National

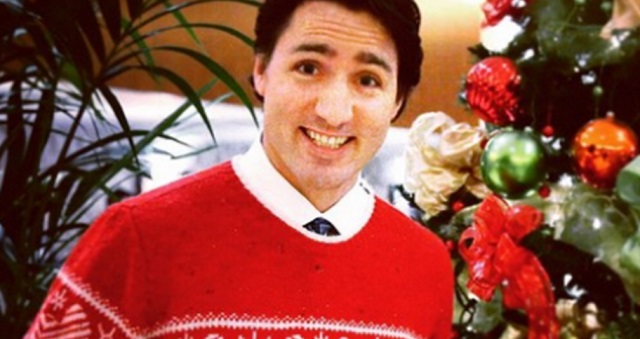

Generous Justin: Trudeau hands out one million raises in four years

From the Canadian Taxpayers Federation

Author: Ryan Thorpe

The Trudeau government rubberstamped more than one million pay raises to federal bureaucrats since 2020, according to access-to-information records obtained by the Canadian Taxpayers Federation.

The federal government gave 319,067 bureaucrats a raise in 2023. The government has consistently declined to disclose how much annual pay raises cost taxpayers.

“Taxpayers deserve to know how much all these raises are costing us,” said Franco Terrazzano, CTF Federal Director. “It’s wrong for the government to hand out a million raises while taxpayers lost their jobs or struggled to afford ground beef and rent.”

The cost of the federal payroll hit $67 billion last year, a record high, representing a 68 per cent increase since 2016.

Meanwhile, the size of the bureaucracy spiked by about 40 per cent since Prime Minister Justin Trudeau took office, with more than 98,000 new employees being added to the federal payroll.

In 2020, the federal government issued 373,134 pay raises to bureaucrats, followed by 266,646 in 2021 and 162,263 in 2022.

All told, the feds rubberstamped 1,121,110 pay raises since the beginning of 2020.

“What extra value have taxpayers received from the million raises Trudeau has given bureaucrats?” Terrazzano said. “You shouldn’t get a raise just because you show up to work twice a week with your shoes tied.”

The raises come on top of lavish bonuses for federal bureaucrats. The government rubberstamped $406 million in bonuses in 2023 alone.

Bureaucrats working in federal departments and agencies took home $210 million in bonuses last year, while bureaucrats working in federal Crown corporations took $195 million in bonuses.

The government dished out more than $1.5 billion in bonuses to employees in federal departments since 2015, despite the fact that “less than 50 per cent of [performance] targets are consistently met within the same year,” according to the Parliamentary Budget Officer.

The average compensation for each full-time federal employee is $125,300 when pay, pension, paid time off, shift premiums and other benefits are considered, according to the PBO.

Meanwhile, the average annual salary among all full-time workers was less than $70,000 in 2023, according to data from Statistics Canada.

Government employees also receive an “8.5 per cent wage premium, on average, over their private-sector counterparts,” according to a report from the Fraser Institute, an independent, non-partisan think tank.

The Public Service Alliance of Canada, the largest union representing federal bureaucrats, is currently fighting against a government order asking employees return to the office three days per week.

Alex Silas, PSAC’s regional executive vice-president for the National Capital Region, said bureaucrats were “infuriated” by the government asking them to show up to their jobs in person three days per week.

“Taxpayers have zero sympathy for overpaid bureaucrats throwing a hissy fit about having to swap out their sweatpants for suits,” Terrazzano said. “Taxpayers are the ones who should be complaining after the feds hired tens of thousands of extra bureaucrats, paid out hundreds of thousands of raises and hundreds of millions in bonuses and still can’t deliver good services.

“Trudeau needs to take some air out of his ballooning bloated bureaucracy.”

Business

Canada’s economic performance cratered after Ottawa pivoted to the ‘green’ economy

From the Fraser Institute

By Jason Clemens and Jake Fuss

There are ostensibly two approaches to economic growth from a government policy perspective. The first is to create the best environment possible for entrepreneurs, business owners and investors by ensuring effective government that only does what’s needed, maintains competitive taxes and reasonable regulations. It doesn’t try to pick winners and losers but rather introduces policies to create a positive environment for all businesses to succeed.

The alternative is for the government to take an active role in picking winners and losers through taxes, spending and regulations. The idea here is that a government can promote certain companies and industries (as part of a larger “industrial policy”) better than allowing the market—that is, individual entrepreneurs, businesses and investors—to make those decisions.

It’s never purely one or the other but governments tend to generally favour one approach. The Trudeau era represented a marked break from the consensus that existed for more than two decades prior. Trudeau’s Ottawa introduced a series of tax measures, spending initiatives and regulations to actively constrain the traditional energy sector while promoting what the government termed the “green” economy.

The scope and cost of the policies introduced to actively pick winners and losers is hard to imagine given its breadth. Direct spending on the “green” economy by the federal government increased from $600 million the year before Trudeau took office (2014/15) to $23.0 billion last year (2024/25).

Ottawa introduced regulations to make it harder to build traditional energy projects (Bill C-69), banned tankers carrying Canadian oil from the northwest coast of British Columbia (Bill C-48), proposed an emissions cap on the oil and gas sector, cancelled pipeline developments, mandated almost all new vehicles sold in Canada to be zero-emission by 2035, imposed new homebuilding regulations for energy efficiency, changed fuel standards, and the list goes on and on.

Despite the mountain of federal spending and regulations, which were augmented by additional spending and regulations by various provincial governments, the Canadian economy has not been transformed over the last decade, but we have suffered marked economic costs.

