Automotive

Canada’s electric vehicle industry faces multiple threats

From the Fraser Institute

While Trump’s trade war continues to grab all the headlines, Canada’s electric vehicle (EV) industry may be steaming toward an iceberg, due mainly to shifts in policy south of the border.

Specifically, the Trump administration has withdrew from the Paris Agreement (and its net-zero 2050 framework) and eliminated the U.S. EV mandate, which required upwards of 56 per cent of new vehicles sold in the United States. to be EV and 13 per cent be plug-in hybrids by 2032. These moves represent an existential threat to Canada’s EV investments and the viability of the large EV battery plants under various stages of planning and construction in Ontario and Quebec.

Indeed, the Trudeau government, along with the Ontario and Quebec governments, negotiated several significant battery manufacturing deals, which included subsidies and construction funding totalling $4.6 billion for the Northvolt AB plant near Montreal, $13.2 billion for the Volkswagen plant in Saint Thomas, Ontario, $15 billion for the Stellantis plant in Windsor, Ontario and $1.6 billion for the Japanese battery company Asahi Kasei plant in Port Colborne, Ontario. (Although both Northvolt AB and Stellantis are reconsidering their EV battery investments in Canada—Northvolt AB is approaching bankruptcy and Stellantis thinks that current federal subsidies are insufficient to justify its investment.)

According to the Parliamentary Budget Officer, taxpayer subsidies (a.k.a. corporate welfare) for these deals will cost Canadians up to $44 billion between 2022/23 and 2032/33. In the U.S., EV sales in 2024 were 1.2 million (7 per cent of auto total sales) buoyed by an EV tax credit of US$7,500 per new vehicle, which translates into US$9 billion in EV consumer subsidies that year alone.

All of this raises the question: can the EV industry stand on its own without massive subsidies from taxpayers?

In 2023, of the two largest EV producers (Tesla and Ford), only Tesla would break even without the EV tax credit subsidies. According to Reuters, Tesla earned approximately US$8,300 in profit per EV in 2023, and of the 1.8 million Tesla vehicles produced globally, only 400,000 were produced in the U.S. Meanwhile, even after the subsidies, Ford lost US$64,700 per EV in 2023 and US$32,700 in 2024. (It’s also worth noting that Ford, with the second-highest EV production in the U.S., produced a mere 72,000 vehicles in 2023.)

While Ford still plans to make EVs, it recently announced plans to shift production at its Oakville, Ontario factory from electric sports vehicles to gas-powered pickup trucks. The news came shortly after General Motors announced it would trim its forecast of EVs produced in 2024 by 50,000.

Clearly, U.S. legacy automakers are worried about overproducing against sluggish consumer demand, knowing that their profitability and fiscal viability resides in their internal combustion engine vehicle production lines. Numerous large European automotive manufacturers also saw a decline in EV sales in 2024 and are re-investing in their combustion engine production lines to protect profits.

Finally, beyond only EVs, Canada’s automotive manufacturing sector is in decline. Between 2014 and 2023, automotive production fell from 2.4 million to 1.5 million vehicles while automobile imports increased from $57 billion to $82 billion. Of the 1.5 million vehicles produced in Canada in 2023, 88 per cent were exported to the U.S., leaving the industry highly vulnerable to shifts in American policy (which currently include President Trump’s threat of a 100 per cent tariff on automobile exports).

The iceberg is in view. The new Carney government and our provincial governments must take stock of the decline in the automotive manufacturing sector, its near total dependence on U.S. exports, and uncertain government-driven EV investments. And they should ask if the push to electrify the automotive manufacturing base is in the long-term best interests of Canadians.

Automotive

Canada’s EV experiment has FAILED

By Dan McTeague

The government’s attempt to force Canadians to buy EVs by gambling away billions of tax dollars and imposing an EV mandate has been an abject failure.

GM and Stellantis are the latest companies to back track on their EV plans in Canada despite receiving billions in handouts from Canadian taxpayers.

Dan McTeague explains in his latest video.

Automotive

Carney’s Budget Risks Another Costly EV Bet

From the Frontier Centre for Public Policy

GM’s Ontario EV plant was sold as a green success story. Instead it collapsed under subsidies, layoffs and unsold vans

Every age invents new names for old mistakes. In ours, they’re sold as investments. Before the Carney government unveils its November budget promising another future paid for in advance, Canadians should remember Ingersoll, Ont., one of the last places a prime minister tried to buy tomorrow.

Eager to transform the economy, in December 2022, former prime minister Justin Trudeau promised that government backing would help General Motors turn its Ingersoll plant into a beacon of green industry. “By 2025 it will be producing 50,000 electric vehicles per year,” he declared: 137 vehicles daily, six every hour. What sounded like renewal became an expensive demonstration of how progressive governments peddle rampant spending as sound strategy.

The plan began with $259 million from Ottawa and another $259 million from Ontario: over half a billion to switch from Equinox production to BrightDrop electric delivery vans. The promise was thousands of “good, middle-class jobs.”

