Business

Innovative Solutions Like This Plan To Provide Power For Data Centres Will Drive Natural Gas Demand For Decades

From the Daily Caller News Foundation

By David Blackmon

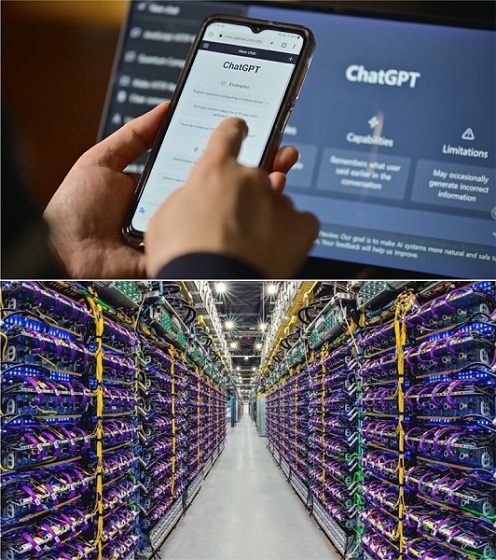

The dramatic expansion of the number and scale of planned datacenter projects across the United States has generated a great deal of news over the last year. The central question in many of those stories centers around the power needs of these projects, and how the power will be generated.

Early developers hyped their preference to use electricity generated by wind and/or solar to power their projects but found the 99.999% datacenter uptime requirements can’t be met by these intermittent power sources, even when backed up by stationary batteries.

With new nuclear projects facing permitting times of 10-15 years and coal being crowded out by emissions regulations, more recent speculation has centered heavily on natural gas as being the fuel of choice for developers whose projects won’t be interconnected into a regional power grid. Natural gas generation is cheaper and faster to build than nuclear, and, while anti-fossil fuel activists complain that gas still comes with emissions, it presents a far cleaner alternative to coal.

In Wyoming, a group of three companies said this week they’ve agreed to a joint project that also satisfies the emissions critics. In a release dated May 6, data center developer Prometheus Hyperscale, Wyoming’s largest gas producer PureWest Energy, and carbon capture and storage (CCS) developer Frontier Carbon Solutions, LLC, rolled out what they call “a first-of-its-kind partnership focused on driving innovation and sustainability while contributing to Wyoming’s long-term economic growth.”

In simple terms, the plan goes like this:

- Prometheus will permit and build the datacenter;

- PureWest will produce and supply the natural gas to a nearby power plant operated by an independent power provider from its Wyoming production portfolio, which it boasts maintains “industry leading emissions performance with a rigorous Measurement, Monitoring, Reporting and Verification (MMRV) program and ISO 14067 verification;”

- Frontier will capture biogenic carbon dioxide from across the Mountain West and sequester it in underground formations in Southwestern Wyoming; and

- Frontier will sell traceable carbon removal credits to Prometheus.

Through entering into these various agreements, a datacenter sporting a net-zero emissions profile is created. This not only embellishes the clean energy scorecards for the three companies involved in the partnership, but also for customers who purchase the computing power from the datacenter, as well as the operators of processing plants and transportation systems which move both the natural gas and the carbon dioxide.

“PureWest’s goal to be the region’s energy supplier of choice is rooted in innovation and cutting-edge technology, and today’s exciting announcement reflects our ongoing mission and progress,” said Ty Harrison, President and CFO of PureWest said in a release. “We’re proud to partner with Prometheus and Frontier because this project affirms the critical role that verified low-carbon natural gas will play in sustainably meeting the growing energy needs of AI and its related infrastructure. PureWest is committed to ensuring Wyoming continues to be a leader in delivering scalable energy and decarbonization solutions for the data-driven future of the United States.”

While the joint venture is fairly complex with a number of moving parts, it actually represents a pretty ingenious solution. Once up and running, the partners end up creating a major datacenter with the same carbon footprint as one powered by wind or solar would have, but which will enjoy the added benefit of being able to meet its 99.999% uptime requirements.

