Economy

ON LOW NATURAL GAS PRICES…

From the Frontier Centre for Public Policy

By Terry Etam

To say that “natural gas is a dying commodity” takes either some world-class mental dishonesty, disturbingly blind faith in policy over reality, or some kind of “clouds hate me” philosophical stance on life.

Is there any critical industrial material as bizarre as natural gas?

The stuff holds almost zero interest for the general public, for the same reason no one is interested in the sound of a washing machine. Both boring. Both ubiquitous. Natural gas isn’t even sold on Amazon. But forty-six percent of American homes use natural gas for heat, and surely more in Canada.

But consider the storm below the surface. Traders love it, because it is one of the most volatile commodities in existence, and volatility means trading profits. The volatility, at the slightest provocation, is almost unbelievable at times. The weather pattern shifts for three weeks out over a portion of the US and boom – the entire forward 18 months of prices can collapse or soar.

In the bigger picture though, natural gas today in North America trades at close to the same price it did a quarter century ago – not inflation adjusted, just the same old nominal dollar value, which is astonishing since global gas demand has increased by 60 percent in that time.

Natural gas is a critical fuel for much of the world, and usage is growing, particularly the relatively new field of LNG. According to the Global Gas Infrastructure Tracker website, which doesn’t even like the stuff, there are a total of 2,449 significant pipeline projects underway in the world for a total of 1.2 million kilometers (and that’s the big pipe, not the little straws that go to your house). There are 238 LNG import terminals and 189 export trains in development globally. One hundred and thirty countries either have natural gas systems or are constructing them.

Traders, consumers and businesses love the stuff even if they don’t say it often enough, while others loathe it because it is a ‘fossil fuel’. Natural gas is caught in an existential war whereby said opponents will do everything in their power to just make it go away (they really think they can). The Toronto Globe and Mail, “Canada’s news paper” (note to self: develop ethnocentric balloon head emoji, make millions), recently ran a pricelessly ludicrous opinion piece entitled ‘Natural gas is a dying commodity, and Canada needs to stop supporting it’. The article was written by one of those think tanks (International Institute for Sustainable Development) that produces nothing but ideological amplification, safely distanced from people that actually do stuff, and a mountain of impressive T4 income tax slips (latest fiscal year personnel/consultant expense: $33 million). There is no surprise that their team of political scientists would attack natural gas; their latest financials show that the Government of Canada granted them $40 million, a third of which is from climate activist/federal minister Guilbeault’s office. There’ll be no biting that little hand.

Many climate leadership icons of the world, the US, Canada, Western Europe, Japan… pretty much anyone that can, is building natural gas (LNG or non) infrastructure as fast as they can. Germany, home to the world’s most advanced green energy demolition derby, built an LNG import terminal in an astounding 5 months. Many that want to import LNG but weren’t able to last year because Europe hoovered up every molecule on the market are simply doing what it takes to attain energy security, and that can mean, lord tunderin’, coal. Pakistan is the most notable example – the country plans to quadruple coal fired power output and move away from gas only because it could not obtain it: “A shortage of natural gas, which accounts for over a third of the country’s power output, plunged large areas into hours of darkness last year.” The country’s energy minister went on, “We have some of the world’s most efficient regasified LNG-based power plants. But we don’t have the gas to run them.”

For those fortunate enough to line up LNG supplies, the ante is normally a 15-20 year contract.

To say that “natural gas is a dying commodity” takes either some world-class mental dishonesty, disturbingly blind faith in policy over reality, or some kind of “clouds hate me” philosophical stance on life.

Beyond the silly messaging looking to undermine natural gas though are some very powerful undercurrents that are shaping the world in ways most don’t consider, but they should.

Thanks to the shale revolution in the US and Canada, native natural gas production exploded onto a scene that couldn’t handle the excess, leading to persistently low prices. North America is turning into an LNG export powerhouse, but until that export capacity outpaces productive capability, natural gas prices in North America look set to remain far below global prices.

It is worth remembering how significant this scenario is for North America. Cheap natural gas is an industrial godsend, enabling many strata of industries and enterprises that simply would not exist without. In May of 2022, the head of the Western Equipment Dealers Association, said that the previous winter’s high natural gas prices were unsustainable for businesses that had to heat 30-40,000 square-foot shops. The 2021-22 winter of which he was discontented saw Henry Hub prices average $4.56/mmbtu – about a third of global prices, and a fraction of what the world was to face later that year.

