National

Censured doctor who’s now a Conservative MP calls COVID mandates ‘full Communism’

From LifeSiteNews

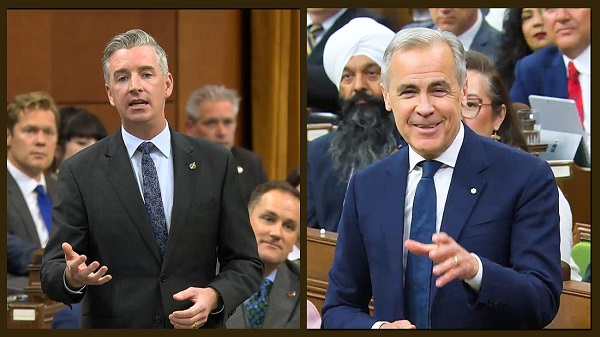

Dr. Matt Strauss, just elected as a Conservative Party of Canada MP, used his first speech in Parliament to blast COVID mandates

A censured Canadian doctor critical of virus lockdowns who was just elected as a new Conservative Party of Canada (CPC) MP used his first speech in Parliament to blast COVID mandates as “full Communism,” which he said allowed governments full “top-down” control of people’s lives.

“The zenith of all this top-down control came during the pandemic,” Dr. Matt Strauss, CPC MP for Kitchener South-Hespeler, Ontario, said to Parliament on Tuesday.

“The members opposite went full Communism.”

I gave my maiden speech in Canada's House of Commons:

The Liberals trampled on the Charter rights of Canadians. I see no indication the leopard can change it's spots. I am here to speak truth to their power. pic.twitter.com/tkmLgZilH0

— Matt Strauss (@strauss_matt) June 3, 2025

While working as an emergency care doctor, Strauss was critical of COVID lockdowns and mandates. In 2021, he observed that full hospitals in Canada have been the norm for decades.

For speaking out, he was the target of Queen’s University after it allegedly censored him and enacted professional reprisals against him because of his outspoken views against COVID mandates and lockdowns. Elon Musk’s X helped fund Strauss’s legal against his former employer Queen’s University after it forced him to resign.

In his speech, Strauss lamented that the Canadian government under former Prime Minister Justin Trudeau “ruined” people’s lives due to mandated lockdowns and mandates.

“They locked Canadians down in their homes, ruined weddings, funerals, Easters, proms and Christmases, closed the borders, kept mothers from children and brothers from sisters, deprived the House of its ancient rights, spent $600 billion of taxpayer money with no budget and doubled our national debt to pay healthy 16-year-olds to sit in their basement,” a visibly emotional Strauss said.

He blasted the fact this was all done “in the name of crisis management” as well as the fact those who opposed the COVID dictates were “hunted down.”

“Physicians, professors and journalists who spoke out against these abuses were hunted down. They had their licenses and their jobs threatened. I know this because it happened to me,” he said.

Strauss said that “every member of the Liberal caucus voted to trample their rights further.”

Many Canadian doctors who spoke out against COVID mandates and the experimental mRNA injections were censured by their medical boards.

In October 2021, Trudeau announced unprecedented COVID-19 shot mandates for all federal workers and those in the transportation sector and said the unvaccinated will no longer be able to travel by air, boat, or train, both domestically and internationally.

This policy resulted in thousands losing their jobs or being placed on leave for non-compliance.

Trudeau had disparaged unvaccinated Canadians, saying those opposing his measures were of a “small, fringe minority” who hold “unacceptable views” and do not “represent the views of Canadians who have been there for each other.”

LifeSiteNews has published an extensive amount of research on the dangers of the experimental COVID mRNA jabs that include heart damage and blood clots.

Business

This Sunday, June 8, is Tax Freedom Day, when Canadians finally start working for themselves

From the Fraser Institute

By Milagros Palacios, Jake Fuss and Nathaniel Li

This Sunday, June 8, Canadians will celebrate Tax Freedom Day, the day in the year when they start working for themselves and not government, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“If Canadians paid all their taxes up front, they would work the first 158 days of this year before bringing any money home for themselves and their families,” said Jake Fuss, director of fiscal studies at the Fraser Institute.

Tax Freedom Day measures the total annual tax burden imposed on Canadian families by federal, provincial, and municipal governments.

In 2025, the average Canadian family (with two or more people) will pay $68,266 in total taxes. That’s 43.1 per cent of its annual income ($158,533) going to income taxes, payrolltaxes (including the Canada Pension Plan), health taxes, sales taxes (like the GST), property taxes, fuel taxes, “sin” taxes and more.

