beijing’s tactics, warning that “licensing procedures must not be used as a means of exerting political pressure.”

All signs point to a calculated effort by Beijing to maintain leverage over the West—despite public commitments to ease trade. With China controlling 90% of global supply for these crucial materials, the U.S. and its allies are now forced to confront a familiar truth: when it comes to rare earths, China holds the cards, and it’s not afraid to play them.

-

armed forces2 days ago

armed forces2 days agoIt’s not enough to just make military commitments—we must also execute them

-

Business2 days ago

Business2 days agoOttawa Funded the China Ferry Deal—Then Pretended to Oppose It

-

armed forces2 days ago

armed forces2 days agoNATO commits to 5% defense floor after Trump pushes allies to step up

-

MAiD2 days ago

MAiD2 days agoCanada’s euthanasia regime is not health care, but a death machine for the unwanted

-

Business2 days ago

Business2 days agoMunicipal government per-person spending in Canada hit near record levels

-

Health1 day ago

Health1 day agoRed Deer Hospital Lottery 2025 Winners

-

conflict23 hours ago

conflict23 hours agoThe Oil Price Spike That Didn’t Happen

-

Business1 day ago

Business1 day agoA new federal bureaucracy will not deliver the affordable housing Canadians need