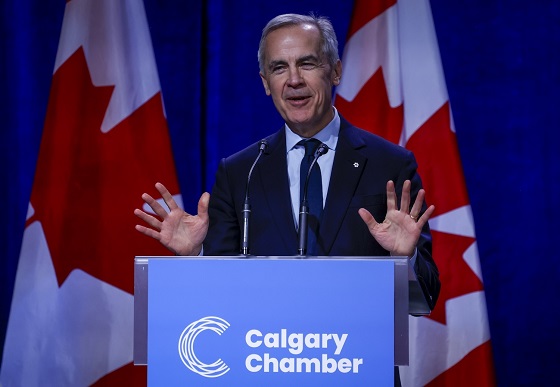

Tanker Dubai Angel at the Trans Mountain terminal, Burnaby

(Photo: Radio-Canada / Georgie Smyth / CBC)

Ottawa’s Commitment to 30 percent Indigenous Stake in Trans Mountain Pipeline Still Awaiting Confirmation.

Indigenous leaders in Western Canada have been waiting for months for confirmation that the federal government will indeed enable Indigenous Peoples to get a 30 percent share in the Trans Mountain oil pipeline system.

That Ottawa has such a share in mind has been confirmed by Alberta Premier Danielle Smith. She says Ottawa is looking at possibly offering a loan guarantee to First Nations.

“They wanted to get the Indigenous partners to own 30 per cent. . . . It’s going to be a great source of income for the Indigenous partners.”

With the pipeline system’s capacity set to almost triple through the expansion project known as TMX, the federal government first announced in 2019, its intention to explore the possibility of the economic participation of 129 affected Indigenous Peoples.

Finance Minister Chrystia Freeland sent Indigenous leaders a letter last August outlining a plan to sell a stake in the pipeline system to eligible communities through a special-purpose vehicle. It said they would not have to risk any of their own money to participate.

But since then Indigenous groups have been awaiting further word from federal authorities on how and when the equity promise will be kept.

All Ottawa has said publicly is this on May 1: “The federal government will launch a divestment process in due course.”

Two key groups have aired proposals for acquiring equity in the oil pipeline:

- The Western Indigenous Pipeline Group was formed in 2018 “ to acquire a major stake in Trans Mountain for the benefit of Indigenous communities who live along the pipeline.” It’s been working behind the scenes, and, with Pembina Pipelines Corporation, developed in 2021 the Chinook Pathways operating partnership.

“Chinook Pathways is finance ready. There are no capital contributions required for Indigenous communities. We will structure the transaction so that participating communities will make zero financial contribution.”

- Project Reconciliation, also founded in 2018, proposed a ”framework” that would give ownership of the pipeline system to 129 Indigenous Peoples.

“We are poised to facilitate Indigenous ownership of up to 100 percent, fostering economic autonomy and environmental responsibility.”

And: “A portion of revenue generated (portion directed by each Indigenous community) will be used to establish the Indigenous Sovereign Wealth Fund, supporting investment in infrastructure, clean energy projects and renewable technologies.”

In Alberta, the pipeline system spans the territories of Treaty 6, Treaty 8, and the Métis Nation of Alberta (Zone 4). In British Columbia, the system crosses numerous traditional territories and 15 First Nation reserves.

Commentator Joseph Quesnel writes: “According to Trans Mountain, there have been 73,000 points of contact with Indigenous communities throughout Alberta and British Columbia as the expansion was developed and constructed. . . .

“Beyond formal Indigenous engagement, the project proponent conducted numerous environmental and engineering field studies. These included studies drawing on deep Indigenous input, such as traditional ecological knowledge studies, traditional land use studies, and traditional marine land use studies.”

And Alberta’s Canadian Energy Centre reported: “In addition to $4.9 billion in contracts with Indigenous businesses during construction, the project leaves behind more than $650 million in benefit agreements and $1.2 billion in skills training with Indigenous communities.”

Not all First Nations have been happy with the expansion project.

In 2018, the federal appeal court ruled that Ottawa had failed to consider the concerns of several nations that challenged the project. In 2019, the project was re-approved by Ottawa, and again several nations (including the Squamish and Tsleil-Waututh) appealed. That appeal was dismissed in 2020. The nations then went to the Supreme Court of Canada, but it declined to hear the case.

Private company Kinder Morgan originally proposed the expansion project, but when it threatened to back out in 2018, the federal government stepped in and bought the existing pipeline, and the expansion project, for $4.5-billion. Ottawa said it was “a necessary and serious investment in the national interest.”

Ottawa at that time estimated that the total cost of the expansion project would come in around $7.4 billion. But cost overruns have since driven the final price to some $34 billion.

On the other hand, Ernst & Young found that between 2024 and 2043, the expanded Trans Mountain system will pay $3.7 billion in wages, generate $9.2 billion in GDP, and pay $2.8 billion in government taxes.

The TMX expansion twinned the 1953 Trans Mountain pipeline from near Edmonton to Burnaby (1,150 km) and increased the system’s capacity to 890,000 barrels a day from 300,000 barrels a day.

The original pipeline will carry refined products, synthetic crude oils, and light crude oils with the capability for heavy crude oils. The new pipeline will primarily carry heavier oils but can also transport lighter oils.

And the Alberta Energy Regulator says it expects oilsands production to grow by more than 17 per cent by 2033 (increasing to four million barrels a day from 3.4 million in 2023). And it expects global oil prices will continue to rise.

The TMX expansion finally opened and began to fill on May 1 this year.

And, as our CEO Stewart Muir noted, there was a quick reduction of eight cents a litre in gasoline prices for Vancouver due to completion of the project.

From Trans Mountain’s Westridge Marine Terminal at Burnaby, around three million barrels of oil have been shipped to China or India since the TMX expansion opened.

But because the port of Vancouver can handle only smaller Aframax tankers, more than half the oil has first been shipped to California, where it is then transferred to much larger VLCC (Very Large Crude Carrier) tankers. That makes for a longer but potentially cheaper journey.

At Westridge, because of limited tanker size, cargoes are limited to about 600,000 barrels per Aframax vessel. The largest VLCCs can carry two million barrels of oil. Westridge now can handle 34 Aframax tankers per month.

Some 20 tankers loaded oil there in June, a couple fewer than TMX had hoped for.

“This first month is just shy of the 350,000-400,000 bpd (barrels a day) we expected ahead of the startup,” said shipping analyst Matt Smith. “We are still in the discovery phase, with kinks being ironed out . . . but in the grand scheme of things, this has been a solid start.”

The Dubai Angel became the first Aframax tanker to load at Westridge. It took on 550,000 barrels of Alberta crude in the last week of May, and headed for the port of Zhoushan, China.

Now the Dubai Angel is headed to Burnaby for another load, and is expected to arrive there on July 8.