National

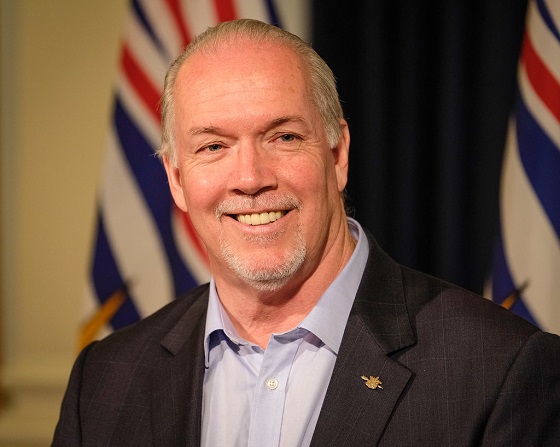

Former BC Premier John Horgan passes away at 65

From Resource Works

He will be remembered as a principled, pragmatic, and honest man, and a popular premier during uncertain times.

John Horgan has passed away at 65 after a courageous third battle with cancer.

A born-and-raised Vancouver Islander, Horgan was a tough and resilient man who will be remembered as a popular, pragmatic premier who brought principles and honesty with him while navigating a changing economic and political landscape.

Regardless of partisan affiliation or belief, there is no question that Horgan truly loved his home province of BC and cared deeply for its people and their future.

Horgan’s path to the premier’s office took him across Canada and beyond, first from Victoria to Ontario, then on to Australia, before returning home to Vancouver Island. Between attending university as a young man, Horgan worked in a pulp mill in Ocean Falls, a small community on the Central Coast of BC. This experience provided him with real insight into the province’s resource sector and the communities that depended on it then—and still do today.

From the 1990s, Horgan worked for the BC New Democratic Party in various staff roles before starting his own business after 2001. In 2005, he returned to politics by being elected as the MLA for Malahat-Juan de Fuca (now Langford-Juan de Fuca). Horgan was re-elected five times by the riding’s voters.

In 2014, Horgan became the leader of the BC NDP, and in 2017, he became Premier of BC, the first NDP premier in 16 years. Once in the premier’s office, Horgan championed pragmatic, progressive policies that strove to balance economic growth with sustainability. His work in developing the province’s liquefied natural gas (LNG) sector was invaluable.

From the outset, Horgan recognized LNG’s potential to modernize the BC economy and make it a key player in global energy markets, and he worked hard to attract investment to the sector. In 2018, he unveiled a new LNG framework that paved the way for LNG Canada’s $40 billion investment in a project that would bring thousands of jobs to northern BC.

Horgan was confident that the LNG sector could coexist with his government’s climate goals and that BC would play a role in reducing global carbon emissions. His pragmatic, forward-thinking vision centered on the ambitious goal of exporting LNG to Asian markets to help them reduce their reliance on higher-emitting energy sources.

Forestry was another sector where Horgan made his mark. Having once worked in a pulp mill, Horgan recognized the importance of forestry to both the province’s history and economy. His approach emphasized sustainability and partnerships with First Nations, while increasing domestic production and reducing log exports. His attempts to modernize forestry had mixed results, but there was no questioning the honesty and good faith he brought to the table.

Another notable aspect of Horgan’s leadership was his commitment to the rule of law, even when it aroused frustration from fellow progressives. In 2020, during the Coastal GasLink protests, Horgan made it clear that the court rulings in favor of the project meant it would proceed regardless. That same year, Horgan acknowledged that the Trans Mountain pipeline project, which his government opposed, would move forward after another court ruling mandated its completion.

It should also be noted that court rulings were some of the only defeats he ever faced as premier, as he led the NDP to a historic victory in the 2020 election. Horgan was also unafraid to take responsibility for policies that went awry, such as stepping back from an unpopular $789-million proposal to rebuild the Royal BC Museum and accepting the blame for it.