Represented as days on the calendar, the total tax burden comprises more than five months of income—from January 1 to June 7. On June 8th—Tax Freedom Day—Canadians finally start working for themselves, and not government.

But Canadians should also be worried about the nearly $90 billion in deficits the federal and provincial governments are forecasting this year, because they will have substantial tax implications in future years.

To better illustrate this point, the study also calculates a Balanced Budget Tax Freedom Day—the day of the year when the average Canadian finally would finally start working for themselves if governments paid for all of this year’s spending with taxes collected this year.

In 2025, the Balanced Budget Tax Freedom Day won’t arrive until June 21. “Tax Freedom Day helps put the total tax burden in perspective, and helps Canadians understand just how much of their money they pay in taxes every year,” Fuss said. “Canadians need to decide for themselves whether they are getting their money’s worth when it comes to how governments are spending their tax dollars.”

Tax Freedom Day for each province varies according to the extent of the provincially and locally levied tax burden.

2025 Provincial Tax Freedom Days

Manitoba May 17

Saskatchewan May 31

British Columbia May 31

Alberta May 31

Prince Edward Island June 2

New Brunswick June 4

Ontario June 7

Nova Scotia June 10

Newfoundland & Labrador June 19

Quebec June 21

CANADA June 8

Canadians Celebrate Tax Freedom Day on June 8, 2025

- In 2025, the average Canadian family will earn $158,533 in income and pay an estimated $68,266 in total taxes (43.1%).

- If the average Canadian family had to pay its taxes up front, it would have worked until June 7 to pay the total tax bill imposed on it by all three levels of government (federal, provincial, and local).

- This means that Tax Freedom Day, the day in the year when the average Canadian family has earned enough money to pay the taxes imposed on it, falls on June 8.

- Tax Freedom Day in 2025 comes one day earlier than in 2024, when it fell on June 9. This change is due to the expectation that the total tax revenues forecasted by Canadian governments will increase slower than the incomes of Canadians.

- Tax Freedom Day for each province varies according to the extent of the provincially levied tax burden. The earliest provincial Tax Freedom Day falls on May 17 in Manitoba, while the latest falls on June 21 in Quebec.

- Canadians are right to be thinking about the tax implications of the $89.4 billion in projected federal and provincial government deficits in 2025. For this reason, we calculated a Balanced Budget Tax Freedom Day, the day on which average Canadians would start working for themselves if governments were obliged to cover current expenditures with current taxation. In 2025, the Balanced Budget Tax Freedom Day arrives on June 21.

Fraser Institute

Health-care lessons from Switzerland for a Canada ready for reform

From the Fraser Institute

Last year marked the 40th anniversary of the Canada Health Act, long considered a pillar of national identity. But today, that symbol is showing signs of strain. Despite record government spending, health-care wait times have reached historic highs—more than 30 weeks on average for planned treatment—and access to care continues to deteriorate. Fewer than one in five Canadians now say the system works well.

While political leaders tinker at the margins, countries such as Switzerland have taken bold steps to build universal health-care systems that are more responsive, more flexible and, above all, more accessible.

Switzerland achieves universal health coverage through a fundamentally different and patient-centered model. Instead of relying on a government monopoly, the Swiss health-care system is organized around principles of regulated competition. Forty-four private non-profit insurers offer standardized basic coverage, and every resident must enroll. But unlike in Canada, Swiss patients are free to choose their insurer and switch plans twice a year. This freedom of choice drives insurers to innovate, tailor benefits, and ultimately improve service.

Switzerland’s universal system is also more comprehensive than Canada’s. It covers not only hospital and physician services, but also prescription drugs, mental health care and certain long-term care services. At the same time, patients can choose from a variety of plan designs, which have varying deductibles and premiums, and manage care based on their preferences.

By contrast, the Canadian system offers virtually no choice. The government enrols every citizen in the same plan, with the same benefits, on the same terms. The Canada Health Act, the federal legislation meant to promote equity, prohibits flexibility. It’s a lowest-common-denominator model—rigid, bureaucratic and unresponsive to patient needs.

Nowhere is this clearer than how we access care. In Canada, patients must go through a family doctor—compulsory gatekeeping—before seeing a specialist. But six million Canadians don’t even have a family doctor. For them, this requirement isn’t just inconvenient, it’s a dead end. The result is long delays, lost diagnoses and growing public frustration.

Conversely, the Swiss model prioritizes adaptability, driven by the power of patient choice and regulated competition among insurance providers. Because residents can switch insurers twice a year and select among different care models, insurers are incentivized to innovate and respond to evolving needs. As a result, patients can choose from a variety of insurance plans: a standard model with no gatekeeping; managed care with family doctors; pharmacy-based coordination; telemedicine-first plans, or other models. And they don’t have wait long. According to the latest survey from the Commonwealth Fund, 76 per cent of Swiss residents are able to obtain a medical appointment with a doctor or nurse within five days, compared to only 46 per cent of Canadians.