Consider the share of the total economy in 2014 linked with the “green” sector, a term used by Statistics Canada in its measurement of economic output, was 3.1 per cent. In 2023, the green economy represented 3.6 per cent of the Canadian economy, not even a full one-percentage point increase despite the spending and regulating.

And Ottawa’s initiatives did not deliver the green jobs promised. From 2014 to 2023, only 68,000 jobs were created in the entire green sector, and the sector now represents less than 2 per cent of total employment.

Canada’s economic performance cratered in line with this new approach to economic growth. Simply put, rather than delivering the promised prosperity, it delivered economic stagnation. Consider that Canadian living standards, as measured by per-person GDP, were lower as of the second quarter of 2025 compared to six years ago. In other words, we’re poorer today than we were six years ago. In contrast, U.S. per-person GDP grew by 11.0 per cent during the same period.

Median wages (midpoint where half of individuals earn more, and half earn less) in every Canadian province are now lower than comparable median wages in every U.S. state. Read that again—our richest provinces now have lower median wages than the poorest U.S. states.

A significant part of the explanation for Canada’s poor performance is the collapse of private business investment. Simply put, businesses didn’t invest much in Canada, particularly when compared to the United States, and this was all pre-Trump tariffs. Canada’s fundamentals and the general business environment were simply not conducive to private-sector investment.

These results stand in stark contrast to the prosperity enjoyed by Canadians during the Chrétien to Harper years when the focus wasn’t on Ottawa picking winners and losers but rather trying to establish the most competitive environment possible to attract and retain entrepreneurs, businesses, investors and high-skilled professionals. The policies that dominated this period are the antithesis of those in place now: balanced budgets, smaller but more effective government spending, lower and competitive taxes, and smart regulations.

As the Carney government prepares to present its first budget to the Canadian people, many questions remain about whether there will be a genuine break from the policies of the Trudeau government or whether it will simply be the same old same old but dressed up in new language and fancy terms. History clearly tells us that when governments try to pick winners and losers, the strategy doesn’t lead to prosperity but rather stagnation. Let’s all hope our new prime minister knows his history and has learned its lessons.

Business

Canadians paid $90 billion in government debt interest in 2024/25

From the Fraser Institute

By Jake Fuss, Tegan Hill and William Dunstan

Next week, the Carney government will table its long-awaited first budget. Earlier this year, Prime Minister Mark Carney launched a federal spending review to find $25 billion in savings by 2028. Even if the government meets this goal, it won’t be enough to eliminate the federal deficit—projected to reach as high as $92.2 billion in 2025/26—and start paying down debt. That means a substantial amount of taxpayer dollars will continue to flow towards federal debt interest payments, rather than programs and services or tax relief for Canadians.

When a government spends more than it raises in revenue and runs a budget deficit, it accumulates debt. As of 2024/25, the federal and provincial governments will have accumulated a total projected $2.3 trillion in combined net debt (total debt minus financial assets).

Of course, like households, governments must pay interest on their debt. According to our recent study, the provinces and federal government expect to spend a combined $92.5 billion on debt interest payments in 2024/25.

And like any government spending, taxpayers fund these debt interest payments. The difference is that instead of funding important programs, such as health care, these taxpayer dollars will finance government debt. This is the cost of deficit spending.

How much do Canadians pay each year in government debt interest costs? On a per-person basis, combined provincial and federal debt interest costs in 2024/25 are expected to range from $1,937 in Alberta to $3,432 in Newfoundland and Labrador. These figures represent provincial debt interest costs, plus the federal portion allocated to each province based on a five-year average (2020-2024) of their share of Canada’s population.

For perspective, it’s helpful to compare debt interest payments to other budget items. For instance, the federal government estimates that in 2024/25 it will spend more on debt interest costs ($53.8 billion) than on child-care benefits ($35.1 billion) or the Canada Health Transfer ($52.1 billion), which supports provincial health-care systems.

Provincial governments too spend more money on interest payments than on large programs. For example, in 2024/25, Ontario expects to spend more on debt interest payments ($15.2 billion) than on post-secondary education ($14.2 billion). That same year, British Columbia expects to spend more on debt interest payments ($4.4 billion) than on child welfare ($4.3 billion).

Unlike other forms of spending, governments cannot simply decide to spend less on debt interest payments in a given year. To lower their debt interest payments, governments must rein in spending and eliminate deficits so they can start to pay down debt.

Unfortunately, most governments in Canada are doing the opposite. All but one province (Saskatchewan) plans to run a deficit in 2025/26 while the federal deficit could exceed $90 billion.

To stop racking up debt, governments must balance their budgets. By spending less today, governments can ensure that a larger share of tax dollars go towards programs or tax relief to benefit Canadians rather than simply financing government debt.

-

Alberta7 hours ago

Alberta7 hours agoFrom Underdog to Top Broodmare

-

International18 hours ago

International18 hours agoPrince Andrew banished from the British monarchy

-

Alberta2 days ago

Alberta2 days agoNobel Prize nods to Alberta innovation in carbon capture

-

Business1 day ago

Business1 day agoCanada’s attack on religious charities makes no fiscal sense

-

Business17 hours ago

Business17 hours ago“We have a deal”: Trump, Xi strike breakthrough on trade and fentanyl

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoGet Ready: Your House May Not Be Yours Much Longer

-

Crime17 hours ago

Crime17 hours agoCanada Seizes 4,300 Litres of Chinese Drug Precursors Amid Trump’s Tariff Pressure Over Fentanyl Flows

-

National2 days ago

National2 days agoCanadian MPs order ethics investigation into Mark Carney’s corporate interests