Fraser Institute

Health-care costs for typical Canadian family will reach almost $18,000 this year

From the Fraser Institute

By Nathaniel Li and Milagros Palacios and Nadeem Esmail

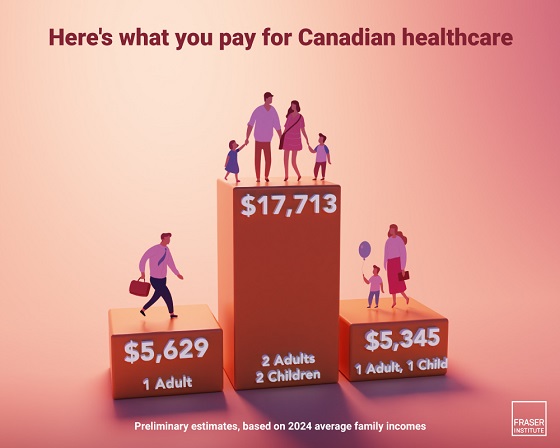

A typical Canadian family of four will pay an estimated $17,713 for public health-care insurance this year, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Canadians pay a substantial amount of money for health care through a variety of taxes—even if we don’t pay directly for medical services,” said Nadeem Esmail, senior fellow at the Fraser Institute and co-author of The Price of Public Health Care Insurance, 2024.

Most Canadians are unaware of the true cost of health care because they never see a bill for medical services, may only be aware of partial costs collected via employer health taxes and contributions (in provinces that impose them), and because general government revenue—not a dedicated tax—funds Canada’s public health-care system.

The study estimates that a typical Canadian family consisting of two parents and two children with an average household income of $176,266 will pay $17,713 for public health care this year. Couples without dependent children will pay an estimated $16,528. Single Canadians will pay $5,629 for health care insurance, and single parents with one child will pay $5,345.

Since 1997, the first year for which data is available, the cost of healthcare for the average Canadian family has increased substantially, and has risen more quickly than its income. In fact, the cost of public health care insurance for the average Canadian family increased 2.2 times as fast as the cost of food, 1.6 times as fast as the cost of housing, and 1.7 times as fast as the average income.

“Understanding how much Canadians actually pay for health care, and how much that amount has increased over time, is an important first step for taxpayers to assess the value and performance of the health-care system, and whether it’s financially sustainable,” Esmail said.

- Canadians often misunderstand the true cost of our public health care system. This occurs partly because Canadians do not incur direct expenses for their use of health care, and partly because Canadians cannot readily determine the value of their contribution to public health care insurance.

- In 2024, preliminary estimates suggest the average payment for public health care insurance ranges from $4,908 to $17,713 for six common Canadian family types, depending on the type of family.

- Between 1997 and 2024, the cost of public health care insurance for the average Canadian family increased 2.2 times as fast as the cost of food, 1.7 times as fast as the average income, and 1.6 times as fast as the cost of shelter. It also increased much more rapidly than the cost of clothing, which has been falling in recent years.

- The 10 percent of Canadian families with the lowest incomes will pay an average of about $639 for public health care insurance in 2024. The 10 percent of Canadian families who earn an average income of $81,825 will pay an average of $7,758 for public health care insurance, and the families among the top 10 percent of income earners in Canada will pay $47,071.

Authors:

Business

Canada’s health-care system is not ‘free’—and we’re not getting good value for our money

From the Fraser Institute

By Nadeem Esmail and Mackenzie Moir

In 2025, many Canadians still talk about our “free” health-care system. But in reality, through taxes, we pay a lot for health care. In fact, according to the latest data, a typical Canadian family will pay $19,060 (or about 24 per cent of their total tax bill) for health care this year.

Given the size of that bill, it’s worth asking—do Canadians get good value for all those tax dollars? Not even close.

