Alberta

Free Alberta Strategy petition demanding PM Trudeau fire Steven Guilbeault passes 13,000 signatures

News release from Free Alberta Strategy

Are you tired of watching elected officials flout the law and disregard public concerns with impunity?

Are you frustrated by a federal government that prioritizes arrogance over accountability?

If so, you’re not alone.

Over 13,000 people have signed our petition calling on Justin Trudeau to fire Steven Guilbeault.

Once one of Greenpeace’s most disruptive forces, Guilbeault has spent enough time in an orange jumpsuit to build up a reputation for deliberately ignoring both law enforcement and the courts.

Since then, his career has been marked by a troubling disregard for both legal boundaries and public sentiment.

In 2001, Guilbeault was found guilty of mischief for scaling the CN Tower in Toronto and displaying a banner.

He received a sentence of one year’s probation, was mandated to complete 100 hours of community service in Montreal, and was ordered to pay $1,000 in restitution.

The incident incurred approximately $50,000 in costs for the tower operators.

Shortly thereafter, Guilbeault orchestrated another audacious act, leading a Greenpeace team in a demonstration at the Calgary residence of then Alberta Premier Ralph Klein and his wife, Colleen.

They erected a banner, positioned ladders against the house, and ascended to the roof to install a solar panel.

The intrusion deeply unsettled Colleen Klein, who was alone at the time and feared a home invasion – she resorted to grabbing a broom for defense.

Despite his controversial background, Justin Trudeau’s decision to appoint Guilbeault as Minister of Environment and Climate Change raised eyebrows and elicited criticism.

Jason Kenney, then premier of Alberta, accurately predicted the consequences of Guilbeault assuming a significant role in Justin Trudeau’s cabinet.

“His own personal background and track record on these issues suggests someone who is more an absolutist than a pragmatist when it comes to finding solutions,” Kenney said.

It’s perhaps no surprise then that Guilbeault’s response to legal setbacks in his political career, such as the Supreme Court’s ruling on the unconstitutionality of his Impact Assessment Act, has been dismissive, indicating a stubborn adherence to his own agenda rather than a willingness to heed judicial guidance.

Instead of accepting that he was wrong and repealing the law, Guilbeault wants to pass minor amendments and pretend like the Supreme Court ruling never happened.

Worse, the amendments – buried 552 pages into a 686-page budget implementation bill – don’t fix the problem.

Guilbeault still has the power to control projects that fall under provincial jurisdiction.

Consequently, tensions between the federal and provincial governments have escalated, with Alberta poised to immediately challenge the amended legislation in court once again.

This charade is getting old.

This pattern of defiance and disregard for legal constraints has become wearisome, eroding public trust in the integrity of federal institutions.

The rotation of headlines proclaiming federal overreach and constitutional breaches underscores a troubling trend within the governing party, where arrogance appears to have supplanted prudent governance.

Guilbeault, with his checkered past and continued ignorance of the law since becoming Minister, are crippling public confidence.

A few months ago, we launched a petition calling on Justin Trudeau to see the light, and fire his most controversial Minister.

Since then, things have only gotten worse.

If you agree, and think Guilbeault should be fired, please sign our petition today:

Then, send this petition to your friends, family, and every Albertan so that they can sign too!

Regards,

The Free Alberta Strategy Team

Alberta

Alberta poll shows strong resistance to pornographic material in school libraries

From LifeSiteNews

A government survey revealed strong public support, particularly among parents, for restricting or banning sexually explicit books.

Albertans are largely opposed to their children viewing pornography in school libraries, according to government polling.

In a June 20 press release, the Government of Alberta announced that their public engagement survey, launched after the discovery of sexually explicit books in school libraries, found that Albertans strongly support removing or limiting such content.

“Parents, educators and Albertans in general want action to ensure children don’t have access to age-inappropriate materials in school libraries,” Demetrios Nicolaides, Minister of Education and Childcare, said.

“We will use this valuable input to guide the creation of a province-wide standard to ensure the policy reflects the priorities and values of Albertans,” he continued.

READ: Support for traditional family values surges in Alberta

The survey, conducted between May 28 to June 6, received nearly 80,000 responses, revealing a widespread interest in the issue.

While 61 percent of respondents said that they had never previously been concerned about children viewing sexually explicit content in libraries, most were opposed to young children viewing it. 34 percent said children should never be able to access sexually explicit content in school libraries, while 23 percent believed it should be restricted to those aged 15 and up.

Similarly, 44 percent of parents of school-aged children were supportive of government regulations to control content in school libraries. Additionally, 62 percent of respondents either agreed or strongly agreed that “parents and guardians should play a role in reporting or challenging the availability of materials with sexually explicit content in school libraries.”

