Business

Indigo creates temporary website for browsing after cyberattack

By Tara Deschamps in Toronto

Indigo Books & Music Inc. has created a temporary website for its customers to browse for books and gifts after a cyberattack halted the company’s online operations last week.

In a notice posted to the new site Friday titled “shop in store, window-shop online,” the Toronto-based retailer said the temporary website only allows for browsing and it is still not possible to make Indigo purchases online.

The company did not offer a timeline for when its website or app, which is also unavailable, might return.

“We are working hard to provide the seamless online shopping experience that our customers have come to expect,” the note read.

“Please check back daily for updates and progress.”

The temporary website was launched more than a week after Indigo first notified customers of a “cybersecurity incident” that left it unable to process electronic payments, including through its website.

When the incident began Feb. 8, Indigo was only able to process purchases made in store with cash, but some of its services, including credit and debit payments and some return capabilities, have since been restored.

The company has said it immediately engaged third-party experts to investigate and resolve the matter, but has still not explained the nature of the incident or what caused it.

“Our investigation is under way but not yet complete,” it added Friday.

The incident has placed many of Indigo’s sales in jeopardy as customers must purchase items in brick-and-mortar stores and were only able to make purchases in cash for much of the outage. Though debit and credit cards are now accepted at stores, the overall impact on Indigo’s sales will be felt more deeply the longer the other problems persist.

Its investigation has so far not found any instances of customer credit or debit cards being compromised, but it has not completely ruled such a breach out.

“If at any point in the future we determine that personal data has been compromised, we commit to contacting those impacted directly,” Indigo wrote in its Friday note.

The company has also assured customers that points distributed through its Plum loyalty program have not been impacted, but redemptions, sign-ups, or renewals are not currently possible.

However, customers can still receive Plum discounts for purchases made in store while the incident is ongoing. Points will be issued at a future date as long as shoppers retain their receipts.

Plum points typically expire when a customer doesn’t make a qualifying purchase within 12 months. Shoppers with points set to expire in February, will see their expiration date extended to March 31, Indigo said.

The company has also extended the 30-day exchange or return timeline for purchases that had to be brought back between Feb. 8 and 15. Customers with such items will now have until Feb. 21 to make returns.

The retailer remains unable to cancel orders placed before the incident, but said once the issue is resolved, it will provide refunds. It is also unable to offer order status updates or estimated delivery timelines for people awaiting shipments from Indigo.

This report by The Canadian Press was first published Feb. 27, 2023.

Companies in this story: (TSX:IDG)

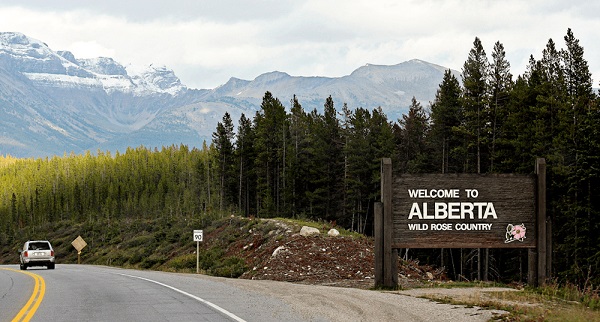

Alberta

Alberta taxpayers should know how much their municipal governments spend

From the Fraser Institute

By Tegan Hill and Austin Thompson

Next week, voters across Alberta will go to the polls to elect their local governments. Of course, while the issues vary depending on the city, town or district, all municipal governments spend taxpayer money.

And according to a recent study, Grande Prairie County and Red Deer County were among Alberta’s highest-spending municipalities (on a per-person basis) in 2023 (the latest year of comparable data). Kara Westerlund, president of the Rural Municipalities of Alberta, said that’s no surprise—arguing that it’s expensive to serve a small number of residents spread over large areas.

That challenge is real. In rural areas, fewer people share the cost of roads, parks and emergency services. But high spending isn’t inevitable. Some rural municipalities managed to spend far less, demonstrating that local choices about what services to provide, and how to deliver them, matter.

Consider the contrast in spending levels among rural counties. In 2023, Grande Prairie County and Red Deer County spent $5,413 and $4,619 per person, respectively. Foothills County, by comparison, spent just $2,570 per person. All three counties have relatively low population densities (fewer than seven residents per square kilometre) yet their per-person spending varies widely. (In case you’re wondering, Calgary spent $3,144 and Edmonton spent $3,241.)

Some of that variation reflects differences in the cost of similar services. For example, all three counties provide fire protection but in 2023 this service cost $56.95 per person in Grande Prairie County, $38.51 in Red Deer County and $10.32 in Foothills County. Other spending differences reflect not just how much is spent, but whether a service is offered at all. For instance, in 2023 Grande Prairie County recorded $46,283 in daycare spending, while Red Deer County and Foothills County had none.

Put simply, population density alone simply doesn’t explain why some municipalities spend more than others. Much depends on the choices municipal governments make and how efficiently they deliver services.

Westerlund also dismissed comparisons showing that some counties spend more per person than nearby towns and cities, calling them “apples to oranges.” It’s true that rural municipalities and cities differ—but that doesn’t make comparisons meaningless. After all, whether apples are a good deal depends on the price of other fruit, and a savvy shopper might switch to oranges if they offer better value. In the same way, comparing municipal spending—across all types of communities—helps Albertans judge whether they get good value for their tax dollars.

Every municipality offers a different mix of services and those choices come with different price tags. Consider three nearby municipalities: in 2023, Rockyview County spent $3,419 per person, Calgary spent $3,144 and Airdrie spent $2,187. These differences reflect real trade-offs in the scope, quality and cost of local services. Albertans should decide for themselves which mix of local services best suits their needs—but they can’t do that without clear data on what those services actually cost.

