Business

Massive growth in federal workforce contributes to Ottawa’s red ink

From the Fraser Institute

By Ben Eisen

At the same time the Trudeau government opened Canada’s borders to historic numbers of immigrants leading to an explosion in population, the federal workforce was growing even faster.. much faster.

Here’s a fact that all Canadians should understand. Prime Minister Justin Trudeau has overseen the seven highest years of federal government spending in Canadian history (on a per-person basis, after adjusting for inflation).

The federal government’s high spending levels have produced a long string of budget deficits and growing mountain of debt. Federal net debt has approximately doubled in nominal terms since 2014/15 (one year before Trudeau took office), rising from $17,800 per person to $34,000 this year.

What’s driving all of this?

There are many factors, including the growth in the number of federal government employees. Our new study published by the Fraser Institute (based on data from the Parliamentary Budget Officer) found that after years of shrinking, the size of the federal government workforce began to grow in the mid-2010s. In fact, it began to grow significantly faster than the Canadian population.

To measure the growth, we used the federal government’s Full Time Equivalents (FTEs), which captures the expected work hours of a fulltime employee and allows for comparisons over time. In 2014/15, there were 340,669 FTE workers working directly for the federal government. By 2022/23 (the latest fiscal year of comparable data), this number had grown to 431,537 or by 26.1 per cent. By comparison, the Canadian population grew 9.1 per cent during this period—still a substantial growth rate, but far slower than the rate of growth of the federal workforce.

So how much has the rapid growth in federal government jobs cost taxpayers?

In our study, we consider what would have happened had the Trudeau government simply held the rate of growth in federal employment to the rate of population growth. Under this scenario, the federal government’s workforce today would be 57,170 fewer FTE workers than is in fact the case. Given that the average per-FTE cost of federal employment in 2022/23 was $130,583 (which includes salaries and other costs), the savings would have been substantial. Specifically, taxpayers would have saved $7.5 billion in 2022/23 alone. And if this money had not been spent, the federal deficit would have been 21.2 per cent smaller that year.

At all times, but particularly during a period of large deficits, the federal government should scrutinize all areas of spending including government employment. Personnel costs represent approximately half of the federal government’s operating costs, so it’s no surprise that growing employment costs have heavily contributed to Ottawa’s recent string of deficits.

According to the Trudeau government’s latest budget, Ottawa will run deficits for the foreseeable future and in 2029 net federal debt will reach $1.5 trillion. Unless the government reverses its spending trends, the cost of increased government employment will continue to strain federal finances in the years ahead, with taxpayers paying the bill.’

Business

Parliamentary Budget Officer begs Carney to cut back on spending

PBO slices through Carney’s creative accounting

The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to cut spending following today’s bombshell Parliamentary Budget Officer report that criticizes the government’s definition of capital spending and promise to balance the operating budget.

“The reality is that Carney is continuing on a course of unaffordable borrowing and the PBO report shows government messaging about ‘balancing the operating budget’ is not credible,” said Franco Terrazzano, CTF Federal Director. “Carney is using creative accounting to hide the spiralling debt.”

Carney’s Budget 2025 splits the budget into operating and capital spending and promises to balance the operating budget by 2028-29.

However, today’s PBO budget report states that Carney’s definition of capital spending is “overly expansive.” Without using that “overly expansive” definition of capital spending, the government would run an $18 billion operating deficit in 2028-29, according to the PBO.

“Based on our definition, capital investments would total $217.3 billion over 2024-25 to 2029-30, which is approximately 30 per cent ($94 billion) lower compared to Budget 2025,” according to the PBO. “Moreover, based on our definition, the operating balance in Budget 2025 would remain in a deficit position over 2024-25 to 2029-30.”

The PBO states that the Carney government is using “a definition of capital investment that expands beyond the current treatment in the Public Accounts and international practice.” The report specifically points out that “by including corporate income tax expenditures, investment tax credits and operating (production) subsidies, the framework blends policy measures with capital formation.”

The federal government plans to borrow about $80 billion this year, according to Budget 2025. Carney has no plan stop borrowing money and balance the budget. Debt interest charges will cost taxpayers $55.6 billion this year, which is more than the federal government will send to the provinces in health transfers ($54.7 billion) or collect through the GST ($54.4 billion).

“Carney isn’t balancing anything when he borrows tens of billions of dollars every year,” Terrazzano said. “Instead of applying creative accounting to the budget numbers, Carney needs to cut spending and debt.”

Business

Carney government needs stronger ‘fiscal anchors’ and greater accountability

From the Fraser Institute

By Tegan Hill and Grady Munro

Following the recent release of the Carney government’s first budget, Fitch Ratings (one of the big three global credit rating agencies) issued a warning that the “persistent fiscal expansion” outlined in the budget—characterized by high levels of spending, borrowing and debt accumulation—will erode the health of Canada’s finances and could lead to a downgrade in Canada’s credit rating.

Here’s why this matters. Canada’s credit rating impacts the federal government’s cost of borrowing money. If the government’s rating gets downgraded—meaning Canadian federal debt is viewed as an increasingly risky investment due to fiscal mismanagement—it will likely become more expensive for the government to borrow money, which ultimately costs taxpayers.

The cost of borrowing (i.e. the interest paid on government debt) is a significant part of the overall budget. This year, the federal government will spend a projected $55.6 billion on debt interest, which is more than one in every 10 dollars of federal revenue, and more than the government will spend on health-care transfers to the provinces. By 2029/30, interest costs will rise to a projected $76.1 billion or more than one in every eight dollars of revenue. That’s taxpayer money unavailable for programs and services.

