Business

Maxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

From LifeSiteNews

If ‘the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.’

People’s Party of Canada leader Maxime Bernier has warned that the Liberal government’s push for World Economic Forum (WEF) “Global Tax” scheme should concern Canadians.

According to Canada’s 2024 Budget, Prime Minister Justin Trudeau is working to pass the WEF’s Global Minimum Tax Act which will mandate that multinational companies pay a minimum tax rate of 15 percent.

“Canadians should be very concerned, for several reasons,” People’s Party leader Maxime Bernier told LifeSiteNews, in response to the proposal.

“First, the WEF is a globalist institution that actively campaigns for the establishment of a world government and for the adoption of socialist, authoritarian, and reactionary anti-growth policies across the world,” he explained. “Any proposal they make is very likely not in the interest of Canadians.”

“Second, this minimum tax on multinationals is a way to insidiously build support for a global harmonized tax regime that will lower tax competition between countries, and therefore ensure that taxes can stay higher everywhere,” he continued.

“Canada reaffirms its commitment to Pillar One and will continue to work diligently to finalize a multilateral treaty and bring the new system into effect as soon as a critical mass of countries is willing,” the budget stated.

“However, in view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot continue to wait before taking action,” it continued.

The Trudeau government also announced it would be implementing “Pillar Two,” which aims to establish a global minimum corporate tax rate.

“Pillar Two of the plan is a global minimum tax regime to ensure that large multinational corporations are subject to a minimum effective tax rate of 15 per cent on their profits wherever they do business,” the Liberals explained.

“The federal government is moving ahead with legislation to implement the regime in Canada, following consultations last summer on draft legislative proposals for the new Global Minimum Tax Act,” it continued.

According to the budget, Trudeau promised to introduce the new legislation in Parliament soon.

The global tax was first proposed by Secretary-General of Amnesty International at the WEF meeting in Davos this January.

“Let’s start taxing carbon…[but] not just carbon tax,” the head of Amnesty International, Agnes Callamard, said during a panel discussion.

According to the WEF, the tax, proposed by the Organization for Economic Co-operation and Development (OECD), “imposes a minimum effective rate of 15% on corporate profits.”

Following the meeting, 140 countries, including Canada, pledged to impose the tax.

While a tax on large corporations does not necessarily sound unethical, implementing a global tax appears to be just the first step in the WEF’s globalization plan by undermining the sovereignty of nations.

While Bernier explained that multinationals should pay taxes, he argued it is the role of each country to determine what those taxes are.

“The logic of pressuring countries with low taxes to raise them is that it lessens fiscal competition and makes it then less costly and easier for countries with higher taxes to keep them high,” he said.

Bernier pointed out that competition is good since it “forces everyone to get better and more efficient.”

“In the end, we all end up paying for taxes, even those paid by multinationals, as it causes them to raise prices and transfer the cost of taxes to consumers,” he warned.

Bernier further explained that the new tax could be a first step “toward the implementation of global taxes by the United Nations or some of its agencies, with the cooperation of globalist governments like Trudeau’s willing to cede our sovereignty to these international organizations.”

“Just like ‘temporary taxes’ (like the income tax adopted during WWI) tend to become permanent, ‘minimum taxes’ tend to be raised,” he warned. “And if the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.”

Trudeau’s involvement in the WEF’s plan should not be surprising considering his current environmental goals – which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development – which include the phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum – the aforementioned group famous for its socialist “Great Reset” agenda – in which Trudeau and some of his cabinet are involved.

Business

US Supreme Court may end ‘emergency’ tariffs, but that won’t stop the President

From the Fraser Institute

By Scott Lincicome

The U.S. Supreme Court will soon decide the fate of the global tariffs President Donald J. Trump has imposed under the International Emergency Powers Act (IEEPA). A court decision invalidating the tariffs is widely expected—hovering around 75 per cent on various betting markets—and would be welcome news for American importers, the United States economy and the rule of law. Even without IEEPA, however, other U.S. laws all but ensure that much higher tariffs will remain the norm. Realizing that protection will just take a little longer and, perhaps, be a little more predictable.