Horgan’s leadership of BC during the COVID-19 oubtreak is another part of his legacy that will not be forgotten, especially his trust in British Columbians to be responsible, leading to some of Canada’s most relaxed restrictions during the pandemic.

In 2022, Horgan stepped down after beating cancer for the second time in his life, saying, “While I have a lot of energy, I must acknowledge this may not be the case two years from now.”

Perhaps one of the most important aspects of Horgan’s legacy was that he was a well-liked politician across the political spectrum. While many disagreed with him over policies, few could question that he was an honest and principled leader when it came to steering economic change, respecting the rule of law, and taking responsibility for his actions as premier.

Horgan was a fair, honest, and open-minded man—qualities shared by the best people we meet in life and ones we can only hope all politicians will emulate. We will miss John Joseph Horgan and send our heartfelt condolences to his family, especially his wife and two children.

2025 Federal Election

Post election report indicates Canadian elections are becoming harder to secure

Chief Electoral Officer Stéphane Perrault highlights strong participation and secure voting, but admits minority politics, rising costs, and administrative pressures are testing the system’s limits.

Monday in Ottawa, Stéphane Perrault, Canada’s Chief Electoral Officer, delivered a long press conference on April’s federal election. It was supposed to be a victory lap, record turnout, record early voting, a secure process. But if you listened closely, you heard something else: an admission that Canada’s election machinery is faltering, stretched thin by a system politicians refuse to fix.

Perrault touted the highest turnout in 30 years, 69 percent of eligible voters, nearly 20 million Canadians. Almost half of those ballots were cast before election day, a dramatic shift in how citizens take part in democracy.

“Twenty years ago, less than 7% voted early. This year, nearly half did,” Perrault told reporters. “Our system may have reached its limit.”

That’s the core problem. The system was built for one decisive day, not weeks of advance voting spread across campuses, long-term care homes, mail-in ballots, and local Elections Canada offices. It’s no longer a single event; it’s an extended process that stretches the capacity of staff, polling locations, and administration.

Perrault admitted bluntly that the 36-day writ period, the time between when an election is called and when the vote happens, may no longer be workable. “If we don’t have a fixed date election, the current time frame does not allow for the kind of service preparations that is required,” he said.

And this is where politics collides with logistics. Canada is once again under a minority government, which means an election can be triggered at almost any moment. A non-confidence vote in the House of Commons, where opposition parties withdraw support from the government, can bring down Parliament in an instant. That’s not a flaw in the system; it’s how parliamentary democracy works. But it leaves Elections Canada on permanent standby, forced to prepare for a snap election without knowing when the writ will drop.

The result? Sixty percent of voter information cards were mailed late this year because Elections Canada couldn’t finalize leases for polling stations on time. Imagine that, more than half the country got their voting information delayed because the system is clogged. And that’s when everything is supposedly working.

The April election cost an estimated $570 million, almost identical to 2021 in today’s dollars. But here’s the kicker: Elections Canada also spent $203 million just to stay ready during three years of minority Parliament. That’s not democracy on the cheap. That’s bureaucracy on retainer.

Perrault admitted as much: “We had a much longer readiness period. That’s the reality of minority governments.”

No Foreign Interference… But Plenty of ‘Misinformation’

Canada’s top election official wanted to make something perfectly clear: “There were no acts of foreign interference targeting the administration of the electoral process.” That’s the line. And it’s a good one… reassuring, simple, the kind of phrase meant to make headlines and calm nerves.

But listen closely to the wording. He didn’t say there was no interference at all. He said none of it targeted the administration of the vote. Which raises the obvious question: what interference did occur, and who was behind it?

Perrault admitted there was “more volume than ever” of misinformation circulating during the 2025 election. He listed the greatest hits: rumors that Elections Canada gives voters pencils so ballots can be erased, or claims that non-citizens were voting. These are hardly new — they’ve appeared in the U.S. and in Europe too. The difference, he said, is scale. In 2025, Canadians saw those narratives across more channels, more platforms, more communities than ever before.

