Economy

Canada living standards falling behind rest of developed world

From the Fraser Institute

By Alex Whalen, Milagros Palacios, and Lawrence Schembri

On Canada Day, Deputy Prime Minister Chrystia Freeland proclaimed that “Canada is the best country in the world,” yet Canadians are getting poorer relative to their peers in many other countries and our living standards are falling. This trend is expected to continue well into the future, unless our policymakers make significant changes.

Economists often measure living standards by real gross domestic product (GDP) per person—in other words, the inflation-adjusted monetary value of what a country produces in goods and services divided by its population.

As noted in a new study published by the Fraser Institute, from 2002 to 2014, Canada’s GDP per-person growth roughly kept pace with the rest of the OECD. But from 2014 to 2022, the latest year of available comparable data, Canada’s annual average growth rate declined sharply, ranking third-lowest among 30 countries over the period. Consequently, in dollar terms, Canada’s GDP per person increased only $1,325 during this time period, compared to the OECD average increase of $5,070 (all values in 2015 U.S. dollars).

Moreover, between 2014 and 2022, Canada’s GDP per person declined from 80.4 per cent of the U.S. level to 72.3 per cent, and lost substantial ground to key allies and trading partners such as the United Kingdom, New Zealand and Australia.

And according to OECD projections, Canada will have the lowest projected average annual growth rate of GDP per person (at 0.78 per cent) from 2030 to 2060 when our GDP per person will be below the OECD average by $8,617. This represents a swing of more than $11,000 from where it was in 2002.

Why is this happening?

Several reasons, including historically weak business investment over the past decade, a substantial shift in the composition of permanent and temporary immigrants towards those with less education and fewer skills, and subdued technological innovation and adoption. These factors have combined to produce very low or negative labour productivity growth due to weak growth in the education and skills of the average worker and the amount of capital (namely plant, machinery and equipment) per worker.

While most advanced countries are experiencing similar trends, the situation in Canada is among the worst. Consequently, our relative decline in living standards grows exponentially because Canada’s poor performance compounds over time.

To break out of this rut and prevent this further decline in Canada’s living standards relative to our peers, policymakers must enact comprehensive and bold policy changes to encourage business investment and innovation, promote worker education and training, and achieve better immigration outcomes where more is not always better.

As a starting point, governments should improve the climate for business investment and for investment in education and training by streamlining regulation and major project approvals and reducing current and expected future tax burdens on firms and workers.

Levels of government debt and debt interest costs are approaching thresholds of unsustainability not seen since the 1990s. Governments, including the federal government, must exercise spending restraint to put their finances on a more sustainable path to mitigate the “crowding out” effects of government spending and debt in private markets, and thereby promote private investment. In addition, policies that liberalise intra-provincial and international trade and foster more competition, especially in key industries (e.g. transportation, communication, finance) would help boost investment, productivity and living standards.

Because GDP per person is so closely connected to incomes and living standards, Canada’s decline relative to our peer countries on this key metric should concern all Canadians. Given Canada’s projected continued poor performance, our country needs a major series of policy reforms to avoid further declines in living standards.

Authors:

Business

Ottawa should stop using misleading debt measure to justify deficits

From the Fraser Institute

By Jake Fuss and Grady Munro

Based on the rhetoric, the Carney government’s first budget was a “transformative” new plan that will meet and overcome the “generational” challenges facing Canada. Of course, in reality this budget is nothing new, and delivers the same approach to fiscal and economic policy that has been tried and failed for the last decade.

First, let’s dispel the idea that the Carney government plans to manage its finances any differently than its predecessor. According to the budget, the Carney government plans to spend more, borrow more, and accumulate more debt than the Trudeau government had planned. Keep in mind, the Trudeau government was known for its recklessly high spending, borrowing and debt accumulation.

While the Carney government has tried to use different rhetoric and a new accounting framework to obscure this continued fiscal mismanagement, it’s also relied on an overused and misleading talking point about Canada’s debt as justification for higher spending and continued deficits. The talking point goes something like, “Canada has the lowest net debt-to-GDP ratio in the G7” and this “strong fiscal position” gives the government the “space” to spend more and run larger deficits.

Technically, the government is correct—Canada’s net debt (total debt minus financial assets) is the lowest among G7 countries (which include France, Germany, Italy, Japan, the United Kingdom and the United States) when measured as a share of the overall economy (GDP). The latest estimates put Canada’s net debt at 13 per cent of GDP, while net debt in the next lowest country (Germany) is 49 per cent of GDP.

But here’s the problem. This measure assumes Canada can use all of its financial assets to offset debt—which is not the case.

When economists measure Canada’s net debt, they include the assets of the Canada Pension Plan (CPP) and the Quebec Pension Plan (QPP), which were valued at a combined $890 billion as of mid-2025. But obviously Canada cannot use CPP and QPP assets to pay off government debt without compromising the benefits of current and future pensioners. And we’re one of the only industrialized countries where pension assets are accounted in such a way that it reduces net debt. Simply put, by falsely assuming CPP and QPP assets could pay off debt, Canada appears to have a stronger fiscal position than is actually the case.