As my Cato Institute colleague Clark Packard and I wrote last year, the Constitution grants Congress the power to impose tariffs, but the legislative branch during the 20th century delegated much of that authority to the president under the assumption that he would be the least likely to abuse it. Thus, U.S. trade law is today littered with provisions granting the president broad powers to impose tariffs for various reasons. No IEEPA needed.

This includes laws that Trump has already invoked. Today, for example, we have “Section 301” tariffs of up to 25 per cent on around half of all Chinese imports, due to alleged “unfair trade” practices by Beijing. We also have global “Section 232” tariffs of up to 50 per cent on imports of steel and aluminum, automotive goods, heavy-duty trucks, copper and wood products—each imposed on the grounds that these goods threaten U.S. national security. The Trump administration also has created a process whereby “derivative” products made from goods subject to Section 232 tariffs will be covered by those same tariffs. Several other Section 232 investigations—on semiconductors, pharmaceuticals, critical minerals, commercial aircraft, and more—were also initiated earlier this year, setting the stage for more U.S. tariffs in the weeks ahead.

Trump administration officials admit that they’ve been studying these and other laws as fallback options if the Supreme Court invalidates the IEEPA tariffs. Their toolkit reportedly includes completing the actions above, initiating new investigations under Section 301 (targeting specific countries) and Section 232 (targeting certain products), and imposing tariffs under other laws that have not yet been invoked. Most notably, there’s strong administration interest in Section 122 of the Trade Act of 1974, which empowers the president to address “large and serious” balance-of-payments deficits via global tariffs of up to 15 per cent for no more than 150 days (after which Congress must act to continue the tariffs). The administration might also consider Section 338 of the Tariff Act of 1930—a short and ambiguous law that authorizes the president to impose tariffs of up to 50 per cent on imports from countries that have “discriminated” against U.S. commerce—but this is riskier because the law may have been superseded by Section 301.

We should expect the administration to move quickly to use these measures to reverse engineer Trump’s global tariff regime under IEEPA. The main difference would be in how he does so. IEEPA was essentially a tariff switch in the Oval Office that could be flipped on and off instantly, creating massive uncertainty for businesses, foreign governments and the U.S. economy. The alternative authorities, by contrast, all have substantive and procedural guardrails that limit their size and scope, or, at the very least, give American and foreign companies time to prepare for forthcoming tariffs (or lobby against them).

Section 301, for example, requires an investigation of a foreign country’s trade and economic policies—cases that typically take nine months and involve public hearings and formal findings. Section 232 requires an investigation into and a report on whether imports threaten national security—actions that also typically take months. Section 122 has fewer procedures, but its limited duration and 15 per cent cap make it far less dangerous than IEEPA, under which Trump has repeatedly threatened tariffs of 100 per cent or more.

Of course, “procedural guardrails” is a relative term for an administration that has already stretched Section 232’s “national security” rationale to cover bathroom vanities. The courts also have largely rubber-stamped the administration’s previous moves under Section 232 and Section 301—a big reason why we should expect the Trump administration’s tariff “Plan B” to feature them.

Thus, a court ruling against the IEEPA tariffs would be an important victory for constitutional governance and would eliminate the most destabilizing element of Trump’s tariff regime. But until the U.S. Congress reclaims some of its constitutional authority over U.S. trade policy, high and costly tariffs will remain.

