Energy

Ontario Plans Major Nuclear Refurbishment to Meet Growing Electricity Demand

Pickering Nuclear Generating Station

From EnergyNow.ca

Ontario Power Generation planning to extend life of aging Pickering Nuclear Generating Station by decades

Ontario Power Generation is moving ahead with a plan to extend the life of the aging Pickering Nuclear Generating Station by decades, as the province tries to secure more electricity supply in the face of increasing demand.

Nuclear big player in getting to Net Zero

“Our province still needs this station and its workers,” he said at a press conference outside the nuclear plant. The construction phase will create about 11,000 jobs, he said, and provide about 6,000 jobs for decades.

OPG plans to spend $2 billion on engineering and design work and securing key components for the project that is expected to be completed in the mid-2030s.

Neither Smith nor OPG officials would give an estimate for how much the entire refurbishment will cost.

“It would be irresponsible at this point in time to put a number out there, because it’s this essential design and scoping and engineering work that is going to get us to the place where we can have a number,” Smith said.

OPG said a refurbishment at its Darlington Nuclear Generating Station is costing $12.8 billion and is on time and on budget.

Ken Hartwick, chief executive of OPG, said the Darlington refurbishment as well as one at Bruce Power will help guide the Pickering life extension.

“We have learned a lot about what it takes to refurbish a nuclear station the right way with thousands of lessons learned from Darlington and Bruce Power that we will apply to Pickering,” Hartwick said.

The four units produce about 2,000 megawatts of electricity, enough to power two million homes.

The Independent Electricity System Operator has said Ontario’s electricity demand is expected to grow by about two per cent each year, but could be even higher. A promise to build 1.5 million homes by 2031 and several large-scale manufacturing investments such as electric vehicle battery plants are helping to push demand higher.

The province needs more supply particularly starting in the mid-2030s, the IESO has said.

Keith Stewart, a senior energy strategist with Greenpeace Canada, said the price of wind and solar power with battery storage has “dropped like a stone” and should be more central to Ontario’s energy policy.

“Any credible independent cost-benefit analysis would find that we should be investing in the renewable-powered energy system of the future, rather than pouring billions more into rebuilding nuclear reactors long past their best-before date,” he wrote in a statement.

Pickering produces about 14 per cent of the province’s electricity but its current licence to operate the four units in question expires at the end of this year. OPG has asked the Canadian Nuclear Safety Commission to extend that to 2026, but a public hearing for that application has not yet been scheduled.

Green Party Leader Mike Schreiner said Greens understand that nuclear power will continue to be part of the energy mix for decades, but the province also needs much more wind and solar power and no more natural gas generation.

“Instead of attracting jobs and investment in low-cost renewables, the Ford government is making Ontario’s grid dirtier and more expensive by prioritizing dirty fossil gas plants and the costly, poor-performing Pickering plant,” he wrote in a statement.

The IESO announced last month that it is looking to add 2,000 megawatts of non-emitting electricity generation online such as wind, solar, bioenergy and hydro to the system. However, it also says natural gas is still required to ensure supply and stability in the short to medium term, though it will also increase greenhouse-gas emissions from the electricity sector.

Ontario’s electricity system was 94 per cent emissions free in 2020, but today that figure has fallen to 90 per cent.

The nuclear safety commission would still have to approve the Pickering refurbishment.

Two other units at Pickering are also set to stop operating at the end of this year. They are part of what’s known as the A units, which came online in the 1970s and were removed from service in 1997. Two of the units were refurbished and began operating again in 2003 and 2005.

Alberta

The permanent CO2 storage site at the end of the Alberta Carbon Trunk Line is just getting started

Wells at the Clive carbon capture, utilization and storage project near Red Deer, Alta. Photo courtesy Enhance Energy

From the Canadian Energy Centre

Inside Clive, a model for reducing emissions while adding value in Alberta

It’s a bright spring day on a stretch of rolling farmland just northeast of Red Deer. It’s quiet, but for the wind rushing through the grass and the soft crunch of gravel underfoot.

The unassuming wellheads spaced widely across the landscape give little hint of the significance of what is happening underground.

