National

Free expression trial of Amy Hamm nears its end

News release from the Justice Centre for Constitutional Freedoms

The Justice Centre for Constitutional Freedoms is providing lawyers for British Columbia nurse Amy Hamm, whose disciplinary hearings will conclude on March 18-19, 2024. Oral arguments, beginning at 10:00 a.m. PT, will conclude the hearing before the three-person Disciplinary Committee of the British Columbia College of Nurses and Midwives in Vancouver. Lawyers will also answer any questions the panel may have following the submissions. The public is invited to view the proceedings online.

The prosecution of Amy Hamm over the off-duty expression of her opinions dates back to September 2020, when she co-sponsored a billboard featuring the words, “I ♥ JK Rowling” – a reference to the famous British author who, in 2019, came to the defense of a British woman whose employment contract was terminated after expressing “gender critical views.”

Two complaints by members of the public to the College about Ms. Hamm’s involvement with the billboard led to an investigation. That resulted in a 332-page report on Ms. Hamm’s activities, including a collection of her tweets, podcast transcripts and articles she had authored on the topic of gender identity and its conflict with women’s rights and the safeguarding of children.

The charge against Ms. Hamm reads, “Between approximately July 2018 and March 2021, you made discriminatory and derogatory statements regarding transgender people, while identifying yourself as a nurse or nurse educator. These statements were made across various online platforms, including but not limited to, podcasts, videos, published writings and social media.” The hearing began on September 21, 2022, and the panel heard 20 days of testimony, including approximately five days of challenges to the expert evidence provided by Ms. Hamm.

Much of the hearings to date has concentrated on the qualification, testimony and questioning of expert witnesses for both sides. The College presented as experts Dr. Elizabeth Saewyc and Dr. Greta Bauer, who argued that statements made by J. K. Rowling were “transphobic” and, by extension, so were Ms. Hamm’s. In Ms. Hamm’s defense, her legal team presented experts Dr. James Cantor, Dr. Kathleen Stock and Dr. Linda Blade.

As stated in their February 19, 2024, written submissions to the Committee, Ms. Hamm’s lawyers argue that:

- There is no evidence of breach of standards or bylaws, nor a case for a finding of unprofessional conduct;

- Her statements do not have a sufficient nexus to her status as a nurse to warrant regulatory interference;

- Her speech is reasonable and scientifically supportable;

- There is social value to her speech;

- Her advocacy is conducted in good faith, including to affect political change;

- She believes in the truth of her statements;

- There is no evidence of “discrimination” or “harm;”

- The infringement of her Charter right to freedom of expression, belief and opinion cannot be justified on a proportionate balancing against the objectives of the College.”

Lisa Bildy, lawyer for Amy Hamm, stated, “A key issue in this case is whether professionals can express criticism of gender identity ideology or other political issues in the public square without being subject to regulatory discipline. We argue that the College has allowed itself and its disciplinary process to become participants in a public and political controversy on which it should not be taking a side. The College should enforce high standards of performance for nurses and midwives when caring for their patients, and otherwise refrain from taking sides on political, cultural and moral issues that are debated in the public square. The College has lost its way.”

Crime

‘Modern-Day Escobar’: U.S. Says Former Canadian Olympian Ran Cocaine Pipeline with Cartel Protection and a Corrupt Toronto Lawyer

Ryan Wedding, believed to be hiding in Mexico, is on the FBI’s Ten Most Wanted Fugitives list. The State Department reward is up to $15 million for information leading to his arrest.

The U.S. government has unsealed fresh criminal charges and sweeping financial sanctions against former Canadian Olympic snowboarder Ryan James Wedding, alleging that he orchestrated the importation of up to 60 metric tonnes of cocaine a year into the United States and Canada, relied on a Toronto lawyer who, according to the U.S. Treasury, “has also helped Wedding with bribery and murder,” and, while under the protection of a former Mexican law-enforcement officer with ties to senior Mexican police officials, ordered dozens of sophisticated assassinations across Canada, Latin America and the United States — including the execution of a federal witness in Colombia, according to U.S. government filings.

