Business

Forget DEI, we need to embrace MEI: meritocracy, excellence, and intelligence

From LifeSiteNews

Countering DEI globalists like BlackRock’s Larry Fink and the World Economic Forum, a young entrepreneur named Alexandr Wang has taken a stand, provided leadership, and is triggering a new movement—hiring and promoting based on MEI: merit, excellence, and intelligence.

Silicon Valley experienced an earthquake on June 13, 2024. This geological event was definitely not televised, but it triggered aftershocks from progressive corporate media like Fortune magazine (which, in a typical propaganda move, cites unnamed “experts” in its reporting on the topic). The earthquake was a consequence of the widespread excesses and consequences of the DEI (Diversity, Equity and Inclusion) hiring and promotion policies that have been actively promoted by the World Economic Forum and its leading corporatist sponsors including Blackrock, Vanguard, State Street and World Economic Foundation (WEF) favored consulting group McKinsey & Company.

To advance and enforce their DEI agenda, which plays a key role in the WEF-promoted vision of “Stakeholder Capitalism”, the WEF has created the “Global Parity Alliance”. The WEF, which defines itself as a key player in an emerging global government (in partnership with the United Nations), has structured this alliance of corporations to implement DEI initiatives across the globe rapidly.

The Global Parity Alliance, a cross-industry group of companies, is not just taking action, but accelerating it. Their urgency to promote diversity, equity and inclusion (DE&I) in the workplace and beyond is palpable, and their commitment to this cause is unwavering.

This group, the Global Parity Alliance, is not just a collection of companies. It’s a community of like-minded organizations, all striving for the same goal-better and faster DE&I outcomes. By sharing proven DE&I best practices and practical insights, they are inviting others to join them in this important work.

To realize the promise of diversity, the Global Parity Alliance members and identified DE&I lighthouses will work to close opportunity gaps faster in the new economy.

According to Blackrock CEO Larry Fink, the WEF DEI initiative intends to (quite literally) force the implementation of social engineering/”stakeholder capitalism” DEI policies as the basis for corporate hiring and promotion rather than focusing on profitability, return on investment, and shareholder/owner value measured by financial outcome measures.

The problem with this globalist “can’t we all get along” Kumbaya naïveté is that the dogs of investment are not eating the dog food. And, of course, inquiring minds are raising questions after the serial DEI financial fiascos of Target and its line of transgender attire for infants, InBev with its transgender Bud Light advertising campaign, Disney with its corporate commitment to woke/grooming everything, farming icon John Deere’s surprise discovery that flyover state farmers were not buying into its DEI genuflecting to the WEF, and WEF partner CrowdStrike crashing the world wide web.

To say that the financial genius of the WEF globalist leaders is looking a bit threadbare is a self-evident understatement. Oh yeah, and then there is the US Secret Service and the attempted Trump assassination. As covered in this recent Fox Business News segment, the natives are becoming restless, and drumbeats are being heard in the distance.

Now is an excellent time to remind all concerned that Larry Fink and Blackrock’s corporate financial ascendency is just another classic tale of DC/Democrat crony capitalism. Fink and company are not business masterminds. They are merely garden-variety Obama cronies parading around and masquerading as captains of industry. I admit to a growing sense of schadenfreude with the perverse logic inherent in all this. Perhaps merit-based selection of federal contractors actually results in better outcomes than just allowing politicians to develop public-private partnerships based on cronyism?

Please consider this AI-generated summary of BlackRock’s rise to global financial dominance, primarily based on “Times of India” reporting, for those who are not singing along with the bouncing ball.

During the 2008 financial crisis, BlackRock played a significant role in the Troubled Asset Relief Program (TARP) under the Obama administration. Here are key points:

- TARP’s Legacy Securities Program: In 2009, the Obama administration’s Treasury Department partnered with BlackRock to manage the Legacy Securities Program, a component of TARP. The program aimed to remove toxic assets from banks’ balance sheets, stabilizing the financial system.

- BlackRock’s Acquisition of Merrill Lynch’s Assets: In September 2008, BlackRock acquired a significant portion of Merrill Lynch’s troubled assets, including mortgage-backed securities, for $3 billion. This deal helped stabilize Merrill Lynch and prevented a systemic crisis.

