Alberta

Five ways Canada’s oil and gas industry showed improved environmental performance in 2023

Natural gas processing facility in Alberta. Photo courtesy Alberta Energy Regulator

From the Canadian Energy Centre

Data shows work industry is doing to reduce its environmental footprint

New data released in 2023 shows the progress Canada’s oil and gas industry is making to reduce its environmental footprint.

From emissions to water use and reclamation, here are some key performance statistics.

1. Methane emissions reduction target achieved three years ahead of schedule

The Alberta Energy Regulator (AER) released data in November showing that oil and gas producers in the province achieved the target of reducing methane emissions by 45 per cent compared to 2014.

The milestone was achieved in 2022, three years ahead of the 2025 government deadline.

Reducing methane emissions comes primarily from reducing small leaks from valves, pump seals, and other equipment, as well as reducing flaring and venting.

2. Oil sands emissions stay flat despite production growth

An updated study by S&P Global in August found oil sands emissions did not increase in 2022 even though production grew.

It’s a significant first that indicates oil sands emissions may start decreasing sooner than previously expected, said Kevin Birn, S&P Global’s vice-president of Canadian oil markets.

Total oil sands emissions were 81 megatonnes in 2022, nearly flat with 2021 despite a production increase of about 50,000 barrels per day.

In 2022, S&P Global predicted peak oil sands emissions around 2025. The new findings indicate it could happen faster.

3. Producers spend millions more than required on oil and gas cleanup

Oil and gas producers in Alberta spent significantly more than required in 2022 cleaning up inactive wells, facilities and pipelines, the AER reported in October.

The regulator’s industry-wide minimum “closure” spend for 2022 was set at $422 million. But the final tally showed producers spent $685 million, or about 60 per cent more than the regulator required.

Industry abandoned 10,334 inactive wells, pipelines and facilities in 2022 – nearly double the amount abandoned in 2019 and 2020, the AER reported.

Reclamation activity also accelerated, with the AER issuing 461 reclamation certificates, an increase of one third compared to 2021.

The regulator reports that 17 per cent of licensed wells in Alberta are now considered inactive, down from 21 per cent in 2019. And about 30 per cent of licensed wells are now considered reclaimed, up from 27 per cent in 2019.

4. Oil sands reclaimed land growing

Wetland in reclaimed area in the Athabasca oil sands region. Photo by Greg Halinda for the Canadian Energy Centre

Data released by Canada’s Oil Sands Innovation Alliance highlights the growing spread of the industry’s reclaimed land.

As of 2021, oil sands operators had permanently reclaimed 10,344 hectares, the equivalent area of more than 20,000 NFL football fields – a 16 per cent increase from 2019.

Of this, 1,296 hectares (about 2,500 NFL football fields) is permanently reclaimed to wetlands and aquatics.

5. Fresh water use per barrel declining

New data on water use in Alberta’s oil and gas industry released in December shows producers continue to reduce the use of fresh water from lakes, rivers and shallow groundwater

The oil and gas industry used less than one per cent of Alberta’s available fresh water in 2022, the AER reported.

Thanks primarily to increased water recycling, fresh water use per barrel in Alberta oil and gas has decreased by 22 per cent since 2013.

Overall, 82 per cent of water used in Alberta oil and gas in 2022 was recycled; 80 per cent in oil sands mining, and 90 per cent in drilled or “in situ” oil sands production.

Alberta

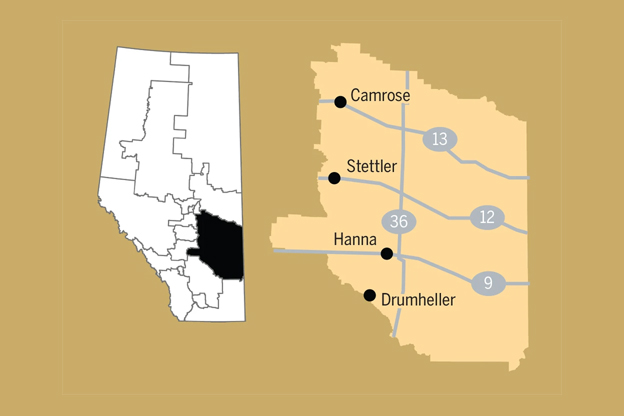

Pierre Poilievre will run to represent Camrose, Stettler, Hanna, and Drumheller in Central Alberta by-election

From LifeSiteNews

Conservative MP-elect Damien Kurek announced Friday he would be willing to give up his seat as an MP so Pierre Poilievre, who lost his seat Monday, could attempt to re-join Parliament.

Conservative MP-elect Damien Kurek announced Friday he would be willing to give up his seat in a riding that saw the Conservatives easily defeat the Liberals by 46,020 votes in this past Monday’s election. Poilievre had lost his seat to his Liberal rival, a seat which he held for decades, which many saw as putting his role as leader of the party in jeopardy.

Kurek has represented the riding since 2019 and said about his decision, “It has been a tremendous honor to serve the good people of Battle River—Crowfoot.”

“After much discussion with my wife Danielle, I have decided to step aside for this Parliamentary session to allow our Conservative Party Leader to run here in a by-election,” he added.

Newly elected Prime Minister of Canada Mark Carney used his first post-election press conference to say his government will unleash a “new economy” that will further “deepen” the nation’s ties to the world.

He also promised that he would “trigger” a by-election at once, saying there would be “no games” trying to prohibit Poilievre to run and win a seat in a safe Conservative riding.