According to Attorney General Pam Bondi, “Wedding controls one of the most prolific and violent drug trafficking organizations in this world,” working “closely with the Sinaloa Cartel, a foreign terrorist organization, to flood not only American but also Canadian communities with cocaine.” Bondi said Wedding’s organization is responsible for moving multi-ton quantities of cocaine each year through Mexico into Los Angeles, before the drugs are shipped onward to Canadian and U.S. cities in long-haul semi-trucks.

As reported by The Bureau, these trucks and routes are controlled by Indo-Canadian crime networks. The U.S. government says that a Toronto lawyer, Deepak Balwant Paradkar, “introduced Wedding to the drug traffickers that have been moving Wedding’s cocaine and has also helped Wedding with bribery and murder.”

FBI Director Kash Patel likened Wedding to a “modern-day iteration” of Pablo Escobar and Joaquin “El Chapo” Guzmán and said Wedding is responsible for “engineering a narco-trafficking and narco-terrorism program that we have not seen in a long time.”

The Justice Department and FBI say Wedding, who competed for Canada at the 2002 Winter Olympics in Salt Lake City, now heads a billion-dollar-a-year narcotics enterprise that engages in cocaine trafficking, contract killings and intimidation across the United States, Canada and Latin America. Another target named along with Wedding is a former Italian special-forces soldier who helps the network with training, according to the U.S. government.

Wedding is believed to be hiding in Mexico and remains on the FBI’s Ten Most Wanted Fugitives list, with the State Department increasing its reward to up to $15 million for information leading to his arrest.

Prosecutors say the new indictment centres on the January 31, 2025, murder of a federal witness in Medellín, Colombia. According to U.S. Attorney Bill Essayli of the Central District of California, Wedding “placed a bounty on the victim’s head in the erroneous belief that the victim’s death would result in the dismissal of criminal charges against him and his international drug trafficking ring and would further ensure that he was not extradited to the United States.” The victim was shot five times in the head while dining at a restaurant in Medellín and died instantly, Essayli said.

Justice Department filings and officials at today’s Washington news conference allege that Wedding and his associates used a fake gangland “news” site, The Dirty News, as part of the plot. The indictment states that co-accused Gursewak Singh Bal, a Mississauga man described as co-founder and co-operator of The Dirty News, agreed — “in exchange for payment” — not to post negative material about Wedding and instead published a photograph of the cooperating witness so that he “could be hunted down and killed.” Essayli said the site was seized pursuant to a federal warrant and is no longer online.

Ten defendants were arrested Tuesday in Colombia, Florida, Québec and Ontario. In a parallel move, the U.S. Treasury Department’s Office of Foreign Assets Control announced sanctions against Wedding and nine individuals plus nine entities, effectively cutting them off from the American financial system.

Treasury describes Wedding as “an extremely violent criminal believed to be responsible for the murder of numerous people abroad, including U.S. citizens,” who “continues to direct drug trafficking, murder, and other serious criminal activities” from Mexico while on the run. The sanctions designation outlines a trans-Atlantic laundering system that moves proceeds through cryptocurrency, high-end cars and motorcycles, and front companies on three continents.

Among those named by Treasury:

Edgar Aaron Vázquez Alvarado, a former Mexican law-enforcement officer known as “the General,” who allegedly uses sources within Mexican police agencies to locate targets for Wedding and owns fuel-sector companies in Mexico;

Miryam Andrea Castillo Moreno, Wedding’s wife, accused of laundering his drug proceeds and assisting in acts of violence;

Carmen Yelinet Valoyes Florez, a Colombian running a high-end prostitution ring in Mexico who allegedly assisted with the murder of a federal witness;

Daniela Alejandra Acuña Macias, a Colombian national described as Wedding’s girlfriend, accused of collecting hundreds of thousands of dollars from him and helping obtain intelligence on rivals;

Deepak Balwant Paradkar, the Canadian attorney who Treasury says provided “illegal services” beyond a normal lawyer-client relationship, including introducing Wedding to key traffickers, helping with bribery and murder, and allowing Wedding to eavesdrop on privileged calls with other clients he allegedly wanted to kill;

Rolan Sokolovski, a Toronto jeweler who Treasury alleges laundered millions through his “Diamond Tsar” business and cryptocurrency transfers; and

Gianluca Tiepolo, an Italian former special-forces member who allegedly helped Wedding park his money in exotic vehicles and ran tactical training camps for hitmen.