First, Canadians endure some of the longest wait times for medical care—including primary care, specialist consultations and non-emergency surgery—among developed countries with universal health care. In fact, the wait in Canada for non-emergency care is now more than seven months from referral to treatment, which is more than three times longer than in 1993 when wait times were first measured nationally.

Why the delays?

Part of the reason is the limited number of medical resources available to Canadians. Compared to our universal health-care peers, Canada had some of the fewest physicians, hospital beds and medical technologies such as MRI machines and CT scanners.

And before you wonder if $19,000 per year isn’t enough money for world-class universal coverage, remember that Canada has one of the most expensive universal health-care systems in the developed world, which means Canadians are among the highest spenders on universal health care yet have some of the worst access to health-care services.

Fortunately, countries such as Switzerland and Australia, which both provide far more timely access to high-quality universal care for similar or even lower cost than Canada, offer lessons for reform. Compared to Canada, both countries allow a larger degree of private-sector involvement and, perhaps more importantly, competition in their universal health-care systems.

In Switzerland, for instance, health insurance coverage is mandatory and provided by independent insurers that compete in a regulated market. Swiss citizens freely choose between insurers (which must accept all applicants) and can even personalize some aspects of their universal insurance policy. Patients also have a choice of hospitals, more than half of which are operated privately and for-profit.

In Australia, citizens can purchase private insurance, which covers the cost of treatment in private hospitals. Higher income Australians are actively encouraged to purchase private health insurance and even have to pay additional taxes if they do not. Some 39 per cent of hospitals in Australia are private and for-profit, providing care to both privately and publicly insured patients.

Vitally, competition between private health-care businesses and entrepreneurs in both countries (and many others including Germany and the Netherlands) has helped create a more cost-effective and accessible universal health-care system. Back here in Canada, the lack of private-sector efficiency, innovation and patient-focus has led to the opposite—namely, long waits and poor access.

Health care in Canada is not free. It comes with a substantial price tag through our tax system. And the size of that bill leaves less money for savings and other things families need.

Getting better value for our health-care tax dollars, and solving the longstanding access problems patients face, requires policy reform with a more contemporary understanding of how to structure a truly world-class universal health-care system. Until that reform happens, Canadians will continue to be stuck with a big bill for lousy access to health care.

Fraser Institute

Carney government should scrap gun ‘buyback’ program and save taxpayer money

From the Fraser Institute

By Gary Mauser

More than 90 per cent of guns used in crimes are illegally imported into Ontario from the United States, which means the confiscation (or “buyback”) program would not affect these guns. And the program diverts financial and policing resources towards law-abiding Canadians who own firearms

Given the mountain of federal debt, the Carney government’s much-anticipated fall budget should tell us how Ottawa plans to deal with the prime minister’s new priorities. Carney has urged cabinet to find existing programs to cut so Ottawa can afford the new spending he’s promised, such as meeting the NATO 5 per cent commitment and opening up new energy corridors.

Clearly, if the government wants to cut waste, it should axe the Trudeau-era gun ban and confiscation program, which—according to reports—the government plans to fully rollout this fall.

First, some background. In 2020, with the stroke of a pen, the Trudeau government instantly made it a crime for federally-licenced firearms owners to buy, sell, transport, import, export or use hundreds of thousands of formerly legal rifles and shotguns. According to the government, the ban targets “assault-style weapons,” which are actually classic semi-automatic rifles and shotguns used by hunters and sport shooters for more than 100 years. When announcing the ban, the prime minister said the government would confiscate the banned firearms and provide “fair compensation” to owners. That hasn’t happened.

In fact, the government has revealed no plans about how it will collect the banned firearms nor has it included compensation costs in any federal budget. The amnesty period (to allow compliance with the ban), which the government has extended in the past, is set to expire on Oct. 30, 2025.

The program faces stiff opposition from several key players.