The same article pointed out how the Industrial Energy Consumers of America, a trade group whose members include smelters, plastics and paper-goods makers, wanted the US to stop permitting new LNG export terminals because “The manufacturing sector cannot invest and create jobs without assurances that our natural gas and electricity prices will not be imperiled by excessive LNG exports.”

Those guys aren’t crazy. The US gas market is balanced on a knife edge. A change in next month’s forecast can create havoc in forward prices even up to several years out.

The rise of LNG is making things even more unstable. The Freeport LNG terminal had an 8 month outage due to an accident, removing 2 bcf/d of demand from the market (in a 100 bcf/d market); this single event caused a storage surplus in the US that has depressed natural gas prices ever since. All else being equal, the US natural gas storage scene would be in a deficit to the five year average as opposed to today’s surplus if Freeport had not gone down, and both spot and futures prices would most likely be significantly higher. The Freeport outage probably knocked US natural gas prices down by at least $1/mmbtu for a period of 8 months, and actually probably much more. But even at that level, in a 100 bcf/d market, where 1 bcf is equal to 1 million mmbtus, the cost savings to US consumers totaled $100 million per day. (Of course, had the price stayed higher, we might have seen far more drilling, which may have caused a collapse as well, just a bit further down the road.)

That $100 million per day cost saving came out of the hide of North American natural gas producers selling into that market, and you’d think they wouldn’t like that one little bit. And they don’t. But gas producers have their own realities and game plans which don’t generally involve sacrificing any of their sales for the good of all other producers, as economically sensible as that strategy may be.

US producers find themselves in an odd situation. Every one of the large producers knows that they could cut production by 5 percent and double their profits; the market is that tightly balanced. Doing so would single handedly drive up NG prices substantially – just observe how the gas market goes ape over a change in weather forecast.

But driving up prices, even if it is in their own self interest, will mean a spike in production, because at sustained $4 US gas, the market becomes flooded. EQT president Toby Rice, the largest US gas producer (EQT, not Toby), says at a sustained $4/mmbtu natural gas price, the US could export 60 bcf/d of natural gas. Keep in mind that $4 gas is a fraction, anywhere from a third to ten percent of global LNG prices.

Mr. Rice may very well be correct, but glosses over the reality of natural gas prices: we will never see a sensible sustained price like $4, even though we may average it – we will see 2 and 8 and 3 and 9 and so on and so on.

On top of this, solution gas from oil plays like Permian is providing massive amounts of gas in itself. The Permian, primarily an oil field, produces more solution gas than the entire country of Canada. Permian solution gas, if a stand alone country, would be one of the world’s top five largest producers.

So who cares? Well, you all do. We all do. The goofballs that wrote the Globe & Mail article do, though they either won’t admit it or simply refuse to understand.

Natural gas is the bedrock of most economies, and cheap natural gas is a special elixir to North America. It is absolutely crucial to the level of industrial activity we enjoy. There is no substitute for the clean burning capability of the stuff. Wander into a typical big box store or more crucially try to wander into an industrial building that you won’t be allowed to because it is unsafe… drive around an industrial park and look at all the magnificent industrial activity that gives us the life we live. Now imagine those being heated by wood stoves. Or solar panels in dead of winter. Geothermal? Sure, if you plan on drilling into the earth’s mantle. And if you live on an appropriate acreage. And have enough money. I guess there’s always coal.

And that sums up a lot of the world’s population’s situation: If countries aren’t building LNG, it’s likely because they are building coal, as in the countries that Europe outbid for LNG last winter in a shocking me-first display of hydrocarbon-swilling (accompanied by fossil-fuel-subsidizing self-loathing?) hypocrisy.

There are storm clouds on the horizon. The drilling efficiency that these companies boast about relentlessly in IR presentations and every 90 days in conference calls consists to a large degree on drilling longer horizontal wells. Do the math on that one. Reservoirs are finite in size. If you increase the length of wells by another mile or two, you’re just draining the reservoir faster. One day we will see true sweet spot exhaustion, which is not a laughing matter when one considers that three fields – Appalachia, Haynesville and Permian – account for more than 70 percent of US gas production, and about a fifth of global production.

But for now, North America reigns supreme with respect to the world’s most coveted heating and industrial fuel. The US, Canada and Mexico remain more or less isolated from global natural gas prices for now, which brings incalculable benefits to North American businesses and citizens, a benefit that shouldn’t be taken for granted.

Terry Etam is a columnist with the BOE Report, a leading energy industry newsletter based in Calgary. He is the author of The End of Fossil Fuel Insanity. You can watch his Policy on the Frontier session from May 5, 2022 here.

