Uncategorized

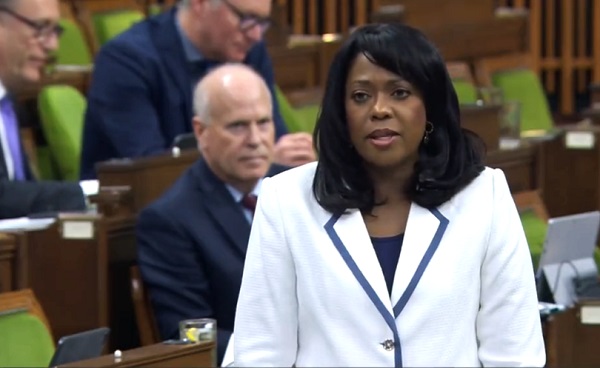

Conservative MP Leslyn Lewis calls out Liberals for not supporting anti-church burning bill

From LifeSiteNews

Speaking about the ‘hundreds of churches’ that have been ‘set on fire across Canada’ in the last number of years, Conservative MP Leslyn Lewis questioned why the Liberals seem completely unconcerned.

One of Canada’s most prominent pro-life MPs has called out the Trudeau government for its apparent lack of support for an anti-arson bill which aims to curb the rash of church burnings plaguing Christians in the country.

In an X post Monday, Conservative MP Leslyn Lewis pointed out that under the Liberal government of Prime Minister Justin Trudeau, church burnings have shot up “100 percent,” and that the government does not seem to have expressed any “concern” at all.

“In the last several years, hundreds of churches and other places of worship have been set on fire across Canada. Under this Liberal government, these crimes have increased by over 100%,” wrote Lewis on X.

“Where is the concern or action from the Liberals regarding these attacks on Christian churches?”

Lewis’s post included a link to another X post from Conservative MP Marc Dalton, who posted a video on October 31 highlighting the recent rash of church burnings and how his bill, C-411, aims to stop this.

“Thank you @MarcDalton for bringing forward Bill C-411, the Anti-Arson Act, an important bill to protect places of worship and increase penalties on those who would target them,” wrote Lewis.

Bill C-411, or, An Act to amend the Criminal Code (arson — wildfires and places of worship), was introduced by Dalton in June.

The law, if passed, would create specific criminal offenses for setting fires to churches and for starting wildfires.

Dalton said in his video that there is a “serious problem in Canada that must be addressed” concerning Catholic and Christian churches being the target of arson.

He highlighted how since 2010, 592 churches have been the target of arson in Canada, with a large portion of these being concentrated to the last few years.

Dalton noted how Canada’s Criminal Code, as it stands, does not include specific protections against arson directed at religious institutions. C-411 aims to “change that,” said Dalton, noting that the bill would implement a minimum sentence of five years in jail for a first offense of this kind, and seven years for a repeat offense.

“This bill strengthens our criminal code and punishes these hateful arson attacks,” he said.

“Commonsense Conservatives stand for strict punishments against criminals who target places of worship.”

Since the spring of 2021, 112 churches, most of them Catholic, have been burned to the ground, vandalized or defiled in Canada.

The church burnings started in earnest after the mainstream media and the federal government ran with inflammatory and dubious claims that hundreds of children were buried and disregarded by Catholic priests and nuns who ran some of the now-closed residential schools in Canada, particularly a school in Kamloops, British Columbia.

The anti-Catholic narrative that developed following these claims continues to this day, despite the fact that no bodies have actually been discovered.

Uncategorized

Mortgaging Canada’s energy future — the hidden costs of the Carney-Smith pipeline deal

Much of the commentary on the Carney-Smith pipeline Memorandum of Understanding (MOU) has focused on the question of whether or not the proposed pipeline will ever get built.

That’s an important topic, and one that deserves to be examined — whether, as John Robson, of the indispensable Climate Discussion Nexus, predicted, “opposition from the government of British Columbia and aboriginal groups, and the skittishness of the oil industry about investing in a major project in Canada, will kill [the pipeline] dead.”

But I’m going to ask a different question: Would it even be worth building this pipeline on the terms Ottawa is forcing on Alberta? If you squint, the MOU might look like a victory on paper. Ottawa suspends the oil and gas emissions cap, proposes an exemption from the West Coast tanker ban, and lays the groundwork for the construction of one (though only one) million barrels per day pipeline to tidewater.

