Business

Competition Bureau is right—Canada should open up competition in the air

From the Fraser Institute

By Jake Fuss and Alex Whalen

Here’s a statement few Canadians will disagree with—air travel in Canada is expensive and frustrating. But there’s hope. According to a recent report from the Competition Bureau, a law enforcement agency that reports to the federal government, the key solution is to increase competition among airlines.

And government policies are the primary reason for the lack of airline competition. Specifically, excessive regulatory barriers and restrictions on foreign airlines limit choice and increase ticket prices.

Currently, the federal government prohibits foreign airlines from operating domestic routes within Canada’s borders. For example, a German airline such as Lufthansa is permitted to fly from Frankfurt to Toronto, but is barred from flying passengers from Toronto to another Canadian city. The result? There’s little competitive pressure for Canadian airlines to lower their prices for domestic air travel.

The European Union offers a stark contrast. After the EU removed restrictions for member-state airlines to operate in all EU countries, low-cost carriers such as Ryanair entered the market, flight frequencies increased and airfares dropped 34 per cent.

In fact, the Competition Bureau examined the EU model and said Canada should relax restrictions on foreign airlines to improve service quality and bring down ticket prices. Our recent study similarly suggests the federal government negotiate deals with other countries to allow foreign airlines to operate within Canada in exchange for allowing Canadian airlines to operate in those countries—a win-win for Canadian consumers and Canadian airlines.

But the federal government should not stop there. High taxes and fees comprise a large portion (25 to 35 per cent) of airfare costs, driving up ticket prices. In Canada, fees for airport improvement, security, landing and other charges are all largely uncompetitive with peer countries. And Canadian fuel taxes and sales taxes drive prices up further.

Why are fees so high? While several government policies play a part, Canada’s outdated airport ownership structure remains a key factor. The federal government owns the land upon which our large airports are built and charges the not-for-profit airport authorities rent (as high as 12 per cent of airport revenue). In 2023, the government received $487 million in rent charges from airports. In response, the airports levy fees on passengers to recoup these costs.

Improving the policy environment to reduce taxes and fees to levels more competitive with peer countries should be one lever Ottawa pulls to address sky-high airfares. Moreover, Canada should also—based on the successful airport ownership structures in Europe, Australia and New Zealand—sell its remaining interests in airport leases and allow for-profit organizations to own and operate airports in Canada.

Finally, Ottawa should ease the regulatory burden on the airline industry while maintaining strong safety standards. The United States undertook a successful deregulation effort in the 1970s and 1980s, which helped create more competition and choice, lower airfares and safety improvements.

Canadians face high airfares and have few choices to fly within in Canada, mainly due to bad government policy. It’s past time for Ottawa to make bold reforms to open up competition and reduce travel costs for Canadians.

Addictions

The War on Commonsense Nicotine Regulation

From the Brownstone Institute

Cigarettes kill nearly half a million Americans each year. Everyone knows it, including the Food and Drug Administration. Yet while the most lethal nicotine product remains on sale in every gas station, the FDA continues to block or delay far safer alternatives.

Nicotine pouches—small, smokeless packets tucked under the lip—deliver nicotine without burning tobacco. They eliminate the tar, carbon monoxide, and carcinogens that make cigarettes so deadly. The logic of harm reduction couldn’t be clearer: if smokers can get nicotine without smoke, millions of lives could be saved.

Sweden has already proven the point. Through widespread use of snus and nicotine pouches, the country has cut daily smoking to about 5 percent, the lowest rate in Europe. Lung-cancer deaths are less than half the continental average. This “Swedish Experience” shows that when adults are given safer options, they switch voluntarily—no prohibition required.

In the United States, however, the FDA’s tobacco division has turned this logic on its head. Since Congress gave it sweeping authority in 2009, the agency has demanded that every new product undergo a Premarket Tobacco Product Application, or PMTA, proving it is “appropriate for the protection of public health.” That sounds reasonable until you see how the process works.

Manufacturers must spend millions on speculative modeling about how their products might affect every segment of society—smokers, nonsmokers, youth, and future generations—before they can even reach the market. Unsurprisingly, almost all PMTAs have been denied or shelved. Reduced-risk products sit in limbo while Marlboros and Newports remain untouched.

