Business

Is dirty Chinese money undermining Canada’s Arctic?

By Pauline Springer for Inside Policy

Pauline Springer warns that Canada’s lax rules on foreign investment are doing the dirty work for our geopolitical adversaries.

China’s interest in the Canadian Arctic is growing. The People’s Republic evidently views the Arctic as a strategic frontier rich in untapped resources and geopolitical leverage. China’s attempt to acquire stakes in mining operations such as the Izok Corridor and the Doris North gold mine in Nunavut indicate a broader strategy. China’s Arctic activity is a calculated bid to lock in influence under the friendly sounding banners of the Polar Silk Road and the Belt and Road Initiative, using investment and infrastructure to secure long-term influence.

Admittedly most Chinese investments in the Canadian Arctic to date have failed, are yet to be realized, or are relatively insignificant, but this should not lead Canadians to underestimate the threat or ignore the broader strategy behind China’s significant engagement across the Arctic. Some Canadian stakeholders view Chinese capital as a benign path to regional development and self-sufficiency but this is naïve and dangerous. The limited scale of successful, traceable Chinese investment to date should not be used as a justification for inaction against the clear threat to regional sovereignty.

National security threats arising from foreign investment led to the creation of the Investment Canada Act in early 2024, which requires disclosure of foreign investors and mandates transparency in the submission of investment information. With the passage of Bill C-34 in 2009, the Act was further strengthened to include specific timelines for security reviews and mechanisms for information-sharing with investigative bodies. These reforms were a late and incomplete admission that foreign capital is not just risky – it’s already rewriting the rules in sectors critical to national security.

Chinese state-linked and private entities have not only engaged in opaque investment practices but have also been implicated in large-scale money laundering operations across Canada. The money laundering schemes typically involve underground banking networks, convoluted ownership structures, and unregistered money service businesses, which funnel illicit capital into high-value assets such as real estate, infrastructure, and mining ventures. According to FINTRAC’s Laundering the Proceeds of Crime through Underground Banking Schemes, much of this money is moved through informal and untraceable financial channels, often linked to Chinese sources.

Money laundering typically unfolds in three stages: placement (introducing illicit funds into the financial system), layering (concealing the origin through complex transactions), and integration (reintroducing the money as seemingly legitimate income).

A particularly relevant mechanism in this context is trade-based money laundering (TBML) which enables illicit funds to be disguised as legitimate commerce through the manipulation of trade transactions.

In northern Canada, where oversight of mineral exports and industrial equipment imports is limited, the mining sector provides opportunities for trade based laundering of proceeds from transnational crime under the pretext of resource development. The Organized Crime and Corruption Reporting Project (OCCRP) reported that Chinese Triads and other transnational criminal organizations have laundered billions of dollars through Canadian financial and corporate systems, particularly in British Columbia.

This laundering activity is not a parallel issue to foreign investment – it is embedded within it. The same corporate tools used to facilitate transnational investments are often used to conceal the source of funds, mask ownership, and bypass national scrutiny. Shell companies and foreign actors can disguise themselves as Canadian or Indigenous-owned companies, while the actual control remains offshore.

One of the key enablers of this opacity is the phenomenon known as snow-washing: a term that refers to the use of Canada’s pristine international reputation to launder money through anonymous corporations. Canada’s corporate registration system still allows individuals to form companies without disclosing the true beneficial owner. As of late 2023, Canada ranked 70th in terms of ability to access information on companies, below Sri Lanka, El Salvador and Bahrain. Foreign actors can register companies, list local nominees as front directors, and then use these entities to invest in sensitive sectors with virtually no public oversight. Canada’s lax rules are doing the dirty work for our adversaries.

In early 2024, Canada introduced a requirement under the Canada Business Corporations Act (CBCA) to collect information on “individuals with significant control,” marking a step toward greater transparency. A federal public registry is in development. Crucially, publicly listed corporations are exempt from these disclosure requirements, and the system’s effectiveness hinges on alignment with provincial registries. Without full national coverage and seamless integration between federal and provincial systems, Canada’s transparency framework risks remaining fragmented, with loopholes that continue to benefit bad actors.

What might this look like operationally? The formation of such a shell company in Canada’s Arctic is relatively straightforward. A local entrepreneur registers a mining company in the High North, listing themselves as the owner. However, the actual financial backing originates from Chinese private or state-linked actors, who remain in the background. Due to the scale of their investment and the influence it affords, these individuals become de-facto beneficial owners. Yet, in the absence of effective monitoring mechanisms and a central, publicly accessible registry for beneficial ownership, the company continues to appear Canadian-owned. This poses a significant governance challenge: it is impossible to assess how many ostensibly local companies are, in fact, under foreign control and to what extent.

