Business

Elon Musk Exposes the System Keeping Government Fraud Alive

The only way to reconcile the databases and get rid of waste and fraud is to actually look at the computers and see what’s going on.

Elon Musk just pulled back the curtain on what’s really fueling government waste and fraud. Speaking with Senator Ted Cruz, he revealed there are at least 14 “magic money computers” that can “send money out of nothing,” meaning these government systems are issuing trillions in payments with little oversight or real-time accountability.

Musk explained that these computers don’t operate in a way where they “talk to each other.” Instead, Musk explained they function in a way that allows money to move through government agencies unchecked, sometimes in ways that don’t align with official records.

The numbers lawmakers see aren’t always accurate, with government books potentially off by 5% to 10%. That could mean up to hundreds of billions in taxpayer dollars are misallocated or disappearing, while the actual financial activity remains hidden deep inside these systems.

Join 100K+ Substack readers and 1.6 million 𝕏 users who follow the work of Vigilant Fox.

Subscribe for top-tier news aggregation and exclusive stories you won’t find anywhere else.

“So you may think that the government computers all talk to each other. They synchronize, they add up what funds are going somewhere, and it’s coherent that the numbers, for example, that you’re presented as a senator are actually the real numbers. They’re not,” Musk explained.

“They’re not totally wrong,” he continued. “They’re probably off by 5% or 10% in some cases. So I call it Magic Money Computer. Any computer which can just make money out of thin air. That’s Magic Money.”

“So how does that work?” Ted Cruz asked.

“It just issues payments,” Musk answered. “I think we found now 14 magic money computers. They just send money out of nothing.”

This raises a critical question: If the government’s books are off by 5% to 10% in some cases, leaving up to hundreds of billions of dollars unaccounted for, where is all that money actually going?

|

Image: Shutterstock / Deacons docs

On a related note, Elon Musk has previously called government-funded NGOs one of the biggest scams in history, saying they take hundreds of billions in taxpayer dollars with little accountability, leading to massive waste and misallocation.

He estimates that up to $700 billion per year is funneled through these so-called nonprofits, many of which he claims are nothing more than money laundering operations disguised as charity.

Instead of focusing on bureaucratic structures, Musk believes the key to understanding waste, fraud, and financial manipulation is to go straight to the source: the computers handling the payments.

Musk previously said something to the effect, “I don’t want a job in Washington. All I want is the login for every computer.”

Musk explained that policy decisions eventually filter down to computers for implementation.

The problem? These systems are buried under layers of bureaucracy, making it nearly impossible for lawmakers—or even agency heads—to track where the money is actually going in real-time.

He explained, “The government is run by computers. So you’ve got essentially several hundred computers that effectively run the government. So when somebody, like, even when the President issues an executive order, that’s got to go through a whole bunch of people until ultimately it is implemented at a computer somewhere,” Musk explained.

“And if you want to know what the situation is with the accounting and you’re trying to reconcile accounting and get rid of waste and fraud, you must be able to analyze the computer databases. Otherwise, you can’t figure it out because all you’re doing is asking a human who will then ask another human, ask another human, and finally usually ask some contractor who will ask another contractor to do a query on the computer,” Musk lamented.

“That’s how it actually works,” he stressed. “So it’s many layers deep. So the only way to reconcile the databases and get rid of waste and fraud is to actually look at the computers and see what’s going on. That’s what I sort of cryptically referred to, reprogramming the matrix. You have to understand what’s going on in the computers. You have to reconcile the computer databases in order to identify the waste of fraud.”

Watch the full conversation below:

A little bit about me.

I was a healthcare veteran until Biden’s vax mandates hit America. That’s when I became a citizen journalist.

Since then, I’ve clipped thousands of videos featuring dissident doctors dismantling the COVID narrative, amassing billions of views. If you’ve followed the COVID scam, there’s a good chance you’ve seen my work.

On another note! I need your input!

Big things are happening! This Substack is evolving fast. I’m ramping up production, expanding the team, and working hard to bring you the best content possible.

The more support this page gets, the better the user experience becomes. If you’re enjoying the work here, consider becoming a paid subscriber. Your support truly makes a difference.

Anyway, I want to know what kind of content you enjoy the most. And what topics should I focus on for exclusive, subscriber-only stories?

|

Check out exclusive content for paid subscribers here. More coming soon!

