Energy

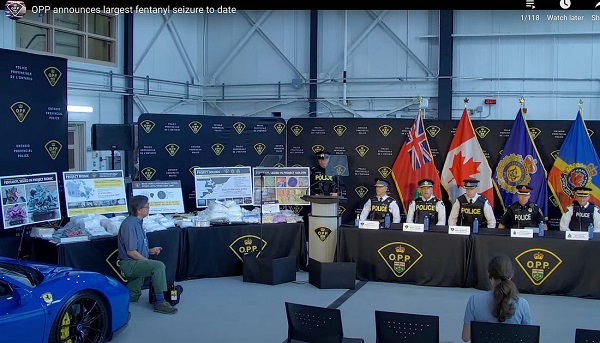

Climate Change Movement Goes To Court — Will Judges Ban Fossil Fuels?

From the Daily Caller News Foundation

From the Daily Caller News Foundation

Things are not going well at all for the global warming crusaders. Despite hundreds of billions of tax dollars spent on green energy over the past decade, the world and America used more fossil fuels than ever before in history last year.

The electric vehicle movement is stalled out, solar and wind power are both still fringe forms of energy, and the green candidates got crushed in recent elections in Europe because voters are sick of the higher prices associated with green policies.

So, having struck out with consumers, businesses and at the ballot box, the greens now are moving on to the courts. The climate-change industrial complex has now joined forces with trial lawyers to advance their war on fossil fuels.

One of the more absurd lawsuits happened in Hawaii.

There, a group of 13 teenagers — honest, I’m not making this up — sued Hawaii’s government over its use of fossil fuels. Environmental law firms Our Children’s Trust and Earthjustice claim that Hawaii’s natural resources are imperiled by CO2 emissions. Even if that were true, shouldn’t they be suing China?

The settlement will require the state to eliminate fossil fuels from its transportation system by 2045, and also formally recognizes the right to file future lawsuits against other parties.

Democratic Gov. Josh Green even stood next to the young plaintiffs as he read a statement claiming, “This settlement informs how we as a state can best move forward to achieve life-sustaining goals.”

There is so much that is wrong about this decision. How did a bunch of teenagers possibly have standing to sue? What possible harm have they suffered from fossil fuels?

The irony is that this island paradise in the Pacific — whose primary industry is tourism — is going to collapse without fossil fuels. With no jets and cruise ships allowed, will tourists and business travelers have to arrive by sailboat?

But this new technique of using lawsuits to advance the anti-fossil fuels movement has spread to other states. Last August, a judge ruled that GOP-dominated Montana violated its constitution when it approved fossil fuel projects without taking climate change into account.

After recent flooding in Vermont, green activists sued the state for not abolishing fossil fuels.

Massachusetts is suing Exxon Mobil for adverse weather conditions.

There are now 32 cases filed by state attorneys general, cities, counties and tribal nations against companies including Exxon Mobil, BP and Shell. The lawsuits claim that the industry tried to undermine scientific consensus about the crisis.

Here’s what’s so frightening about these sham lawsuits from trial lawyers who hope to turn oil companies into cash cows similar to the tobacco lawsuits 20 years ago: The end game of lawsuits against states and oil and gas companies for using or producing energy because of alleged damage to the environment could bring about abolition of fossil fuels through the back door of the nation’s courthouses.

But what none of these judges or litigators take into account is the catastrophic economic effects of not using fossil fuels. As an example, the Left wants to abolish air conditioning, which requires electricity, which mostly comes from fossil fuels. But air conditioning saves tens of thousands of lives a year. What about the millions of jobs that would be wiped out with no fossil fuels? How many thousands of Americans would die in hospitals, or assisted living centers, or day care centers, or schools if the lights go out with no fossil fuel power plants?

Fossil fuels have saved millions more lives over the last century than they take. They make Americans much richer and safer and happier and healthier and more mobile. Meanwhile, there is no evidence backing up the absurd claim by teenagers that if Hawaii stopped using fossil fuels, the state’s weather conditions would improve.