Bill C-34 aims to mitigate this risk by imposing minimum reporting requirements for foreign investment. Nonetheless, the challenge becomes even more acute when examined through the lens of money laundering. As previously discussed, there is substantial evidence that Chinese (including state-linked) entities have used Canada’s economy as a vehicle for laundering illicit funds. When those funds pass through complex corporate layers, where even identifying foreign ownership is already difficult, they can be easily embedded in the local economy. The profits, now “clean,” carry the appearance of legitimate origin, completing the cycle and reinforcing a system that is fundamentally opaque and unaccountable.

Crucially, the use of shell companies for money laundering in the Arctic is extraordinarily difficult to prove, as both the existence of shell structures and the laundering activities themselves are inherently opaque and challenging to detect. Canadian oversight bodies are playing catch-up while foreign actors exploit the shadows.

As a result, there is a serious lack of reliable data in the public domain on the actual extent of the problem. Investigative bodies face structural and legal obstacles in tracing ownership or financial flows, especially when they intersect with international jurisdictions or nominal Indigenous ownership structures that shield the real beneficiaries.

This lack of hard evidence makes it easy for policymakers to downplay or disregard the threat. However, the absence of precise numbers should not be misread as an absence of risk. On the contrary, the reasonable deduction that such structures are ripe for abuse – especially given China’s documented use of opaque financial networks and strategic investments – provides sufficient grounds to act. The deep concealment and the below-threshold tactics are precisely what make it dangerous.

The risks posed by unmonitored foreign investment stem, in part, from deeper domestic shortcomings. Chronic underfunding and a top-down governance model where decisions about the North are made in Ottawa, have left northern regions exposed. Canada’s northern provinces and territories, despite covering over 40 per cent of the national landmass, remain economically marginalized and structurally underdeveloped. This vacuum may invite external actors like China to step in where the federal government has long neglected to act. This further underscores the need for any policy response, whether from the RCMP, FINTRAC, or CSIS, to be coordinated with territorial and Indigenous governments, ensuring their meaningful involvement in the policymaking process and law enforcement actions.

Canada must act decisively on two fronts:

First, it must adopt robust transparency measures in corporate law and foreign investment screening, including following through with establishing a publicly accessible beneficial ownership registry on a national level, and closing loopholes that allow nominee directors or shell entities to hide foreign control.

Second, domestic investment must be scaled up dramatically. Canada needs to close the infrastructure and development gap in the Arctic by directly funding northern communities. Rather than simply increasing spending, policy should focus on making capital more accessible to northern and Indigenous-led projects through transparent, well-regulated mechanisms. This includes expanding grant and loan programs tailored to regional development, enhancing Indigenous financial institutions, and embedding anti-money laundering safeguards into all funding streams. These efforts would not only support reconciliation but also defend against covert financial influence.

Only strong domestic foundations and clear regulations can protect Canada from the corrosive threats of dirty foreign money. A threat exists where both intent and opportunity align; and the opportunity to launder money through shadow companies and foreign investment is undeniably present. The Canadian government must stop treating Arctic security as a seasonal concern, starting with the laws and loopholes that allow foreign money to buy silence, access, and influence in the Arctic.

Pauline Springer is a graduate researcher in International Relations specializing in Arctic security and Chinese influence.

Business

Conservative MPs denounce Liberal plan to strip charitable status of pro-life, Christian groups

From LifeSiteNews

Conservative MPs presented a petition in Parliament defending pro-life charities and religious organizations against a Liberal proposal to strip their charitable tax status.

Conservative MPs presented a petition calling for the rejection of the Liberals’ plan to strip pro-life charities and places of worship of their charitable status.

During the September 16 session, Conservative Members of Parliament (MPs) Andrew Lawton, Jacob Mantle, and Garnett Genuis defended pro-life charities and places of worship against Liberal recommendations to remove the institutions’ charitable status for tax purposes.

“I have received from houses of worship across this country so much concern, reflected in this petition, that these recommendations are fundamentally anti-free speech and anti-religious freedom,” Lawton told Parliament. “The petitioners, and I on their behalf, advocate for the complete protection of charitable status regardless of these ideological litmus tests.”

