Business

Canada falls further behind U.S. in race to attract top talent

From the Fraser Institute

By Jake Fuss

The United States Congress recently passed President Donald Trump’s “Big Beautiful Bill,” which among things extended and made permanent the income tax rate reductions and revised tax brackets first implemented in the 2017 Tax Cuts and Jobs Act. This should raise alarm bells for policymakers north of the border as Canada will continue to have uncompetitive personal income tax rates compared to our American counterparts, and fall even farther behind in the race to attract entrepreneurs, professionals, investors and top talent.

Jurisdictions around the world compete to attract and retain top talent including entrepreneurs, engineers and doctors, who contribute significantly to the economy. While taxes are one of many factors these professionals consider when deciding where to live and work, jurisdictions with relatively low taxes generally enjoy a competitive edge in attracting these individuals.

According to research, taxes have the largest effect on mobility for high-skilled individuals. For example, relatively high personal income tax (PIT) rates in one jurisdiction incentivize workers to reduce their tax burden by relocating to a lower tax jurisdiction. This creates competition between jurisdictions, as the lowest tax jurisdictions are typically more successful at attracting and retaining professionals, business owners and entrepreneurs.

Indeed, according to Moretti and Wilson (2017), the number of “star” scientists in a state increases by 0.4 per cent annually if the after-tax income in that state increases by 1 per cent due to a reduction in PIT rates. Put differently, high-income scientists are acutely sensitive to personal income taxes and make decisions about where to work in part based on the level of taxation in a given jurisdiction. Similarly, Agrawal and Feremny (2018) found workers in finance, real estate and health care are more sensitive to taxes and more likely to migrate than other professionals.

Research from Akcigit et al. (2015) similarly discovered “superstar” inventors are significantly affected by top tax rates when deciding where to locate. Another study (Iqbal, 2000) on international mobility examined the exodus of Canadian professionals to the U.S. and determined that high-skilled Canadians respond strongly to tax rates—specifically that a “1 percent increase in the existing tax gap (measured by the ratio of total tax revenue to GDP) can push 2 percent more Canadians toward the United States.”

The effect also shows up in international professional sports. Henrik Kleven and his colleagues (2013) examined data on European soccer players and found countries with low taxes attract more “high ability players” that have high rates of compensation. Among NHL fans and pundits, there’s been recent discussion about the Florida Panthers having an advantage in attracting the most talented hockey players because the players do not pay state-level income taxes.

Florida certainly has wonderful beach weather and other luxuries, but its advantage in tax rates give professional hockey teams such as the Panthers and Tampa Bay Lightning a competitive edge in recruiting top talent. Big names such as Sam Bennett, Aaron Ekblad and Brad Marchand recently re-upped with the Panthers on bargain contracts, in part due to relatively low tax rates. Another big name, Mitch Marner, left Toronto this summer for greener pastures and substantially lower taxes (with sunny weather) in Nevada by signing a lucrative eight-year contract with the Las Vegas Golden Knights.

Moreover, five of the last six Stanley Cup-winning teams have come from U.S. states that do not impose state level income taxes (the Colorado Avalanche being the only exception). And again, although taxes are not the sole factor in any player’s career decisions, they are undoubtedly a key reason why these teams successfully manage the salary cap and build the best possible roster.

Why is this relevant for Canada?

Our personal income tax (PIT) rates are uncompetitive compared to other advanced countries that we directly compete with for talented people, particularly the U.S. Among 38 countries within the Organization for Economic Cooperation and Development (OECD), Canada’s personal income tax system is ranked the 8th-least competitive. And Canada’s top combined (federal and provincial) PIT rate was the fifth-highest among those same 38 high-income countries in 2024 as illustrated in the chart below. The country’s combined PIT rate is higher than in countries such as Australia (17th), the United Kingdom (20th) and the U.S. (23rd). Again, this makes Canada less attractive to professionals, entrepreneurs and business owners who drive innovation, investment and private-sector job creation—all things fundamental to the economy.

Over the last decade, tax hikes at the federal and provincial levels have increased top PIT rates in every province. For example, the Trudeau government in 2015 raised the top federal PIT rate from 29 per cent to 33 per cent. Provinces such as Alberta, British Columbia, and Newfoundland and Labrador followed suit.