Will judges take that into consideration when they try to rob Exxon and coal companies of their profits for the sin of making life on earth much better?

Stephen Moore is a visiting fellow at the Heritage Foundation and a senior economic advisor to Donald Trump. His latest book is: “Govzilla: How the Relentless Growth of Government Is Devouring Our Economy.”

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

(Featured Image Media Credit: Screen Capture/Supreme Court of the United States)

Alberta

Alberta is investing up to $50 million into new technologies to help reduce oil sands mine water

Technology transforming tailings ponds

Alberta’s oil sands produce some of the most responsible energy in the world and have drastically reduced the amount of fresh water used per barrel. Yet, for decades, operators have been forced to store most of the water they use on site, leading to billions of litres now contained largely in tailings ponds.

Alberta is investing $50 million from the industry-funded TIER system to help develop new and improved technologies that make cleaning up oil sands mine water safer and more effective. Led by Emissions Reduction Alberta, the new Tailings Technology Challenge will help speed up work to safely reclaim the water in oil sands tailing ponds and eventually return the land for use by future generations.

“Alberta’s government is taking action by funding technologies that make treating oil sands water faster, effective and affordable. We look forward to seeing the innovative solutions that come out of this funding challenge, and once again demonstrate Alberta’s global reputation for sustainable energy development and environmental stewardship.”

“Tailings and mine water management remain among the most significant challenges facing Alberta’s energy sector. Through this challenge, we’re demonstrating our commitment to funding solutions that make water treatment and tailings remediation more affordable, scalable and effective.”

As in other mines, the oil sands processing creates leftover water called tailings that need to be properly managed. Recently, Alberta’s Oil Sands Mine Water Steering Committee brought together industry, academics and Indigenous leaders to identify the best path forward to safely address mine water and reclaim land.

This new funding competition will support both new and improved technologies to help oil sands companies minimize freshwater use, promote responsible ways to manage mine water and reclaim mine sites. Using technology for better on-site treatment will help improve safety, reduce future clean up costs and environmental risks, and speed up the process of safely addressing mine water and restoring sites so they are ready for future use.

“Innovation has always played an instrumental role in the oil sands and continues to be an area of focus. Oil sands companies are collaborating and investing to advance environmental technologies, including many focused on mine water and tailings management. We’re excited to see this initiative, as announced today, seeking to explore technology development in an area that’s important to all Albertans.”

Quick facts

- All mines produce tailings. In the oil sands, tailings describe a mixture of water, sand, clay and residual bitumen that are the byproduct of the oil extraction process.

- From 2013 to 2023, oil sands mine operations reduced the amount of fresh water used per barrel by 28 per cent. Recycled water use increased by 51 per cent over that same period.

- The Tailings Technology Challenge is open to oil sands operators and technology providers until Sept. 24.

- The Tailings Technology Challenge will invest in scale-up, pilot, demonstration and first-of-kind commercial technologies and solutions to reduce and manage fluid tailings and the treatment of oil sands mine water.

- Eligible technologies include both engineered and natural solutions that treat tailings to improve water quality and mine process water.

- Successful applicants can receive up to $15 million per project, with a minimum funding request of $1 million.

- Oil sands operators are responsible for site management and reclamation, while ongoing research continues to inform and refine best practices to support effective policy and regulatory outcomes.

Related information

conflict

Middle East clash sends oil prices soaring

This article supplied by Troy Media.

By Rashid Husain Syed

By Rashid Husain Syed

The Israel-Iran conflict just flipped the script on falling oil prices, pushing them up fast, and that spike could hit your wallet at the pump

Oil prices are no longer being driven by supply and demand. The sudden escalation of military conflict between Israel and Iran has shattered market stability, reversing earlier forecasts and injecting dangerous uncertainty into the global energy system.

What just days ago looked like a steady decline in oil prices has turned into a volatile race upward, with threats of extreme price spikes looming.