Business

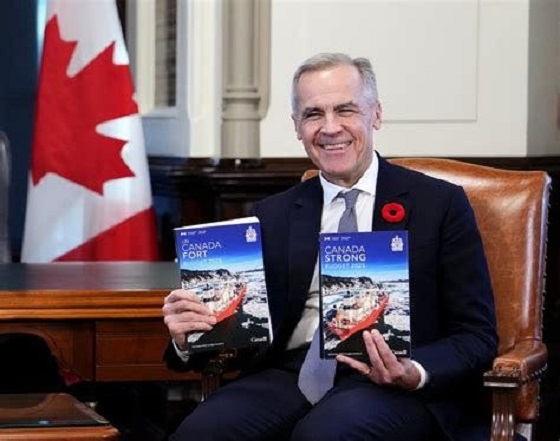

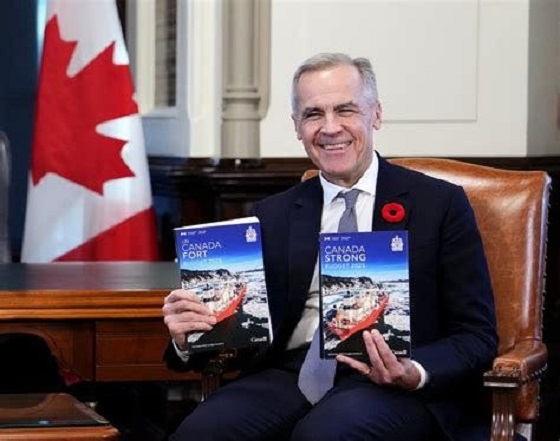

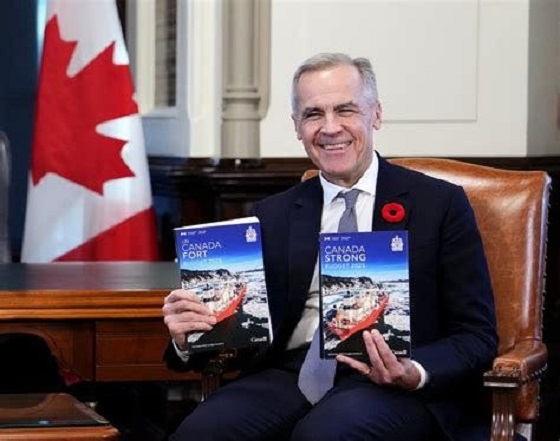

Budget 2025: Ottawa Fakes a Pivot and Still Spends Like Trudeau

It finally happened. Canada received a federal budget earlier this month, after more than a year without one. It’s far from a budget that’s great. It’s far from what many expected and distant from what the country needs. But it still passed.

With the budget vote drama now behind us, there may be space for some general observations beyond the details of the concerning deficits and debt. What kind of budget did Canada get?

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

For a government that built its political identity on social-program expansion and moralized spending, Budget 2025 arrives wearing borrowed clothing. It speaks in the language of productivity, infrastructure, and capital formation, the diction of grown-up economics, yet keeps the full spending reflex of the Trudeau era. The result feels like a cabinet trying to change its fiscal costume without changing the character inside it. Time will tell, to be fair, but it feels like more rhetoric, and we have seen this same rhetoric before lead to nothing. So, I remain skeptical of what they say and how they say it.

The government insists it has found a new path, one where public investment leads private growth. That sounds bold. However, it is more a rebranding than a reform. It is a shift in vocabulary, not in discipline.

A comparison with past eras makes this clear.

Jean Chrétien and Paul Martin did not flirt with restraint; they executed it. Their budgets were cut deeply, restored credibility, and revived Canada’s fiscal health when it was most needed. The Chrétien years were unsentimental. Political capital was spent so financial capital could return. Ottawa shrank so the country could grow. Budget 2025 tries to invoke their spirit but not their actions. Nothing in this plan resembles the structural surgery of the mid 1990s.

Stephen Harper, by contrast, treated balanced budgets as policy and principle. Even during the global financial crisis, his government used stimulus as a bridge, not a way of life. It cut taxes widely and consistently, limited public service growth, and placed the long-term burden on restraint rather than rhetoric. Budget 2025 nods toward Harper’s focus on productivity and capital assets, yet it rejects the tax relief and spending controls that made his budgets coherent.