But it’s more than that. As the Trump administration’s energy and climate regulatory agenda moves ahead to consolidation, these companies will also avoid running into the reality of so many U.S. wind and solar projects becoming financially unsustainable when the endless stream of rising subsidies their business models require are inevitably reduced or cut off entirely.

As the religious global fervor driven by climate alarmism continues its inevitable fade, producers of American natural gas like PureWest will find themselves presented with a wide array of innovative opportunities like this one. Those opportunities will be driven by customers and potential partners who need the combination of abundance, affordability, reliability, speed of development and low emissions profile that only natural gas is capable of providing.

Anyone who still believes that oil and gas is a dying industry is in for a very rude awakening.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

armed forces

How Much Dollar Value Does Our Military Deliver?

To my great surprise I recently noticed that, despite being deeply engaged in wars against at least four determined enemies, Israel doesn’t spend all that much more on their military than Canada does on its forces. What might that tell us about government efficiency?

There’s fairly universal agreement that Canada doesn’t spend enough on its military. But before we can even ask how much we should be spending, we should understand how much we’re already spending. And figuring that out isn’t nearly as easy as I’d expected.

According to the 2025–26 Expenditures by Purpose data released by the Treasury Board Secretariat, the Department of National Defence (DND) was allocated $35.7 billion (CAN). However, the New York Times recently reported that Primer Minister Carney’s $9.3 billion increase would bring the total defence-related spending to $62.7 billion – which suggests that, prior to the increase, we were set to spend $53.4 billion (CAN).

So I’ll work with both of those figures: $35.7 billion ($26 billion USD) and the pre-announcement $53.4 billion ($39 billion USD). By contrast, Israel currently spends around $37 billion (USD) on the Israel Defense Forces (IDF) which is in the neighborhood of 18 percent of their total budget.¹ The IDF is (literally) getting a much bigger bang for their buck.²

I’m going to compare the military inventories of both countries to get a sense of what a dollar of government spending can get you. I understand that this isn’t an apples-to-apples comparison and there are many complicating factors here. But I think the exercise could lead us to some useful insights. First off, here’s a very rough estimate of existing inventories:

I’m sure there are plenty of caveats we could apply to those numbers, including how much of that equipment is actually fit for service on any given day. But they’ll have to do.

In addition, there are currently 68,000 regular troops in the Canadian Armed Forces (CAF) along with 22,500 reserves, while the IDF employs 169,500 regular troops and 465,000 reserves. They also cost money.

Based on some very rough estimates,³ I’d assess the value of IDF assets at around 2.6 times the value of comparable CAF assets. That means that the IDF – using their procurement systems – would need to spend just $14.4 billion (USD) to purchase the equivalent of the current set of CAF assets.

Now compare that with our actual (pre-increase) expenditures of either $26 billion USD or $39 billion USD and it seems that we’re overspending by either 80 percent or 270 percent.

I think we’d be wise to wonder why that is.

For full context, Israel receives around $3.8 billion (USD) in military aid annually from the U.S.

Speaking of which, for simplicity, I completely left the ongoing costs of ordinance out of my calculations.

If you’re really interested, you can see my calculations here.

Subscribe to The Audit.

For the full experience, upgrade your subscription.

Business

High Taxes Hobble Canadian NHL Teams In Race For Top Players

From the Frontier Centre for Public Policy

By Lee Harding

Canada’s steep income taxes leave NHL players with less cash in their pockets, putting Canadian teams at a serious disadvantage against their U.S. rivals. Find out why it’s not just bad luck that Canada hasn’t won the Stanley Cup in decades.

NHL commissioner Gary Bettman badly underestimates how much higher income taxes in Canada put Canadian teams at a serious competitive disadvantage by reducing players’ take-home pay and limiting their ability to attract top talent.

The NHL salary cap limits how much teams can spend on player salaries each season, so higher taxes mean players on Canadian teams effectively take home less money for the same salary, putting those teams at a disadvantage when competing for talent.