For Canadians, these shifts are more than numbers on a commodities chart. Oil is a major Canadian export, and price swings affect everything from

provincial revenues, especially in Alberta and Saskatchewan, to what you pay at the pump. A sustained spike in global oil prices could also feed inflation, driving up the cost of living across the country.

Until recently, optimism over easing trade tensions between the U.S. and China had analysts projecting oil could fall below US$50 a barrel this year. Brent crude traded at US$66.82, and West Texas Intermediate (WTI) hovered near US$65, with demand growth sluggish, the slowest since the pandemic.

That outlook changed dramatically when Israeli airstrikes on Iranian targets and Tehran’s counterattack, including hits on Israel’s Haifa refinery, sent shockwaves through global markets. Within hours, Brent crude surged to US$74.23, and WTI climbed to US$72.98, despite later paring back overnight gains of over 13 per cent. The conflict abruptly reversed the market outlook and reintroduced a risk premium amid fears of disruption in the world’s critical oil-producing region.

Amid mounting tensions, attention has turned to the Strait of Hormuz—the narrow waterway between Iran and Oman through which nearly 20 per cent of the world’s oil ows, including supplies that inuence global and

Canadian fuel prices. While Iran has not yet signalled a closure, the possibility

remains, with catastrophic implications for supply and prices if it occurs.

Analysts have adjusted forecasts accordingly. JPMorgan warns oil could hit US$120 to US$130 per barrel in a worst-case scenario involving military conflict and a disruption of shipments through the strait. Goldman Sachs estimates Brent could temporarily spike above US$90 due to a potential loss of 1.75 million barrels per day of Iranian supply over six months, partially offset by increased OPEC+ output. In a note published Friday morning, Goldman Sachs analysts Daan Struyven and his team wrote: “We estimate that Brent jumps to a peak just over US$90 a barrel but declines back to the US$60s in 2026 as Iran supply recovers. Based on our prior analysis, we estimate that oil prices may exceed US$100 a barrel in an extreme tail scenario of an extended disruption.”

Iraq’s foreign minister, Fuad Hussein, has issued a more dire warning: “The Strait of Hormuz might be closed due to the Israel-Iran confrontation, and the world markets could lose millions of barrels of oil per day in supplies. This could result in a price increase of between US$200 and US$300 per barrel.”

During a call with German Foreign Minister Johann Wadephul, Hussein added: “If military operations between Iran and Israel continue, the global market will lose approximately five million barrels per day produced by Iraq and the Gulf states.”

Such a supply shock would worsen inflation, strain economies, and hurt both exporters and importers, including vulnerable countries like Iraq.

Despite some analysts holding to base-case forecasts in the low to mid-US$60s for 2025, that optimism now looks fragile. The oil market is being held hostage by geopolitics, sidelining fundamentals.

What happens next depends on whether the region plunges deeper into conflict or pulls back. But for now, one thing is clear: the calm is over, and oil is once again at the mercy of war.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Health1 day ago

Health1 day agoLast day and last chance to win this dream home! Support the 2025 Red Deer Hospital Lottery before midnight!

-

Business2 days ago

Business2 days agoCarney’s European pivot could quietly reshape Canada’s sovereignty

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoThe Canadian Medical Association’s inexplicable stance on pediatric gender medicine

-

Alberta2 days ago

Alberta2 days agoAlberta’s grand bargain with Canada includes a new pipeline to Prince Rupert

-

conflict1 day ago

conflict1 day ago“Evacuate”: Netanyahu Warns Tehran as Israel Expands Strikes on Iran’s Military Command

-

Energy1 day ago

Energy1 day agoCould the G7 Summit in Alberta be a historic moment for Canadian energy?

-

Crime1 day ago

Crime1 day agoMinnesota shooter arrested after 48-hour manhunt

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWOKE NBA Stars Seems Natural For CDN Advertisers. Why Won’t They Bite?