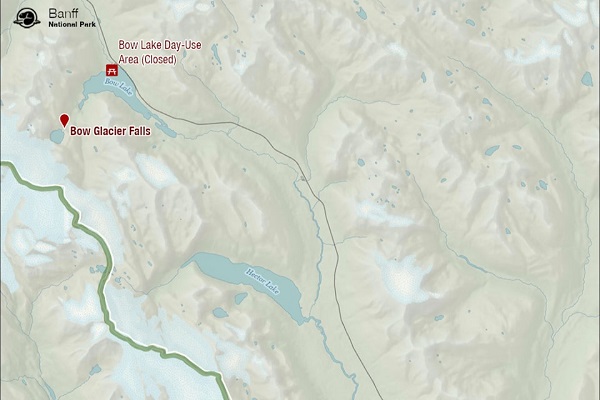

In just five years, this site has locked away more than 6.5 million tonnes of CO₂ — equivalent to the annual emissions of about 1.5 million cars — stored nearly four CN Towers deep beneath the surface.

The CO₂ injection has not only reduced emissions but also breathed life into an oilfield that was heading for abandonment, generating jobs, economic activity and government revenue that would have otherwise been lost.

This is Clive, the endpoint of one of Canada’s largest carbon capture, utilization and storage (CCUS) projects. And it’s just getting started.

Rooted in Alberta’s first oil boom

Clive’s history ties to Alberta’s first oil boom, with the field discovered in 1952 along the same geological trend as the legendary 1947 Leduc No. 1 gusher near Edmonton.

“The Clive field was discovered in the 1950s as really a follow-up to Leduc No. 1. This is, call it, Leduc No. 4,” said Chris Kupchenko, president of Enhance Energy, which now operates the Clive field.

Over the last 70 years Clive has produced about 70 million barrels of the site’s 130 million barrels of original oil in place, leaving enough energy behind to fuel six million gasoline-powered vehicles for one year.

“By the late 1990s and early 2000s, production had gone almost to zero,” said Candice Paton, Enhance’s vice-president of corporate affairs.

“There was resource left in the reservoir, but it would have been uneconomic to recover it.”

Gearing up for CO2

Calgary-based Enhance bought Clive in 2013 and kept it running despite high operating costs because of a major CO2 opportunity the company was developing on the horizon.

In 2008, Enhance and North West Redwater Partnership had launched development of the Alberta Carbon Trunk Line (ACTL), one of the world’s largest CO2 transportation systems.

Wolf Midstream joined the project in 2018 as the pipeline’s owner and operator.

Completed in 2020, the groundbreaking $1.2 billion project — supported by the governments of Canada and Alberta — connects carbon captured at industrial sites near Edmonton to the Clive facility.

“With CO2 we’re able to revitalize some of these fields, continue to produce some of the resource that was left behind and permanently store CO2 emissions,” Paton said.

An oversized pipeline on purpose

Each year, about 1.6 million tonnes of CO2 captured at the NWR Sturgeon Refinery and Nutrien Redwater fertilizer facility near Fort Saskatchewan travels down the trunk line to Clive.

In a unique twist, that is only about 10 per cent of the pipeline’s available space. The project partners intentionally built it with room to grow.

“We have a lot of excess capacity. The vision behind the pipe was, let’s remove barriers for the future,” Kupchenko said.

The Alberta government-supported goal was to expand CCS in the province, said James Fann, CEO of the Regina-based International CCS Knowledge Centre.

“They did it on purpose. The size of the infrastructure project creates the opportunity for other emitters to build capture projects along the way,” he said.

CO2 captured at the Sturgeon Refinery near Edmonton is transported by the Alberta Carbon Trunk Line to the Clive project. Photo courtesy North West Redwater Partnership

Extending the value of aging assets

Building more CCUS projects like Clive that incorporate enhanced oil recovery (EOR) is a model for extending the economic value of aging oil and gas fields in Alberta, Kupchenko said.

“EOR can be thought of as redeveloping real estate,” he said.

“Take an inner-city lot with a 700-square-foot house on it. The bad thing is there’s a 100-year-old house that has to be torn down. But the great thing is there’s a road to it. There’s power to it, there’s a sewer connection, there’s water, there’s all the things.

“That’s what this is. We’re redeveloping a field that was discovered 70 years ago and has at least 30 more years of life.”

The 180 existing wellbores are also all assets, Kupchenko said.

“They may not all be producing oil or injecting CO2, but every one of them is used. They are our eyes into the reservoir.”

CO2 injection well at the Clive carbon capture, utilization and storage project. Photo for the Canadian Energy Centre

Alberta’s ‘beautiful’ CCUS geology

The existing wells are an important part of measurement, monitoring and verification (MMV) at Clive.