- BlackRock’s Management of TARP Assets: As part of the Legacy Securities Program, BlackRock managed a portfolio of troubled assets, including mortgage-backed securities and other complex financial instruments. This role allowed BlackRock to profit from the recovery of these assets, while also helping to stabilize the economic system.

- Larry Fink’s Relationship with Obama: BlackRock’s CEO, Larry Fink, developed a close relationship with President Obama and his administration. Fink was a key advisor on financial matters, and BlackRock’s expertise was leveraged to inform policy decisions.

- Thomas Donilon’s Connection: Thomas E. Donilon, former National Security Advisor to President Obama, is currently the Chairman of the BlackRock Investment Institute. During his tenure as National Security Advisor, Donilon worked closely with Fink and other financial leaders, including Secretary of the Treasury Timothy Geithner.

Key Takeaways

- BlackRock played a crucial role in the Obama administration’s TARP program, managing troubled assets and helping to stabilize the financial system.

- Larry Fink’s relationship with President Obama and his administration was significant. Fink served as a key advisor on financial matters.

- Thomas Donilon’s connection to BlackRock, as Chairman of the BlackRock Investment Institute, highlights the firm’s continued influence in Washington, D.C.

What the AI missed is that BlackRock was able to leverage its special relationship with the Obama administration and the TARP program to produce the most globally comprehensive database of business transactions that the world has ever known. And then to exclusively datamine this rich insider resource to generate forward-looking predictions, which it leveraged to yield a globally dominant investment portfolio. And now, BlackRock has captured the exclusive (US, of course) contract to manage the rebuilding of Ukraine. Once the US/NATO military-industrial complex has succeeded in depopulating and then occupying that region. See how that works? Thanks, O’Biden/Uniparty. Let’s watch to see how that plays out.

Getting back on track.

As exemplified by the overlapping fiascos of CrowdStrike and the US Secret Service, the whole problem with DEI-based hiring and promotion policies is that they result in a gradual, creeping degradation of organizational competence, which I have previously covered in my recent substack essay titled “The Great Enshittening.”

Here’s the thing: In the 21st century, we are the inheritors of an interlaced network of complex systems, each requiring considerable competence to maintain and almost all of which are currently strained to the breaking point. Electricity grids, air traffic control networks, server farms, food supply chains, global shipping, petroleum, finance, the internet—the list goes on and on. They are all interdependent and at risk of cascading failure. And into this mix, the self-proclaimed geniuses of global governance have injected themselves and their untested theoretical fantasies of “Stakeholder Capitalism.” Which unproven theory is just another way of saying Marxist social engineering lathered up with a thin veneer of Adam Smith to reduce the friction of forced introduction.

Returning now to that Silicon Valley earthquake that I mentioned in the opening.

A young entrepreneur-genius (named Alexandr Wang) has taken a stand, provided leadership, and is triggering a new movement—sort of a back-to-the-future moment. Hiring and promotion based on MEI: merit, excellence, and intelligence. What a novel concept! Many (including Elon Musk) are jumping on this bandwagon and endorsing this breakthrough concept <sarcasm mine>, which was just the way things were in my youth. Little things like acceptance into medical school. Hiring and promotion. Back in the day, it was understood that the business of business was producing quality goods, services, and value, and deriving wealth from honest productivity.

To provide perspective and put in another plug for the Dean of anarcho-capitalism, Murray Rothbard, there are only two ways of accumulating wealth:

- Labor: Wealth can be accumulated through productive labor, where an individual creates value by providing goods and services to others. This approach is based on voluntary exchange, where individuals trade their labor for compensation, such as wages or profits.

- Theft: Wealth can also be accumulated through theft, where an individual takes wealth from others without their consent. This approach is based on coercion, where one party uses force or fraud to seize wealth from another.

Rather than quote derivative reporting from Fox Business News or even Callum Borchers of the Wall Street Journal, I prefer to let AI technology leader Alexandr Wang do the talking (originally on “X”, of course).

MERITOCRACY AT SCALE

In the wake of our fundraise, I’ve been getting a lot of questions about talent. All of our external success—powering breakthroughs in L4 autonomy, partnering with OpenAI on RLHF going back to GPT-2, supporting the DoD and every major AI lab, and the recent $1bn financing transaction—all of it is downstream from us hiring the best people for the job. Talent is our #1 input metric.

Because of this, I spend a lot of my time on recruiting. I either personally interview every hire or sign off on every candidate packet. It’s the thing I spend the plurality of my time on, easily. But everyone can and should contribute to this effort. There are almost a thousand of us now, and it takes a lot to hire quickly while maintaining, and continuing to raise, our bar for quality.

