Economy

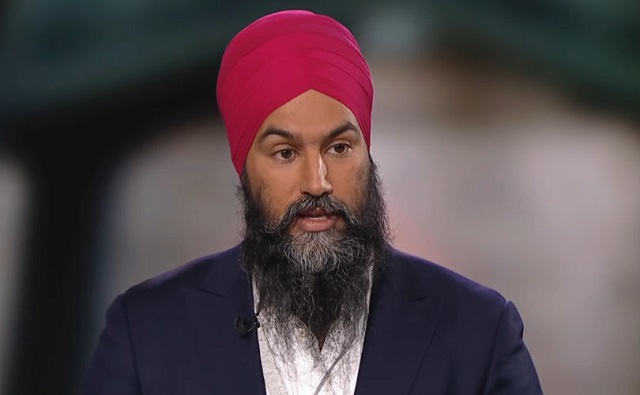

NDP slated to back Conservative motion calling for nationwide pause on home heating carbon tax

From LifeSiteNews

‘The reality is we have people who are struggling to make ends meet— to heat their homes during the winter,’ NDP House leader Peter Julian told reporters Thursday, indicating the party’s support for the Conservatives’ motion.

In a rare turn of events, the New Democratic Party (NDP) is slated to vote in favor of a Conservative Party of Canada (CPC motion calling for a nationwide pause on the carbon tax applied to home heating fuel.

While the motion is non-binding, should the NDP vote in favor of the motion, it could force the federal government under Liberal Prime Minister Justin Trudeau to pause the tax for all Canadians, and could even open up the possibility of a future vote of non-confidence.

CPC MPs served a notice in the House of Commons that they will put to a vote, as early as this coming Monday, their motion which reads: “That given the government has announced a ‘temporary three-year pause’ to the federal carbon tax on home heating oil, the House call on the government to extend that pause to all forms of home heating.”

The motion was brought forth by CPC leader Pierre Poilievre on Tuesday of this week.

Trudeau announced last week he was pausing the collection of the carbon tax on home heating oil for three years, but only for Atlantic Canadian provinces. The current cost of the carbon tax on home heating fuel is 17 cents per liter. Most Canadians however heat their homes with clean-burning natural gas, a fuel which will not be exempted from the carbon tax.

Trudeau’s carbon tax pause for Atlantic Canada announcement came amid dismal polling numbers showing his government is likely to be defeated in a landslide by the Conservative Party come the next election.

Earlier this week, Poilievre dared Trudeau to call a “carbon tax” election so Canadians can decide for themselves if they want a government for or against a tax that has caused home heating bills to double in some provinces.

Trudeau claimed the Conservatives “still want to fight another election on denying climate change,” and that they are “wrong” as Canadians would vote Liberal again.

After he suggested Canadians would vote Liberal again, despite polls suggesting the party would lose badly if an election were called today, Poilievre hand gestured Trudeau to “bring it [an election].”

Trudeau has thus far rejected calls for giving carbon tax exemptions to other provinces.

NDP appears to support Conservative motion

The CPC’s motion appears to have the support of the NDP, an interesting development considering the deal they have with the Liberal Party. The Liberal Party has a minority government and formed an informal coalition with the NDP last year, with the latter agreeing to support and keep the former in power until the next election is mandated by law in 2025.

Yesterday, NDP House Leader Peter Julian told reporters, “The reality is we have people who are struggling to make ends meet— to heat their homes during the winter.”

“The panicked action of last week really needs to be adjusted so there are supports that go to people right across the country,” he said.

Julian added that Trudeau’s backtracking of the carbon tax for one region of the country is not fair for the rest of Canadians.

“It tends to disadvantage a lot of people,” he said.

Should the NDP vote in favor of the CPC motion, it should pass the House of Commons. It is unclear whether the Bloc Québecois are in favor of the motion.

Trudeau’s latest offering of a three-year pause on the carbon tax in Atlantic Canada has caused a major rift with oil and gas-rich western provinces, notably Alberta and Saskatchewan, and even Manitoba which has a new NDP government.

Saskatchewan Premier Scott Moe on Monday said his province will stop collecting a federal carbon tax on natural gas used to heat homes come January 1, 2024, unless it gets a similar tax break as the Atlantic Canadian provinces.