Business

Upcoming federal budget likely to increase—not reduce—policy uncertainty

From the Fraser Institute

By Tegan Hill and Grady Munro

The government is opening the door to cronyism, favouritism and potentially outright corruption

In the midst of budget consultations, the Carney government hopes its upcoming fall budget will provide “certainty” to investors. While Canada desperately needs to attract more investment, the government’s plan thus far may actually make Canada less attractive to investors.

Canada faces serious economic challenges. In recent years, the economy (measured on an inflation-adjusted per-person basis) has grown at its slowest rate since the Great Depression. And living standards have hardly improved over the last decade.

At the heart of this economic stagnation is a collapse in business investment, which is necessary to equip Canadian workers with the tools and technology to produce more and provide higher quality goods and services. Indeed, from 2014 to 2022, inflation-adjusted business investment (excluding residential construction) per worker in Canada declined (on average) by 2.3 per cent annually. For perspective, business investment per worker increased (on average) by 2.8 per cent annually from 2000 to 2014.

While there are many factors that contribute to this decline, uncertainty around government policy and regulation is certainly one. For example, investors surveyed in both the mining and energy sectors consistently highlight policy and regulatory uncertainty as a key factor that deters investment. And investors indicate that uncertainty on regulations is higher in Canadian provinces than in U.S. states, which can lead to future declines in economic growth and employment. Given this, the Carney government is right to try and provide greater certainty for investors.

But the upcoming federal budget will likely do the exact opposite.

According to Liberal MPs involved in the budget consultation process, the budget will expand on themes laid out in the recently-passed Building Canada Act (a.k.a. Bill C-5), while also putting new rules into place that signal where the government wants investment to be focused.

This is the wrong approach. Bill C-5 is intended to help improve regulatory certainty by speeding up the approval process for projects that cabinet deems to be in the “national interest” while also allowing cabinet to override existing laws, regulations and guidelines to facilitate such projects. In other words, the legislation gives cabinet the power to pick winners and losers based on vague criteria and priorities rather than reducing the regulatory burden for all businesses.

Put simply, the government is opening the door to cronyism, favouritism and potentially outright corruption. This won’t improve certainty; it will instead introduce further ambiguity into the system and make Canada even less attractive to investment.

In addition to the regulatory side, the budget will likely deter investment by projecting massive deficits in the coming years and adding considerably to federal debt. In fact, based on the government’s election platform, the government planned to run deficits totalling $224.8 billion over the next four years—and that’s before the government pledged tens of billions more in additional defence spending.

A growing debt burden can deter investment in two ways. First, when governments run deficits they increase demand for borrowing by competing with the private sector for resources. This can raise interest rates for the government and private sector alike, which lowers the amount of private investment into the economy. Second, a rising debt burden raises the risk that governments will need to increase taxes in the future to pay off debt or finance their growing interest payments. The threat of higher taxes, which would reduce returns on investment, can deter businesses from investing in Canada today.

Much is riding on the Carney government’s upcoming budget, which will set the tone for federal policy over the coming years. To attract greater investment and help address Canada’s economic challenges, the government should provide greater certainty for businesses. That means reining in spending, massive deficits and reducing the regulatory burden for all businesses—not more of the same.

Alberta

OPEC+ chooses market share over stability, and Canada will pay

This article supplied by Troy Media.

OPEC+ output hike could sink prices, blow an even bigger hole in Alberta’s budget and drag Canada’s economy down with it

OPEC and its allies are flooding the global oil market again, betting that regaining lost market share is worth the risk of triggering a price collapse.

On Sept. 7, eight of its leading members agreed to boost production by 137,000 barrels per day beginning in October. That move, taken more than a year ahead of schedule, marks the start of a second major unwind of previous output cuts, even as warnings of a supply glut grow. OPEC+, a coalition led by Saudi Arabia and Russia, coordinates oil production targets in an effort to influence global pricing.

This isn’t oil politics in a vacuum. It’s a direct blow to Alberta’s finances, and a growing threat to Canada’s economic stability.

Canada’s broader economy depends heavily on a strong oil and gas sector, but no province is more directly reliant on resource royalties than Alberta, where oil revenues fund everything from hospitals to schools.

The province is already forecasting a $6.5-billion deficit by spring. A further slide in oil prices would deepen that gap, threatening everything from vital programs to jobs. Every drop in the benchmark West Texas Intermediate price, currently averaging around US$64, is estimated to wipe out another $750 million in annual revenue.

