Business

Number of federal executives up 42% under Trudeau

From the Canadian Taxpayers Federation

By Ryan Thorpe

“The government has ballooned the bureaucracy across the board, but even more concerning is that this government is swelling the ranks of its most expensive bureaucrats”

Both the number and cost of federal executives has exploded under the watch of Prime Minister Justin Trudeau, according to government data and access-to-information records obtained by the Canadian Taxpayers Federation.

As of 2024, there are 9,155 federal bureaucrats classified as executives by the Trudeau government, an increase of 42 per cent since 2016, when the total sat at 6,414.

“The government has ballooned the bureaucracy across the board, but even more concerning is that this government is swelling the ranks of its most expensive bureaucrats,” said Franco Terrazzano, CTF Federal Director. “Trudeau should go after the fat cats first and that means cutting back the size and cost of the federal c-suite.”

Growth has been seen among every class of executives within the federal government, with salaries ranging from $134,827 to $255,607.

In 2022, the last year for which records are available, federal executives raked in $1.95 billion in total compensation. That represented a 41 per cent increase over 2015.

Inflation increased by 19.4 per cent between 2015 and 2022, according to Statistics Canada data.

About 90 per cent of federal executives get a bonus each year, according to records obtained by the CTF. The feds handed out $202 million in bonuses in 2022. The average bonus among executives was $18,252.

“Taxpayers are paying for more executives taking bigger salaries and bigger bonuses, but the government still can’t deliver good results,” Terrazzano said. “Can anyone in government explain why we’re paying so much for so little?”

The ballooning of the federal c-suite comes at a time when growth in the government’s bureaucracy has also been exploding.

The total size of the federal bureaucracy has grown by 42 per cent since Trudeau came to power, with more than 108,000 new bureaucrats added to the payroll.

Spending on federal bureaucrats hit a record high $67.4 billion last year, representing a 68 per cent increase in costs since 2016.

Meanwhile, spending on consultants has also reached a record high, with expenditures for 2023-24 sitting at $21.6 billion.

Despite the increased size of the bureaucracy and the federal c-suite, as well as record spending on outside consultants, departments continue to struggle to meet half of their performance targets.

In 2022-23, federal departments hit just 50 per cent of their performance targets, according to data from the Treasury Board of Canada Secretariat. Each year from 2018 through 2021, federal departments hit less than half of their performance targets.

“Less than 50 per cent of [performance] targets are consistently met within the same year,” according to a 2023 report from the Parliamentary Budget Officer, the government’s independent budget watchdog.

“Taxpayers are paying through the nose because everywhere you look the size and cost of government is ballooning,” Terrazzano said. “If any politician is serious about fixing the budget and cutting taxes, they will have to shrink Ottawa’s bloated bureaucracy.”

Business

The Grocery Greed Myth

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

“It’s not okay that our biggest grocery stores are making record profits while Canadians are struggling to put food on the table.” —PM Justin Trudeau, September 13, 2023.

A couple of days after the above statement, the then-prime minister and his government continued a campaign to blame rising food prices on grocery retailers.

The line Justin Trudeau delivered in September 2023, triggered a week of political theatre. It also handed his innovation minister, François-Philippe Champagne, a ready-made role: defender of the common shopper against supposed corporate greed. The grocery price problem would be fixed by Thanksgiving that year. That was two years ago. Remember the promise?

But as Ian Madsen of the Frontier Centre for Public Policy has shown, the numbers tell a different story. Canada’s major grocers have not been posting “record profits.” They have been inching forward in a highly competitive, capital-intensive sector. Madsen’s analysis of industry profit margins shows this clearly.

Take Loblaw. Its EBITDA margin (earnings before interest, taxes, depreciation, and amortization) averaged 11.2 per cent over the three years ending 2024. That is up slightly from 10 per cent pre-COVID. Empire grew from 3.9 to 7.6 per cent. Metro went from 7.6 to 9.6. These are steady trends, not windfalls. As Madsen rightly points out, margins like these often reflect consolidation, automation, and long-term investment.

Meanwhile, inflation tells its own story. From March 2020 to March 2024, Canada’s money supply rose by 36 per cent. Consumer prices climbed about 20 per cent in the same window. That disparity suggests grocers helped absorb inflationary pressure rather than drive it. The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

Yet Ottawa pressed ahead with its chosen solution: the Grocery Code of Conduct. It was crafted in the wake of pandemic disruptions and billed as a tool for fairness. In practice, it is a voluntary framework with no enforcement and no teeth. The dispute resolution process will not function until 2026. Key terms remain undefined. Suppliers are told they can expect “reasonable substantiation” for sudden changes in demand. They are not told what that means. But food inflation remains.

This ambiguity helps no one. Large suppliers will continue to settle matters privately. Small ones, facing the threat of lost shelf space, may feel forced to absorb losses quietly. As Madsen observes, the Code is unlikely to change much for those it claims to protect.

What it does serve is a narrative. It lets the government appear responsive while avoiding accountability. It shifts attention away from the structural causes of price increases: central bank expansion, regulatory overload, and federal spending. Instead of owning the crisis, the state points to a scapegoat.

