Business

Canada Revenue Agency has found a way to hit “Worse Than Rock Bottom”

From Conservative Part Communications

Last month, Carney’s Minister responsible for the Canada Revenue Agency (CRA) debuted their new slogan: “It can’t get much worse than it is now.” Today, the Auditor General reported that under the Liberals, it has.

Over the 2024/25 period, only 18 per cent of callers were able to reach a CRA agent within 15 minutes, a far cry from the target of 65 per cent of callers. In June, the numbers plunged to just 5 per cent of callers able to get through within the service standard of 15 minutes.

The average wait time took over half an hour, double what it was the year prior. And that was if you were even given the option of getting help. Nearly nine million calls were “deflected” by an automated voice telling Canadians to figure it out themselves, with no option to speak with an agent.

Wait times are so bad that over 7.6 million calls were disconnected before callers were able to reach an agent or be provided automated service. As wait times continue to get worse and worse, Canadians have just given up, evidenced by 2.4 million more abandoned calls over the previous year.

Even when Canadians manage to get hold of an agent, employees regularly fail to provide correct information about personal and business taxes. Auditors found the call centre gave incorrect information 83 per cent of the time when asked general individual tax questions.

Non-specific questions about benefits, including about eligibility, were wrong 44 per cent of the time. Meanwhile, the CRA’s automated chatbot “Charlie”, meant to relieve the call centre, answered only two of six tax-related questions correctly.

“How is it that an organization so important to the smooth functioning of the country is failing to serve Canadians and, as the Auditor General notes, places greater importance on adhering to shift schedules and breaks than on the accuracy and completeness of the information provided?” asked Gérard Deltell, Conservative Shadow Minister for Revenue.

It’s no surprise that complaints about the CRA’s contact centre increased 145 per cent from 2021/22 to 2024/25. Despite this, the Liberals announced they will begin auto-filing taxes for 5.5 million Canadians, automatically enrolling people in benefits the CRA is regularly unable to provide accurate information about.

Worse of all, the cost of the CRA’s call centre has ballooned from $50 million over 10 years in 2015 to $190 million. The total cost is projected to continue rising to $214 million over the next two years, a more than 320 per cent increase from the original contracted amount.

Meanwhile, Auditors found “there was no process documented or followed to ensure that amounts invoiced … were accurate and reflected the services received,” and that there was “little evidence that invoice details were appropriately reviewed and approved by … the Canada Revenue Agency prior to issuing payment.”

The Liberals have delivered higher taxes and higher costs with worse service for Canadians. We deserve better than continued Liberal failures. Conservatives will continue holding Carney accountable and fight to cut taxes and waste so Canadians keep more of what they earn.

Business

Canada has fewer doctors, hospital beds, MRI machines—and longer wait times—than most other countries with universal health care

From the Fraser Institute

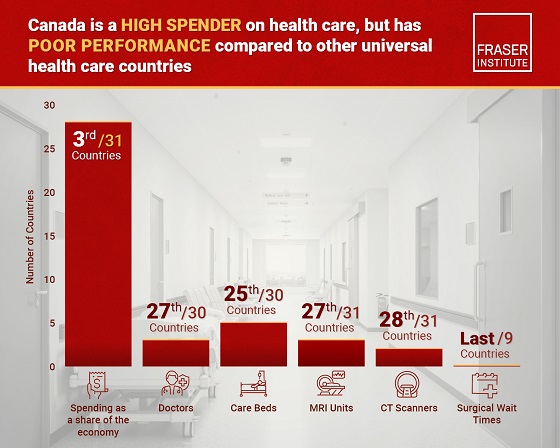

Despite a relatively high level of spending, Canada has significantly fewer doctors, hospital beds, MRI machines and CT scanners compared to other countries with universal health care, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“There’s a clear imbalance between the high cost of Canada’s health-care system and the actual care Canadians receive in return,” said Mackenzie Moir, senior policy

analyst at the Fraser Institute and author of Comparing Performance of Universal Health-Care Countries, 2025.

In 2023, the latest year of available comparable data, Canada spent more on health care (as a percentage of the economy/GDP, after adjusting for population age) than

most other high-income countries with universal health care (ranking 3rd out of 31 countries, which include the United Kingdom, Australia and the Netherlands).

And yet, Canada ranked 27th (of 30 countries) for the availability of doctors and 25th (of 30) for the availability of hospital beds.

In 2022, the latest year of diagnostic technology data, Canada ranked 27th (of 31 countries) for the availability of MRI machines and 28th (of 31) for CT scanners.

And in 2023, among the nine countries with universal health-care systems included in the Commonwealth Fund’s International Health Policy Survey, Canada ranked last for the percentage of patients able to make same- or next-day appointments when sick (22 per cent) and had the highest percentage of patients (58 per cent) who waited two months or more for non-emergency surgery. For comparison, the Netherlands had much higher rates of same- or next-day appointments (47 per cent) and much lower waits of two months or more for non-emergency surgery (20 per cent).

“To improve health care for Canadians, our policymakers should learn from other countries around the world with higher-performing universal health-care systems,”

said Nadeem Esmail, director of health policy at the Fraser Institute.

Comparing Performance of Universal Health Care Countries, 2025

- Of the 31 high-income universal health-care countries, Canada ranks among the highest spenders, but ranks poorly on both the availability of most resources and access to services.