That’s why this is the time to codify a hiring principle that I consider crucial to our success: Scale is a meritocracy, and we must always remain one.

Hiring on merit will be a permanent policy at Scale.

It’s a big deal whenever we invite someone to join our mission, and those decisions have never been swayed by orthodoxy or virtue signaling or whatever the current thing is. I think of our guiding principle as MEI: merit, excellence, and intelligence.

That means we hire only the best person for the job, we seek out and demand excellence, and we unapologetically prefer people who are very smart.

We treat everyone as an individual. We do not unfairly stereotype, tokenize, or otherwise treat anyone as a member of a demographic group rather than as an individual.

We believe that people should be judged by the content of their character — and, as colleagues, be additionally judged by their talent, skills, and work ethic.

There is a mistaken belief that meritocracy somehow conflicts with diversity. I strongly disagree. No group has a monopoly on excellence. A hiring process based on merit will naturally yield a variety of backgrounds, perspectives, and ideas. Achieving this requires casting a wide net for talent and then objectively selecting the best, without bias in any direction. We will not pick winners and losers based on someone being the “right” or “wrong” race, gender, and so on. It should be needless to say, and yet it needs saying: doing so would be racist and sexist, not to mention illegal.

Upholding meritocracy is good for business and is the right thing to do. This approach not only results in the strongest possible team, but also ensures we’re treating our colleagues with fairness and respect.

As a result, everyone who joins Scale can be confident that they were chosen for their outstanding talent, not any other reasons. MEI has gotten us to where we are today. And it’s the same thing that’ll get us where we’re going, as we embark on our next chapter focusing on data abundance, frontier data, and reliable measurement to accelerate the development and adoption of AI models.

Alex

This statement quickly picked up an endorsement from someone who knows something about promoting excellence.

If you are committed to Making America Great Again, then be like Alex. Pursue MEI, not DEI, in all of your management practices.

For the sake of the broader community and mitigation of enshittification risk, if for no other reason.

Reprinted with permission from Robert Malone.

Business

Carney government should retire misleading ‘G7’ talking point on economic growth

From the Fraser Institute

By Ben Eisen and Milagros Palacios

If you use the more appropriate measure for measuring economic wellbeing and living standards—growth in per-person GDP—the happy narrative about Canada’s performance simply falls apart.

Tuesday, Nov. 4, the Carney government will table its long-awaited first budget. Don’t be surprised if it mentions Canada’s economic performance relative to peer countries in the G7.

In the past, this talking point was frequently used by prime ministers Stephen Harper and Justin Trudeau and their senior cabinet officials. And it’s apparently survived the transition to the Carney government, as the finance minister earlier this year triumphantly tweeted that Canada’s economic growth was “among the strongest in the G7.”

But here’s the problem. Canada’s rate of economic growth relative to the rest of the G7 is almost completely irrelevant as an indicator of economic strength because it’s heavily influenced by Canada’s much faster rate of population growth. In other words, Canada’s faster pace of overall economic growth (measured by GDP) compared to most other developed countries has not been due to Canadians becoming more productive and generating more income for their families, but rather primarily because there are more people in Canada working and producing things.

In reality, if you use the more appropriate measure for measuring economic wellbeing and living standards—growth in per-person GDP—the happy narrative about Canada’s performance simply falls apart.

According to a recent study published by the Fraser Institute, if you simply look at total economic growth in the G7 in recent years (2020-24) without reference to population, Canada does indeed look good. Canada’s economy has had the second-most total economic growth in the G7 behind only the United States.

However, if you make a simple adjustment for differences in population change over this same time, a completely different picture emerges. Canada’s per-person GDP actually declined by 2 per cent from 2020 to 2024. This is the worst five-year decline since the Great Depression nearly a century ago. And on this much more important measure of wellbeing, Canada goes from second in the G7 to dead last.

Due to Canada’s rapid population growth in recent years, fuelled by record-high levels of immigration, aggregate GDP growth is quite simply a misleading economic indicator for comparing our performance to other countries that aren’t experiencing similar increases in the size of their labour markets. As such, it’s long past time for politicians to retire misleading talking points about Canada’s “strong” growth performance in the G7.

