Fraser Institute

Canadians are ready for health-care reform—Australia shows the way

From the Fraser Institute

By Bacchus Barua and Mackenzie Moir

Australia offers real-world examples of how public/private partnerships can be successfully integrated in a universal health-care framework. Not only does Australia prove it can be done without sacrificing universal coverage for all, Australia spends less money (as a share of its economy) than Canada and enjoys more timely medical care.

Canada’s health-care system is crumbling. Long wait times, hallway health care and burned-out staff are now the norm. Unsurprisingly, a new poll finds that the majority of Canadians (73 per cent) say the system needs major reform.

As noted in a recent editorial in the Globe and Mail, we can learn key lessons from Australia.

There are significant similarities between the two countries with respect to culture, the economy and even geographic characteristics. Both countries also share the goal of ensuring universal health coverage. However, Australia outperforms Canada on several key health-care performance metrics.

After controlling for differences in age (where appropriate) between the two countries, our recent study found that Australia’s health-care system outperformed Canada’s on 33 (of 36) performance measures. For example, Australia had more physicians, hospital beds, CT scanners and MRI machines per person compared to Canada. And among the 30 universal health-care countries studied, Canada ranked in the bottom quartile for the availability of these critical health-care resources.

Australia also outperforms Canada on key measures of wait times. In 2023 (the latest year of available data), 39.5 per cent of patients in Australia were able to make a same or next day appointment when they were sick compared to only 22.3 per cent in Canada. And 9.6 per cent of Canadians reported waiting more than one year to see a specialist compared to only 4.5 per cent of Australians. Similarly, almost one-in-five (19.9 per cent) Canadians reported waiting more than one year for non-emergency surgery compared to only 11.8 per cent of Australians.

So, what does Australia do differently to outperform Canada on these key measures?

Although the Globe and Mail editorial touches on the availability of private insurance in Australia, less attention is given to the private sector’s prominent role in the delivery of health care.

In 2016 (the latest year of available data) almost half of all hospitals in Australia (48.5 per cent) were private. And in 2021/22 (again, the latest year of available data), 41 per cent of all hospital care took place in a private facility. That percentage goes up to 70.3 per cent when only considering hospital admissions for non-emergency surgery.

But it’s not only higher-income patients who can afford private insurance (or those paying out of pocket) who get these surgeries. The Australian government encourages the uptake of private insurance and partially subsidizes private care (at a rate of 75 per cent of the public fee), and governments in Australia also regularly contract out publicly-funded care to private facilities.

In 2021/22, more than 300,000 episodes of publicly-funded care occurred in private facilities in Australia. Private hospitals also delivered 73.5 per cent of care funded by Australia’s Department of Veterans’ Affairs. And in 2019/20, government sources (including the federal government) paid for almost one-third (32.8 per cent) of private hospital expenditures.

Which takes us back to the new opinion poll (by Navigator), which found that 69 per cent of Canadians agree that health-care services should include private-sector involvement. While defenders of the status quo continue to criticize this approach, Australia offers real-world examples of how public/private partnerships can be successfully integrated in a universal health-care framework. Not only does Australia prove it can be done without sacrificing universal coverage for all, Australia spends less money (as a share of its economy) than Canada and enjoys more timely medical care.

While provincial governments remain stubbornly committed to a failed model, Canadians are clearly expressing their desire for health-care reforms that include a prominent role for private partners in the delivery of universal care.

Australia is just one example. Public/private partnerships are the norm in several more successful universal health-care systems (such as Germany and Switzerland). Instead of continuing to remain an outlier, Canada should follow the examples of Australia and other countries and engage with the private sector to fulfill the promise of universal health care.

Authors:

Business

Canada’s recent economic growth performance has been awful

From the Fraser Institute

By Ben Eisen and Milagros Palacios

Recently, Statistics Canada released a revision of its calculations of Canada’s gross domestic product (GDP) in recent years. GDP measures the total production in an economy in a given year, and per-person GDP is widely accepted by economists as one of the most useful metrics for assessing quality of life. The new estimate places Canada’s GDP for 2024 at 1.4 per cent larger than previously reported.