Alberta Premier Danielle Smith has said she will be looking into whether a Supreme Court challenge on the carbon tax is in order. She noted however that as Alberta has a deregulated energy industry, unlike Saskatchewan, she is not in a position to stop collecting the federal carbon tax.

LifeSiteNews reported earlier this month how Trudeau’s carbon tax is costing Canadians hundreds of dollars annually, as the rebates given out by the federal government are not enough to compensate for the increased fuel costs.

The Trudeau government’s current environmental goals – in lockstep with the United Nations’ “2030 Agenda for Sustainable Development” – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of the use of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum (WEF) – the globalist group behind the socialist “Great Reset” agenda – an organization in which Trudeau and some of his cabinet are involved.

Send an urgent message to Canadian legislators urging them to stop more online censorship laws

Business

Carney government needs stronger ‘fiscal anchors’ and greater accountability

From the Fraser Institute

By Tegan Hill and Grady Munro

Following the recent release of the Carney government’s first budget, Fitch Ratings (one of the big three global credit rating agencies) issued a warning that the “persistent fiscal expansion” outlined in the budget—characterized by high levels of spending, borrowing and debt accumulation—will erode the health of Canada’s finances and could lead to a downgrade in Canada’s credit rating.

Here’s why this matters. Canada’s credit rating impacts the federal government’s cost of borrowing money. If the government’s rating gets downgraded—meaning Canadian federal debt is viewed as an increasingly risky investment due to fiscal mismanagement—it will likely become more expensive for the government to borrow money, which ultimately costs taxpayers.

The cost of borrowing (i.e. the interest paid on government debt) is a significant part of the overall budget. This year, the federal government will spend a projected $55.6 billion on debt interest, which is more than one in every 10 dollars of federal revenue, and more than the government will spend on health-care transfers to the provinces. By 2029/30, interest costs will rise to a projected $76.1 billion or more than one in every eight dollars of revenue. That’s taxpayer money unavailable for programs and services.

Again, if Canada’s credit rating gets downgraded, these costs will grow even larger.

To maintain a good credit rating, the government must prevent the deterioration of its finances. To do this, governments establish and follow “fiscal anchors,” which are fiscal guardrails meant to guide decisions regarding spending, taxes and borrowing.

Effective fiscal anchors ensure governments manage their finances so the debt burden remains sustainable for future generations. Anchors should be easily understood and broadly applied so that government cannot get creative with its accounting to only technically abide by the rule, but still give the government the flexibility to respond to changing circumstances. For example, a commonly-used rule by many countries (including Canada in the past) is a ceiling/target for debt as a share of the economy.

The Carney government’s budget establishes two new fiscal anchors: balancing the federal operating budget (which includes spending on day-to-day operations such as government employee compensation) by 2028/29, and maintaining a declining deficit-to-GDP ratio over the years to come, which means gradually reducing the size of the deficit relative to the economy. Unfortunately, these anchors will fail to keep federal finances from deteriorating.

For instance, the government’s plan to balance the “operating budget” is an example of creative accounting that won’t stop the government from borrowing money each year. Simply put, the government plans to split spending into two categories: “operating spending” and “capital investment” —which includes any spending or tax expenditures (e.g. credits and deductions) that relates to the production of an asset (e.g. machinery and equipment)—and will only balance operating spending against revenues. As a result, when the government balances its operating budget in 2028/29, it will still incur a projected deficit of $57.9 billion when spending on capital is included.

Similarly, the government’s plan to reduce the size of the annual deficit relative to the economy each year does little to prevent debt accumulation. This year’s deficit is expected to equal 2.5 per cent of the overall economy—which, since 2000, is the largest deficit (as a share of the economy) outside of those run during the 2008/09 financial crisis and the pandemic. By measuring its progress off of this inflated baseline, the government will technically abide by its anchor even as it runs relatively large deficits each and every year.

Moreover, according to the budget, total federal debt will grow faster than the economy, rising from a projected 73.9 per cent of GDP in 2025/26 to 79.0 per cent by 2029/30, reaching a staggering $2.9 trillion that year. Simply put, even the government’s own fiscal plan shows that its fiscal anchors are unable to prevent an unsustainable rise in government debt. And that’s assuming the government can even stick to these anchors—which, according to a new report by the Parliamentary Budget Officer, is highly unlikely.