In a recent TNT broadcast, Bettman dismissed the idea that teams might adjust the salary cap to offset income tax differences, calling it “a ridiculous issue” and saying taxes were only “a little bit of a factor.” Pointing to high state taxes in California and New York, he asked, “What are we going to do? Subsidize those teams?”

What Bettman either ignored or didn’t understand is that every Canadian NHL player faces significantly higher income taxes than any of their U.S. counterparts. According to the Fraser Institute’s 2023 study, Ontario’s top marginal tax rate is 53.5 per cent, and even Alberta’s is 47 per cent. Compare that to the highest U.S. state rate among NHL locations—Minnesota at 41.85 per cent, California at 41.3 and New York at 38.85. Several states, including Florida, Texas, Nevada and Tennessee, impose no state income tax at all.

This tax gap translates into huge differences in players’ actual take-home pay, the money they keep after taxes. With a 2024-25 NHL salary cap of US$88 million, Toronto Maple Leafs players collectively earn $5.7 million less after taxes than Edmonton Oilers players, and a staggering $18.9 million less than players on the tax-free Florida Panthers. That difference alone could sign a star player and shift competitive balance.

Leafs fans frustrated by two decades of playoff disappointment should look less to coaches and management and more to Canada’s punishing tax system that drives talent south of the border or limits how much teams can pay. Lower taxes are a proven magnet for high-priced talent, driving better results and stronger teams.

University of Calgary economist Trevor Tombe calls this the “great divergence,” referring to the growing gap between the U.S. and Canadian economies. He points out that U.S. GDP per capita outpaces Canada’s by 43 per cent, and the gap is widening. This economic advantage means U.S. teams operate in wealthier markets with more financial flexibility, enabling them to offer players better after-tax compensation and attract top talent more easily than Canadian teams can.

Canadian teams also face more intense media and fan pressure in smaller markets, adding to their challenges. The NHL’s prolonged Stanley Cup drought for Canadian teams since 1993 isn’t just bad luck. Statistically, the odds of no Canadian team winning the Cup in over 30 years are about one in 781. Tax policy plays a major role in this unlikely streak.

Don’t blame Bettman or the NHL. Blame the Canadian governments that keep imposing high taxes that punish success, stifle economic growth and keep Canadian teams from competing on a level playing field. Unless tax policy changes, Canadian hockey fans should expect more frustration and fewer championships.

Lee Harding is a research fellow for the Frontier Centre for Public Policy.

-

conflict21 hours ago

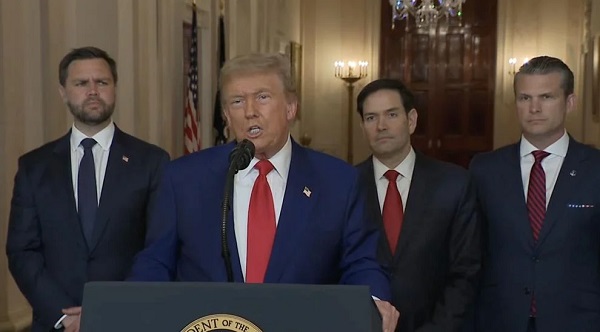

conflict21 hours agoPete Hegseth says adversaries should take Trump administration seriously

-

Health2 days ago

Health2 days agoKennedy sets a higher bar for pharmaceuticals: This is What Modernization Should Look Like

-

Business1 day ago

Business1 day agoHigh Taxes Hobble Canadian NHL Teams In Race For Top Players

-

conflict1 day ago

conflict1 day agoTrump urges Iran to pursue peace, warns of future strikes

-

Energy21 hours ago

Energy21 hours agoEnergy Policies Based on Reality, Not Ideology, are Needed to Attract Canadian ‘Superpower’ Level Investment – Ron Wallace

-

conflict20 hours ago

conflict20 hours agoU.S. cities on high alert after U.S. bombs Iran

-

Automotive2 days ago

Automotive2 days agoCarney’s exercise in stupidity

-

Business2 days ago

Business2 days agoOttawa Slams Eby Government Over Chinese Shipyard Deal, Citing Security and Sovereignty Risks