Fraser Institute

Opposition says Premier Eby using tariff fight to give B.C. cabinet ‘unlimited power’

From the Fraser Institute

By Bruce Pardy

It’s been 800 years since the Magna Carta. Governments everywhere now aspire to tear down the concept that it helped establish: the rule of law. Last week, British Columbia’s NDP government introduced the Economic Stabilization (Tariff Response) Act, also known as Bill 7, which would allow Premier David Eby and his cabinet the power to take the law into their own hands without going through the elected legislature.

In this case, the justification is President Donald Trump’s tariffs. But the bill would authorize any action taken for the vague purpose of supporting the economy of B.C. or Canada, or responding to the actions of any foreign government, even if the actions haven’t happened yet. But according to Eby, “These are not sweeping powers.”

The project of concentrating power in the executive branch (i.e. cabinet) and usurping the role of legislators has a long pedigree. In theory, no office or officers are above the law or are empowered to make it up as they go. In practise, that theory counts for less and less. Governments, including in Canada, don’t like the rule of law.

But what, exactly, does “the rule of law” mean? Legal theorists say it’s complicated. It need not be. To see it clearly, compare it to the alternative: the rule of persons. When King Solomon decreed that a baby claimed by two women should be split in half, he had absolute power to decide what to do. When Henry VIII ordered that Anne Boleyn should lose her head, that was absolute power, too. In each case, tyrants exercised their personal rule for good or bad.

The “rule of law” is the opposite idea. No single authority has free reign to decide how the state will use its force. The rule of law limits the powers of those who govern.

It does so in part by separating powers between three branches of the state. The Supreme Court of Canada has said that the “separation of powers” is a fundamental feature of the Canadian Constitution. Legislatures legislate. The executive executes. Judges adjudicate. In principle, no single office or officer can alone decide what should be done.

But not in practise. Exceptions are so common today as to be ubiquitous. The Human Rights Commission, not the legislature, declares what constitutes discrimination. The police decide whether to enforce court orders. Environment ministry officials determine when environmental impacts are permissible. Cabinet decides when pipelines will be built.

But in these cases, decision-makers at least must keep themselves within the boundaries of their authorizing statute, which was passed by elected legislatures. Under Bill 7, the Eby government will take delegation to the next level. Its cabinet will have the power not just to exercise broad discretion in accordance with legislation, but to override legislation itself. The bill will allow cabinet to make exceptions to the law, modify the law’s requirements, limit the law’s application, or establish powers or duties in place of the law. And not just a specific law, but any enactment on the books. The cabinet’s edicts will be valid for more than two years, until May 2027.

In 1539, the Statute of Proclamations conferred on King Henry VIII the power to rule by decree, directing that the King’s proclamations should be obeyed as though they were legislation. Such provisions, since known as “Henry VIII clauses,” are controversial because they eviscerate limits on executive power. Yet they may be constitutionally permissible in Canada. Parliament cannot abdicate its functions, the Supreme Court of Canada wrote in 1918, in a case considering the government’s conscription orders under the broad powers of the War Measures Act of 1914. But Parliament can pass legislation that delegates its powers to the executive as it sees fit. As long as the legislature retains the power to reverse the delegation, the theory goes, then separation of powers remains intact.

The rule of law is inconvenient. It gets in the way of governments and officials crafting solutions to problems they perceive as important. That’s not its downside but its purpose. Even when government efforts are well-intentioned, the power of officials to solve problems can pose a more serious threat to citizens than the problem itself. As the late Alan Borovoy, former general counsel of the Canadian Civil Liberties Association, once put it, “The source of the most insidious peril is not evil wrongdoers seeking to do harm, but parochial bureaucrats seeking to do good.” If the modern administrative state is incompatible with the rule of law, then the state should be required to adapt. For decades, the current has flowed strongly in the other direction.

Crises are an ideal time for the state to advance into territory from which it will not wish to retreat. COVID-19 was the previous excuse. Now the threat of American tariffs is the latest justification to declare an emergency and discard the limitations of the rule of law. Even impending calamity does not justify the tyranny of unfettered discretion. Boundless authority to respond to circumstances is an unbearable licence to dictate.

This commentary is based on previous commentaries.

Business

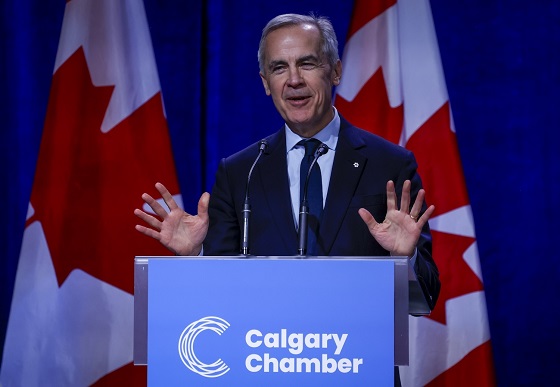

The great policy challenge for governments in Canada in 2026

From the Fraser Institute

According to a recent study, living standards in Canada have declined over the past five years. And the country’s economic growth has been “ugly.” Crucially, all 10 provinces are experiencing this economic stagnation—there are no exceptions to Canada’s “ugly” growth record. In 2026, reversing this trend should be the top priority for the Carney government and provincial governments across the country.

Indeed, demographic and economic data across the country tell a remarkably similar story over the past five years. While there has been some overall economic growth in almost every province, in many cases provincial populations, fuelled by record-high levels of immigration, have grown almost as quickly. Although the total amount of economic production and income has increased from coast to coast, there are more people to divide that income between. Therefore, after we account for inflation and population growth, the data show Canadians are not better off than they were before.