- After adjustments for differences in the age of the population of these 31 countries, Canada ranked third highest for spending as a percentage of GDP in 2023 (the most recent year of comparable data).

- Across 13 indictors measured, the availability of medical resources and timely access to medical services in Canada was generally below that of the average OECD country.

- In 2023, Canada ranked 27th (of 30) for the relative availability of doctors and 25th (of 30) for hospital beds dedicated to physical care. In 2022, Canada ranked 27th (of 31) for the relative availability of Magnetic Resonance Im-aging (MRI) machines, and 28th (of 31) for CT scanners.

- Canada ranked last (or close to last) on three of four indicators of timeliness of care.

- Notably, among the nine countries for which comparable wait times measures are available, Canada ranked last for the percentage of patients reporting they were able to make a same- or next-day appointment when sick (22%).

- Canada also ranked eighth worst for the percentage of patients who waited more than one month to see a specialist (65%), and reported the highest percentage of patients (58%) who waited two months or more for non-emergency surgery.

- Clearly, there is an imbalance between what Canadians get in exchange for the money they spend on their health-care system.

Mackenzie Moir

Senior Policy Analyst, Fraser Institute

Alberta

Petition threatens independent school funding in Alberta

From the Fraser Institute

Recently, amid the backdrop of a teacher strike, an Alberta high school teacher began collecting signatures for a petition to end government funding of independent schools in the province. If she gets enough people to sign—10 per cent of the number of Albertans who voted in the last provincial election—Elections Alberta will consider launching a referendum about the issue.

In other words, the critical funding many Alberta families rely on for their children’s educational needs may be in jeopardy.

In Alberta, the provincial government partially funds independent schools and charter schools. The Alberta Teachers’ Association (ATA), whose members are currently on strike, opposes government funding of independent and charter schools.

But kids are not one-size-fits-all, and schools should reflect that reality, particularly in light of today’s increasing classroom complexity where different kids have different needs. Unlike government-run public schools, independent schools and charter schools have the flexibility to innovate and find creative ways to help students thrive.

And things aren’t going very well for all kids or teachers in government-run pubic school classrooms. According to the ATA, 93 per cent of teachers report encountering some form of aggression or violence at school, most often from students. Additionally, 85 per cent of unionized teachers face an increase in cognitive, social/emotional and behavioural issues in their classrooms. In 2020, one-quarter of students in Edmonton’s government-run public schools were just learning English, and immigration to Canada—and Alberta especially—has exploded since then. It’s not easy to teach a classroom of kids where a significant proportion do not speak English, many have learning disabilities or exceptional needs, and a few have severe behavioural problems.

Not surprisingly, demand for independent schools in Alberta is growing because many of these schools are designed for students with special needs, Autism, severe learning disabilities and ADHD. Some independent schools cater to students just learning English while others offer cultural focuses, expanded outdoor time, gifted learning and much more.

Which takes us back to the new petition—yet the latest attempt to defund independent schools in Alberta.

Wealthy families will always have school choice. But if the Alberta government wants low-income and middle-class kids to have the ability to access schools that fit them, too, it’s crucial to maintain—or better yet, increase—its support for independent and charter schools.

Consider a fictional Alberta family: the Millers. Their daughter, Lucy, is struggling at her local government-run public school. Her reading is below grade level and she’s being bullied. It’s affecting her self-esteem, her sleep and her overall wellbeing. The Millers pay their taxes. They don’t take vacations, they rent, and they haven’t upgraded their cars in many years. They can’t afford to pay full tuition for Lucy to attend an independent school that offers the approach to education she needs to succeed. However, because the Alberta government partially funds independent schools—which essentially means a portion of the Miller family’s tax dollars follow Lucy to the school of their choice—they’re able to afford the tuition.

The familiar refrain from opponents is that taxpayers shouldn’t pay for independent school tuition. But in fact, if you’re concerned about taxpayers, you should encourage school choice. If Lucy attends a government-run public school, taxpayers pay 100 per cent of her education costs. But if she attends an independent or charter school, taxpayers only pay a portion of the costs while her parents pay the rest. That’s why research shows that school choice saves tax dollars.

If you’re a parent with a child in a government-run public school in Alberta, you now must deal with another teacher strike. If you have a child in an independent or charter school, however, it’s business as usual. If Albertans are ever asked to vote on whether or not to end government funding for independent schools, they should remember that students are the most important stakeholder in education. And providing parents more choices in education is the solution, not the problem.

-

Business4 hours ago

Business4 hours agoQuebecers want feds to focus on illegal gun smuggling not gun confiscation

-

Business4 hours ago

Business4 hours agoEmission regulations harm Canadians in exchange for no environmental benefit

-

Energy1 day ago

Energy1 day agoMinus Forty and the Myth of Easy Energy

-

Uncategorized1 day ago

Uncategorized1 day agoNew report warns WHO health rules erode Canada’s democracy and Charter rights

-

Crime22 hours ago

Crime22 hours agoFrance stunned after thieves loot Louvre of Napoleon’s crown jewels

-

Courageous Discourse2 hours ago

Courageous Discourse2 hours agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoOttawa Should Think Twice Before Taxing Churches

-

Alberta2 days ago

Alberta2 days agoBusting five myths about the Alberta oil sands