National

Liberals, NDP admit closed-door meetings took place in attempt to delay Canada’s next election

From LifeSiteNews

Pushing back the date would preserve the pensions of some of the MPs who could be voted out of office in October 2025.

Aides to the cabinet of Prime Minister Justin Trudeau confirmed that MPs from the Liberal and New Democratic Party (NDP) did indeed hold closed-door “briefings” to rewrite Canada’s elections laws so that they could push back the date of the next election.

The closed-door talks between the NDP and Liberals confirmed the aides included a revision that would guarantee some of its 28 MPs, including three of Trudeau’s cabinet members, would get a pension.

Allen Sutherland, who serves as the assistant cabinet secretary, testified before the House of Commons affairs committee that the changes to the Elections Act were discussed in the meetings.

“We attended a meeting where the substance of that proposal was discussed,” he said, adding that his “understanding is the briefing was primarily oral.”

According to Sutherland, as reported by Blacklock’s Reporter, it was only NDP and Liberal MPs who attended the secret meetings regarding changes to Canada’s Elections Act via Bill C-65, An Act to Amend the Canada Elections Act before the bill was introduced in March.

As reported by LifeSiteNews before, the Liberals were hoping to delay the 2025 federal election by a few days in what many see as a stunt to secure pensions for MPs who are projected to lose their seats. Approximately 80 MPs would qualify for pensions should they sit as MPs until at least October 27, 2025, which is the newly proposed election date. The election date is currently set for October 20, 2025.

Sutherland noted when asked by Conservative MP Luc Berthold that he recalled little from the meetings, but he did confirm he attended “two meetings of that kind.”

“Didn’t you find it unusual that a discussion about amending the Elections Act included only two political parties and excluded the others?” Berthold asked.

Sutherland responded, “It’s important to understand what my role was in those meetings which was simply to provide background information.”

Berthold then asked, “You nevertheless suggested amendments to the legislation including a change of dates?”

“My role was to provide information,” replied Sutherland, who added he could not provide the exact dates of the meetings.

MPs must serve at least six years to qualify for a pension that pays $77,900 a year. Should an election be called today, many MPs would fall short of reaching the six years, hence Bill C-65 was introduced by the Liberals and NDP.

The Liberals have claimed that pushing back the next election date is not over pensions but due to “trying to observe religious holidays,” as noted by Liberal MP Mark Gerretsen.

“Conservatives voted against this bill,” Berthold said, as they are “confident of winning re-election. We don’t need this change.”

Trudeau’s popularity is at a all-time low, but he has refused to step down as PM, call an early election, or even step aside as Liberal Party leader.

As for the amendments to elections laws, they come after months of polling in favour of the Conservative Party under the leadership of Pierre Poilievre.

A recent poll found that 70 percent of Canadians believe the country is “broken” as Trudeau focuses on less critical issues. Similarly, in January, most Canadians reported that they are worse off financially since Trudeau took office.

Additionally, a January poll showed that 46 percent of Canadians expressed a desire for the federal election to take place sooner rather than the latest mandated date in the fall of 2025.

Energy

Canada’s oilpatch shows strength amid global oil shakeup

This article supplied by Troy Media.

Global oil markets are stumbling under too much supply and too little demand but Canada’s energy sector is managing to hold its own

Oil prices are sliding under the weight of global oversupply and weakening demand, but Canada’s oilpatch is holding steady—perhaps even thriving—as others flounder.

Crude is piling up in tankers, major producers are flooding the system, and demand is fading fast. According to a Windward report cited by Oilprice.com, the amount of oil held in floating storage—tankers sitting offshore waiting for buyers —has hit record highs. Sanctions on Russian and Iranian crude have sidelined entire fleets. Meanwhile, Middle East cargoes continue to pour in, keeping global supply bloated.

Gunvor CEO Torbjorn Tornqvist called the scale “unprecedented,” warning the market would be flooded overnight if sanctions against Russian and Iran were lifted.