By the standards of these sorts of revisions—which are usually quite small—the recent update is significant. But make no mistake, the new numbers do not change the fundamental story of Canada’s economic performance, which has been one of historically weak growth and stagnant living standards for an unusually long stretch of time.

Let’s get into the numbers (all adjusted for inflation, in 2017 dollars) with some historical perspective. The new figures put Canada’s per-person GDP estimate for 2024 at $59,529. By comparison, in 2019 per-person GDP was slightly higher at $59,581. This means there has been no progress at all in Canadian living standards as measured by per-person GDP over the past five years. Even with the revision, five years of flat living standards is an extraordinary result.

This is historically anomalous. From 2000 to 2018—a period that was itself not especially strong by the standards of earlier decades—per-person GDP still grew at a compounded annual rate of just under one per cent. In the 1990s, growth was faster still at roughly 1.8 per cent annually. In both periods, living standards were rising meaningfully, even if the pace varied. The fact that they have completely stagnated for five years is alarming, even if our GDP numbers aren’t quite as bleak as we believed a few weeks ago.

Some pundits determined to view all economic data through a political lens have emphasized that under the new revisions, the overall rate of per-person growth during Justin Trudeau’s time as prime minister is now approximately the same as what occurred during Stephen Harper’s tenure.

However, this is more relevant as a political talking point than an economic insight. The historical data show that at an average annual growth rate of just 0.5 per cent, the Canadian economy’s performance under Harper was weak by long-term standards. This is something that Trudeau himself recognized when he first sought high office, criticizing the Harper government for “having the worst record on economic growth since R.B. Bennett in the depths of the Great Depression.”

Trudeau was right back then that Canadian economic growth during the Harper era was historically weak. As such, a revision showing that Canada’s slow growth has approximately continued for the past decade is hardly cause for celebration. It simply underscores that both governments presided over a long period of weak productivity growth and very slow improvements in living standards—and that in recent years even that sluggish growth has given way to complete stagnation.

Of course, an upward revision to recent GDP calculations is welcome news, but it must not be allowed to distract policymakers or the public from the reality of Canada’s severe long-term growth problem, which in recent years has gone from bad to worse.

Community

Charitable giving on the decline in Canada

From the Fraser Institute

By Jake Fuss and Grady Munro

There would have been 1.5 million more Canadians who donated to charity in 2023—and $755.5 million more in donations—had Canadians given to the same extent they did 10 years prior

According to recent polling, approximately one in five Canadians have skipped paying a bill over the past year so they can buy groceries. As families are increasingly hard-pressed to make ends meet, this undoubtedly means more and more people must seek out food banks, shelters and other charitable organizations to meet their basic necessities.

And each year, Canadians across the country donate their time and money to charities to help those in need—particularly around the holiday season. Yet at a time when the relatively high cost of living means these organizations need more resources, new data published by the Fraser Institute shows that the level of charitable giving in Canada is actually falling.

Specifically, over the last 10 years (2013 to 2023, the latest year of available data) the share of tax-filers who reported donating to charity fell from 21.9 per cent to 16.8 per cent. And while fewer Canadians are donating to charity, they’re also donating a smaller share of their income—during the same 10-year period, the share of aggregate income donated to charity fell from 0.55 per cent to 0.52 per cent.

To put this decline into perspective, consider this: there would have been 1.5 million more Canadians who donated to charity in 2023—and $755.5 million more in donations—had Canadians given to the same extent they did 10 years prior. Simply put, this long-standing decline in charitable giving in Canada ultimately limits the resources available for charities to help those in need.

On the bright side, despite the worrying long-term trends, the share of aggregate income donated to charity recently increased from 0.50 per cent in 2022 to 0.52 per cent in 2023. While this may seem like a marginal improvement, 0.02 per cent of aggregate income for all Canadians in 2023 was $255.7 million.