The Alberta Energy Regulator requires CCUS projects to implement a comprehensive MMV program to assess storage performance and demonstrate the long-term safety and security of CO₂.

Katherine Romanak, a subsurface CCUS specialist at the University of Texas at Austin, said that her nearly 20 years of global research indicate the process is safe.

“There’s never been a leak of CO2 from a storage site,” she said.

Alberta’s geology is particularly suitable for CCUS, with permanent storage potential estimated at more than 100 billion tonnes.

“The geology is beautiful,” Romanak said.

“It’s the thickest reservoir rocks you’ve ever seen. It’s really good injectivity, porosity and permeability, and the confining layers are crazy thick.”

CO2-EOR gaining prominence

The extra capacity on the ACTL pipeline offers a key opportunity to capitalize on storage potential while addressing aging oil and gas fields, according to the Alberta government’s Mature Asset Strategy, released earlier this year.

The report says expanding CCUS to EOR could attract investment, cut emissions and encourage producers to reinvest in existing properties — instead of abandoning them.

However, this opportunity is limited by federal policy.

Ottawa’s CCUS Investment Tax Credit, which became available in June 2024, does not apply to EOR projects.

“Often people will equate EOR with a project that doesn’t store CO2 permanently,” Kupchenko said.

“We like to always make sure that people understand that every ton of CO2 that enters this project is permanently sequestered. And we take great effort into storing that CO2.”

The International Energy Forum — representing energy ministers from nearly 70 countries including Canada, the U.S., China, India, Norway, and Saudi Arabia — says CO₂-based EOR is gaining prominence as a carbon sequestration tool.

The technology can “transform a traditional oil recovery method into a key pillar of energy security and climate strategy,” according to a June 2025 IEF report.

Tapping into more opportunity

In Central Alberta, Enhance Energy is advancing a new permanent CO2 storage project called Origins that is designed to revitalize additional aging oil and gas fields while reducing emissions, using the ACTL pipeline.

“Origins is a hub that’s going to enable larger scale EOR development,” Kupchenko said.

“There’s at least 10 times more oil in place in this area.”

Meanwhile, Wolf Midstream is extending the pipeline further into the Edmonton region to transport more CO2 captured from additional industrial facilities.

Energy

This Canada Day, Celebrate Energy Renewal

From the National Citizens Coalition

By Geoff Russ

As we head towards Canada Day, there is much to be proud of.

So many great accomplishments and victories have been earned by Canadians over the years, and all of it is inspiring.

Throughout the life of this country, Canadians were able to construct grand projects like continent-spanning railways, long-winding highways for the Olympic Games, and grand hydroelectric dams. It all helped to transform this land into a great and prosperous country.

This year’s July 1 will be one filled with appreciation for past glories, for that is just about all that we still have.

Canada’s present and future are respectively grim and dim, so thank God this country has memories to give people the temporary high of nostalgia.

Those who can remember the days of rich job prospects, empowering salaries, and receiving the keys to the first home they purchased – those would be the lucky ones.

For the millions of young, disillusioned Canadians, who are still early in their careers and reckoning with the ills borne from the Trudeau era, one can excuse them for not wholly revelling in this national holiday.

Being able to easily choose aspects of this country to celebrate has become a sort of privilege and marker of social status. Youth are rarely the most enthusiastic cohort when it comes to love of country.

Canada is hardly a fair or free place if you are under 40 years of age.

For the past decade, the federal government and its accomplices in the provinces have run this country into the ground. It will require heavy lifting to pull it out and get it back on the road.

For the youngest and present working generations to grow into genuine patriotism, instead of degenerating into permanent apathy, it requires a government and state that gives them a roadmap to the good life. That cannot be achieved by the top-down redistribution of wealth; that is not just a regurgitated libertarian talking point, but an observation of recent history.

If Liberal social democracy had paid true dividends, the last decade’s mammoth expansion of government welfare programs on borrowed money would have yielded a healthy and growing middle class.

Instead, Canada’s middle class is one of the most economically trapped and sclerotic in the developed world, with just enough to not qualify for government assistance, but far less than they need to be financially secure.

Canadian leaders, and particularly the Liberals, cannot afford to keep doubling down on the failed model of taxing and spending a dwindling supply of wealth, and covering the shortfalls with massive borrowing.