And there’s more coming. U.S. crude production has hit a new record of 13.8 million barrels per day in August. And China’s Changqing oilfield just surpassed 20 million tonnes in cumulative output, and national totals have topped 400 million tonnes of oil equivalent this year. More barrels. More pressure. Less price support.

At the same time, demand is slipping. U.S. gasoline use is down. Global shipping activity has slowed. JPMorgan just trimmed its 2025 oil demand forecast by 300,000 barrels per day. China’s manufacturing sector shrank for the seventh month in a row.

Japan’s purchasing index dropped to an 18-month low. And recession fears are back in the headlines.

OPEC+ tried to calm the chaos by announcing a modest increase in output this December, with a pause on future hikes. But the move didn’t move markets. Then Saudi Arabia cut its selling prices to Asia, a clear signal that the kingdom sees weak demand ahead.

In short, it’s messy out there. But not everywhere.

Amid this global downturn, Canada’s energy sector stands out for one rare quality: resilience. While other producers are scaling back or scrambling to adapt, Canada’s oilpatch is quietly outperforming.

A recent CBC News report highlighted the sector’s staying power and why it’s better positioned than its U.S. counterparts. “The companies that have survived here are the companies that have been able to adapt,” said Patrick O’Rourke, managing director at ATB Capital Markets. “It’s effectively Darwinism.”

It’s also smart design. Canada’s oilsands—primarily in Alberta—are expensive to build but cheap to run. Once the upfront costs are covered, producers can keep pumping for decades with relatively low reinvestment. That means even in a

downturn, output stays strong.

Dane Gregoris of Enverus says Canada’s conventional sector is holding up better than the U.S. shale patch. Why? Canadian oil producers operate more efficiently, with fewer legal and logistical barriers tied to land access and ownership than their U.S. shale counterparts. They also benefit from lower operating costs and are less dependent on relentless drilling just to maintain output.

And now, they finally have a way to get more oil out.

The long-delayed Trans Mountain pipeline expansion is finally complete. It delivers Alberta crude to B.C.’s tidewater and, from there, to Asian markets. That access, once a significant limitation for Canadian producers, is now a strategic advantage. It’s already helping offset lower global prices.

Canada’s energy sector also benefits from long-life assets, slow decline rates and political stability. We have a reputation for responsible regulation, but that same system can slow development and limit how quickly we respond to shifting global demand. We can offer a stable, secure supply but only if infrastructure and regulatory hurdles don’t block access to it.

And for Canadians, that matters. Oil prices don’t just fuel industry headlines; they shape provincial and national budgets, drive investment and underpin jobs across the country. Most producers around the world are bracing for pain but Canada may be bracing for opportunity to expand its presence in Asian markets, secure long-term export contracts and position itself as a reliable supplier in a turbulent global landscape.

None of this means Canada is immune. If demand collapses or sanctions lift, prices could sink further. But in a volatile global landscape, Canada isn’t scrambling—it’s competing.

While others slash forecasts, shut wells or hope for an OPEC rescue, Canada’s energy producers are doing something rare in today’s oil market: holding the line.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

Business

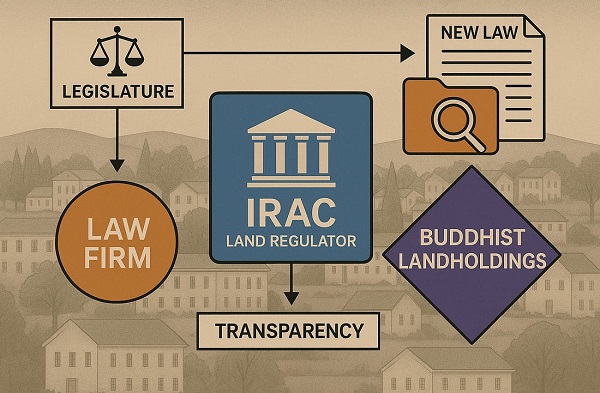

P.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

Following an exclusive report from The Bureau detailing transparency concerns at Prince Edward Island’s land regulator — and a migration of lawyers from firms that represented the Buddhist land-owning entities the regulator had already probed — the P.E.I. Legislature has passed a new law forcing the Island Regulatory and Appeals Commission (IRAC) to make its land-investigation reports public.

