Business

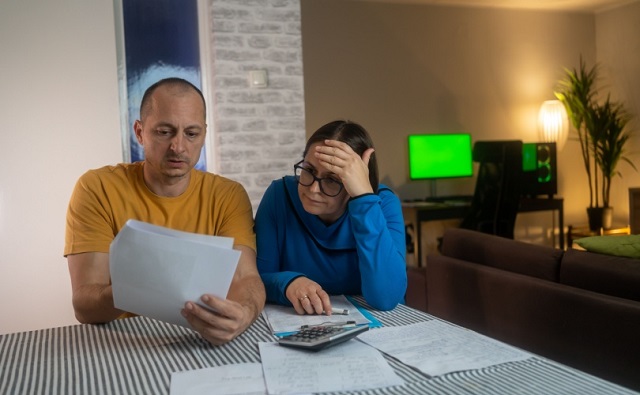

New survey finds nearly half of Canadians are only $200 from financial ruin

From LifeSiteNews

MNP Consumer Debt Index survey indicates that 46% of Canadians are close to financial devastation after years of Justin Trudeau’s policies led to high inflation.

Hot off the heels of a report that Canada’s poverty rate increased for the first time in years due to high inflation spurred by government spending, a new poll shows that nearly half of Canadians are only $200 from complete financial ruin.

According to the MNP Consumer Debt Index survey, which was conducted by Ipsos and released on July 22, 46 percent of Canadians are a few hundred dollars away from not being able to meet their financial obligations.

“Some individuals are living paycheque to paycheque, struggling to make ends meet and cover day-to-day necessities. Others are so deeply indebted that their financial challenges won’t be manageable, regardless of interest rates,” noted Grant Bazian, president of MNP LTD, in the press release.

“Canadians may have hoped for a more significant cut to interest rates or to experience a quicker impact from the reduction.”

Bazian noted that “With the prices of many daily necessities still high, many have not seen the meaningful decrease in their monthly expenses needed to ease their financial burdens.”

According to MNP, Canada’s Consumer Debt Index “has dropped to 85 points, down six points from the previous quarter.”

The survey showed that about one-in-three Canadians, or 29 percent, indicated they can’t cover bill payments, with people who are about $1 to $20 from insolvency increasing by 3 points.

The province with the highest rise in financial duress is Alberta, with about 47 percent of Albertans saying they are just $200 from complete financial ruin.

In June, LifeSiteNews reported that despite decades of progress in lowering the poverty rate in Canada has been wiped out in the last few years under Prime Minister Justin Trudeau’s Liberal government, one of his own federal departments has reported.

Despite the Bank of Canada cutting interest rates by half a point to 4.5 from 5 percent in the last few months, according to MNP, this won’t help much in terms of helping struggling families pay their basic bills.

Under Trudeau, due to excessive COVID money printing, inflation has skyrocketed.

LifeSiteNews reported that fast-rising food costs in Canada have led to many people feeling a sense of “hopelessness and desperation” with nowhere to turn for help, according to the Canadian government’s own National Advisory Council on Poverty.

In 2021, Canada’s Parliament raised the federal debt borrowing amount by a whopping 56 percent under the Borrowing Authority Act. The amount went from $1.168 trillion to $1.831 trillion.

Previously speaking to LifeSiteNews, Canadian Taxpayers Federation (CTF) federal director Franco Terrazzano urged the Trudeau government to cut spending, balance the budget and “completely scrap” the “carbon tax.”

In January, the National Advisory Council on Poverty (NACP) observed to Parliament that fast-rising food costs have led to many people feeling a sense of “hopelessness and desperation.”

Business

Taxpayers Federation calls on politicians to reject funding for new Ottawa Senators arena

The Canadian Taxpayers Federation is calling on the federal, Ontario and municipal governments to publicly reject subsidizing a new arena for the Ottawa Senators.

“Politicians need to stand up for taxpayers and tell the Ottawa Senators’ lobbyists NO,” said Noah Jarvis, CTF Ontario Director. “Prime Minister Mark Carney, Ontario Premier Doug Ford and Ottawa Mayor Mark Sutcliffe all need to publicly reject giving taxpayers’ money to the owners of the Ottawa Senators.”

The Ottawa Citizen recently reported that “the Ottawa Senators have a team off the ice lobbying federal and provincial governments for funds to help pay the hefty price tag for a new arena.”

The Ottawa Senators said they don’t intend on asking the city of Ottawa for taxpayer dollars. However, the Ottawa Citizen reported that “it’s believed Senators’ owner Michael Andlauer would like a similar structure to the [Calgary] arena deal.” The Calgary arena deal included municipal subsidies.