The provinces also reflect the national trends. From 2013 to 2023, every province saw a decline in the share of tax-filers donating to charity. These declines ranged from 15.4 per cent in Quebec to 31.4 per cent in Prince Edward Island.

Similarly, almost every province recorded a drop in the share of aggregate income donated to charity, with the largest being the 24.7 per cent decline seen in P.E.I. The only province to buck this trend was Alberta, which saw a 3.9 per cent increase in the share of aggregate income donated over the decade.

Just as Canada as a whole saw a recent improvement in the share of aggregate income donated, so too did many of the provinces. Indeed, seven provinces (except Manitoba, Nova Scotia and Newfoundland and Labrador) saw an increase in the share of aggregate income donated to charity from 2022 to 2023, with the largest increases occurring in Saskatchewan (7.9 per cent) and Alberta (6.7 per cent).

Canadians also volunteer their time to help those in need, yet the latest data show that volunteerism is also on the wane. According to Statistics Canada, the share of Canadians who volunteered (both formally and informally) fell by 8 per cent from 2018 to 2023. And the total numbers of hours volunteered (again, both formal and informal) fell by 18 per cent over that same period.

With many Canadians struggling to make ends meet, food banks, shelters and other charitable organizations play a critical role in providing basic necessities to those in need. Yet charitable giving—which provides resources for these charities—has long been on the decline. Hopefully, we’ll see this trend turn around swiftly.

-

Crime8 hours ago

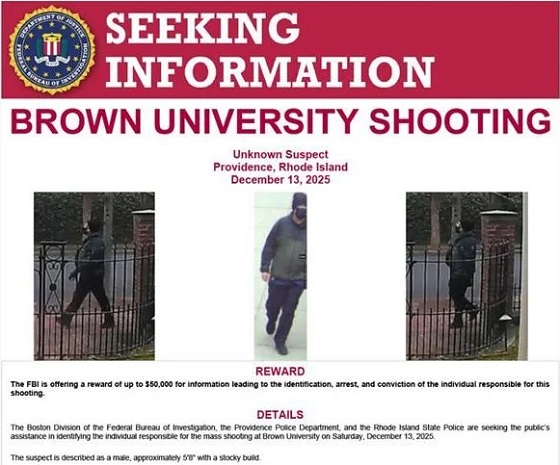

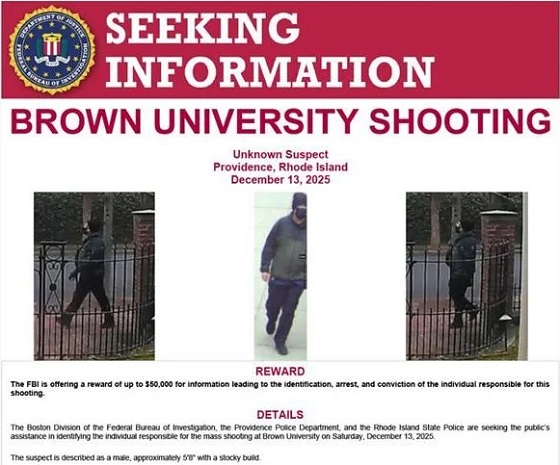

Crime8 hours agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Business2 days ago

Business2 days agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

Business19 hours ago

Business19 hours agoCanada Hits the Brakes on Population

-

Energy2 days ago

Energy2 days agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Crime1 day ago

Crime1 day agoBondi Beach Survivor Says Cops Prevented Her From Fighting Back Against Terrorists

-

International1 day ago

International1 day agoHouse Rejects Bipartisan Attempt To Block Trump From Using Military Force Against Venezuela

-

Frontier Centre for Public Policy21 hours ago

Frontier Centre for Public Policy21 hours agoCanada Lets Child-Porn Offenders Off Easy While Targeting Bible Believers