This is where things get interesting. Because the way Perrault framed it wasn’t that a rogue actor or a foreign intelligence service was pushing disinformation. He was blunt: this was a domestic problem as much as anything else. In his words, “whether foreign or not,” manipulation of information poses the “single biggest risk to our democracy.”

Perrault insists the real danger isn’t foreign hackers or ballot-stuffing but Canadians themselves, ordinary people raising questions online. “Information manipulation, whether foreign or not, poses the single biggest risk to our democracy,” he said.

Well, maybe he should look in the mirror. If Canadians are skeptical of the system, maybe it’s because the people running it haven’t done enough to earn their trust. It took years for Ottawa to even acknowledge the obvious , that foreign actors were meddling in our politics long before this election. Endless commissions and closed-door reports later, we’re told to stop asking questions and accept that everything is secure.

Meanwhile, what gets fast-tracked? Not a comprehensive fix to protect our democracy, but a criminal investigation into a journalist. Keean Bexte, co-founder of JUNO News, is facing prosecution under Section 91(1) of the Canada Elections Act for his reporting on allegations against Liberal candidate Thomas Keeper. The maximum penalty? A $50,000 fine and up to five years in prison. His reporting, incidentally, was sourced, corroborated, and so credible that the Liberal Party quietly dropped Keeper from its candidate list.

If people doubt the system, it isn’t because they’re gullible or “misinformed.” It’s because the government has treated transparency as an afterthought and accountability as an inconvenience. And Perrault knows it. Canadians aren’t children to be scolded for asking questions, they’re citizens who expect straight answers.

But instead of fixing the cracks in the system, Ottawa points the finger at the public. Instead of rebuilding trust, they prosecute journalists.

You don’t restore faith in democracy by threatening reporters with five years in prison. You do it by showing, quickly and openly, that elections are beyond reproach. Until then, spare us the lectures about “misinformation.” Canadians can see exactly where the problem lies, and it isn’t with them.

The Takeaway

Of course, they’re patting themselves on the back. Record turnout, no servers hacked, the trains ran mostly on time. Fine. But what they don’t want to admit is that the system barely held together. It was propped up by 230,000 temporary workers, leases signed at the last minute, and hundreds of millions spent just to keep the lights on. That’s not stability. That’s triage.

And then there’s the lecturing tone. Perrault tells us the real threat isn’t incompetence in Ottawa, it’s you, Canadians “sharing misinformation.” Excuse me? Canadians asking questions about their elections aren’t a threat to democracy, they are democracy. If the government can’t handle people poking holes in its story, maybe the problem isn’t the questions, maybe it’s the answers.

So yes, on paper, the 2025 election looked like a triumph. But listen closely and you hear the sound of a system cracking under pressure, led by officials more interested in controlling the narrative than earning your trust. And when the people running your elections think the real danger is the voters themselves? That’s when you know the elastic isn’t just stretched. It’s about to snap.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Health

MAiD should not be a response to depression

This article supplied by Troy Media.

Canadians need real mental health support, not state-sanctioned suicide

If the law Parliament plans to roll out in 2027 had been on the books 15 years ago, Member of Parliament Andrew Lawton says he’d probably be dead. He’s not exaggerating. He’s referring to Canada’s scheduled expansion of medical assistance in dying (MAiD) to include people suffering only from mental illness.

Lawton, who survived a suicide attempt during a period of deep depression, knows what’s at stake. So do others who’ve shared similar stories. What they needed back then wasn’t a government-approved exit plan. They needed care, time, and something MAiD quietly discards: the possibility of recovery.

MAiD, medical assistance in dying, was legalized in Canada in 2016 for people with grievous and irremediable physical conditions. The 2027 expansion would, for the first time, allow people to request MAiD solely on the basis of a mental illness, even if they have no physical illness or terminal condition.

With the expansion now delayed to March 2027, Parliament will once again have to decide whether it wants to cross this particular moral threshold. Although the legislation was passed in 2021, it has never come into force. First pushed back to 2024, then to 2027, it remains stalled, not because of foot-dragging, but due to intense medical, ethical and public concern.