Similarly, Mantle, a newly elected MP, added that Canadians “lament that some members opposite are so blinded by their animus towards charitable organizations that they would seek to undermine the good works that these groups do for the most vulnerable Canadians.”

Religious charities provide care and compassion to the most vulnerable in our society, but some members of the Liberal and New Democratic parties are so blinded by their animus towards religion and faith that they are actively seeking to revoke the charitable status of ALL… pic.twitter.com/O12rkw3pJ0

— Jacob Mantle (@jacobmantle) September 16, 2025

Finally, Genuis, who officially presented the petition signed by hundreds of Canadians, stressed the importance work accomplished by religious and pro-life organizations.

“(R)eligious charities in Canada provide vital services for society, including food banks, care for seniors, newcomer support, youth programs and mental health outreach, all of which is rooted in their faith tradition, and that singling out or excluding faith charities from the charitable sector based on religious belief undermines the diversity and pluralism foundational to Canadian society,” he explained.

As LifeSiteNews previously reported, before last Christmas, a proposal by the all-party Finance Committee suggested legislation that could strip pro-life pregnancy centers and religious groups of their charitable status.

The legislation would amend the Income Tax Act and Income Tax. Section 429 of the proposed legislation recommends the government “no longer provide charitable status to anti-abortion organizations.”

The bill, according to the finance department, would require “registered charities that provide services, advice, or information in respect of the prevention, preservation, or termination of pregnancy (i.e., destroying the unborn)” to disclose that they “do not provide specific services, including abortions or birth control.”

Similarly, Recommendation 430 aims to “amend the Income Tax Act to provide a definition of a charity which would remove the privileged status of ‘advancement of religion’ as a charitable purpose.”

Many Canadians have warned that the proposed legislation would wipe out thousands of Christian churches and charities across Canada.

As LifeSiteNews reported in March, the Canadian Conference of Catholic Bishops (CCCB) appealed to the Liberal government to rethink the plan to strip pro-life and religious groups of their tax charity status, stressing the vital work done by those organizations.

Business

The Real Reason Tuition Keeps Going Up at Canada’s Universities

Since 2020, steep increases to tuition fees have triggered large-scale protests by the students who pay those fees at the University of Alberta, University of Calgary, University of British Columbia and at McGill University and Concordia University in Quebec, among many other schools. (A freeze on tuition fees in Ontario since 2019 explains that province’s absence from the list.)

It’s true that tuition has been on the rise. According to Statistics Canada , between 2006-2007 and 2024-2025, the average undergraduate full-year tuition fee at a Canadian university grew from approximately $4,900 to $7,360.

But do the students really know what’s behind the increases?

University administrators looking to deflect responsibility like to blame provincial government cutbacks to post-secondary funding. Here, the evidence is unconvincing. Going back two decades, nationwide full-time equivalent (FTE) student transfer payments from provincial governments have remained essentially constant, after accounting for inflation. While government grants have remained flat, tuition fees are up.

The issue, then, is where all this extra money is going – and whether it benefits students. Last year researcher and consultant Alex Usher took a close look at the budgeting preferences of universities on a nationwide basis. He found that between 2016-2017 and 2021-2022 the spending category of “Administration” – which comprises the non-teaching, bureaucratic operations of a university – grew by 15 percent. Curiously enough “Instruction,” the component of a university that most people would consider to be its core function, was among the slowest growing categories, at a mere 3 percent. This top-heavy tendency for universities is widely known as “administrative bloat”.

Administrative bloat has been a problem at Canadian universities for decades and the topic of much debate on campus. In 2001, for example, the average top-tier university in Canada spent $44 million (in 2019 dollars) on central administration. By 2019 this had more than doubled to $93 million, supporting Usher’s shorter-term observations. Usher calculated that the size of the non-academic cohort at universities has increased by between 85 percent and 170 percent over the past 20 years.

While some level of administration is obviously necessary to operate any post-secondary institution, the current scale and role of campus bureaucracies is fundamentally different from the experience of past decades. The ranks of university administration used to be filled largely with tenured professors who would return to teaching after a few terms of service. Today, the administrative ranks are largely comprised of a professional cadre of bureaucrats. (They are higher paid too; teaching faculty are currently paid about 10 percent less than non-academic personnel.)