When Alberta’s finances falter, the ripple effects spread across the country. Equalization transfers from Ottawa to have-not provinces decline. Private investment dries up. Energy-sector jobs vanish not just in Alberta, but in supplier and service industries nationwide. Even the Canadian dollar takes a hit, reflecting reduced confidence in one of the country’s key economic engines. When Alberta stumbles, Canada’s broader economic momentum slows with it.

The timing couldn’t be crueller. October marks the end of the summer driving season, typically a lull for fuel demand. Yet extra supply is about to hit a market already leaning bearish. Oil prices have dropped roughly 15 per cent this year; Brent crude is treading just above US$65, still well beneath April’s lows.

But OPEC+ isn’t alone in raising the taps. Non-OPEC producers in Brazil, Canada, Guyana and Norway are all increasing production. The International Energy Agency warns global supply could exceed demand by as much as 500,000 barrels per day.

The market is bracing for a sustained price war. Alberta is staring down the barrel.

OPEC+ claims it’s playing the long game to reclaim market share. But gambling on long-term gains at the cost of short-term pain is reckless, especially for Alberta. The province faces immediate financial consequences: revenue losses, tougher budget decisions and diminished policy flexibility.

To make matters worse, U.S. forecasts are underwhelming, with an unexpected 2.4-million-barrel build in inventories. U.S. production remains at record highs above 13.5 million barrels per day, and refinery margins are shrinking. The signal is clear: demand isn’t coming back fast enough to absorb growing supply.

OPEC+ may think it’s posturing strategically. But for Canada, starting with Alberta, the fallout is real and immediate. It’s not just a market turn. It’s a warning blast. And the consequences? Jobs lost, public services cut and fiscal strain for months ahead.

Canada can’t direct OPEC. But it can brace for the fallout—and plan accordingly.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

Crime2 days ago

Crime2 days agoArrest made in Charlie Kirk assassination

-

International2 days ago

International2 days agoBreaking: ‘Catch This Fascist’: Radicalized Utah Suspect Arrested in Charlie Kirk Assassination, Officials Say

-

Frontier Centre for Public Policy2 days ago

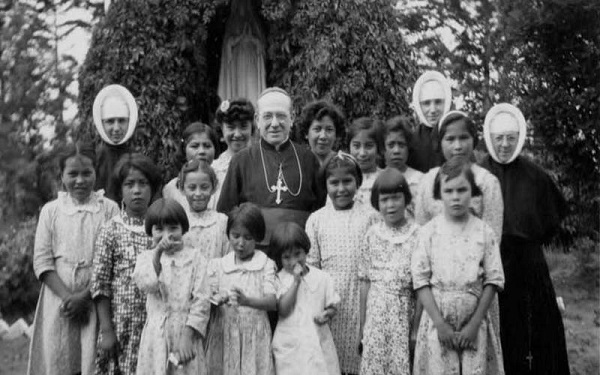

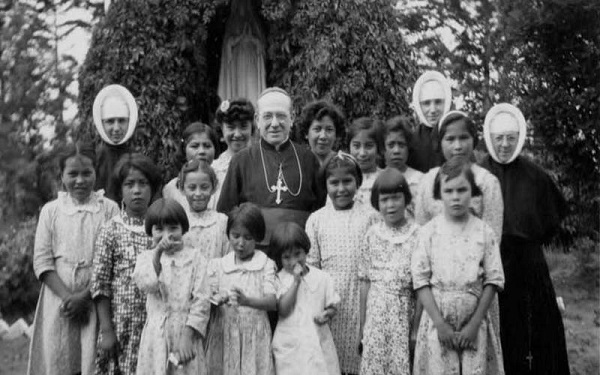

Frontier Centre for Public Policy2 days agoEvery Child Matters, Except When It Comes To Proof In Kamloops

-

Crime2 days ago

Crime2 days ago“Hey fascist! Catch!”: Authorities confirm writing on alleged Kirk killer’s bullet casings

-

J.D. Tuccille2 days ago

J.D. Tuccille2 days agoAfter Charlie Kirk’s Murder, Politicians Can Back Away From the Brink, or Make Matters Worse

-

International2 days ago

International2 days agoCharlie Kirk Shooting Suspect Revealed: Here’s What His Ammunition Said

-

Daily Caller1 day ago

Daily Caller1 day ago‘You Have No Idea What You Have Unleashed’: Erika Kirk Addresses Supporters For First Time Since Kirk’s Assassination

-

Crime2 days ago

Crime2 days ago‘Radicalized’ shooter dead, two injured in wake of school shooting