Then there is Justin Trudeau, the high tide of redistribution, vacuous identity politics, and deficit-as-virtue posturing. Ottawa expanded into an ideological planner for everything, including housing, climate, childcare, inclusion portfolios, and every new identity category. Much of that ideological scaffolding consisted of mere words, weakening the principle of equality under the law and encouraging the government to referee culture rather than administer policy.

Budget 2025 is the first hint of retreat from that style. The identity program fireworks are dimmer, though they have not disappeared. The social policy boosterism is quieter. Perhaps fiscal gravity has begun to whisper in the prime minister’s ear.

However, one cannot confuse tone for transformation.

Spending is still vast. Deficits grew. The new fiscal anchor, balancing only the operating budget, is weaker than the one it replaced. The budget relies on the hopeful assumption that Ottawa’s capital spending will attract private investment on a scale that economists politely describe as ambitious.

The housing file illustrates the contradiction. The budget announces new funding for the construction of purpose-built rentals and a larger federal role in modular and subsidized housing builds. These are presented as productivity measures, yet they continue the Trudeau-era instinct to centralize housing policy rather than fix the levers that matter. Permitting delays, zoning rigidity, municipal approvals, and labour shortages continue to slow actual construction. Ottawa spends, but the foundations still cure at the same pace.

Defence spending tells the same story. Budget 2025 offers incremental funding and some procurement gestures, but it avoids the core problem: Canada’s procurement system is broken. Delays stretch across decades. Projects become obsolete before contracts are signed. The system cannot buy a ship, an aircraft, or an armoured vehicle without cost overruns and missed timelines. Spending more through this machinery will waste time and money. It adds motion, not capability.

Most importantly, the structural problems remain untouched: no regulatory reform for major projects, no tax competitiveness agenda, no strategy for shrinking a federal bureaucracy that has grown faster than the economy it governs. Ottawa presides over a low-productivity country but insists that a new accounting framework will solve what decades of overregulation and policy clutter have created. More bluster.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

From an Alberta vantage, the pivot is welcome but inadequate. The economy that pays for Confederation, energy, mining, agriculture, and transportation receives more rhetorical respect in Budget 2025, yet the same regulatory thicket that blocks pipelines and mines remains intact. The government praises capital formation but still undermines the key sectors that generate it.

Budget 2025 tries to walk like Chrétien and talk like Harper while spending like Trudeau. That is not a transformation; it is a costume change. The country needed a budget that prioritized growth rooted in tangible assets and real productivity. What it got instead is a rhetorical turn without the courage to cut, streamline, or reform.

Canada does not require a new budgeting vocabulary. It requires a government willing to govern in the best interest of the country.

Haultain’s Substack is a reader-supported publication.

Help us bring you more quality research and commentary.

-

Carbon Tax2 days ago

Carbon Tax2 days agoCarney fails to undo Trudeau’s devastating energy policies

-

Business2 days ago

Business2 days agoBudget 2025: Ottawa Fakes a Pivot and Still Spends Like Trudeau

-

Health2 days ago

Health2 days agoTens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

-

Opinion1 day ago

Opinion1 day agoLandmark 2025 Study Says Near-Death Experiences Can’t Be Explained Away

-

Focal Points1 day ago

Focal Points1 day agoSTUDY: TikTok, Instagram, and YouTube Shorts Induce Measurable “Brain Rot”

-

International10 hours ago

International10 hours ago“The Largest Funder of Al-Shabaab Is the Minnesota Taxpayer”

-

Bruce Dowbiggin16 hours ago

Bruce Dowbiggin16 hours agoElbows Down For The Not-So-Magnificent Seven: Canada’s Wilting NHL Septet

-

Censorship Industrial Complex13 hours ago

Censorship Industrial Complex13 hours agoUK Government “Resist” Program Monitors Citizens’ Online Posts