Business

Coffee price explosion a self-inflicted wound: Liberal tariff drives up cost of coffee

This article supplied by Troy Media.

Since March 3, Canadian importers have been paying an additional 25 per cent tariff on imported coffee. This counter-tariff, introduced as part of Ottawa’s retaliatory response to a trade dispute triggered by new United States duties on Canadian agricultural exports earlier this year, directly affects a product that isn’t even grown in Canada.

Coffee is up 19 per cent—and global markets aren’t to blame. Ottawa’s political posturing is burning your wallet, one cup at a time

Canadians are paying 19 per cent more for ground coffee this year—and it’s not because of global supply issues. It’s because of a self-inflicted policy

mistake: a 25 per cent tariff imposed by Ottawa on imported coffee, a product Canada doesn’t even grow.

Many consumers may attribute the spike to global market volatility, especially after coffee futures soared to a record high of more than US$4.40 per

pound in February. But that explanation no longer holds—futures have since dropped by more than 30 per cent, yet retail prices remain stubbornly high. So, what’s driving this divergence?

The answer lies, in part, in trade policy.

Since March 3, Canadian importers have been paying an additional 25 per cent tariff on imported coffee.

This counter-tariff, introduced as part of Ottawa’s retaliatory response to a trade dispute triggered by new United States duties on Canadian agricultural exports earlier this year, directly affects a product that isn’t even grown in Canada.

Unlike dairy or poultry, coffee has no domestic farming sector to protect. These tariffs aren’t shielding Canadian producers—they’re punishing

Canadian consumers and businesses.

To grasp the scale of this impact, consider the size of the industry. According to Introspective Market Research, retail coffee sales in Canada total more than $2.7 billion annually and are projected to grow steadily over the next decade. Meanwhile, coffee shops and quick-service restaurants, from Tim Hortons to independent cafés, generate an additional $6.4 billion per year. Tim Hortons alone sells more than five million cups of coffee per day.

This is not a fringe sector; it’s a critical part of both our economy and our culture.

Ironically, the U.S.—our supposed trade adversary in this case—doesn’t grow coffee either. Yet both countries are now entangled in a tariff tug-of-war that serves no practical purpose. The same logic applies to tea, which is also subject to retaliatory measures.

The tariffs were introduced under the Trudeau government in a broader geopolitical strategy that often felt more performative than pragmatic. Trudeau’s combative approach to trade, seemingly crafted on a whiteboard without regard for economic fallout, may have resonated politically, but it ignored basic economic principles. Consumers were never part of the equation.

In contrast, Prime Minister Mark Carney appears to be taking a more measured approach. Tariffs on U.S. alcohol and citrus products remain, but those can be sourced from other markets with relatively little disruption. Coffee and tea, however, are a different matter. There are no alternative domestic sources. The cost of these tariffs is being passed directly to roasters, grocers, restaurants, and ultimately, to the consumer.

Compounding the problem is the volatility of American trade policy under U.S. President Donald Trump, which continues to inject uncertainty into food markets. Tariffs come and go with the political winds, forcing companies to engage in “buffer pricing.” Much like travelers buying insurance for

unpredictable weather, companies build in extra costs to guard against political surprises. It’s effectively a tax on unpredictability, and it’s now embedded in the price Canadians pay at the till.

And while consumers might not feel the same pinch at their local café, where coffee is a smaller fraction of the total cost of a cup, the grocery aisle tells a different story. That’s where the full weight of these policies lands.

Whether a new trade agreement can be reached by the self-imposed July 21 deadline—or a damaging 35 per cent tariff Trump has set for August 1 can be avoided—remains uncertain. But what should be obvious is this: both Canada and the U.S. need to keep essential agri-food imports like coffee and tea out of their geopolitical fights.

Canada has a vibrant coffee ecosystem, built on roasting, innovation and consumer culture, not cultivation. There is no economic rationale for taxing it. Canadians shouldn’t be paying more for their morning brew just to send a symbolic message to Washington.

It’s time Ottawa led by example and scrapped these pointless tariffs.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Business

Conservative MPs denounce Liberal plan to strip charitable status of pro-life, Christian groups

From LifeSiteNews

Conservative MPs presented a petition in Parliament defending pro-life charities and religious organizations against a Liberal proposal to strip their charitable tax status.

Conservative MPs presented a petition calling for the rejection of the Liberals’ plan to strip pro-life charities and places of worship of their charitable status.

During the September 16 session, Conservative Members of Parliament (MPs) Andrew Lawton, Jacob Mantle, and Garnett Genuis defended pro-life charities and places of worship against Liberal recommendations to remove the institutions’ charitable status for tax purposes.