The assembly plant employed 2,000 workers before retooling. Today, fewer than 700 remain; a two-thirds collapse. With $518 million in public funds and only 3,500 vans built in 2024, taxpayers paid $148,000 per vehicle. The subsidy works out to over half a million dollars per remaining worker. Two out of every three employees from Trudeau’s photo-op are now unemployed.

The failure was entirely predictable. Demand for EVs never met the government’s plan. Parking lots filled with unsold inventory. GM did the rational thing: slowed production, cut staff and left. The Canadian taxpayer was left to pay the bill.

This reveals the weakness of Ottawa’s industrial policy. Instead of creating conditions for enterprise, such as reliable energy, stable regulation, and moderate taxes, progressive governments spend to gain applause. They judge success by the number of jobs announced, yet those jobs vanish once the cameras leave.

Politicians keep writing cheques to industry. Each administration claims to be more strategic, yet the pattern persists. No country ever bought its way into competitiveness.

Trudeau “bet big on electric vehicles,” but betting with other people’s money isn’t vision; it’s gambling. The wager wasn’t on technology but narrative, the naive idea that moral intention could replace market reality. The result? Fewer jobs, unwanted products and claims of success that convinced no one.

Prime Minister Mark Carney has mastered the same rhetorical sleight of hand. Spending becomes “investment,” programs become “platforms.” He promises to “catalyze unprecedented investments” while announcing fiscal restraint: investing more while spending less. His $13-billion federal housing agency is billed as a future investment, though it’s immediate public spending under a moral banner.

“We can build big. Build bold. Build now,” Carney declared, promising infrastructure to “reduce our vulnerabilities.” The cadence of certainty masks the absence of limits. Announcing “investment” becomes synonymous with action itself; ambition replaces accountability.

The structure mirrors the Ingersoll case: promise vast returns from state-directed spending, redefine subsidy as vision, rely on tomorrow to conceal today’s bill. “Investment” has become the language of evasion, entitlement and false pride.

As Carney prepares his first budget, Canadians should remember what happened when their last leader tried to buy a future with lavish “investment.”

A free economy doesn’t need bribery to breathe. It requires the discipline of risk and liberty to fail without dragging a country down. Ingersoll wasn’t undone by technology but by ideological conceit. Prosperity cannot be decreed and markets cannot be commanded into obedience.

Every age invents new names for old mistakes. Ours keeps making the same ones. Entitled hubris knows no bounds.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

-

Business1 day ago

Business1 day agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

Business1 day ago

Business1 day agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

-

Environment1 day ago

Environment1 day agoThe era of Climate Change Alarmism is over

-

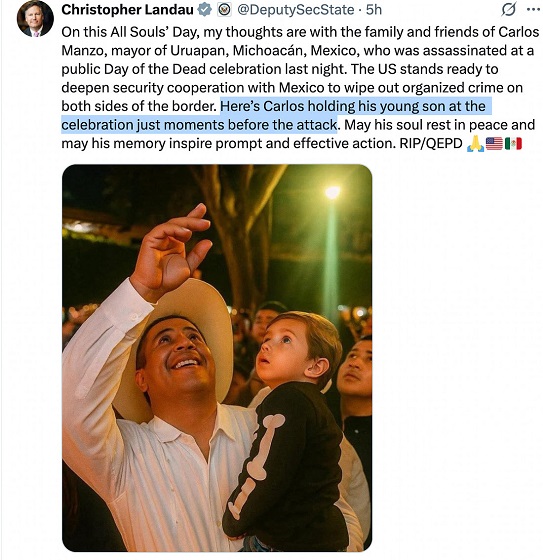

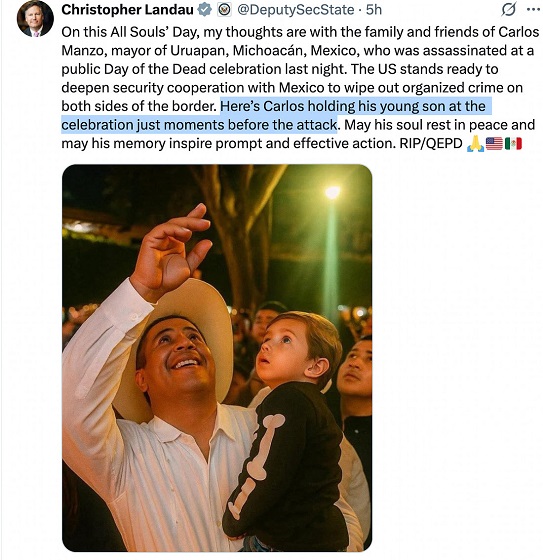

Crime16 hours ago

Crime16 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Automotive1 day ago

Automotive1 day agoCarney’s Budget Risks Another Costly EV Bet

-

Aristotle Foundation16 hours ago

Aristotle Foundation16 hours agoB.C. government laid groundwork for turning private property into Aboriginal land

-

Justice16 hours ago

Justice16 hours agoA Justice System That Hates Punishment Can’t Protect the Innocent