A big municipal tax bill isn’t an inevitable consequence of rural living. How much gets spent in each Alberta municipality depends greatly on the choices made by the mayors, reeves and councillors Albertans will elect next week. And for Albertans to determine whether or not they get good value for their local tax dollars, they must know how much their municipality is spending.

Business

Major Projects Office Another Case Of Liberal Political Theatre

From the Frontier Centre for Public Policy

By Lee Harding

Ottawa’s Major Projects Office is a fix for a mess the Liberals created—where approval now hinges on politics, not merit.

They are repeating their same old tricks, dressing up political favouritism as progress instead of cutting barriers for everyone

On Sept. 11, the Prime Minister’s Office announced five projects being examined by its Major Projects Office, all with the potential to be fast-tracked for approval and to get financial help. However, no one should get too excited. This is only a bad effort at fixing what government wrecked.

During the Trudeau years, and since, the Liberals have created a regulatory environment so daunting that companies need a trump card to get anything done. That’s why the Major Projects Office (MPO) exists.

“The MPO will work to fast-track nation-building projects by streamlining regulatory assessment and approvals and helping to structure financing, in close partnership with provinces, territories, Indigenous Peoples and private investors,” explains a government press release.

Canadians must not be fooled. A better solution would be to create a regulatory and tax environment where these projects can meet market demand through private investment. We don’t have that in Canada, which is why money has fled the country and our GDP growth per capita is near zero.

Instead of this less politicized and more even-handed approach, the Liberals have found a way to make their cabinet the only gatekeepers able to usher someone past the impossible process they created. Then, having done so, they can brag about what “they” got done.

The Fraser Institute has called out this system for its potential to incentivize bribes and kickbacks. The Liberals have such a track record of handing out projects and even judicial positions to their friends that such scenarios become easier to believe. Innumerable business groups will be kissing up to the Liberals just to get anything major done.

The government has created the need for more of itself, and it is following up in every way it can. Already, the federal government has set up offices across Canada for people to apply for such projects. Really? Anyone with enough dollars to pursue a major project can fly to Ottawa to make their pitch.

No, this is as much about the show as it is about results—and probably much more. It is all too reminiscent of another big-sounding, mostly ineffective program the Liberal government rolled out in 2017. They announced a $950-million Innovation Superclusters Initiative “designed to help strengthen Canada’s most promising clusters … while positioning Canadian firms for global leadership.”

That program allowed any company in the world to participate, with winners getting matching dollars from taxpayers for their proposals. (But all for the good of Canada, we were told.) More than 50 applications were made for these sweepstakes, which included more than 1,000 businesses and 350 other participants. In Trudeau Liberal fashion, every applicant had to articulate how their proposal would increase female jobs and leadership and encourage diversity in the long term.

The entire process was like one big Dragon’s Den series. The Liberals trotted out a list of contestants full of nice-sounding possibilities, with maximum hype and minimal reality. Late in the process, Minister of Innovation, Science and Industry Navdeep Bains picked the nine finalists himself (all based in cities with a Liberal MP), from which five would be chosen.

The alleged premise was to leverage local and regional commercial clusters, but that soon proved ridiculous. The “Clean, Low-energy, Effective and Remediated Supercluster” purported to power clean growth in mining in Ontario, Quebec and Vancouver. Not to be outdone, the “Mobility Systems and Technologies for the 21st Century Supercluster” included all three of these locations, plus Atlantic Canada. They were only clustered by their tendency to vote Liberal.

Today, the MPO repeats this virtue-signalling, politicking, drawn-out, tax-dollar-spending drama. The Red Chris Mine expansion in northwest British Columbia is one of the proposals under consideration. It would be done in conjunction with the Indigenous Tahltan Nation and is supposed to reduce greenhouse gas emissions by 70 per cent. That’s right up the Liberal alley.

Meanwhile, the project is somehow part of a proposed Northwest Critical Conservation Corridor that would cordon off an area the size of Greece from development. Is this economic growth or economic prohibition? This approach is more like the United Nations’ Agenda 2030 than it is nation-building. And it is more like the World Economic Forum’s “stakeholder capitalism” approach than it is free enterprise.

At least there are two gems among the five proposals. One is to expand capacity at the Port of Montreal, and another is to expand the Canada LNG facility in Kitimat, B.C. Both have a market case and clear economic benefits.

Even here, Canadians must ask themselves, why must the government use a bulldozer to get past the red tape it created? Why not cut the tape for everyone? The Liberals deserve little credit for knocking down a door they barred themselves.

Lee Harding is a research fellow for the Frontier Centre for Public Policy.

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoCanada’s privacy commissioner says he was not consulted on bill to ban dissidents from internet

-

Business2 days ago

Business2 days agoFormer Trump Advisor Says US Must Stop UN ‘Net Zero’ Climate Tax On American Ships

-

Alberta2 days ago

Alberta2 days agoEnbridge CEO says ‘there’s a good reason’ for Alberta to champion new oil pipeline

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoLong-Distance Field Goals Have Flipped The Field. Will The NFL Panic?

-

Business2 days ago

Business2 days ago“Nation Building,” Liberal Style: We’re Fixing a Sewer, You’re Welcome, Canada

-

National1 day ago

National1 day agoDemocracy Watch Renews Push for Independent Prosecutor in SNC-Lavalin Case

-

Business1 day ago

Business1 day agoOver two thirds of Canadians say Ottawa should reduce size of federal bureaucracy

-

Alberta7 hours ago

Alberta7 hours agoAlberta taxpayers should know how much their municipal governments spend