From The Center Square

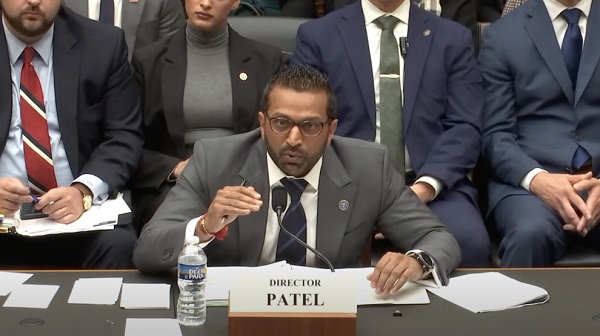

House Democrats drilled down on FBI Director Kash Patel’s handling of the Epstein files during an FBI oversight hearing Wednesday, after their counterparts in the Senate focused many of their questions on Patel’s “politicization” of the agency.

Several times on Wednesday, Democrats showed footage of comments Patel made about the case files of disgraced financier and child sex trafficker Jeffrey Epstein before Patel became FBI director.

In 2023, Patel appeared on The Benny Show, a politics podcast hosted by conservative commentator Benny Johnson, where Johnson asked him why the FBI hadn’t released the alleged Epstein client list.

“They’re sitting on it….. That seems like an evil thing to do, regardless of who may be embarrassed in the release of that list. Why is the FBI protecting the greatest pederast, the largest-scale pederast in human history?” Johnson asked.

“Simple, because of who’s on that list,” Patel replied.

“Put on your big boy pants and let us know who the pedophiles are,” Patel said to Johnson in another clip, referring to the FBI.

Patel also spoke to Glenn Beck, former Fox News show host and founder of Blaze Media, about the Epstein files in December 2023.

“Who has Jeffrey Epstein’s…” Beck started.

“Black book?” Patel asked. “The FBI.”

“But who?” Beck prodded.

“That’s under direct control of the director of the FBI,” Patel quickly responded.

Rep. Jamie Raskin, D-Md., used Patel’s prior comments to challenge how the FBI has handled the files thus far under his leadership.

“You were sworn in as director more than 200 days ago. Now the black book is under your direct control. So why haven’t you released the names of Epstein’s co-conspirators in the rape and sex trafficking of young women and girls?” Raskin pressed.

Patel said the “Rolodex” had been released. Raskin challenged Patel further.

“Oh, no. You’re talking about what the journalist got five years ago? No, that’s not what we’re talking about. We’re talking about what you were talking about there: the black book under the direct control of the FBI director,” Raskin said.

Patel responded by highlighting that the FBI under his direction has released more material than prior administrations that had access to the same information.

“We have released more material than anyone else before. The Biden administration, the Obama administration had the exact opportunities to release this material. They never did,” Patel argued.

So far, Patel’s FBI has provided more than 33,000 pages pursuant to requests from Congress, according to Patel, including what has “got to be thousands” of pages of the Epstein files. His predecessor, Chris Wray, provided less than half that many in seven years of heading the FBI compared to Patel’s seven months, Patel said.

On Tuesday and Wednesday, Patel repeatedly said that the FBI had released everything credible that they are legally permitted to share. He has claimed that court orders stand in the way of releasing more.

Later, Rep. Dan Goldman, D-N.Y., who, like Patel, has a legal background, accused the director of gatekeeping files that court orders don’t prohibit the FBI from disclosing.