But in return, Alberta must agree to jack its industrial carbon tax up from $95 to $130 per tonne at a minimum, while committing to tens of billions in carbon capture, utilization, and storage (CCUS) spending, including the $16.5 billion Pathways Alliance megaproject.

Here’s the part none of the project’s boosters seem to want to mention: those concessions will make the production of Canadian hydrocarbon energy significantly more expensive.

As economist Jack Mintz has explained, the industrial carbon tax hike alone adds more than $5 USD per barrel of Canadian crude to marginal production costs — the costs that matter when companies decide whether to invest in new production. Layer on the CCUS requirements and you get another $1.20–$3 per barrel for mining projects and $3.60–$4.80 for steam-assisted operations.

While roughly 62% of the capital cost of carbon capture is to be covered by taxpayers — another problem with the agreement, I might add — the remainder is covered by the industry, and thus, eventually, consumers.

Total damage: somewhere between $6.40 and $10 US per barrel. Perhaps more.

“Ultimately,” the Fraser Institute explains, “this will widen the competitiveness gap between Alberta and many other jurisdictions, such as the United States,” that don’t hamstring their energy producers in this way. Producers in Texas and Oklahoma, not to mention Saudi Arabia, Venezuela, or Russia, aren’t paying a dime in equivalent carbon taxes or mandatory CCUS bills. They’re not so masochistic.

American refiners won’t pay a “low-carbon premium” for Canadian crude. They’ll just buy cheaper oil or ramp up their own production.

In short, a shiny new pipe is worthless if the extra cost makes barrels of our oil so expensive that no one will want them.

And that doesn’t even touch on the problem for the domestic market, where the higher production cost will be passed onto Canadian consumers in the form of higher gas and diesel prices, home heating costs, and an elevated cost of everyday goods, like groceries.

Either way, Canadians lose.

So, concludes Mintz, “The big problem for a new oil pipeline isn’t getting BC or First Nation acceptance. Rather, it’s smothering the industry’s competitiveness by layering on carbon pricing and decarbonization costs that most competing countries don’t charge.” Meanwhile, lurking underneath this whole discussion is the MOU’s ultimate Achilles’ heel: net-zero.

The MOU proudly declares that “Canada and Alberta remain committed to achieving Net-Zero greenhouse gas emissions by 2050.” As Vaclav Smil documented in a recent study of Net-Zero, global fossil-fuel use has risen 55% since the 1997 Kyoto agreement, despite trillions spent on subsidies and regulations. Fossil fuels still supply 82% of the world’s energy.

With these numbers in mind, the idea that Canada can unilaterally decarbonize its largest export industry in 25 years is delusional.

This deal doesn’t secure Canada’s energy future. It mortgages it. We are trading market access for self-inflicted costs that will shrink production, scare off capital, and cut into the profitability of any potential pipeline. Affordable energy, good jobs, and national prosperity shouldn’t require surrendering to net-zero fantasy.If Ottawa were serious about making Canada an energy superpower, it would scrap the anti-resource laws outright, kill the carbon taxes, and let our world-class oil and gas compete on merit. Instead, we’ve been handed a backroom MOU which, for the cost of one pipeline — if that! — guarantees higher costs today and smothers the industry that is the backbone of the Canadian economy.

This MOU isn’t salvation. It’s a prescription for Canadian decline.

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

-

Alberta2 days ago

Alberta2 days agoOttawa-Alberta agreement may produce oligopoly in the oilsands

-

International2 days ago

International2 days ago$2.6 million raised for man who wrestled shotgun from Bondi Beach terrorist

-

Energy2 days ago

Energy2 days agoWestern Canada’s supply chain for Santa Claus

-

Energy2 days ago

Energy2 days agoThe Top News Stories That Shaped Canadian Energy in 2025 and Will Continue to Shape Canadian Energy in 2026

-

Frontier Centre for Public Policy16 hours ago

Frontier Centre for Public Policy16 hours agoTent Cities Were Rare Five Years Ago. Now They’re Everywhere

-

armed forces17 hours ago

armed forces17 hours agoRemembering Afghanistan and the sacrifices of our military families

-

Fraser Institute17 hours ago

Fraser Institute17 hours agoHow to talk about housing at the holiday dinner table

-

Opinion17 hours ago

Opinion17 hours agoPope Leo XIV’s Christmas night homily