This method is not new. The Trudeau government, of which Carney’s is a continuation, has always shown a tendency to favour symbolism over substance. Its approach to identity politics follows the same pattern. Policies are announced with fanfare, dissent is painted as bigotry, and inconvenient facts are set aside.

The Grocery Code fits this model. It is not a policy grounded in need or economic logic. It is a ritual. It gives the illusion of action. It casts grocers as villains. It gives the impression to the uncaring public that the government is “providing solutions,” and that “it has their backs.” It flatters the state.

Madsen’s work cuts through that illusion. It reminds us that grocery margins are modest, inflation was monetary, and the public is being sold a story.

Canadians deserve better than fables, but they keep voting for the same folks. They don’t think to think that they deserve a government that governs within its limits; a government that accept its role in the crises it helped cause, and restores the conditions for genuine economic freedom. The Grocery Code is not a step in that direction. It was always a distraction, wrapped in a moral pose.

And like most moral poses in Ottawa, it leaves the facts behind.

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

Business

Tax filing announcement shows consultation was a sham

The Canadian Taxpayers Federation is criticizing Prime Minister Mark Carney for announcing that the government is expanding automatic tax filing within hours of the government’s consultation ending.

“There’s no way government bureaucrats pulled an all-nighter reading through thousands of submissions and survey responses before sending Carney out to make an announcement on automatic tax filing the next morning,” said Franco Terrazzano, CTF Federal Director. “Asking Canadians for their opinion and then ignoring them isn’t a good look for Carney, it makes it look like the government is holding sham consultations.”

The government of Canada announced consultations on automatic tax filing so Canadians could give the government “broad input through an online questionnaire.”

The government’s consultation ended on Thursday, Oct. 9, 2025.

Hours after the consultation ended, Carney today announced the government would expand automatic tax filing.

The CRA is already one of the largest arms of the federal government with 52,499 bureaucrats.

The CRA added 13,015 employees since 2016 – a 33 per cent increase. For comparison, America’s Internal Revenue Service has 90,516 bureaucrats. The CRA has one bureaucrat for every 800 Canadians. The IRS has one bureaucrat for every 3,800 Americans.

“The CRA can barely answer the phone, so Carney shouldn’t be giving those bureaucrats more busy work to do,” Terrazzano said. “The CRA is a bloated mess, and Carney should be cutting the cost of bureaucracy not scheming up ways to give the bureaucracy more power over taxpayers.”

The CRA only answered about 36 per cent of the 53.5 million calls it received between March 2016 and March 2017, according to a 2017 Auditor General report. When Canadians were able to get the CRA on the phone, call centre agents gave inaccurate information about 30 per cent of the time.

“The CRA acting as both tax collector and tax filer is a serious conflict of interest,” Terrazzano said. “Trusting the taxman to do your tax return is like trusting your dog to protect your burger.

“Carney should stop the CRA power grab and instead cut taxes and simplify the tax code.”

-

Alberta1 day ago

Alberta1 day agoFact, fiction, and the pipeline that’s paying Canada’s rent

-

Energy2 days ago

Energy2 days ago“It is intellectually dishonest not to acknowledge the … erosion of trust among global customers in Canada’s ability to deliver another oil pipeline.”

-

Energy2 days ago

Energy2 days agoIn the halls of Parliament, Ellis Ross may be the most high-profile advocate of Indigenous-led development in Canada.

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoEfforts to halt Harry Potter event expose the absurdity of trans activism

-

International2 days ago

International2 days agoIsraeli government approves Gaza ceasefire

-

Crime2 days ago

Crime2 days agoFlorida teens credited for averting school shooting plot in Washington state

-

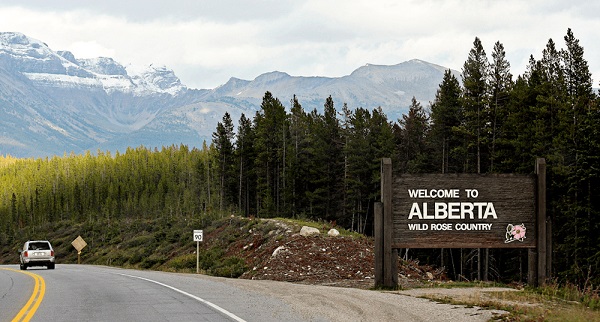

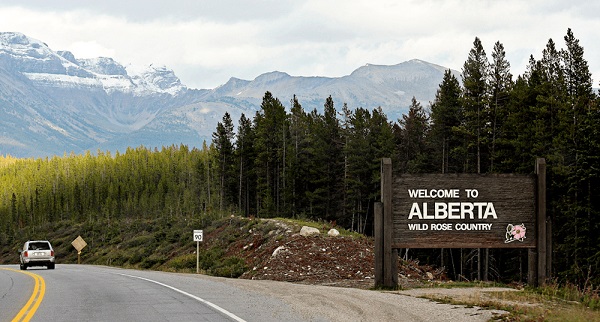

Alberta1 day ago

Alberta1 day agoAlberta Is Where Canadians Go When They Want To Build A Better Life

-

International1 day ago

International1 day agoTrump-brokered Gaza peace agreement enters first phase