Invite your friends and earn rewards

Business

Trump’s Tariffs Have Not Caused Economy To Collapse

From the Daily Caller News Foundation

By Mark Simon

The APEC Summit in Korea last week marked a pivotal moment for U.S. trade policy, delivering tangible wins for American interests. Solid deals were struck with South Korea, while the U.S. and China de-escalated their long-simmering trade war—a clear positive for President Trump. In the chaotic world of Donald Trump, such normalcy disappointed the news media and foreign policy pundits, who grumbled that the event lacked the drama of a disaster.

Yet, as Trump departed Busan, a deeper transformation unfolded, largely overlooked by observers. In just two days, President Trump orchestrated the most significant shift in U.S. trade strategy since China’s 2001 entry into the World Trade Organization (WTO).

The real triumph? Widespread acceptance by Asian trading partners of U.S. tariffs as a cornerstone of a reimagined American economic model. This acceptance dismantles nearly a century of unwavering belief in low tariffs as the unassailable path to global prosperity.

Trump’s tariff approach disrupts the post-World War II global trading system, particularly the U.S.-championed free-trade orthodoxy embraced by both parties for over 50 years. By wielding tariffs effectively, Trump challenges the free-market gospel enshrined in the WTO and echoed by World Economic Forum elites and corporate-sponsored Washington think tanks like AEI and CATO, which decry tariffs as heresy.

At APEC, there was no fiery backlash—only quiet nods to moderate tariffs as fixtures in the evolving economic order. Leaders from across the Asia-Pacific assessed the tariffs’ impacts and moved forward without spectacle, signaling a pragmatic pivot toward Trump’s view of international commerce.

Historically, tariff reductions in Asia stemmed from U.S. pressure to open markets. Mercantilist instincts run deep in most Asian governments—except in freewheeling Hong Kong and Singapore. These nations, built on exports inside protected markets, grasp how tariffs can revitalize U.S. manufacturing and bolster federal revenue. Unlike America’s one-sided openness to Asian imports, Trump’s reciprocity feels like overdue fairness.

As a former free-market purist who once decried tariffs, I initially missed their nuance in Trump’s arsenal. Tariffs impose costs, but the genius lies in offsetting them strategically. Trump’s aggressive deregulation, sweeping tax reforms, and drive for rock-bottom domestic energy prices mitigate burdens and generate a net economic surge—one that Asian leaders implicitly endorsed.

This “internal free-market trio” forms the bedrock of the new U.S. paradigm: moderate tariffs generate revenue and incentivize factory repatriation; deregulation slashes red tape; tax cuts keep capital flowing competitively; and abundant, cheap energy undercuts foreign advantages.

Together, they magnetize global investment, upending a century of free-trade dogma. Energy dominance is key. Through promotion of domestic oil, gas, and renewables, Trump has driven U.S. energy costs 30–50% below those in Europe or much of Asia. For capital-intensive sectors like steel, semiconductors, and electric vehicles, this is structural superiority, not subsidy. Layer on the 2017 Tax Cuts and Jobs Act—slashing the corporate rate to 21% and allowing immediate capital expensing—and the math tilts toward U.S. production. Tariffs may raise import prices by 20–30%, but deregulation accelerates cost-cutting, while energy savings absorb part of the hit.

Critics claim tariffs ravaged the economy post-2018, but COVID-19, not tariffs, triggered the downturn. Trump’s initial round was a successful pilot, extended by Biden—yet without Trump’s deregulation and energy surge, the tariffs became un-offset weight. Blanket cost hikes under Biden stifled growth; Trump’s selective offsets ensure expansion.

America’s edge sharpens as rivals falter. Europe, shackled by leftist policies, environmental mandates, and the Ukraine quagmire, hemorrhages capital to the U.S. In North Asia—China, Korea, Japan, Taiwan—demographic headwinds make investments unappealing compared to North America’s burgeoning market. Aging populations and shrinking workforces amplify this disparity.

APEC underscored America as a vibrant, tariff-protected haven primed for onshoring. Amid Asia’s labor crunch, nations view the U.S. as an investment beacon, mirroring Japan’s model: a high-value exporter offloading low-end manufacturing while retaining competitiveness. Summit chatter revealed minimal tariff gripes. China voiced tepid concerns over escalations, but these seemed rhetorical—testing boundaries rather than igniting conflict.