After making a simple adjustment to account for Canada’s rapidly growing population, it becomes clear that the government has nothing to brag about. In fact, Canada is a growth laggard and has been for a long time, with living standards that have actually declined appreciably over the last half-decade.

Business

Mystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

Plus! Some tough lessons learned by journalists at all levels – not everyone is telling the truth and there are many people with the same name. Verify.

By now it’s established that Ontario Premier Doug Ford is either an ever so dreamy “elbows up” super hero kinda guy who’s shown US President Donald Trump who his daddy is or …. a ham fisted, narcissistic blowhard with all the finesse of a drunken linebacker crashing through the Royal Doulton.

If you follow social media, those appear to be the options. You choose.

The Rewrite needs your support to hold journalism accountable.

Please become a free or paid subscriber.

His $75 million ad buy attempting to show Americans how Trump is offside on tariffs with the late Republican icon President Ronald Reagan (1981-89) was either, as Ford insists, a triumph, or a disaster of epic proportions. Either way, the result is the Americans broke off trade talks until, well, whenever a very aggrieved Trump next wakes up on the right side of the bed. And the progressive bromance between Ford and Prime Minister Mark Carney looks to be on the rocks, with the latter admitting he apologized to Trump and had advised against the ads. Me? I thought Matt Gurney summarized the situation very well in the Toronto Star.

“The Americans are more than savvy enough to have figured out what we’re up to. They’ve responded to our good cop/bad cop strategy by shooting both cops and then torching the police station.”

The Rewrite, though, is about media, not tugging forelocks and authoring political thumb suckers. So what really made me curious about Ford’s ad spend was whether the premier’s media friends in Ontario were going to get their – what’s that phrase again? – oh, right: fair share.

People may have forgotten but it was only last year when Ford, succumbing to News Media Canada’s lobbying, decided that too much government advertising money was going to American tech companies like Meta and Google and not enough to people who report about him and his opponents. Consistent with the progressive belief that government subsidies can cure any problem, Ford ordered that 25 per cent of the $100 million spent on advertising annually by the Liquor Control Board of Ontario (LCBO), the Ontario Cannabis Store, Metrolinx and the Ontario Lottery and Gaming Corporation (OLG) be directed to Ontario newspapers. And he didn’t stop there. The directive news release made it clear that “the government is also making similar commitments with its own advertising spending, helping to provide even more support for Ontario jobs and promote Ontario culture.”

Word on the street is that this cashapalooza – announced mere months before an election- has been warmly received by Ontario media, so I was already trying to find out who was getting how much when the US ads launched.

Turns out what should have been a simple task is not so easy. The specifics are not to be found within Ontario’s public accounts. So I wrote to Grace Lee, the director of communications in the Premier’s office and then Hannah Jensen, who also works there. No response. Then I tried again. Still nothing. When I asked if the directive “also applies to the Government of Ontario’s recent advertising buy in the United States so that additional government advertising – as is indicated in the directive – worth 25 per cent of the US spend will benefit qualified Ontario media” I got the same cold shoulder.

So, while there was a bit of publicity regarding Ford’s initial decision to subsidize Ontario publishers to the tune of $25 million-plus, no one is providing the details. The publishers must know and the government must know, but they seem to be keeping it a secret. It doesn’t seem likely, but if Ford is faithful to the words and spirit of his 2024 directive, there should be some additional cash flowing to approved Ontario publishers as a result of his Trump tantrum-inducing investment.

Alas, it appears unlikely the public will ever know if that’s the case or which media outlets are benefiting from the premier’s benefaction. That makes these arrangements look all too grubby. Keeping them in the dark, where they’ll stay because that’s the way the politicians and the publishers like it, is only going to further diminish public trust in media. But it’s unclear most of them care anymore.

A phrase in a Juno News report caught my eye last week and it should serve as a cautionary tale. In its report on a large Alberta Independence rally in Edmonton, separatism-friendly lawyer Jeffrey Rath was, understandably, a key source. But he was loosely quoted when referring to a competing Pro-Canada petition on the question of separation. Juno reported that “Rath said Saturday that he heard (organizer Thomas) Lukaszuk was 50,000 signatures short, with a Tuesday deadline.”

The issue isn’t whether Rath said that or not – it’s whether what “he heard” was based on anything other than wishful thinking and rumour-planting. Reporters should not pass along that form of information without verifying because, as it turned out, Rath wasn’t even close. Needing 294,000 signatures, the Pro-Canada petition collected 456,000 or at least 200,000 more than what Juno’s source, Rath, “heard.”