It does not have to be this way.

There is the opportunity, the appetite, and the means to revive Canada’s place as an economic leader. Hundreds of billions of dollars in value lie beneath our feet. Massive deposits of critical minerals remain in the ground, with just six types of them valued at over $500 billion.

Hundreds of billions more in oil is still lying unused, instead of being sold and shipped to our democratic allies in global markets, alongside the minerals needed to mass-produce modern technologies.

One of the worst misleading stereotypes about the resource industry is that it only creates jobs out in the bush or the oilpatch. In reality, the offices of Vancouver and Calgary start filling up with new young hires as mining, oil, and forestry grow.

For evidence, look no further than the downturn in oil markets that hollowed out downtown Calgary in 2015, leaving entire towers nearly empty. Boom times for energy turned the city into a Mecca for enterprising young men and women.

The fact that those offices have not been refilled since is an indictment of bad decisions by federal and provincial governments that stymied the cultivation of our resources, and thus delayed our return to a booming economy.

New markets are emerging in Asia and Europe which will eagerly buy oil, gas, and minerals from the first friendly supplier who picks up the phone. That can be Canada, so long as our government has the will and commitment.

Our mineral and energy sectors can become powerhouses that create thousands upon thousands of well-paid, white-and-blue-collar jobs, and generate historic, generational wealth.

Canada may have a fresh prime minister in Mark Carney, but the Trudeau era will not end until he is pushed to turn the page on the Liberal obsession with controlling the economy, instead of letting it naturally breathe.

It is more important than ever to hold their feet to the fire and keep up the pressure so that the Liberals cannot avoid doing the right thing this time. Then, and perhaps only then, will future Canada Days be celebrations of the present, not the past.

Resources alone cannot transform the Canadian economy, but they can be the biggest driver of change, and what turns this country into an ambitious one that builds and is again a place of prosperity.

Geoff Russ is a policy manager in the resource sector and contributor to several national publications across Canada, the United States, and Australia. Read his work in the National Post, the Spectator Australia, and Modern Age.

There’s no solving for Canada’s cost of living crisis — or tariff crisis — without growing Canada’s resource economy, and restrictions on our energy sector have proven themselves to be just another tax on working families. Help us advocate on your behalf, and on behalf of our Great Canadian energy producers and innovators.

SIGN your name to support the NCC’s Energy Affordability Now campaign, or chip in with a generous donation.

-

Health1 day ago

Health1 day ago‘Transgender’ males have 51% higher death rate than general population: study

-

Alberta1 day ago

Alberta1 day agoSo Alberta, what’s next?

-

conflict2 days ago

conflict2 days agoWar over after 12 days? Ceasefire reached between Israel, Iran

-

conflict1 day ago

conflict1 day ago‘They Don’t Know What The F*ck They’re Doing’: Trump Unloads On Iran, Israel

-

conflict1 day ago

conflict1 day agoDespite shaky start, ceasefire shows signs of holding

-

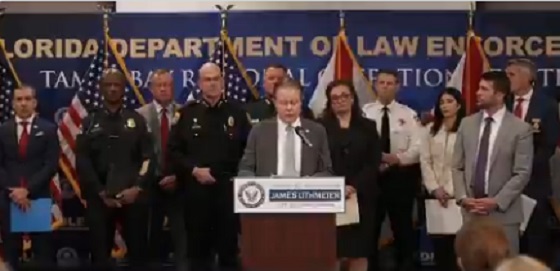

Crime2 days ago

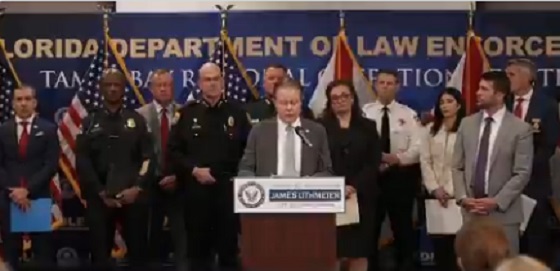

Crime2 days agoFlorida rescues 60 missing kids in nation’s largest-ever operation

-

Business2 days ago

Business2 days agoYounger Casino Bettors Are Upping the Ante on Risky Gambling in British Columbia, Documents Show

-

Business1 day ago

Business1 day agoWhile China Hacks Canada, B.C. Sends Them a Billion-Dollar Ship Building Contract