The bill — introduced by Green Party Leader Matt MacFarlane — passed unanimously on Wednesday, CTV News reported. It amends the Lands Protection Act to require IRAC to table final investigation reports and supporting documents in the Legislature within 15 days of completion.

MacFarlane told CTV the reform was necessary because “public trust … is at an all-time low in the system,” adding that “if Islanders can see that work is getting done, that the (LPA) is being properly administered and enforced, that will get some trust rebuilt in this body.”

The Bureau’s report last week underscored that concern, showing how lawyers from Cox & Palmer — the firm representing the Buddhist landholders — steadily moved into senior IRAC positions after the regulator quietly shut down its mandated probe into those same entities. The issue exploded this fall when a Legislative Committee subpoena confirmed that IRAC’s oft-cited 2016–2018 investigation had never produced a final report at all.

There have been reports, including from CBC, that the Buddhist landholders have ties to a Chinese Communist Party entity, which leaders from the group deny.

In the years following IRAC’s cancelled probe into the Buddhist landholders, The Bureau reported, Cox & Palmer’s general counsel and director of land joined IRAC, and the migration of senior former lawyers culminated this spring, with former premier Dennis King appointing his own chief of staff, longtime Cox & Palmer partner Pam Williams, as IRAC chair shortly after the province’s land minister ordered the regulator to reopen a probe into Buddhist landholdings.

The law firm did not respond to questions, while IRAC said it has strong measures in place to guard against any conflicted decision-making.

Reporting on the overall matter, The Bureau wrote that:

“The integrity of the institution has, in effect, become a test of public confidence — or increasingly, of public disbelief. When Minister of Housing, Land and Communities Steven Myers ordered IRAC in February 2025 to release the 2016–2018 report and reopen the investigation, the commission did not comply … Myers later resigned in October 2025. Days afterward, the Legislative Committee on Natural Resources subpoenaed IRAC to produce the report. The commission replied that no formal report had ever been prepared.”

The Bureau’s investigation also showed that the Buddhist entities under review control assets exceeding $480 million, and there is also a planned $185-million campus development in the Town of Three Rivers, citing concerns that such financial power, combined with a revolving door between key law firms, political offices and the regulator, risks undermining confidence in P.E.I.’s land-oversight regime.

Wednesday’s new law converts the expectation for transparency at IRAC, voiced loudly by numerous citizens in this small province of about 170,000, into a statutory obligation.

Housing, Land and Communities Minister Cory Deagle told CTV the government supported the bill: “We do have concerns about some aspects of it, but the main principles of what you’re trying to achieve are a good thing.”

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

armed forces1 day ago

armed forces1 day agoCanadian veteran says she knows at least 20 service members who were offered euthanasia

-

Frontier Centre for Public Policy14 hours ago

Frontier Centre for Public Policy14 hours agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

Daily Caller2 days ago

Daily Caller2 days agoEx-Terrorist Leader Goes On Fox News, Gives Wild Answer About 9/11

-

Energy2 days ago

Energy2 days agoFor the sake of Confederation, will we be open-minded about pipelines?

-

Daily Caller22 hours ago

Daily Caller22 hours agoLaura Ingraham’s Viral Clash With Trump Prompts Her To Tell Real Reasons China Sends Students To US

-

Business14 hours ago

Business14 hours agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

Business1 day ago

Business1 day agoCarney shrugs off debt problem with more borrowing

-

Automotive1 day ago

Automotive1 day agoThe high price of green virtue