Fine if Rath wants to make a fool of himself. Reporters should be careful not to share the distinction.

A more established title than Juno was in a shambles last week when the venerable Times of London had to quickly pull a story in which former New York Mayor Bill de Blasio was quoted criticizing Democrat mayoralty candidate Zohran Mamdani.

What went wrong? The Times reporter believed he had reached out to de Blasio via email and got a response that questioned Mamdani’s economic plan. The New York Post, also owned by Rupert Murdoch, jumped all over it but when the real former mayor de Blasio responded on X that the report was bogus, The Times stepped back quickly, issuing a statement that it had “apologised to Bill de Blasio and removed the article immediately after discovering that our reporter had been misled by an individual falsely claiming to be the former New York mayor.”

In an interesting twist, the international publication Semafor reported that it had “reached out to a Gmail address our sources believed to be the one used by The Times.”

And:

“You are correct. It was me. The real Bill DeBlasio,” the person who controls the email address responded.

As it turns out, just as there’s more than one Peter Menzies in this world, there’s not just one Bill de Blasio and The Times’ assertion that someone was impersonating the former mayor quickly proved contentious.

The guy who responded to the email turned out to be a 59-year-old Long Island wine importer named Bill DeBlasio.

“I’m Bill DeBlasio. I’ve always been Bill DeBlasio,” DeBlasio (not de Blasio) told Semafor after it knocked on his door. “I never once said I was the mayor. He never addressed me as the mayor.

“So I just gave him my opinion.”

The moral of this story for journos? As the old Chicago City desk saying goes, always “check it out – if your mother says she loves you, check it out.”

In the meantime, we await The Times’ apology to DeBlasio – the one with the wine.

(Peter Menzies is a commentator and consultant on media, Macdonald-Laurier Institute Senior Fellow, a past publisher of the Calgary Herald, a former vice chair of the CRTC and a National Newspaper Award winner.)

-

Business1 day ago

Business1 day agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

Business23 hours ago

Business23 hours agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

-

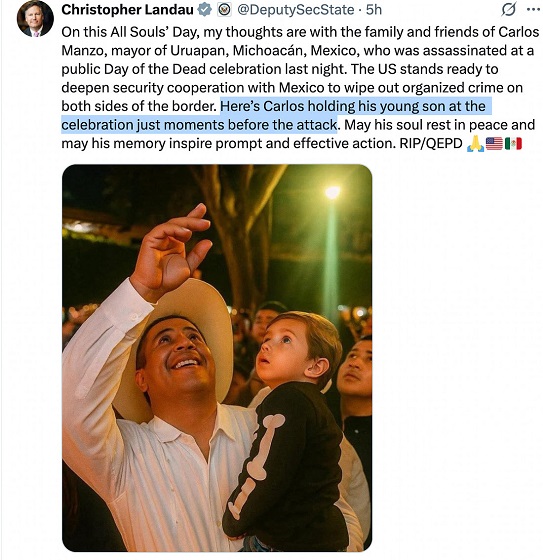

Crime11 hours ago

Crime11 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Automotive1 day ago

Automotive1 day agoCarney’s Budget Risks Another Costly EV Bet

-

Environment19 hours ago

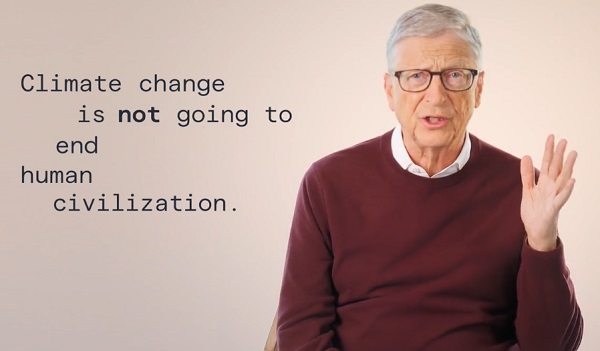

Environment19 hours agoThe era of Climate Change Alarmism is over

-

International10 hours ago

International10 hours agoNigeria better stop killing Christians — or America’s coming “guns-a-blazing”

-

Aristotle Foundation11 hours ago

Aristotle Foundation11 hours agoB.C. government laid groundwork for turning private property into Aboriginal land