Only this January did the agency relent slightly, authorizing 20 ZYN nicotine-pouch products made by Swedish Match, now owned by Philip Morris. The FDA admitted the obvious: “The data show that these specific products are appropriate for the protection of public health.” The toxic-chemical levels were far lower than in cigarettes, and adult smokers were more likely to switch than teens were to start.

The decision should have been a turning point. Instead, it exposed the double standard. Other pouch makers—especially smaller firms from Sweden and the US, such as NOAT—remain locked out of the legal market even when their products meet the same technical standards.

The FDA’s inaction has created a black market dominated by unregulated imports, many from China. According to my own research, roughly 85 percent of pouches now sold in convenience stores are technically illegal.

The agency claims that this heavy-handed approach protects kids. But youth pouch use in the US remains very low—about 1.5 percent of high-school students according to the latest National Youth Tobacco Survey—while nearly 30 million American adults still smoke. Denying safer products to millions of addicted adults because a tiny fraction of teens might experiment is the opposite of public-health logic.

There’s a better path. The FDA should base its decisions on science, not fear. If a product dramatically reduces exposure to harmful chemicals, meets strict packaging and marketing standards, and enforces Tobacco 21 age verification, it should be allowed on the market. Population-level effects can be monitored afterward through real-world data on switching and youth use. That’s how drug and vaccine regulation already works.

Sweden’s evidence shows the results of a pragmatic approach: a near-smoke-free society achieved through consumer choice, not coercion. The FDA’s own approval of ZYN proves that such products can meet its legal standard for protecting public health. The next step is consistency—apply the same rules to everyone.

Combustion, not nicotine, is the killer. Until the FDA acts on that simple truth, it will keep protecting the cigarette industry it was supposed to regulate.

Alberta

Canada’s heavy oil finds new fans as global demand rises

From the Canadian Energy Centre

By Will Gibson

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices”

Once priced at a steep discount to its lighter, sweeter counterparts, Canadian oil has earned growing admiration—and market share—among new customers in Asia.

Canada’s oil exports are primarily “heavy” oil from the Alberta oil sands, compared to oil from more conventional “light” plays like the Permian Basin in the U.S.

One way to think of it is that heavy oil is thick and does not flow easily, while light oil is thin and flows freely, like fudge compared to apple juice.

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices,” said Susan Bell, senior vice-president of downstream research with Rystad Energy.

A narrowing price gap

Alberta’s heavy oil producers generally receive a lower price than light oil producers, partly a result of different crude quality but mainly because of the cost of transportation, according to S&P Global.

The “differential” between Western Canadian Select (WCS) and West Texas Intermediate (WTI) blew out to nearly US$50 per barrel in 2018 because of pipeline bottlenecks, forcing Alberta to step in and cut production.

So far this year, the differential has narrowed to as little as US$10 per barrel, averaging around US$12, according to GLJ Petroleum Consultants.

“The differential between WCS and WTI is the narrowest I’ve seen in three decades working in the industry,” Bell said.

Trans Mountain Expansion opens the door to Asia

Oil tanker docked at the Westridge Marine Terminal in Burnaby, B.C. Photo courtesy Trans Mountain Corporation

The price boost is thanks to the Trans Mountain expansion, which opened a new gateway to Asia in May 2024 by nearly tripling the pipeline’s capacity.

This helps fill the supply void left by other major regions that export heavy oil – Venezuela and Mexico – where production is declining or unsteady.

Canadian oil exports outside the United States reached a record 525,000 barrels per day in July 2025, the latest month of data available from the Canada Energy Regulator.

China leads Asian buyers since the expansion went into service, along with Japan, Brunei and Singapore, Bloomberg reports.

Asian refineries see opportunity in heavy oil

“What we are seeing now is a lot of refineries in the Asian market have been exposed long enough to WCS and now are comfortable with taking on regular shipments,” Bell said.

Kevin Birn, chief analyst for Canadian oil markets at S&P Global, said rising demand for heavier crude in Asia comes from refineries expanding capacity to process it and capture more value from lower-cost feedstocks.