READ: Alberta Conservatives seeking to ban sexually graphic books from school libraries

The polling results come after the Conservative Alberta government under Premier Danielle Smith announced that they are going ahead with plans to eventually ban books with sexually explicit as well as pornographic material, many of which contain LGBT and even pedophilic content, from all school libraries, on May 27.

At the time, Nicolaides revealed that it was “extremely concerning” to discover that sexually explicit books were available in school libraries.

The books in question, found at multiple school locations, are Gender Queer, a graphic novel by Maia Kobabe; Flamer, a graphic novel by Mike Curato; Blankets, a graphic novel by Craig Thompson; and Fun Home, a graphic novel by Alison Bechdel.

Alberta

High costs, low returns – Canada’s wildly expensive emissions cap

In this new commentary, Director of Energy, Natural Resources, and Environment Heather Exner-Pirot reveals why the Canadian government’s oil and gas emissions cap isn’t just expensive – it’s economic insanity.

Canada is the world’s third-largest exporter of oil, fourth-largest producer, and top source of imports to the United States. Much of Canada’s oil wealth is concentrated in the oil sands in northern Alberta, which hosts 99 percent of the country’s enormous oil endowment: about 160 billion barrels of proven reserves, of a total resource of approximately 1.8 trillion barrels. This is the major source of oil to the United States refinery complex, a large part of which is optimized for the oil sands’ heavy oil.

Reliability of energy supply has remerged as a major geopolitical issue. Canadian oil and gas is an essential component of North American energy security. Yet a proposed cap on emissions from the sectors promises to cut Canadian production and exports in the years ahead. It would be hard to provide less environmental benefit for a higher economic and security cost. There are far better ways to reduce emissions while maintaining North America’s security of energy supply.

The high cost of the cap

In 1994 a Liberal federal government, Alberta provincial conservative government and representatives from the oil and gas industry, working together through the national oil sands task force, developed A New Energy Vision for Canada. Their efforts turned what was then a middling resource into a trillion dollar nation-building project. Production has increased tenfold since the report came out.

The task force acknowledged the need for industry to “put its best efforts toward … reducing greenhouse gas emissions.” However, it also expected governments to “understand” that there “is no benefit to Canada or to the environment to have production and value-added processing done outside of the country in less efficient jurisdictions … policies set by regulator must not result in discouraging oil sands production.”

As part of its efforts to meet its climate goals under the Paris Accord, the Canadian government proposed a regulatory framework for an emissions cap on the oil and gas sector in December 2023. It set a legally binding limit on greenhouse gas emissions, targeting a 35 to 38 percent reduction from 2019 levels by 2030 for upstream operations, through regulations to be made under the Canadian Environmental Protection Act, 1999 (CEPA).

The federal government has not yet finalized its proposed regulations. However, industry experts and economists have criticized the current iteration as logistically unworkable, overly expensive, and likely to be challenged as unconstitutional. In effect, this policy layers a cap-and-trade system for just one sector (oil and gas) on top of a competing carbon pricing mechanism (the large-emitter trading systems, often referred to as the industrial carbon price), a discriminatory practice that also undermines the entire economic rationale of a carbon pricing system.

While the Canadian government has maintained that it is focused on reducing emissions rather than production – the latter of which would put it at odds with provincial jurisdiction over non-renewable resources – a series of third party analyses as well as the Parliamentary Budget Office’s own impact assessment find it would indeed constrain Canadian oil and gas production. The economic cost of the emissions cap far exceeds any corresponding benefit in reduced emissions.

How much will the emissions cap cost in terms of dollar per tonne of carbon in avoided emissions, both domestically and globally? Based solely on the cost to the Canadian economy, we estimate the emission cap is equivalent to a C$2,887/tonne carbon price by 2032.

Assuming no impact on global demand and full substitution by non-Canadian crudes, it finds that the cost of each tonne of carbon displaced globally is between C$96,000 to C$289,000 for oil sands bitumen production. For displaced Canadian conventional and natural gas, the cost is infinite, i.e. global emissions would actually be higher for every barrel or unit of Canadian oil and gas displaced with competitor products as a result of the emissions cap.

Canadian oil and gas emissions reduction efforts

The oil and gas sector is the highest emitting economic sector in Canada. However, it has made substantial efforts to reduce emissions over the past two decades and is succeeding. Absolute emissions in the sector peaked in 2014, despite production growing by over a million barrels of oil equivalent since (see Figure 1).

Figure 1 Indexed greenhouse gas (GHG) emissions (and gross domestic product (GDP) at basic prices, for the oil and gas extraction industry, 2009 to 2022 (2009 = 100). Source: Statistics Canada 2024.

Figure 1 Indexed greenhouse gas (GHG) emissions (and gross domestic product (GDP) at basic prices, for the oil and gas extraction industry, 2009 to 2022 (2009 = 100). Source: Statistics Canada 2024.