Poilievre, in a statement posted to X Friday, said that it was with “humility and appreciation that I have accepted Damien Kurek’s offer to resign his seat in Battle River-Crowfoot so that I can work to earn the support of citizens there to serve them in Parliament.”

“Damien’s selfless act to step aside temporarily as a Member of Parliament shows his commitment to change and restoring Canada’s promise,” he noted.

“I will work to earn the trust of the good people of Battle River-Crowfoot and I will continue to hold the Liberal minority government to account until the next federal election, when we will bring real change to all Canadians.”

Carney said a new cabinet will be sworn in on May 12.

Alberta

‘Existing oil sands projects deliver some of the lowest-breakeven oil in North America’

From the Canadian Energy Centre

By Will Gibson

Alberta oil sands projects poised to grow on lower costs, strong reserves

As geopolitical uncertainty ripples through global energy markets, a new report says Alberta’s oil sands sector is positioned to grow thanks to its lower costs.

Enverus Intelligence Research’s annual Oil Sands Play Fundamentals forecasts producers will boost output by 400,000 barrels per day (bbls/d) by the end of this decade through expansions of current operations.

“Existing oil sands projects deliver some of the lowest-breakeven oil in North America at WTI prices lower than $50 U.S. dollars,” said Trevor Rix, a director with the Calgary-based research firm, a subsidiary of Enverus which is headquartered in Texas with operations in Europe and Asia.

Alberta’s oil sands currently produce about 3.4 million bbls/d. Individual companies have disclosed combined proven reserves of about 30 billion barrels, or more than 20 years of current production.

A recent sector-wide reserves analysis by McDaniel & Associates found the oil sands holds about 167 billion barrels of reserves, compared to about 20 billion barrels in Texas.

While trade tensions and sustained oil price declines may marginally slow oil sands growth in the short term, most projects have already had significant capital invested and can withstand some volatility.

“While it takes a large amount of out-of-pocket capital to start an oil sands operation, they are very cost effective after that initial investment,” said veteran S&P Global analyst Kevin Birn.

“Optimization,” where companies tweak existing operations for more efficient output, has dominated oil sands growth for the past eight years, he said. These efforts have also resulted in lower cost structures.

“That’s largely shielded the oil sands from some of the inflationary costs we’ve seen in other upstream production,” Birn said.

Added pipeline capacity through expansion of the Trans Mountain system and Enbridge’s Mainline have added an incentive to expand production, Rix said.

The increased production will also spur growth in regions of western Canada, including the Montney and Duvernay, which Enverus analysts previously highlighted as increasingly crucial to meet rising worldwide energy demand.

“Increased oil sands production will see demand increase for condensate, which is used as diluent to ship bitumen by pipeline, which has positive implications for growth in drilling in liquids-rich regions such as the Montney and Duvernay,” Rix said.

-

Agriculture2 days ago

Agriculture2 days agoLiberal win puts Canada’s farmers and food supply at risk

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoThe Liberals torched their own agenda just to cling to power

-

Crime17 hours ago

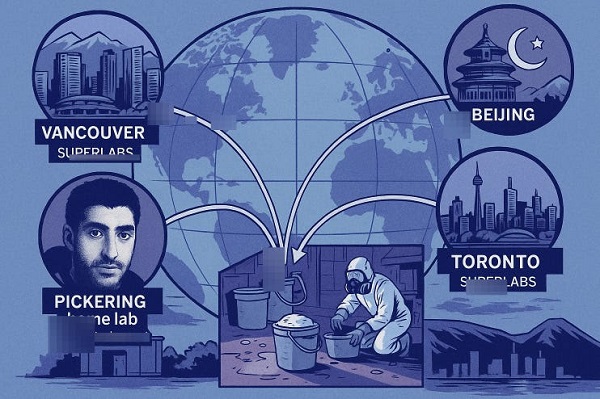

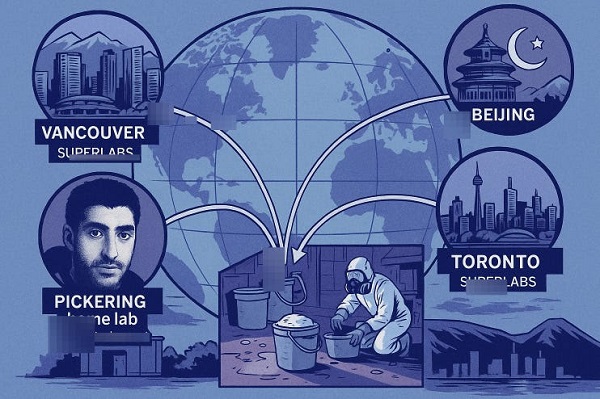

Crime17 hours agoCanada Blocked DEA Request to Investigate Massive Toronto Carfentanil Seizure for Terror Links

-

Alberta2 days ago

Alberta2 days agoIt’s On! Alberta Challenging Liberals Unconstitutional and Destructive Net-Zero Legislation

-

Business9 hours ago

Business9 hours agoTop Canadian bank ditches UN-backed ‘net zero’ climate goals it helped create

-

International2 days ago

International2 days agoNigeria, 3 other African countries are deadliest for Christians: report

-

COVID-199 hours ago

COVID-199 hours agoTulsi Gabbard says US funded ‘gain-of-function’ research at Wuhan lab at heart of COVID ‘leak’

-

Alberta1 day ago

Alberta1 day ago‘Existing oil sands projects deliver some of the lowest-breakeven oil in North America’