“I have received from houses of worship across this country so much concern, reflected in this petition, that these recommendations are fundamentally anti-free speech and anti-religious freedom,” Lawton told Parliament. “The petitioners, and I on their behalf, advocate for the complete protection of charitable status regardless of these ideological litmus tests.”

Similarly, Mantle, a newly elected MP, added that Canadians “lament that some members opposite are so blinded by their animus towards charitable organizations that they would seek to undermine the good works that these groups do for the most vulnerable Canadians.”

Religious charities provide care and compassion to the most vulnerable in our society, but some members of the Liberal and New Democratic parties are so blinded by their animus towards religion and faith that they are actively seeking to revoke the charitable status of ALL… pic.twitter.com/O12rkw3pJ0

— Jacob Mantle (@jacobmantle) September 16, 2025

Finally, Genuis, who officially presented the petition signed by hundreds of Canadians, stressed the importance work accomplished by religious and pro-life organizations.

“(R)eligious charities in Canada provide vital services for society, including food banks, care for seniors, newcomer support, youth programs and mental health outreach, all of which is rooted in their faith tradition, and that singling out or excluding faith charities from the charitable sector based on religious belief undermines the diversity and pluralism foundational to Canadian society,” he explained.

As LifeSiteNews previously reported, before last Christmas, a proposal by the all-party Finance Committee suggested legislation that could strip pro-life pregnancy centers and religious groups of their charitable status.

The legislation would amend the Income Tax Act and Income Tax. Section 429 of the proposed legislation recommends the government “no longer provide charitable status to anti-abortion organizations.”

The bill, according to the finance department, would require “registered charities that provide services, advice, or information in respect of the prevention, preservation, or termination of pregnancy (i.e., destroying the unborn)” to disclose that they “do not provide specific services, including abortions or birth control.”

Similarly, Recommendation 430 aims to “amend the Income Tax Act to provide a definition of a charity which would remove the privileged status of ‘advancement of religion’ as a charitable purpose.”

Many Canadians have warned that the proposed legislation would wipe out thousands of Christian churches and charities across Canada.

As LifeSiteNews reported in March, the Canadian Conference of Catholic Bishops (CCCB) appealed to the Liberal government to rethink the plan to strip pro-life and religious groups of their tax charity status, stressing the vital work done by those organizations.

Business

The Real Reason Tuition Keeps Going Up at Canada’s Universities

Since 2020, steep increases to tuition fees have triggered large-scale protests by the students who pay those fees at the University of Alberta, University of Calgary, University of British Columbia and at McGill University and Concordia University in Quebec, among many other schools. (A freeze on tuition fees in Ontario since 2019 explains that province’s absence from the list.)

It’s true that tuition has been on the rise. According to Statistics Canada , between 2006-2007 and 2024-2025, the average undergraduate full-year tuition fee at a Canadian university grew from approximately $4,900 to $7,360.

But do the students really know what’s behind the increases?

University administrators looking to deflect responsibility like to blame provincial government cutbacks to post-secondary funding. Here, the evidence is unconvincing. Going back two decades, nationwide full-time equivalent (FTE) student transfer payments from provincial governments have remained essentially constant, after accounting for inflation. While government grants have remained flat, tuition fees are up.

The issue, then, is where all this extra money is going – and whether it benefits students. Last year researcher and consultant Alex Usher took a close look at the budgeting preferences of universities on a nationwide basis. He found that between 2016-2017 and 2021-2022 the spending category of “Administration” – which comprises the non-teaching, bureaucratic operations of a university – grew by 15 percent. Curiously enough “Instruction,” the component of a university that most people would consider to be its core function, was among the slowest growing categories, at a mere 3 percent. This top-heavy tendency for universities is widely known as “administrative bloat”.

Administrative bloat has been a problem at Canadian universities for decades and the topic of much debate on campus. In 2001, for example, the average top-tier university in Canada spent $44 million (in 2019 dollars) on central administration. By 2019 this had more than doubled to $93 million, supporting Usher’s shorter-term observations. Usher calculated that the size of the non-academic cohort at universities has increased by between 85 percent and 170 percent over the past 20 years.

While some level of administration is obviously necessary to operate any post-secondary institution, the current scale and role of campus bureaucracies is fundamentally different from the experience of past decades. The ranks of university administration used to be filled largely with tenured professors who would return to teaching after a few terms of service. Today, the administrative ranks are largely comprised of a professional cadre of bureaucrats. (They are higher paid too; teaching faculty are currently paid about 10 percent less than non-academic personnel.)