In addition to expanding patient choice, these different plan options help insurers control costs by reducing unnecessary consultations and hospitalizations. Studies show that such models can lower the cost of care by up to 34 per cent without compromising quality while also discouraging unnecessary treatments or hospital visits. And these plans encourage health-care providers to focus on prevention and chronic care management, ultimately improving efficiency and outcomes while the savings allow insurers to reduce premiums and control long-term spending. In fact, despite offering greater choice and a broader package of health-care services than Canada, real health-care spending (per person) in Switzerland has grown by less than 2 per cent annually since the mid-1990s compared to 2.7 per cent in Canada.

These Swiss facts, which are likely music to the ears of Canadians, raise a key question: how much do Swiss citizens pay out-of-pocket for health care?

While Swiss residents do share some costs through deductibles and co-payments, these costs are capped and vulnerable populations (children, pregnant women, low-income people, etc.) are exempt.

In 2022 (the latest year of available data), average annual out-of-pocket spending per insured person in Switzerland was 581 Swiss francs, equivalent to C$792. For people who don’t require much care, the costs are much lower or non-existent. And nearly 28 per cent of the population receives subsidies to cover their premiums.

Of course, many Canadians assume our system as “free,” forgetting that it’s funded through general taxation. They also tend to overlook our significant out-of-pocket costs not covered by the public system (prescription drugs, mental health care, long-term care, etc.).

Nevertheless, Canada can’t simply copy-and-paste the Swiss model. The Canada Health Act currently prohibits co-payments and mandates uniform public insurance. But that doesn’t mean we have nothing to learn. Switzerland shows that universality isn’t incompatible with choice and competition. In fact, these goals can strengthen each other. When patients have freedom of choice, a health-care system becomes not only more efficient but also more responsive to their needs and preferences. In other words, it becomes a true health-care system.

Canada’s health-care debate has long been framed as a rigid dichotomy between a government monopoly and a privately-funded system where any reform is seen as a threat to universality. This mindset has stifled innovation and made it harder to build a system that is both universal and responsive. Switzerland points the way forward, with a model that reconciles equity, choice and adaptability in ways Canadian policymakers can no longer afford to ignore.

-

Automotive2 days ago

Automotive2 days agoCanada’s EV house of cards is close to collapsing

-

Business1 day ago

Business1 day agoTo Build BIG THINGS Canada Needs to Rid Itself of BIG BARRIERS

-

Business1 day ago

Business1 day agoMeta inks 20 year deal for nuclear power

-

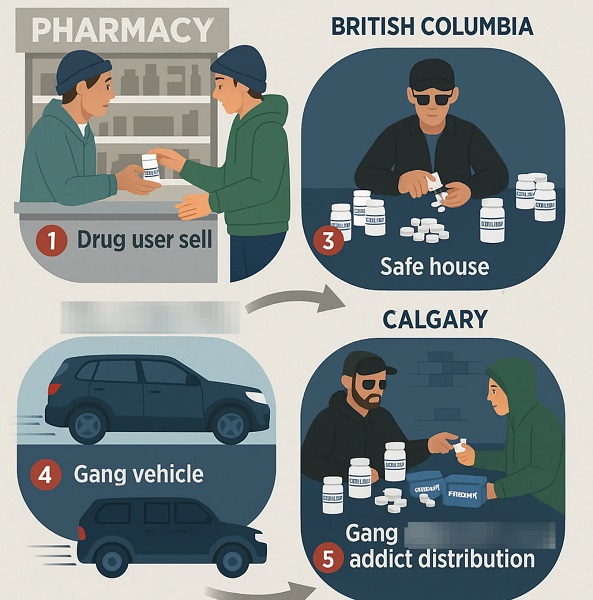

Crime1 day ago

Crime1 day agoBoulder ‘terror’ suspect’s family in ICE custody, pending deportation

-

Crime2 days ago

Crime2 days agoMexican Cartels Expanding Operations in Canada, Using Indigenous Reserves as Factory Hubs

-

Energy1 day ago

Energy1 day agoTrump Keeps Focus On America’s Energy Production

-

Alberta22 hours ago

Alberta22 hours agoAlberta Sports Hall of Fame to Induct Class of 2025

-

Business11 hours ago

Business11 hours agoCarney’s Energy Mirage: Why the Prospects of Economic Recovery Remain Bleak