As of December 2024, the Ottawa Senators were worth just under $1.2 billion, according to Forbes.

Meanwhile, both the federal and Ontario governments are deep in debt. The federal debt will reach $1.35 trillion by the end of the year. The Ontario government is $459 billion in debt. The city of Ottawa is proposing a 3.75 per cent property tax increase in 2026.

“Governments are up to their eyeballs in debt and taxpayers shouldn’t be forced to fund a brand-new fancy arena for a professional sports team,” said Franco Terrazzano, CTF Federal Director. “If the owners of the Ottawa Senators want to build a fancy new arena, then they should be forced to fund it with ticket sales not tax hikes.”

Business

Albertans give most on average but Canadian generosity hits lowest point in 20 years

From the Fraser Institute

By Jake Fuss and Grady Munro

The number of Canadians donating to charity—as a percentage of all tax filers—is at the lowest point in 20 years, finds a new study published by the

Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The holiday season is a time to reflect on charitable giving, and the data shows Canadians are consistently less charitable every year, which means charities face greater challenges to secure resources to help those in need,” said Jake Fuss, director of Fiscal Studies at the Fraser Institute and co-author of Generosity in Canada: The 2025 Generosity Index.

The study finds that the percentage of Canadian tax filers donating to charity during the 2023 tax year—just 16.8 per cent—is the lowest proportion of Canadians donating since at least 2003. Canadians’ generosity peaked at 25.4 per cent of tax-filers donating in 2004, before declining in subsequent years.

Nationally, the total amount donated to charity by Canadian tax filers has also fallen from 0.55 per cent of income in 2013 to 0.52 per cent of income in 2023.

The study finds that Manitoba had the highest percentage of tax filers that donated to charity among the provinces (18.7 per cent) during the 2023 tax year while New Brunswick had the lowest (14.4 per cent).

Likewise, Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71 per cent) while Quebec and Newfoundland and Labrador donated the lowest (both 0.27 per cent).

“A smaller proportion of Canadians are donating to registered charities than what we saw in previous decades, and those who are donating are donating less,” said Fuss.

“This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond,” said Grady Munro, policy analyst and co-author.

Generosity of Canadian provinces and territories

Ranking (2025) % of tax filers who claiming donations Average of all charitable donations % of aggregate income donated

Manitoba 18.7 $2,855 0.71

Ontario 17.2 $2,816 0.58

Quebec 17.1 $1,194 0.27

Alberta 17.0 $3,622 0.68

Prince Edward Island 16.6 $1,936 0.45

Saskatchewan 16.4 $2,597 0.52

British Columbia 15.9 $3,299 0.61

Nova Scotia 15.3 $1,893 0.40

Newfoundland and Labrador 15.0 $1,333 0.27

New Brunswick 14.4 $2,076 0.44

Yukon 14.1 $2,180 0.27

Northwest Territories 10.2 $2,540 0.20

Nunavut 5.1 $2,884 0.15

NOTE: Table based on 2023 tax year, the most recent year of comparable data in Canada

Generosity in Canada: The 2025 Generosity Index

- Manitoba had the highest percentage of tax filers that donated to charity among the provinces (18.7%) during the 2023 tax year while New Brunswick had the lowest (14.4%).

- Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71%) while Quebec and Newfoundland and Labrador donated the lowest (both 0.27%).

- Nationally, the percentage of Canadian tax filers donating to charity has fallen over the last decade from 21.9% in 2013 to 16.8% in 2023.

- The percentage of aggregate income donated to charity by Canadian tax filers has also decreased from 0.55% in 2013 to 0.52% in 2023.

- This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond.

-

Automotive1 day ago

Automotive1 day agoThe $50 Billion Question: EVs Never Delivered What Ottawa Promised

-

Business2 days ago

Business2 days agoConservative MP warns Liberals’ national AI plan could increase gov’t surveillance

-

Great Reset2 days ago

Great Reset2 days agoProposed ban on euthanasia for mental illness sparks passionate debate in Canada’s Parliament

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoLiberals gain support for ‘hate speech’ bill targeting Bible passages against homosexuality

-

Health2 days ago

Health2 days agoUS podcaster Glenn Beck extends a lifeline to a Saskatchewan woman waiting for MAiD

-

Business2 days ago

Business2 days agoStorm clouds of uncertainty as BC courts deal another blow to industry and investment

-

C2C Journal1 day ago

C2C Journal1 day agoWisdom of Our Elders: The Contempt for Memory in Canadian Indigenous Policy

-

Agriculture1 day ago

Agriculture1 day agoGrowing Alberta’s fresh food future