Unfortunately, a federal government that can’t stick to its own fiscal anchors is nothing new. The Trudeau government made a habit of abandoning its fiscal anchors whenever the going got tough. Indeed, Fitch Ratings highlighted this poor track record as yet another reason to expect federal finances to continue deteriorating, and why a credit downgrade may be on the horizon. Again, should that happen, Canadian taxpayers will pay the price.

Much is riding on the Carney government’s ability to restore Canada’s credibility as a responsible fiscal manager. To do this, it must implement stronger fiscal rules than those presented in the budget, and remain accountable to those rules even when it’s challenging.

Business

Sluggish homebuilding will have far-reaching effects on Canada’s economy

From the Fraser Institute

At a time when Canadians are grappling with epic housing supply and affordability challenges, the data show that homebuilding continues to come up short in some parts of the country including in several metro regions where most newcomers to Canada settle.

In both the Greater Toronto area and Metro Vancouver, housing starts have languished below levels needed to close the supply gaps that have opened up since 2019. In fact, the last 12-18 months have seen many planned development projects in Ontario and British Columbia delayed or cancelled outright amid a glut of new unsold condominium units and a sharp drop in population growth stemming from shifts in federal immigration policy.

At the same time, residential real estate sales have also been sluggish in some parts of the country. A fall-off in real estate transactions tends to have a lagged negative effect on construction investment—declining home sales today translate into fewer housing starts in the future.

While Prime Minister Carney’s Liberal government has pledged to double the pace of homebuilding, the on-the-ground reality points to stagnant or dwindling housing starts in many communities, particularly in Ontario and B.C. In July, the Canada Mortgage and Housing Corporation (CMHC) revised down its national forecast for housing starts over 2025/26, notwithstanding the intense political focus on boosting supply.

A slowdown in residential construction not only affects demand for services provided by homebuilders, it also has wider economic consequences owing to the size and reach of residential construction and the closely linked real estate sector. Overall, construction represents almost 8 per cent of Canada’s economy. If we exclude government-driven industries such as education, health care and social services, construction provides employment for more than one in 10 private-sector workers. Most of these jobs involve homebuilding, home renovation, and real estate sales and development.

As such, the economic consequences of declining housing starts are far-reaching and include reduced demand for goods and services produced by suppliers to the homebuilding industry, lower tax revenues for all levels of government, and slower economic growth. The weakness in residential investment has been a key factor pushing the Canadian economy close to recession in 2025.

Moreover, according to Statistics Canada, the value of GDP (in current dollars) directly attributable to housing reached $238 billion last year, up slightly from 2023 but less than in 2021 and 2022. Among the provinces, Ontario and B.C. have seen significant declines in residential construction GDP since 2022. This pattern is likely to persist into 2026.

Statistics Canada also estimates housing-related activity supported some 1.2 million jobs in 2024. This figure captures both the direct and indirect employment effects of residential construction and housing-related real estate activity. Approximately three-fifths of jobs tied to housing are “direct,” with the rest found in sectors—such as architecture, engineering, hardware and furniture stores, and lumber manufacturing—which supply the construction business or are otherwise affected by activity in the residential building and real estate industries.

Spending on homebuilding, home renovation and residential real estate transactions (added together) represents a substantial slice of Canada’s $3.3 trillion economy. This important sector sustains more than one million jobs, a figure that partly reflects the relatively labour-intensive nature of construction and some of the other industries related to homebuilding. Clearly, Canada’s economy will struggle to rebound from the doldrums of 2025 without a meaningful turnaround in homebuilding.

-

Daily Caller2 days ago

Daily Caller2 days agoLaura Ingraham’s Viral Clash With Trump Prompts Her To Tell Real Reasons China Sends Students To US

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

Business2 days ago

Business2 days agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

Business1 day ago

Business1 day agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

Censorship Industrial Complex22 hours ago

Censorship Industrial Complex22 hours agoEU’s “Democracy Shield” Centralizes Control Over Online Speech

-

Business6 hours ago

Business6 hours agoParliamentary Budget Officer begs Carney to cut back on spending

-

International23 hours ago

International23 hours agoBondi and Patel deliver explosive “Clinton Corruption Files” to Congress

-

International22 hours ago

International22 hours agoState Department designates European Antifa groups foreign terror organizations