To free-trade zealots, Trump’s heresy is demolishing sacred economic theory. Past protectionists erred by isolating tariffs without cost-lowering measures. Trump integrates them: selective duties paired with deregulation, technological leaps, and economic decentralization beyond urban centers.

In equilibrium, tariffs harvest revenue and reclaim jobs, capitalizing on America’s fiscal and regulatory advantages. Trump’s blueprint restores balance to free trade, honoring national sovereignty while exposing borderless markets’ perils. It proves moderated protectionism can ignite growth, spur innovation, and draw capital—heralding a bolder, self-reliant American century.

Mark Simon is former group director for Next Digital, parent company for Apple Daily, the leading pro-democracy newspaper in Hong Kong until it was forced to close in 2021.

Brownstone Institute

Bizarre Decisions about Nicotine Pouches Lead to the Wrong Products on Shelves

From the Brownstone Institute

A walk through a dozen convenience stores in Montgomery County, Pennsylvania, says a lot about how US nicotine policy actually works. Only about one in eight nicotine-pouch products for sale is legal. The rest are unauthorized—but they’re not all the same. Some are brightly branded, with uncertain ingredients, not approved by any Western regulator, and clearly aimed at impulse buyers. Others—like Sweden’s NOAT—are the opposite: muted, well-made, adult-oriented, and already approved for sale in Europe.

Yet in the United States, NOAT has been told to stop selling. In September 2025, the Food and Drug Administration (FDA) issued the company a warning letter for offering nicotine pouches without marketing authorization. That might make sense if the products were dangerous, but they appear to be among the safest on the market: mild flavors, low nicotine levels, and recyclable paper packaging. In Europe, regulators consider them acceptable. In America, they’re banned. The decision looks, at best, strange—and possibly arbitrary.

What the Market Shows

My October 2025 audit was straightforward. I visited twelve stores and recorded every distinct pouch product visible for sale at the counter. If the item matched one of the twenty ZYN products that the FDA authorized in January, it was counted as legal. Everything else was counted as illegal.

Two of the stores told me they had recently received FDA letters and had already removed most illegal stock. The other ten stores were still dominated by unauthorized products—more than 93 percent of what was on display. Across all twelve locations, about 12 percent of products were legal ZYN, and about 88 percent were not.

The illegal share wasn’t uniform. Many of the unauthorized products were clearly high-nicotine imports with flashy names like Loop, Velo, and Zimo. These products may be fine, but some are probably high in contaminants, and a few often with very high nicotine levels. Others were subdued, plainly meant for adult users. NOAT was a good example of that second group: simple packaging, oat-based filler, restrained flavoring, and branding that makes no effort to look “cool.” It’s the kind of product any regulator serious about harm reduction would welcome.

Enforcement Works

To the FDA’s credit, enforcement does make a difference. The two stores that received official letters quickly pulled their illegal stock. That mirrors the agency’s broader efforts this year: new import alerts to detain unauthorized tobacco products at the border (see also Import Alert 98-06), and hundreds of warning letters to retailers, importers, and distributors.

But effective enforcement can’t solve a supply problem. The list of legal nicotine-pouch products is still extremely short—only a narrow range of ZYN items. Adults who want more variety, or stores that want to meet that demand, inevitably turn to gray-market suppliers. The more limited the legal catalog, the more the illegal market thrives.

Why the NOAT Decision Appears Bizarre

The FDA’s own actions make the situation hard to explain. In January 2025, it authorized twenty ZYN products after finding that they contained far fewer harmful chemicals than cigarettes and could help adult smokers switch. That was progress. But nine months later, the FDA has approved nothing else—while sending a warning letter to NOAT, arguably the least youth-oriented pouch line in the world.

The outcome is bad for legal sellers and public health. ZYN is legal; a handful of clearly risky, high-nicotine imports continue to circulate; and a mild, adult-market brand that meets European safety and labeling rules is banned. Officially, NOAT’s problem is procedural—it lacks a marketing order. But in practical terms, the FDA is punishing the very design choices it claims to value: simplicity, low appeal to minors, and clean ingredients.

This approach also ignores the differences in actual risk. Studies consistently show that nicotine pouches have far fewer toxins than cigarettes and far less variability than many vapes. The biggest pouch concerns are uneven nicotine levels and occasional traces of tobacco-specific nitrosamines, depending on manufacturing quality. The serious contamination issues—heavy metals and inconsistent dosage—belong mostly to disposable vapes, particularly the flood of unregulated imports from China. Treating all “unauthorized” products as equally bad blurs those distinctions and undermines proportional enforcement.