A more accurate measure of Canada’s indebtedness is to look at the total level of debt.

Based on the latest estimates, Canada’s total debt (as a share of the economy) ranked 5th-highest among G7 countries at 113 per cent of GDP. That’s higher than the total debt burden in the U.K. (103 per cent) and Germany (64 per cent), and close behind France (117 per cent). And over the last decade Canada’s total debt burden has grown faster than any other G7 country, rising by 25 percentage points. Next closest, France, grew by 17 percentage points. Keep in mind, G7 countries are already among the most indebted, and continue to take on some of the most debt, in the industrialized world.

In other words, looking at Canada’s total debt burden reveals a much weaker fiscal position than the government claims, and one that will likely only get worse under the Carney government.

Prior to the budget, Prime Minister Mark Carney promised Canadians he will “always be straight about the challenges we face and the choices that we must make.” If he wants to keep that promise, his government must stop using a misleading measure of Canada’s indebtedness to justify high spending and persistent deficits.

Business

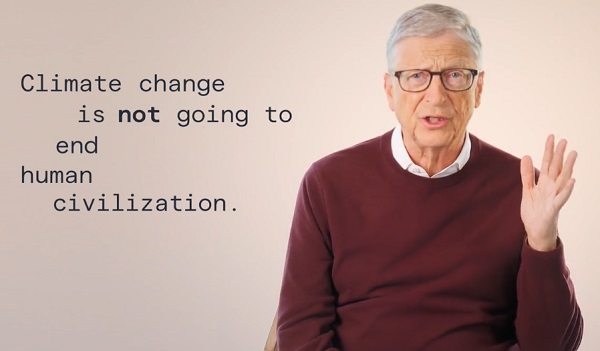

Bill Gates Gets Mugged By Reality

From the Daily Caller News Foundation

You’ve probably heard by now the blockbuster news that Microsoft founder Bill Gates, one of the richest people to ever walk the planet, has had a change of heart on climate change.

For several decades Gates poured billions of dollars into the climate industrial complex.

Some conservatives have sniffed that Bill Gates has shifted his position on climate change because he and Microsoft have invested heavily in energy intensive data centers.

AI and robotics will triple our electric power needs over the next 15 years. And you can’t get that from windmills.

What Bill Gates has done is courageous and praiseworthy. It’s not many people of his stature that will admit that they were wrong. Al Gore certainly hasn’t. My wife says I never do.

Although I’ve only once met Bill Gates, I’ve read his latest statements on global warming. He still endorses the need for communal action (which won’t work), but he has sensibly disassociated himself from the increasingly radical and economically destructive dictates from the green movement. For that, the left has tossed him out of their tent as a “traitor.”

I wish to highlight several critical insights that should be the starting point for constructive debate that every clear-minded thinker on either side of the issue should embrace.

(1) It’s time to put human welfare at the center of our climate policies. This includes improving agriculture and health in poor countries.

(2) Countries should be encouraged to grow their economies even if that means a reliance on fossil fuels like natural gas. Economic growth is essential to human progress.

(3) Although climate change will hurt poor people, for the vast majority of them it will not be the only or even the biggest threat to their lives and welfare. The biggest problems are poverty and disease.

I would add to these wise declarations two inconvenient truths: First: the solution to changing temperatures and weather patterns is technological progress. A far fewer percentage of people die of severe weather events today than 50 or 100 or 1,000 years ago.

Second, energy is the master resource and to deny people reliable and affordable energy is to keep them poor and vulnerable – and this is inhumane.

If Bill Gates were to start directing even a small fraction of his foundation funds to ensuring everyone on the planet has access to electric power and safe drinking water, it would do more for humanity than all of the hundreds of billions that governments and foundations have devoted to climate programs that have failed to change the globe’s temperature.

Stephen Moore is a co-founder of Unleash Prosperity and a former Trump senior economic advisor.

-

armed forces2 days ago

armed forces2 days agoIt’s time for Canada to remember, the heroes of Kapyong

-

Business2 days ago

Business2 days agoBill Gates Gets Mugged By Reality

-

Energy17 hours ago

Energy17 hours agoThawing the freeze on oil and gas development in Treaty 8 territory

-

Alberta2 days ago

Alberta2 days agoAlberta’s number of inactive wells trending downward

-

Agriculture15 hours ago

Agriculture15 hours agoThe Canadian Food Inspection Agency’s Bloodlust: Worshipping Policies While Ignoring Science

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoSchool Cannot Force Students To Use Preferred Pronouns, US Federal Court Rules

-

International15 hours ago

International15 hours agoBBC uses ‘neutrality’ excuse to rebuke newscaster who objected to gender ideology

-

Alberta2 days ago

Alberta2 days agoAlberta Announces Members of Class Size and Complexity Committee