Much of this success can be attributed to methane capture, particularly in the natural gas and conventional oil sectors, where absolute emissions peaked in 2007 and 2014 respectively.

Since 2014, the oil sands have dramatically increased production by over a million barrels per day, but at the same time have reduced the emissions per barrel every year, leaving the absolute emissions of the oil and gas sector relatively flat. The oil sands are performing well vis-à-vis their international peers, seeing their emissions per barrel decline by 30 percent since 2013, compared to 21 percent for global majors and 34 percent for US E&Ps (exploration and production companies) (see Figure 2).

Figure 2 Indexed Oil Sands GHG relative intensity trend (2013=100). Source: BMO Capital Markets, “I Want What You Got: Canada’s Oil Resource Advantage,” April 2025

Figure 2 Indexed Oil Sands GHG relative intensity trend (2013=100). Source: BMO Capital Markets, “I Want What You Got: Canada’s Oil Resource Advantage,” April 2025

On an emissions intensity absolute basis, the oil sands have significantly outperformed their peers, shaving off 25kg/barrel of emissions since 2013 (see Figure 3) and more than 65kg/barrel since the oil sands task force wrote their report in 1994.

As emissions improvements from methane reductions plateau, the oil sands are likely to outperform their conventional peers in emissions per barrel reductions going forward. The sector is working on strategies such as solvent extraction and carbon capture and storage that, if implemented, would reduce the life-cycle emissions per barrel of oil sands to levels at or below the global crude average.

Figure 3 Emissions intensity absolute change (kg CO2e/bbl) (2013–24E) Source: BMO Capital Markets, 2025

Figure 3 Emissions intensity absolute change (kg CO2e/bbl) (2013–24E) Source: BMO Capital Markets, 2025

The high cost of the cap

Several parties have analyzed the proposed emissions cap to determine its economic and production impact. The results of the assessments vary widely. For the purposes of this commentary we rely on the federal Office of the Parliamentary Budget Officer (PBO), which published its analysis of the proposed emissions cap in March 2025. Helpfully, the PBO provided a table summarizing the main findings of the various analyses (see Table 1).

The PBO found that the required reduction in upstream oil and gas sector production levels under an emissions cap would lower real gross domestic product (GDP) in Canada by 0.33 percent in 2030 and 0.39 percent in 2032, and reduce nominal GDP by C$20.5 billion by 2032. The PBO further estimated that achieving the legal upper bound would reduce economy-wide employment in Canada by 40,300 jobs and full-time equivalents by 54,400 in 2032.

Table 2 Comparison of estimated impacts of the proposed emissions cap in 2030. Source: PBO 2025

Table 2 Comparison of estimated impacts of the proposed emissions cap in 2030. Source: PBO 2025

However, the PBO does not estimate the carbon price per tonne of emissions reduced. This is a useful metric as Canadians have become broadly familiar with the real-world impacts of a price on carbon. The federal government quashed the consumer carbon price at $80/tonne in March 2025, ahead of the federal election, due to its unpopularity and perceived impacts on affordability. The federal carbon pricing benchmark is scheduled to hit C$170 in 2030. ECCC has quantified the damages of a tonne of carbon dioxide – referred to as the “Social Cost of Carbon” – as C$294/tonne.

Based on PBO assumptions that the emissions cap will reduce emissions by 7.1MT and reduce GDP by $20.5 billion in 2032, the implied carbon price is C$2,887/tonne.

Emissions cap impact in a global context

Even this eye-popping figure does not tell the full story. The Canadian oil and gas production that must be withdrawn to meet the requirements of the emissions cap will be replaced in global markets from other producers; there is no reason to assume the emissions cap will affect global demand.

Based on life-cycle GHG emissions of the sample of crudes used in the US refinery complex, Canadian oil sands produce only 1 to 3 percent higher emissions than a global average[1] (see Figure 4), with some facilities producing lower emissions than the average barrel.

Figure 4 Life Cycle GHG emissions of crude oils (kg CO2e/bbl). Source: BMO Capital Markets 2025

Figure 4 Life Cycle GHG emissions of crude oils (kg CO2e/bbl). Source: BMO Capital Markets 2025

As such, the emissions cap, if applied just to oil sands production, would only displace global emissions of 71,000 to 213,000 tonnes (1 to 3 percent of 7.1MT). At a cost of C$20.5 billion for those global emissions reductions, the price of carbon is equivalent to C$96,000 to C$289,000 per tonne (see Figure 5).

Figure 5 Cost per tonne of emissions cap behind domestic carbon all (left) and post-global crude substitution (right)

Figure 5 Cost per tonne of emissions cap behind domestic carbon all (left) and post-global crude substitution (right)

For any displaced conventional Canadian crude oil or natural gas, the situation becomes absurd. Because Canadian conventional oil and natural gas have a lower emissions intensity than global averages, global product substitutions resulting from the emissions cap would actually serve to increase global emissions, resulting in an infinite price per tonne of carbon.