This ever-larger administrative state is increasingly displacing the university’s core academic function. As law professor Todd Zywicki notes, “Even as the army of bureaucrats has grown like kudzu over traditional ivy walls, full-time faculty are increasingly being displaced by adjunct professors and other part-time professors who are taking on a greater share of teaching responsibilities than in the past.” While Zywicki is writing about the American experience, his observations hold equally well for Canada.

So while tuition fees keep going up, this doesn’t necessarily benefit the students paying those higher fees. American research shows spending on administration and student fees are not correlated with higher graduation rates. Canada’s huge multi-decade run-up in administrative expenditures is at best doing nothing and at worst harming our universities’ performance and reputations. Of Canada’s 15 leading research universities, 13 have fallen in the global Quality School rankings since 2010. It seems a troubling trend.

And no discussion of administrative bloat today can ignore the elephant in the corner: diversity, equity and inclusion (DEI). Writing in the National Post, Peter MacKinnon, past president of the University of Saskatchewan, draws a straight line from administrative bloat to the current infestation of DEI policies on Canadian campuses.

The same thing is going on at universities across Canada that have permanent DEI offices and bureaucracies, including at UBC, the University of Calgary, University of Waterloo, Western University, Dalhousie University and Thompson Rivers University. As a C2C Journal article explains, DEI offices and programs offer no meaningful benefit to student success or the broader university community. Rather, they damage a school’s reputation by shifting focus away from credible scientific pursuits to identity politics and victimology.

With universities apparently unable to restrain the growth of their administrative Leviathan, there may be little alternative but to impose discipline from the outside. This should begin with greater transparency.

Former university administrator William Doswell Smith highlights a “Golden Rule” for universities and other non-profit institutions: that fixed costs (such as central administration) must never be allowed to rise faster than variable costs (those related to the student population). As an example of what can happen when Smith’s Golden Rule is ignored, consider the fate of Laurentian University in Sudbury, Ontario.

In early 2021 Laurentian announced it was seeking bankruptcy protection under the Companies’ Creditors Arrangement Act, under which a court-appointed manager directs the operations of the delinquent organization. Laurentian then eliminated 76 academic programs, terminated 195 staff and faculty, and ended its relationships with three nearby schools.

Ontario’s Auditor-General Bonnie Lysak found that the primary cause of the school’s financial crisis were ill-considered capital investments. The administrators’ big dreams essentially bankrupted the university.

The lesson is clear: if universities refuse to correct the out-of-control growth of their administrations, then fiscal discipline will eventually be forced upon them. A reckoning is coming for these bloated, profligate schools. The solution to higher tuition is not increasing funding. It’s fewer administrators.

The original, full-length version of this article was recently published in C2C Journal.

Jonathan Barazzutti is an economics student at the University of Calgary. He was the winner of the 2nd Annual Patricia Trottier and Gwyn Morgan Student Essay Contest co-sponsored by C2C Journal.

-

Alberta2 days ago

Alberta2 days agoParents group blasts Alberta government for weakening sexually explicit school book ban

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoBloodvein Blockade Puts Public Land Rights At Risk

-

International2 days ago

International2 days agoFrance records more deaths than births for the first time in 80 years

-

Business2 days ago

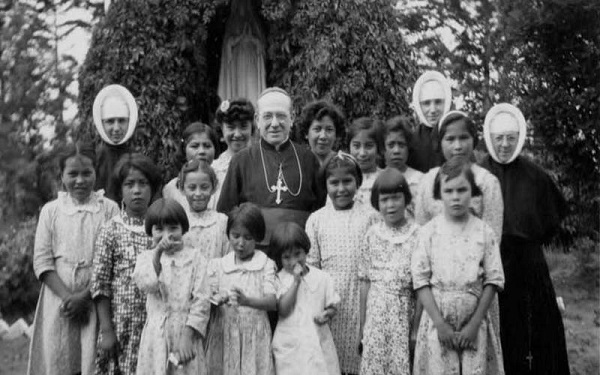

Business2 days agoThe Truth Is Buried Under Sechelt’s Unproven Graves

-

COVID-191 day ago

COVID-191 day agoFreedom Convoy leader slams Canadian gov’t agency for praising its treatment of protesters

-

National2 days ago

National2 days agoChrystia Freeland resigns from Mark Carney’s cabinet, asked to become Ukraine envoy

-

COVID-1920 hours ago

COVID-1920 hours agoCanadian gov’t to take control of vaccine injury program after reports of serious mismanagement

-

Energy1 day ago

Energy1 day agoA Breathtaking About-Face From The IEA On Oil Investments