Business

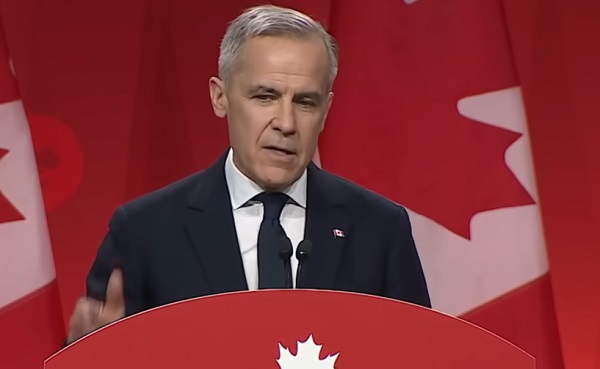

Carney must kick-start private sector to strengthen sputtering economy

From the Fraser Institute

Prime Minister Mark Carney talks frequently of making Canada “the strongest economy in the G7.” That promises to be a tall order, which will require—among other things—advancing many more large-scale energy, mining and infrastructure projects in the next one to five years; streamlining Ottawa’s sclerotic project assessment and environmental permitting rules; and responding to recent tax policy changes in the United States, which have left Canada at a significant competitive disadvantage in attracting new business investment.

The challenges confronting Canadian policymakers are daunting. Carney has inherited a sputtering economy crippled by years of weak business investment, zero productivity growth and an increasingly unattractive business climate—and now the new threat of sweeping tariffs, courtesy of our principal trading partner.

During Justin Trudeau’s nine-plus years in power, the two primary motors of economic growth in Canada were an expanding public sector and an immigration-fuelled surge in the population. The first trend saw the federal government and many of the provinces spend and borrow with abandon, producing a near-term economic jolt but also adding to Canada’s mountain of government debt.

The second trend saw Canada post the fastest population growth of any advanced economy from 2016 to 2024, owing to outsized immigration. This also boosted the economy, since every newcomer creates extra demand for goods, services and housing. And many immigrants gain employment, enlarging the country’s workforce. However, Canada’s population growth since 2016 did little to increase prosperity and living standards on a per-person basis.

Now, Canada’s previous engines of economic growth have run out of gas.

While Carney has hinted at even bigger budget deficits than his notably spendthrift predecessor, in reality Canada is about to enter a period of fiscal austerity as governments are compelled—including by bond markets and credit-rating agencies—to rein in spending and tame excessive deficits. It’s hard to imagine that continued increases in the size of government can or will propel a struggling Canadian economy forward in the next few years.

As for population growth, the federal government’s revised immigration plan unveiled last fall aims to sharply reduce inflows of both permanent immigrants and “non-permanent” foreign residents. After a decade of rising immigration, Canada will experience the opposite over the next three years. As a result, the country’s population is poised to stall—and perhaps even slightly decline—after an extended stretch of steady growth. This sudden demographic shift will dampen economic growth, even as the Carney government muses about supercharging Canada’s stagnant economy.

Recent data from Statistics Canada confirms that the effects of Ottawa’s new immigration policy are starting to materialize. The population didn’t grow at all between the fourth quarter of 2024 and the first quarter of this year, reflecting both smaller inflows of new permanent immigrants and a drop in the size of the “non-permanent” resident population, in line with immigration targets announced last year.

With the population no longer increasing and governments under mounting fiscal pressure, the only way to grow the Canadian economy is to kick-start the private sector. That will require a different playbook than the one favoured by the Trudeau government over the last several years. Ottawa should now focus on improving the business environment to encourage companies, entrepreneurs and investors to deploy their capital and talents to build and expand businesses in Canada. Absent that, there’s little chance the prime minister will meet his goal of making Canada the G7’s economic star.

Business

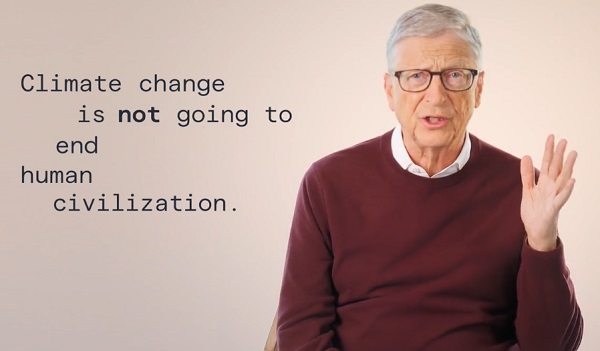

Bill Gates Gets Mugged By Reality

From the Daily Caller News Foundation

You’ve probably heard by now the blockbuster news that Microsoft founder Bill Gates, one of the richest people to ever walk the planet, has had a change of heart on climate change.

For several decades Gates poured billions of dollars into the climate industrial complex.

Some conservatives have sniffed that Bill Gates has shifted his position on climate change because he and Microsoft have invested heavily in energy intensive data centers.