Parliament should scrap the expansion altogether.

A 2023 repeal attempt came surprisingly close—just 17 votes short, at 167 to 150. That’s despite unanimous support from Conservative, NDP and Green MPs. You read that right: all three parties, often at each other’s throats, agreed that death should not be an option handed out for depression.

Their concern wasn’t just ethical, it was practical. The core issues remain unresolved. There’s no consensus on whether mental illness is ever truly irremediable—whether it can be cured, improved or even reliably assessed as hopeless. Ask 10 psychiatrists and you’ll get 12 opinions. Recovery isn’t rare. But authorizing MAiD sends the opposite message: that some people’s pain is permanent, and the only answer is to make it stop—permanently.

Meanwhile, access to real mental health care is sorely lacking. A 2023 Angus Reid Institute poll found 40 per cent of Canadians who needed treatment faced barriers getting it. Half of Canadians said they outright oppose the expansion. Another 21 per cent weren’t sure—perhaps assuming Canada wouldn’t actually go through with something so dystopian. But 82 per cent agreed on one thing: don’t even think about expanding MAiD before fixing the mental health system.

That disconnect between what people need and what they’re being offered leads to a more profound contradiction. Canada spends millions promoting suicide prevention. There are hotlines, campaigns and mental health initiatives. Offering MAiD to people in crisis sends a radically different message: suicide prevention ends where bureaucracy begins.

Even Quebec, normally Canada’s most enthusiastic adopter of progressive policy experiments, has drawn the line. The province has said mental disorders don’t qualify for MAiD, period. Most provincial premiers and health ministers have called for an indefinite delay.

Internationally, the United Nations Committee on the Rights of Persons with Disabilities has condemned Canada’s approach and urged the government not to proceed. Taken together, the message is clear: both at home and abroad, there’s serious alarm over where this policy leads.

With mounting opposition and the deadline for implementation approaching in 2027, Parliament will again revisit the issue this fall.

A private member’s bill from MP Tamara Jansen, Bill C-218, which seeks to repeal the 2027 expansion clause, will bring the issue back to the floor for debate.

Her speech introducing the bill asked MPs to imagine someone’s child, broken by job loss or heartbreak, reaching a dark place. “Imagine they feel a loss so deep they are convinced the world would be better off without them,” she said. “Our society could end a person’s life solely for a mental health challenge.”

That isn’t compassion. That’s surrender.

Expanding MAiD to mental illness risks turning a temporary crisis into a permanent decision. It treats pain as untreatable, despair as destiny, and bureaucracy as wisdom. It signals to the vulnerable that Canada is no longer offering help—just a final form to sign.

Parliament still has time to reverse course. It should reject the expansion, reinvest in suicide prevention and reassert that mental suffering deserves treatment—not a state-sanctioned exit.

Daniel Zekveld is a Policy Analyst with the Association for Reformed Political Action (ARPA) Canada.

Explore more on Euthanasia, Assisted suicide, Mental health, Human Rights, Ethics

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Admin To Push UN Overhaul Of ‘Haphazard And Chaotic’ Refugee Policy

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoWhat are data centers and why do they matter?

-

Business1 day ago

Business1 day agoCarney’s Ethics Test: Opposition MP’s To Challenge Prime Minister’s Financial Ties to China

-

Business2 days ago

Business2 days agoCarney Admits Deficit Will Top $61.9 Billion, Unveils New Housing Bureaucracy

-

Business1 day ago

Business1 day agoCarney government’s housing GST rebate doesn’t go far enough

-

Business1 day ago

Business1 day agoAttrition doesn’t go far enough, taxpayers need real cuts

-

Alberta1 day ago

Alberta1 day agoBreak the Fences, Keep the Frontier

-

Media1 day ago

Media1 day agoCancel culture wins ultimate victory as murder of Charlie Kirk ghoulishly celebrated by radical Left, media included