For example, the provincial governments in Ontario and Saskatchewan don’t want to participate. As noted by Ontario’s solicitor general, more than 90 per cent of guns used in crimes are illegally imported into Ontario from the United States, which means the confiscation (or “buyback”) program would not affect these guns. And the program diverts financial and policing resources towards law-abiding Canadians who own firearms and are already heavily regulated and screened.

The National Police Federation, which represents 20,000 RCMP members, has said the program is a “misdirected effort when it comes to public safety.”

Canada Post, which has been tasked by Ottawa to receive and warehouse firearms, wants nothing to do with the program due to fear of conflicts between staff and gun owners, and the ability of Canada Post to safely store potentially hundreds of firearms in postal substations.

And the Canadian Sporting Arms and Ammunition Association, which represents firearms retailers, said it will have “zero involvement” in helping confiscate these firearms.

Meanwhile, there’s no evidence the program will improve public safety.

In fact, Canadian firearms owners are exceptionally law-abiding and less likely to commit murder than other Canadians—and that shouldn’t be surprising. To own a firearm in Canada, you must obtain a Possession and Acquisition Licence (PAL) from the RCMP after initial vetting and daily monitoring for possible criminal activity. Between 2000 and 2020, an average of 12 PAL holders per year were accused of homicide, out of approximately 2 million PAL holders. The number of PAL holders increased from 1,979,054 to 2,206,755 over this same time period, so the PAL holder firearms homicide rate over 20 years was 0.63 per 100,000 PAL holders. But the firearms homicide rate for adult Canadians is 0.72 per 100,000—that’s 14 per cent higher than the rate for PAL holders.

Even the minister in charge of the program—Gary Anandasangaree, the Carney government’s public safety minister—seems to think it’s a bad idea. In an audio recording released online, he said: “I just don’t think municipal police services have the resources to do this” before adding that the program’s goals may be more about politics than sound policy.

So, with a federal budget looming, how much will the gun ban/confiscation program cost taxpayers?

The plain answer: we don’t know. But back in 2020, the Trudeau government said it would cost $200 million to compensate firearms owners for confiscating their now-banned firearms, although the Parliamentary Budget Officer said compensation costs could reach $756 million. The federal government recently said the program’s administrative costs (safe storage, destruction of hundreds of thousands of firearms, etc.) would reach an estimated $1.8 billion. My estimate, based on a similar program in New Zealand in 2019, for only compensation costs and the collection phase is closer to $6 billion.

Today, more than 150 employees of the Department of Public Safety in Ottawa are working full time on the program, yet few firearms (12,195) have been collected to-date. The program spent $67.2 million by 2024, before it collected a single gun, and is now projected to cost $459.8 million in 2025/26 alone, mainly on public opinion surveys and planning. Basically, they’re trying to figure out how to confiscate and destroy hundreds of thousands of guns from across Canada. Apparently, this planning costs hundreds of millions of dollars.

In sum, Ottawa’s gun ban/confiscation (“buyback”) program is very expensive and likely won’t achieve its stated goals of improving public safety. If the Carney government wants to find savings, the program is good place to start.

-

Crime2 days ago

Crime2 days agoPierre Poilievre says Christians may be ‘number one’ target of hate violence in Canada

-

International1 day ago

International1 day agoNetanyahu hails TikTok takeover as Israel’s new ‘weapon’ in information war

-

Business1 day ago

Business1 day agoElon Musk announces ‘Grokipedia’ project after Tucker Carlson highlights Wikipedia bias

-

International11 hours ago

International11 hours agoPope Leo hails Trump’s Gaza peace plan: “I hope Hamas will accept it”

-

Business10 hours ago

Business10 hours agoCanada’s health-care system is not ‘free’—and we’re not getting good value for our money

-

illegal immigration2 days ago

illegal immigration2 days agoIreland to pay migrant families €10,000 to drop asylum claims, leave country

-

Crime18 hours ago

Crime18 hours agoDrug trafficker says Trump battle with the cartels is making an impact

-

National2 days ago

National2 days agoCanada’s birth rate plummets to an all-time low