This ever-larger administrative state is increasingly displacing the university’s core academic function. As law professor Todd Zywicki notes, “Even as the army of bureaucrats has grown like kudzu over traditional ivy walls, full-time faculty are increasingly being displaced by adjunct professors and other part-time professors who are taking on a greater share of teaching responsibilities than in the past.” While Zywicki is writing about the American experience, his observations hold equally well for Canada.

So while tuition fees keep going up, this doesn’t necessarily benefit the students paying those higher fees. American research shows spending on administration and student fees are not correlated with higher graduation rates. Canada’s huge multi-decade run-up in administrative expenditures is at best doing nothing and at worst harming our universities’ performance and reputations. Of Canada’s 15 leading research universities, 13 have fallen in the global Quality School rankings since 2010. It seems a troubling trend.

And no discussion of administrative bloat today can ignore the elephant in the corner: diversity, equity and inclusion (DEI). Writing in the National Post, Peter MacKinnon, past president of the University of Saskatchewan, draws a straight line from administrative bloat to the current infestation of DEI policies on Canadian campuses.

The same thing is going on at universities across Canada that have permanent DEI offices and bureaucracies, including at UBC, the University of Calgary, University of Waterloo, Western University, Dalhousie University and Thompson Rivers University. As a C2C Journal article explains, DEI offices and programs offer no meaningful benefit to student success or the broader university community. Rather, they damage a school’s reputation by shifting focus away from credible scientific pursuits to identity politics and victimology.

With universities apparently unable to restrain the growth of their administrative Leviathan, there may be little alternative but to impose discipline from the outside. This should begin with greater transparency.

Former university administrator William Doswell Smith highlights a “Golden Rule” for universities and other non-profit institutions: that fixed costs (such as central administration) must never be allowed to rise faster than variable costs (those related to the student population). As an example of what can happen when Smith’s Golden Rule is ignored, consider the fate of Laurentian University in Sudbury, Ontario.

In early 2021 Laurentian announced it was seeking bankruptcy protection under the Companies’ Creditors Arrangement Act, under which a court-appointed manager directs the operations of the delinquent organization. Laurentian then eliminated 76 academic programs, terminated 195 staff and faculty, and ended its relationships with three nearby schools.

Ontario’s Auditor-General Bonnie Lysak found that the primary cause of the school’s financial crisis were ill-considered capital investments. The administrators’ big dreams essentially bankrupted the university.

The lesson is clear: if universities refuse to correct the out-of-control growth of their administrations, then fiscal discipline will eventually be forced upon them. A reckoning is coming for these bloated, profligate schools. The solution to higher tuition is not increasing funding. It’s fewer administrators.

The original, full-length version of this article was recently published in C2C Journal.

Jonathan Barazzutti is an economics student at the University of Calgary. He was the winner of the 2nd Annual Patricia Trottier and Gwyn Morgan Student Essay Contest co-sponsored by C2C Journal.

-

Alberta2 days ago

Alberta2 days agoParents group blasts Alberta government for weakening sexually explicit school book ban

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoBloodvein Blockade Puts Public Land Rights At Risk

-

International2 days ago

International2 days agoFrance records more deaths than births for the first time in 80 years

-

Business2 days ago

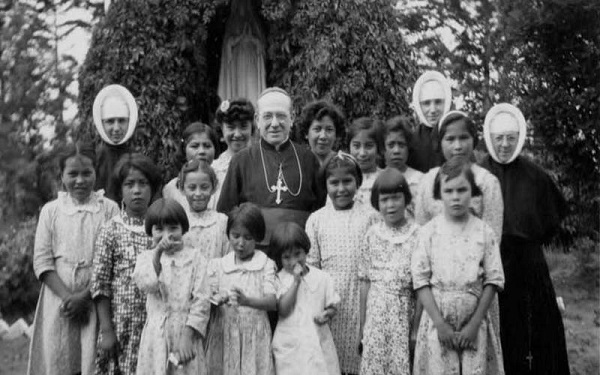

Business2 days agoThe Truth Is Buried Under Sechelt’s Unproven Graves

-

COVID-191 day ago

COVID-191 day agoFreedom Convoy leader slams Canadian gov’t agency for praising its treatment of protesters

-

National2 days ago

National2 days agoChrystia Freeland resigns from Mark Carney’s cabinet, asked to become Ukraine envoy

-

COVID-1920 hours ago

COVID-1920 hours agoCanadian gov’t to take control of vaccine injury program after reports of serious mismanagement

-

Energy1 day ago

Energy1 day agoA Breathtaking About-Face From The IEA On Oil Investments