Again, if Canada’s credit rating gets downgraded, these costs will grow even larger.

To maintain a good credit rating, the government must prevent the deterioration of its finances. To do this, governments establish and follow “fiscal anchors,” which are fiscal guardrails meant to guide decisions regarding spending, taxes and borrowing.

Effective fiscal anchors ensure governments manage their finances so the debt burden remains sustainable for future generations. Anchors should be easily understood and broadly applied so that government cannot get creative with its accounting to only technically abide by the rule, but still give the government the flexibility to respond to changing circumstances. For example, a commonly-used rule by many countries (including Canada in the past) is a ceiling/target for debt as a share of the economy.

The Carney government’s budget establishes two new fiscal anchors: balancing the federal operating budget (which includes spending on day-to-day operations such as government employee compensation) by 2028/29, and maintaining a declining deficit-to-GDP ratio over the years to come, which means gradually reducing the size of the deficit relative to the economy. Unfortunately, these anchors will fail to keep federal finances from deteriorating.

For instance, the government’s plan to balance the “operating budget” is an example of creative accounting that won’t stop the government from borrowing money each year. Simply put, the government plans to split spending into two categories: “operating spending” and “capital investment” —which includes any spending or tax expenditures (e.g. credits and deductions) that relates to the production of an asset (e.g. machinery and equipment)—and will only balance operating spending against revenues. As a result, when the government balances its operating budget in 2028/29, it will still incur a projected deficit of $57.9 billion when spending on capital is included.

Similarly, the government’s plan to reduce the size of the annual deficit relative to the economy each year does little to prevent debt accumulation. This year’s deficit is expected to equal 2.5 per cent of the overall economy—which, since 2000, is the largest deficit (as a share of the economy) outside of those run during the 2008/09 financial crisis and the pandemic. By measuring its progress off of this inflated baseline, the government will technically abide by its anchor even as it runs relatively large deficits each and every year.

Moreover, according to the budget, total federal debt will grow faster than the economy, rising from a projected 73.9 per cent of GDP in 2025/26 to 79.0 per cent by 2029/30, reaching a staggering $2.9 trillion that year. Simply put, even the government’s own fiscal plan shows that its fiscal anchors are unable to prevent an unsustainable rise in government debt. And that’s assuming the government can even stick to these anchors—which, according to a new report by the Parliamentary Budget Officer, is highly unlikely.

Unfortunately, a federal government that can’t stick to its own fiscal anchors is nothing new. The Trudeau government made a habit of abandoning its fiscal anchors whenever the going got tough. Indeed, Fitch Ratings highlighted this poor track record as yet another reason to expect federal finances to continue deteriorating, and why a credit downgrade may be on the horizon. Again, should that happen, Canadian taxpayers will pay the price.

Much is riding on the Carney government’s ability to restore Canada’s credibility as a responsible fiscal manager. To do this, it must implement stronger fiscal rules than those presented in the budget, and remain accountable to those rules even when it’s challenging.

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

armed forces2 days ago

armed forces2 days agoCanadian veteran says she knows at least 20 service members who were offered euthanasia

-

Business1 day ago

Business1 day agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

National2 days ago

National2 days agoConservative bill would increase penalties for attacks on places of worship in Canada

-

Daily Caller2 days ago

Daily Caller2 days agoLaura Ingraham’s Viral Clash With Trump Prompts Her To Tell Real Reasons China Sends Students To US

-

Business1 day ago

Business1 day agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

Alberta2 days ago

Alberta2 days agoHow economic corridors could shape a stronger Canadian future

-

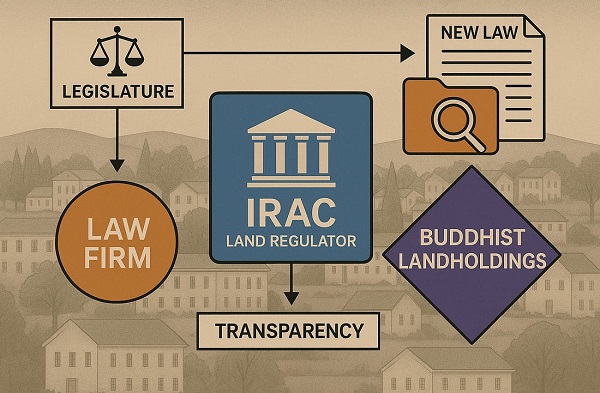

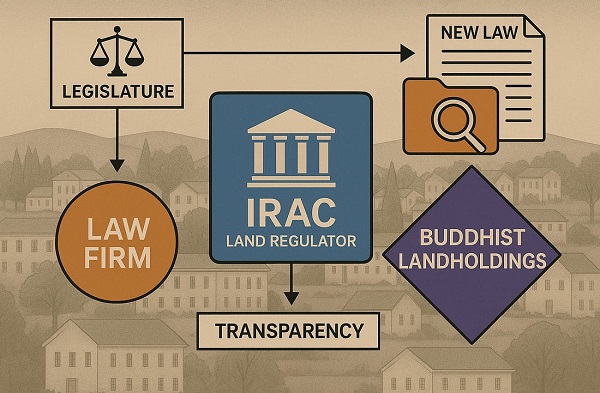

Business1 day ago

Business1 day agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation