Daily Caller

‘Landman’ Airs A Rare And Stirring Defense Of The U.S. Oil-And-Gas Industry

Actor Billy Bob Thornton portraying the character Tommy Norris in an official trailer for the Paramount Plus series “Landman.” (Screen Capture/Landman, Official Trailer, Paramount+)

From the Daily Caller News Foundation

By David Blackmon

Oil companies have always presented easy targets for demonization by the news and entertainment industries. Their operations are highly visible — the flares from a shale well can be seen from many miles distant — the prices they charge for their products can strain family budgets, and they have generally done a lousy job of engaging with the media and defending themselves.

Thus, they typically present the proverbial low-hanging fruit to be exploited by lazy script writers in Hollywood. Those who were in the industry in the early years of the Obama presidency will well remember that pretty much every TV drama series aired at least one episode centered on some highly improbable, often impossible, scenario in which people were killed by a hydraulic fracturing — or “fracking” — accident. Such stuff never happened in real life, but it sure made for compelling entertainment for audiences who did not know that to be the case.

Given this history, it came as no small surprise when the lead character in the new Paramount series “Landman”, the newest offering from “Yellowstone” creator Taylor Sheridan, delivered a stirring 2-minute monologue in defense of America’s oil and gas producers in Episode 3 of the show’s first season. Set in the aftermath of a tragic, fatal Permian Basin oilfield accident that actually could happen in real life, the scene features lead character Tommy Norris, played to near perfection by Billy Bob Thornton, schooling a young, environmentally conscious lawyer who is looking for someone to blame for the accident on the reasons why oil and gas are highly unlikely to be replaced by wind energy in her lifetime.

“You have any idea how much diesel they have to burn to mix that much concrete or make that steel and hold this **** out here and put it together with a 450-foot crane,” Norris says, pointing to a nearby group of 400 ft. wind turbines. “You want to guess how much oil it takes to lubricate that ****ing thing or winterize it? In its 20-year lifespan it won’t offset the carbon footprint of making it. And don’t get me started on solar panels and the lithium in your Tesla battery.”

The monologue goes on for another minute and a half, with Norris detailing all the myriad products made with oil and natural gas, and the fact that, “if Exxon thought them ****ing things right there were the future, they’d be putting them all over the ***damn place.” He isn’t wrong about that last part, by the way. ExxonMobil and its fellow major oil companies like Shell and BP have proven themselves to be pretty much agnostic about the nature of the energy-related projects they’re willing to pursue in recent years.

Those companies and many other traditional oil companies are willing to invest in most any project they believe to be profitable, sustainable and able to deliver strong rates of return to investors. Where wind energy is concerned, both Shell and BP spent years investing heavily in such projects but have been backing away from such investments over the last year as they have failed to produce adequate returns. ExxonMobil, meanwhile, is investing heavily in carbon capture, hydrogen, and even lithium production as part of a growing portfolio of projects in its Low Carbon Solutions business unit.

Back to the Tommy Norris monologue: When I re-posted the clip on LinkedIn and at my Substack newsletter, it went viral, indicating a high level of interest in what Thornton’s character had to say. That may be indicative of a rising recognition of the reality that the US government and global community have in recent years thrown away trillions of dollars in failing attempts to subsidize non-viable, unsustainable, and unprofitable alternatives to oil and natural gas to scale.

Perhaps, then, it is no coincidence that Episode 3 of “Landman” aired on the same day when the media widely reported the COP29 climate conference in Azerbaijan had ended in failure. It also came amid continuing reports that the Trump transition team is developing detailed plans to refocus US energy policy back to Trump’s promised “drill, baby, drill” orientation.

The times are a-changing, and guys like Tommy Norris will look like prophets soon.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Daily Caller

Trump Orders Review Of Why U.S. Childhood Vaccination Schedule Has More Shots Than Peer Countries

From the Daily Caller News Foundation

By Emily Kopp

President Donald Trump will direct his top health officials to conduct a systematic review of the childhood vaccinations schedule by reviewing those of other high-income countries and update domestic recommendations if the schedules abroad appear superior, according to a memorandum obtained by the Daily Caller News Foundation.

“In January 2025, the United States recommended vaccinating all children for 18 diseases, including COVID-19, making our country a high outlier in the number of vaccinations recommended for all children,” the memo will state. “Study is warranted to ensure that Americans are receiving the best, scientifically-supported medical advice in the world.”

Trump directs the secretary of the Health and Human Services (HHS) and the director of the Centers for Disease Control and Prevention to adopt best practices from other countries if deemed more medically sound. The memo cites the contrast between the U.S., which recommends vaccination for 18 diseases, and Denmark, which recommends vaccinations for 10 diseases; Japan, which recommends vaccinations for 14 diseases; and Germany, which recommends vaccinations for 15 diseases.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

HHS Secretary Robert F. Kennedy Jr. has long been a critic of the U.S. childhood vaccination schedule.

The Trump Administration ended the blanket recommendation for all children to get annual COVID-19 vaccine boosters in perpetuity. Food and Drug Administration (FDA) Commissioner Marty Makary and Chief Medical Officer Vinay Prasad announced in May that the agency would not approve new COVID booster shots for children and healthy non-elderly adults without clinical trials demonstrating the benefit. On Friday, Prasad told his staff at the Center for Biologics Evaluation and Research that a review by career staff traced the deaths of 10 children to the COVID vaccine, announced new changes to vaccine regulation, and asked for “introspection.”

Trump’s memo follows a two-day meeting of vaccine advisors to the Centers for Disease Control and Prevention in which the committee adopted changes to U.S. policy on Hepatitis B vaccination that bring the country’s policy in alignment with 24 peer nations.

Total vaccines in January 2025 before the change in COVID policy. Credit: ACIP

The meeting included a presentation by FDA Center for Drug Evaluation and Research Director Tracy Beth Høeg showing the discordance between the childhood vaccination schedule in the U.S. and those of other developed nations.

“Why are we so different from other developed nations, and is it ethically and scientifically justified?” Høeg asked. “We owe our children science-based recommendations here in the United States.”

Business

US Energy Secretary says price of energy determined by politicians and policies

From the Daily Caller News Foundation

During the latest marathon cabinet meeting on Dec. 2, Energy Secretary Chris Wright made news when he told President Donald Trump that “The biggest determinant of the price of energy is politicians, political leaders, and polices — that’s what drives energy prices.”

He’s right about that, and it is why the back-and-forth struggle over federal energy and climate policy plays such a key role in America’s economy and society. Just 10 months into this second Trump presidency, the administration’s policies are already having a profound impact, both at home and abroad.

While the rapid expansion of AI datacenters over the past year is currently being blamed by many for driving up electric costs, power bills were skyrocketing long before that big tech boom began, driven in large part by the policies of the Obama and Biden administration designed to regulate and subsidize an energy transition into reality. As I’ve pointed out here in the past, driving up the costs of all forms of energy to encourage conservation is a central objective of the climate alarm-driven transition, and that part of the green agenda has been highly effective.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

President Trump, Wright, and other key appointees like Interior Secretary Doug Burgum and EPA Administrator Lee Zeldin have moved aggressively throughout 2025 to repeal much of that onerous regulatory agenda. The GOP congressional majorities succeeded in phasing out Biden’s costly green energy subsidies as part of the One Big Beautiful Bill Act, which Trump signed into law on July 4. As the federal regulatory structure eases and subsidy costs diminish, it is reasonable to expect a gradual easing of electricity and other energy prices.

This year’s fading out of public fear over climate change and its attendant fright narrative spells bad news for the climate alarm movement. The resulting cracks in the green facade have manifested rapidly in recent weeks.

Climate-focused conflict groups that rely on public fears to drive donations have fallen on hard times. According to a report in the New York Times, the Sierra Club has lost 60 percent of the membership it reported in 2019 and the group’s management team has fallen into infighting over elements of the group’s agenda. Greenpeace is struggling just to stay afloat after losing a huge court judgment for defaming pipeline company Energy Transfer during its efforts to stop the building of the Dakota Access Pipeline.

350.org, an advocacy group founded by Bill McKibben, shut down its U.S. operations in November amid funding woes that had forced planned 25 percent budget cuts for 2025 and 2026. Employees at EDF voted to form their own union after the group went through several rounds of budget cuts and layoffs in recent months.

The fading of climate fears in turn caused the ESG management and investing fad to also fall out of favor, leading to a flood of companies backtracking on green investments and climate commitments. The Net Zero Banking Alliance disbanded after most of America’s big banks – Goldman Sachs, J.P. Morgan Chase, Citigroup, Wells Fargo and others – chose to drop out of its membership.

The EV industry is also struggling. As the Trump White House moves to repeal Biden-era auto mileage requirements, Ford Motor Company is preparing to shut down production of its vaunted F-150 Lightning electric pickup, and Stellantis cancelled plans to roll out a full-size EV truck of its own. Overall EV sales in the U.S. collapsed in October and November following the repeal of the $7,500 per car IRA subsidy effective Sept 30.

The administration’s policy actions have already ended any new leasing for costly and unneeded offshore wind projects in federal waters and have forced the suspension or abandonment of several projects that were already moving ahead. Capital has continued to flow into the solar industry, but even that industry’s ability to expand seems likely to fade once the federal subsidies are fully repealed at the end of 2027.

Truly, public policy matters where energy is concerned. It drives corporate strategies, capital investments, resource development and movement, and ultimately influences the cost of energy in all its forms and products. The speed at which Trump and his key appointees have driven this principle home since Jan. 20 has been truly stunning.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoUS Condemns EU Censorship Pressure, Defends X

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

espionage1 day ago

espionage1 day agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Business23 hours ago

Business23 hours agoCanada invests $34 million in Chinese drones now considered to be ‘high security risks’

-

Opinion2 days ago

Opinion2 days agoThe day the ‘King of rock ‘n’ roll saved the Arizona memorial

-

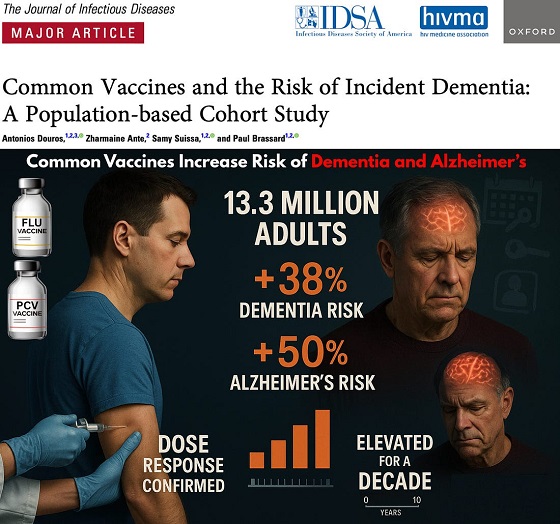

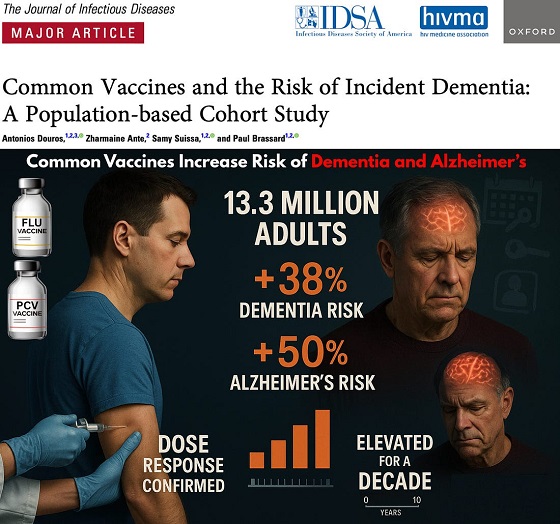

Focal Points2 days ago

Focal Points2 days agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

Agriculture1 day ago

Agriculture1 day agoCanada’s air quality among the best in the world

-

Health1 day ago

Health1 day agoCDC Vaccine Panel Votes to End Universal Hep B Vaccine for Newborns