AI and robotics will triple our electric power needs over the next 15 years. And you can’t get that from windmills.

What Bill Gates has done is courageous and praiseworthy. It’s not many people of his stature that will admit that they were wrong. Al Gore certainly hasn’t. My wife says I never do.

Although I’ve only once met Bill Gates, I’ve read his latest statements on global warming. He still endorses the need for communal action (which won’t work), but he has sensibly disassociated himself from the increasingly radical and economically destructive dictates from the green movement. For that, the left has tossed him out of their tent as a “traitor.”

I wish to highlight several critical insights that should be the starting point for constructive debate that every clear-minded thinker on either side of the issue should embrace.

(1) It’s time to put human welfare at the center of our climate policies. This includes improving agriculture and health in poor countries.

(2) Countries should be encouraged to grow their economies even if that means a reliance on fossil fuels like natural gas. Economic growth is essential to human progress.

(3) Although climate change will hurt poor people, for the vast majority of them it will not be the only or even the biggest threat to their lives and welfare. The biggest problems are poverty and disease.

I would add to these wise declarations two inconvenient truths: First: the solution to changing temperatures and weather patterns is technological progress. A far fewer percentage of people die of severe weather events today than 50 or 100 or 1,000 years ago.

Second, energy is the master resource and to deny people reliable and affordable energy is to keep them poor and vulnerable – and this is inhumane.

If Bill Gates were to start directing even a small fraction of his foundation funds to ensuring everyone on the planet has access to electric power and safe drinking water, it would do more for humanity than all of the hundreds of billions that governments and foundations have devoted to climate programs that have failed to change the globe’s temperature.

Stephen Moore is a co-founder of Unleash Prosperity and a former Trump senior economic advisor.

Automotive

Elon Musk Poised To Become World’s First Trillionaire After Shareholder Vote

From the Daily Caller News Foundation

At Tesla’s Austin headquarters, investors backed Musk’s 12-step plan that ties his potential trillion-dollar payout to a series of aggressive financial and operational milestones, including raising the company’s valuation from roughly $1.4 trillion to $8.5 trillion and selling one million humanoid robots within a decade. Musk hailed the outcome as a turning point for Tesla’s future.

“What we’re about to embark upon is not merely a new chapter of the future of Tesla but a whole new book,” Musk said, as The New York Times reported.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

The decision cements investor confidence in Musk’s “moonshot” management style and reinforces the belief that Tesla’s success depends heavily on its founder and his leadership.

Tesla Annual meeting starting now

https://t.co/j1KHf3k6ch— Elon Musk (@elonmusk) November 6, 2025

“Those who claim the plan is ‘too large’ ignore the scale of ambition that has historically defined Tesla’s trajectory,” the Florida State Board of Administration said in a securities filing describing why it voted for Mr. Musk’s pay plan. “A company that went from near bankruptcy to global leadership in E.V.s and clean energy under similar frameworks has earned the right to use incentive models that reward moonshot performance.”

Investors like Ark Invest CEO Cathie Wood defended Tesla’s decision, saying the plan aligns shareholder rewards with company performance.

“I do not understand why investors are voting against Elon’s pay package when they and their clients would benefit enormously if he and his incredible team meet such high goals,” Wood wrote on X.

Norway’s sovereign wealth fund, Norges Bank Investment Management — one of Tesla’s largest shareholders — broke ranks, however, and voted against the pay plan, saying that the package was excessive.

“While we appreciate the significant value created under Mr. Musk’s visionary role, we are concerned about the total size of the award, dilution, and lack of mitigation of key person risk,” the firm said.

The vote comes months after Musk wrapped up his short-lived government role under President Donald Trump. In February, Musk and his Department of Government Efficiency (DOGE) team sparked a firestorm when they announced plans to eliminate the U.S. Agency for International Development, drawing backlash from Democrats and prompting protests targeting Musk and his companies, including Tesla.

Back in May, Musk announced that his “scheduled time” leading DOGE had ended.

-

Justice2 days ago

Justice2 days agoCarney government lets Supreme Court decision stand despite outrage over child porn ruling

-

Business2 days ago

Business2 days agoCarney’s budget spares tax status of Canadian churches, pro-life groups after backlash

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy leader Tamara Lich to appeal her recent conviction

-

Daily Caller2 days ago

Daily Caller2 days agoUN Chief Rages Against Dying Of Climate Alarm Light

-

Business1 day ago

Business1 day agoCarney budget continues misguided ‘Build Canada Homes’ approach

-

Business2 days ago

Business2 days agoU.S. Supreme Court frosty on Trump’s tariff power as world watches

-

espionage1 day ago

espionage1 day agoU.S. Charges Three More Chinese Scholars in Wuhan Bio-Smuggling Case, Citing Pattern of Foreign Exploitation in American Research Labs

-

Business1 day ago

Business1 day agoCarney budget doubles down on Trudeau-era policies