“They’ve invested in capital improvements on the front end to convert heavier oils into more valuable refined products,” said Birn, who also heads S&P’s Center of Emissions Excellence.

Refiners in the U.S. Gulf Coast and Midwest made similar investments over the past 40 years to capitalize on supply from Latin America and the oil sands, he said.

While oil sands output has grown, supplies from Latin America have declined.

Mexico’s state oil company, Pemex, reports it produced roughly 1.6 million barrels per day in the second quarter of 2025, a steep drop from 2.3 million in 2015 and 2.6 million in 2010.

Meanwhile, Venezuela’s oil production, which was nearly 2.9 million barrels per day in 2010, was just 965,000 barrels per day this September, according to OPEC.

The case for more Canadian pipelines

Worker at an oil sands SAGD processing facility in northern Alberta. Photo courtesy Strathcona Resources

“The growth in heavy demand, and decline of other sources of heavy supply has contributed to a tighter market for heavy oil and narrower spreads,” Birn said.

Even the International Energy Agency, known for its bearish projections of future oil demand, sees rising global use of extra-heavy oil through 2050.

The chief impediments to Canada building new pipelines to meet the demand are political rather than market-based, said both Bell and Birn.

“There is absolutely a business case for a second pipeline to tidewater,” Bell said.

“The challenge is other hurdles limiting the growth in the industry, including legislation such as the tanker ban or the oil and gas emissions cap.”

A strategic choice for Canada

Because Alberta’s oil sands will continue a steady, reliable and low-cost supply of heavy oil into the future, Birn said policymakers and Canadians have options.

“Canada needs to ask itself whether to continue to expand pipeline capacity south to the United States or to access global markets itself, which would bring more competition for its products.”

-

Business1 day ago

Business1 day agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

-

Business1 day ago

Business1 day agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

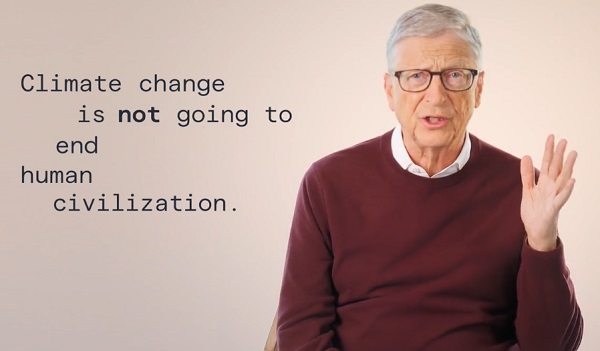

Environment1 day ago

Environment1 day agoThe era of Climate Change Alarmism is over

-

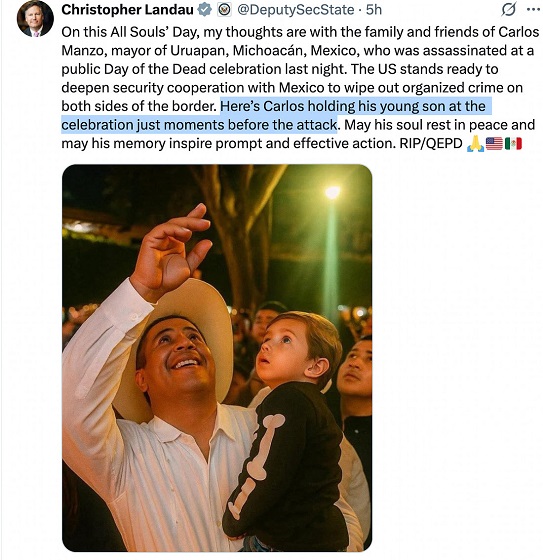

Crime17 hours ago

Crime17 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Automotive1 day ago

Automotive1 day agoCarney’s Budget Risks Another Costly EV Bet

-

Aristotle Foundation17 hours ago

Aristotle Foundation17 hours agoB.C. government laid groundwork for turning private property into Aboriginal land

-

Justice17 hours ago

Justice17 hours agoA Justice System That Hates Punishment Can’t Protect the Innocent