Let’s dive into the numbers (adjusted for inflation) for each province. In British Columbia, the economy has grown by 13.7 per cent over the past five years but the population has grown by 11.0 per cent, which means the vast majority of the increase in the size of the economy is likely due to population growth—not improvements in productivity or living standards. In fact, per-person GDP, a key indicator of living standards, averaged only 0.5 per cent per year over the last five years, which is a miserable result by historic standards.

A similar story holds in other provinces. Prince Edward Island, Nova Scotia, Quebec and Saskatchewan all experienced some economic growth over the past five years but their populations grew at almost exactly the same rate. As a result, living standards have barely budged. In the remaining provinces (Newfoundland and Labrador, New Brunswick, Ontario, Manitoba and Alberta), population growth has outstripped economic growth, which means that even though the economy grew, living standards actually declined.

This coast-to-coast stagnation of living standards is unique in Canadian history. Historically, there’s usually variation in economic performance across the country—when one region struggles, better performance elsewhere helps drive national economic growth. For example, in the early 2010s while the Ontario and Quebec economies recovered slowly from the 2008/09 recession, Alberta and other resource-rich provinces experienced much stronger growth. Over the past five years, however, there has not been a “good news” story anywhere in the country when it comes to per-person economic growth and living standards.

In reality, Canada’s recent record-high levels of immigration and population growth have helped mask the country’s economic weakness. With more people to buy and sell goods and services, the overall economy is growing but living standards have barely budged. To craft policies to help raise living standards for Canadian families, policymakers in Ottawa and every provincial capital should remove regulatory barriers, reduce taxes and responsibly manage government finances. This is the great policy challenge for governments across the country in 2026 and beyond.

Business

Dark clouds loom over Canada’s economy in 2026

From the Fraser Institute

The dawn of a new year is an opportune time to ponder the recent performance of Canada’s $3.4 trillion economy. And the overall picture is not exactly cheerful.

Since the start of 2025, our principal trading partner has been ruled by a president who seems determined to unravel the post-war global economic and security order that provided a stable and reassuring backdrop for smaller countries such as Canada. Whether the Canada-U.S.-Mexico trade agreement (that President Trump himself pushed for) will even survive is unclear, underscoring the uncertainty that continues to weigh on business investment in Canada.

At the same time, Europe—representing one-fifth of the global economy—remains sluggish, thanks to Russia’s relentless war of choice against Ukraine, high energy costs across much of the region, and the bloc’s waning competitiveness. The huge Chinese economy has also lost a step. None of this is good for Canada.

Yet despite a difficult external environment, Canada’s economy has been surprisingly resilient. Gross domestic product (GDP) is projected to grow by 1.7 per cent (after inflation) this year. The main reason is continued gains in consumer spending, which accounts for more than three-fifths of all economic activity. After stripping out inflation, money spent by Canadians on goods and services is set to climb by 2.2 per cent in 2025, matching last year’s pace. Solid consumer spending has helped offset the impact of dwindling exports, sluggish business investment and—since 2023—lacklustre housing markets.

Another reason why we have avoided a sharper economic downturn is that the Trump administration has, so far, exempted most of Canada’s southbound exports from the president’s tariff barrage. This has partially cushioned the decline in Canada’s exports—particularly outside of the steel, aluminum, lumber and auto sectors, where steep U.S. tariffs are in effect. While exports will be lower in 2025 than the year before, the fall is less dramatic than analysts expected 6 to 8 months ago.

Although Canada’s economy grew in 2025, the job market lost steam. Employment growth has softened and the unemployment rate has ticked higher—it’s on track to average almost 7 per cent this year, up from 5.4 per cent two years ago. Unemployment among young people has skyrocketed. With the economy showing little momentum, employment growth will remain muted next year.

Unfortunately, there’s nothing positive to report on the investment front. Adjusted for inflation, private-sector capital spending has been on a downward trajectory for the last decade—a long-term trend that can’t be explained by Trump’s tariffs. Canada has underperformed both the United States and several other advanced economies in the amount of investment per employee. The investment gap with the U.S. has widened steadily since 2014. This means Canadian workers have fewer and less up-to-date tools, equipment and technology to help them produce goods and services compared to their counterparts in the U.S. (and many other countries). As a result, productivity growth in Canada has been lackluster, narrowing the scope for wage increases.

Preliminary data indicate that both overall non-residential investment and business capital spending on machinery, equipment and advanced technology products will be down again in 2025. Getting clarity on the future of the Canada-U.S. trade relationship will be key to improving the business environment for private-sector investment. Tax and regulatory policy changes that make Canada a more attractive choice for companies looking to invest and grow are also necessary. This is where government policymakers should direct their attention in 2026.

-

Business1 day ago

Business1 day agoHow convenient: Minnesota day care reports break-in, records gone

-

Business1 day ago

Business1 day agoThe great policy challenge for governments in Canada in 2026

-

Opinion2 days ago

Opinion2 days agoGlobally, 2025 had one of the lowest annual death rates from extreme weather in history

-

International1 day ago

International1 day agoTrump confirms first American land strike against Venezuelan narco networks

-

International4 hours ago

International4 hours agoMaduro says he’s “ready” to talk

-

Bruce Dowbiggin4 hours ago

Bruce Dowbiggin4 hours agoThe Rise Of The System Engineer: Has Canada Got A Prayer in 2026?

-

International4 hours ago

International4 hours agoLOCKED AND LOADED: Trump threatens U.S. response if Iran slaughters protesters