A Better Balance: Enforce Upstream, Widen the Legal Path

My small Montgomery County survey suggests a simple formula for improvement.

First, keep enforcement targeted and focused on suppliers, not just clerks. Warning letters clearly change behavior at the store level, but the biggest impact will come from auditing distributors and importers, and stopping bad shipments before they reach retail shelves.

Second, make compliance easy. A single-page list of authorized nicotine-pouch products—currently the twenty approved ZYN items—should be posted in every store and attached to distributor invoices. Point-of-sale systems can block barcodes for anything not on the list, and retailers could affirm, once a year, that they stock only approved items.

Third, widen the legal lane. The FDA launched a pilot program in September 2025 to speed review of new pouch applications. That program should spell out exactly what evidence is needed—chemical data, toxicology, nicotine release rates, and behavioral studies—and make timely decisions. If products like NOAT meet those standards, they should be authorized quickly. Legal competition among adult-oriented brands will crowd out the sketchy imports far faster than enforcement alone.

The Bottom Line

Enforcement matters, and the data show it works—where it happens. But the legal market is too narrow to protect consumers or encourage innovation. The current regime leaves a few ZYN products as lonely legal islands in a sea of gray-market pouches that range from sensible to reckless.

The FDA’s treatment of NOAT stands out as a case study in inconsistency: a quiet, adult-focused brand approved in Europe yet effectively banned in the US, while flashier and riskier options continue to slip through. That’s not a public-health victory; it’s a missed opportunity.

If the goal is to help adult smokers move to lower-risk products while keeping youth use low, the path forward is clear: enforce smartly, make compliance easy, and give good products a fair shot. Right now, we’re doing the first part well—but failing at the second and third. It’s time to fix that.

-

Business2 days ago

Business2 days agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

Business2 days ago

Business2 days agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

-

Environment1 day ago

Environment1 day agoThe era of Climate Change Alarmism is over

-

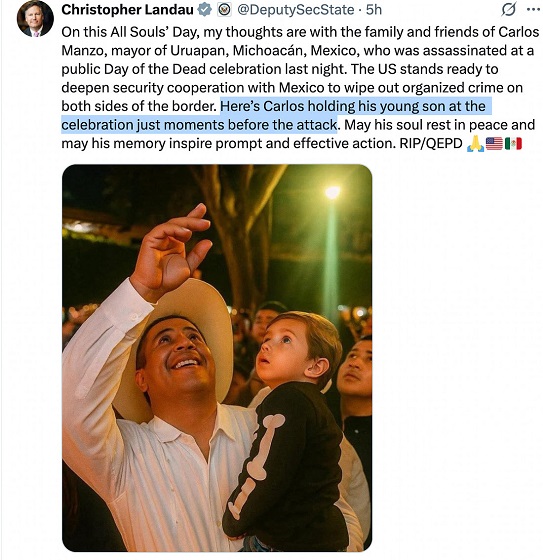

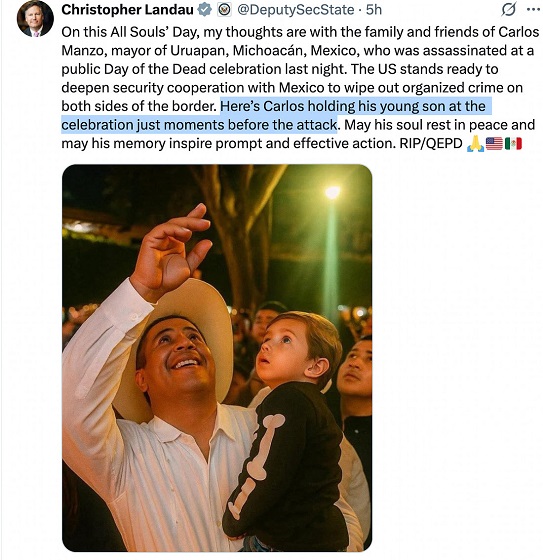

Crime1 day ago

Crime1 day agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Automotive2 days ago

Automotive2 days agoCarney’s Budget Risks Another Costly EV Bet

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoB.C. government laid groundwork for turning private property into Aboriginal land

-

Justice1 day ago

Justice1 day agoA Justice System That Hates Punishment Can’t Protect the Innocent