According to Treasury, Paradkar “introduced Wedding to the drug traffickers that have been moving Wedding’s cocaine and has also helped Wedding with bribery and murder,” in exchange for luxury watches and additional fees. Vázquez and his Mexico-based fuel firms, Sokolovski’s jewelry company, and a series of Italian and U.K. vehicle and motorcycle dealers tied to Tiepolo have all been designated under Executive Order 14059 as part of Wedding’s laundering apparatus.

At the Washington news conference, Royal Canadian Mounted Police Commissioner Mike Duheme emphasized the role of cross-border cooperation, saying: “International cooperation, such as our involvement in Operation Giant Slalom, is vital to our ability to stay ahead of organized crime.”

But that message of seamless cooperation contrasts with what senior U.S. law-enforcement officials were saying privately months ago.

As The Bureau previously reported, a senior U.S. source insisted there has been a troubling lack of RCMP collaboration in probing Wedding’s networks. Not only did the RCMP allegedly stonewall Drug Enforcement Administration requests six years ago to crack down on Canadian trucking routes tied to Wedding’s shipments through the United States, the source said, but there was also a lack of cooperation in targeting his violent cells inside Canada — where associates, competitors, and even an innocent Indo-Canadian family in Caledon, Ontario, mistakenly linked to a trucker from Wedding’s network, were brutally executed.

“We tried to work with RCMP on Wedding too, and they said, ‘No,’” a source aware of probes from three separate U.S. agencies said. “And it’s like — he’s killing Canadian citizens. He’s killed God knows how many. And you still don’t want to cooperate because of whatever grievance. But the RCMP threw up roadblocks. You’ve got to get past those things because Canadians are dying.”

More to come on this breaking story.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Alberta

Carney government’s anti-oil sentiment no longer in doubt

From the Fraser Institute

The Carney government, which on Monday survived a confidence vote in Parliament by the skin of its teeth, recently released a “second tranche of nation-building projects” blessed by the Major Projects Office. To have a chance to survive Canada’s otherwise oppressive regulatory gauntlet, projects must get on this Caesar-like-thumbs-up-thumbs-down list.

The first tranche of major projects released in September included no new oil pipelines but pertained largely to natural gas, nuclear power, mineral production, etc. The absence of proposed oil pipelines was not surprising, as Ottawa’s regulatory barricade on oil production means no sane private company would propose such a project. (The first tranche carries a price tag of $60 billion in government/private-sector spending.)

Now, the second tranche of projects also includes not a whiff of support for oil production, transport and export to non-U.S. markets. Again, not surprising as the prime minister has done nothing to lift the existing regulatory blockade on oil transport out of Alberta.

So, what’s on the latest list?

There’s a “conservation corridor” for British Columbia and Yukon; more LNG projects (both in B.C.); more mineral projects (nickel, graphite, tungsten—all electric vehicle battery constituents); and still more transmission for “clean energy”—again, mostly in B.C. And Nunavut comes out ahead with a new hydro project to power Iqaluit. (The second tranche carries a price tag of $58 billion in government/private-sector spending.)

No doubt many of these projects are worthy endeavours that shouldn’t require the imprimatur of the “Major Projects Office” to see the light of day, and merit development in the old-fashioned Canadian process where private-sector firms propose a project to Canada’s environmental regulators, get necessary and sufficient safety approval, and then build things.

However, new pipeline projects from Alberta would also easily stand on their own feet in that older regulatory regime based on necessary and sufficient safety approval, without the Carney government additionally deciding what is—or is not—important to the government, as opposed to the market, and without provincial governments and First Nations erecting endless barriers.