The C$100k/tonne carbon price estimate is probably low

We believe our assessment of the effective carbon price of the emissions cap at C$96,000+/tonne to be conservative for the following reasons.

First, it assumes Canadian heavy oil will be displaced in global markets by an average, archetypal crude. In fact, it would be displaced by other heavy crudes from places like Venezuela, Mexico, and Iraq (see Figure 4), which have higher average emissions per barrel than Canadian oil sands crudes. In such a circumstance, global emissions would actually rise and the price per carbon tonne from an emissions cap on oil sands production would also effectively be infinite.

Secondly, emissions cap impact assumptions by the PBO are likely conservative. Those by ECCC, based on a particular scenario outlook, are already outdated. ECCC assumed a production loss of only 0.7 percent by 2030, with oil sands production hitting approximately 3.7 million barrels (MMbbls) per day of bitumen production in 2030. According to S&P Global analysis, that level is likely to be hit this year.[2]

S&P further forecasts oil sands production to reach 4.0 MMbbls by 2030, or about 300,000 barrels more than it produces today. This would represent a far lower production growth rate than the oil sands have experienced in the past five years. But assuming the S&P forecast is correct, production would need to decline in the oil sands by 8 percent to meet the emissions cap requirements. PBO assumed only a 5.4 percent overall oil and gas production loss and ECCC assumed only 0.7 percent, while Conference Board of Canada assumed an 11.1 percent loss and Deloitte assumed 11.5 percent (see Table 1). Production numbers to date more closely align with Conference Board of Canada and Deloitte projections.

Let’s make the Canadian oil and gas sector better, not smaller

The Canadian oil and gas sector, and in particular the oil sands, has a responsibility to do their part to reduce emissions while maintaining competitive businesses that can support good Canadian jobs, provide government revenues and diversify exports. The oil sands sector has re-invested for decades in continuous improvements to drive down production costs while improving its emissions per barrel.

It is hard to conceive of a more expensive and divisive way to reduce emissions from the sector and from the Canadian economy than the proposed emissions cap. Other expensive programs, such as Norway’s EV subsidies, the United Kingdom’s offshore wind contracts-for-difference, Germany’s Energiewende feed-in-tariffs and surcharges, and US Inflation Reduction Act investment tax credits, don’t come close to the high costs of the emissions cap on a price-per-tonne of carbon abated basis.

The emissions cap, as currently proposed, will make Canada’s oil and gas sector significantly less competitive, harm investment, and undermine Canada’s vision to be an energy superpower. This policy will also reduce the oil and gas sector’s capacity to invest in technologies that drive additional emission reductions, such as solvents and carbon capture, especially in our current lower price environment. As such it is more likely to undermine climate action than support it.

The federal and provincial governments have come together to advance a vision for Canadian energy in the past. In this moment, they have the opportunity once again to find real solutions to the climate challenge while harnessing the energy sector to advance Canada’s economic well-being, productivity, and global energy security.

About the author

Heather Exner-Pirot is Director of Energy, Natural Resources, and Environment at the Macdonald-Laurier Institute.

-

conflict1 day ago

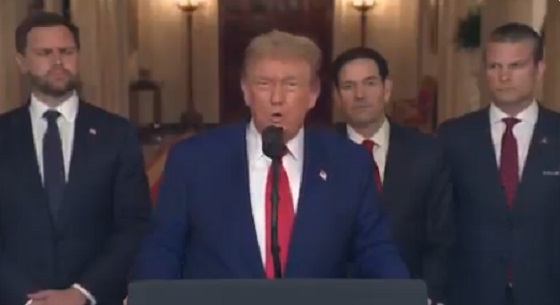

conflict1 day agoPete Hegseth says adversaries should take Trump administration seriously

-

Business2 days ago

Business2 days agoHigh Taxes Hobble Canadian NHL Teams In Race For Top Players

-

conflict2 days ago

conflict2 days agoTrump urges Iran to pursue peace, warns of future strikes

-

Energy1 day ago

Energy1 day agoEnergy Policies Based on Reality, Not Ideology, are Needed to Attract Canadian ‘Superpower’ Level Investment – Ron Wallace

-

conflict2 days ago

conflict2 days ago“Spectacular military success”: Trump addresses nation on Iran strikes

-

conflict1 day ago

conflict1 day agoU.S. cities on high alert after U.S. bombs Iran

-

National1 day ago

National1 day agoPreston Manning: “Appearing to Cope” – Is This The Best We Can Do?

-

armed forces1 day ago

armed forces1 day agoHow Much Dollar Value Does Our Military Deliver?