Regardless of how you value the various projects on the first two tranches, the second tranche makes it crystal clear (if it wasn’t already) that the Carney government will follow (or double down) on the Trudeau government’s plan to constrain oil production in Canada, particularly products derived from Alberta’s oilsands. There’s nary a mention that these products even exist in the government’s latest announcement, despite the fact that the oilsands are the world’s fourth-largest proven reserve of oil. This comes on the heels on the Carney government’s first proposed budget, which also reified the government’s fixation to extinguish greenhouse gas emissions in Canada, continue on the path to “net-zero 2050” and retain Canada’s all-EV new car future beginning in 2036.

It’s clear, at this point, that the Carney government is committed to the policies of the previous Liberal government, has little interest in harnessing the economic value of Canada’s oil holdings nor the potential global influence Canada might exert by exporting its oil products to Asia, Europe and other points abroad. This policy fixation will come at a significant cost to future generations of Canadians.

-

Agriculture2 days ago

Agriculture2 days agoFederal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

-

Daily Caller17 hours ago

Daily Caller17 hours agoDemocrats Explicitly Tell Spy Agencies, Military To Disobey Trump

-

Addictions1 day ago

Addictions1 day agoActivists Claim Dealers Can Fix Canada’s Drug Problem

-

Alberta1 day ago

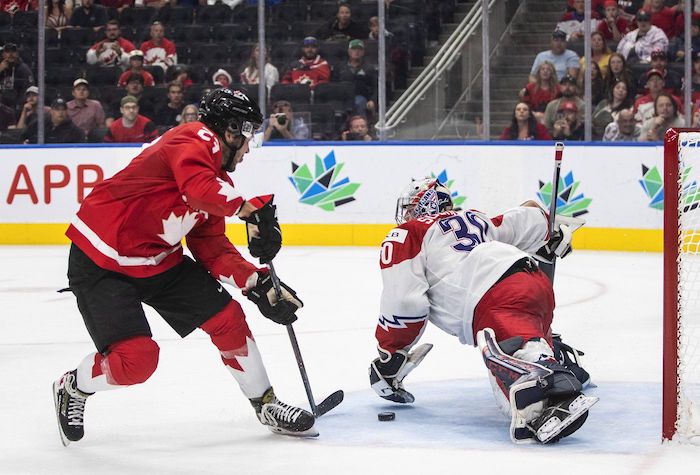

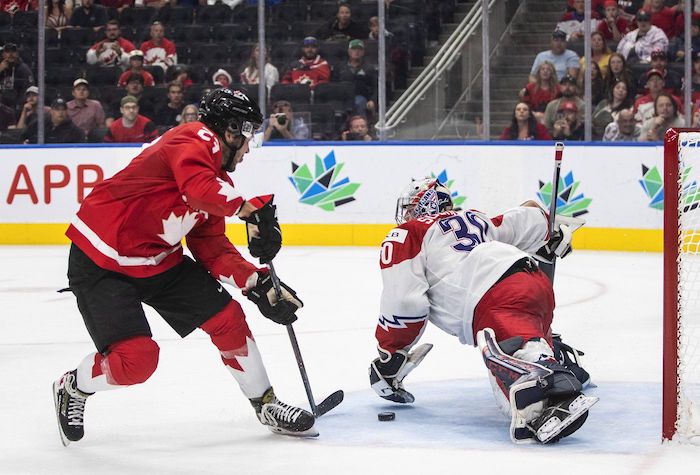

Alberta1 day agoEdmonton and Red Deer to Host 2027 IIHF World Junior Hockey Championship

-

Business24 hours ago

Business24 hours agoClimate Climbdown: Sacrificing the Canadian Economy for Net-Zero Goals Others Are Abandoning

-

Indigenous18 hours ago

Indigenous18 hours agoTop constitutional lawyer slams Indigenous land ruling as threat to Canadian property rights

-

Daily Caller2 days ago

Daily Caller2 days ago‘Holy Sh*t!’: Podcaster Aghast As Charlie Kirk’s Security Leader Reads Texts He Allegedly Sent University Police

-

Uncategorized1 day ago

Uncategorized1 day agoCost of bureaucracy balloons 80 per cent in 10 years: Public Accounts