The Carney government has shown little interest in correcting this problem. While the prime minister cancelled Trudeau’s planned capital gains tax hike, Prime Minister Carney has done little else to attract or retain top talent, despite the recent change to the bottom federal PIT rate from 15 per cent to 14 per cent on income below $57,375. While this move may slightly help improve Canada’s competitiveness for lower- and lower-middle-income workers, it does almost nothing to make the country more attractive to doctors, scientists, engineers and entrepreneurs (and yes, athletes).

When Trump’s Big Beautiful Bill helped solidify the U.S. advantage, it exacerbated Canada’s competitiveness problem. If we compare PIT rates in the 10 Canadian provinces to the 50 U.S. states and the District of Columbia, the scale of our problem becomes apparent (see second chart below). Specifically, when ranking the top combined (federal and provincial/state) PIT rates in 2025, Canadian provinces hold nine of the top 10 highest rates among the 61 North American jurisdictions. Saskatchewan (at 15th highest) is the only province to escape the top 10.

Newfoundland and Labrador has the highest top PIT rate (54.80 per cent) among Canadian and U.S. jurisdictions followed by Nova Scotia (54.00 per cent), Ontario (53.53 per cent), Quebec (53.31 per cent) and New Brunswick (52.50 per cent) compared to top PIT rates as low as 37.00 per cent in Texas, Florida, Nevada, Washington and Tennessee, which impose no state-level personal income taxes.

In addition to the rate differences, there are also differences in income thresholds. For instance, in Ontario the top combined PIT rate (53.53 per cent) kicks in at C$253,414 compared to C$1,384,538 in California, a notorious high-tax state. That difference in the income threshold matters for professionals, business owners and entrepreneurs when deciding where to live.

In addition to top earners, Canada’s PIT rates are also uncompetitive at other income levels. At C$150,000, Canadians in all 10 provinces face higher PIT rates than Americans in every U.S. state (see chart below), with the highest rates in Quebec (47.46 per cent), Prince Edward Island (45.00 per cent) and Ontario (44.97 per cent). While Albertans enjoy the lowest rate (36.00) in Canada, it’s still higher than in California (33.30 per cent). And at C$150,000, nine U.S. states have combined (federal and state) income tax rates at 24.0 per cent.

If we move down the income ladder to C$75,000 (see chart below), Canadian provinces hold nine of the top 10 highest PIT rates, starting with Nova Scotia (37.17 per cent), P.E.I. (37.10 per cent) and Quebec (36.12 per cent). Americans living in geographically similar states such as New Hampshire (22.00 per cent), Vermont (28.60 per cent) and Maine (28.75 per cent) all face significantly lower PIT rates than their Canadian counterparts in the Atlantic region. Oregon (30.75 per cent) is the only U.S. jurisdiction in the top 10 and B.C. (28.20 per cent) is the only Canadian province outside of the top 10.

Finally, PIT rates in Canada are also uncompetitive at C$50,000 (see chart below). Again, Canadian provinces hold nine of the top 10 highest rates while the remaining province sits at 12th in the rankings. Nova Scotia (28.95 per cent) once again has the highest rate followed by Newfoundland and Labrador (28.50 per cent), P.E.I. (27.47 per cent) and Manitoba (26.75 per cent).

Ontarians face the lowest rate in Canada at this income level but still pay a higher rate than Americans in 48 states plus the District of Columbia. In Nevada, New Hampshire, Florida and Texas, workers only pay a 12.00 per cent tax rate at C$50,000.

Across all income levels examined, a couple of trends emerge. First, residents in energy-producing provinces such as Alberta, Saskatchewan, and Newfoundland and Labrador consistently pay PIT rates that exceed those in comparable energy-driven states such as Texas, Oklahoma, Alaska, Wyoming, North Dakota, West Virginia and New Mexico that directly compete with these provinces for investment and talent. For example, Alberta’s top combined PIT rate is 11.00 percentage points higher than in Texas, Wyoming and Alaska. Newfoundland and Labrador fares even worse with top PIT rates 17.40-percentage points higher than in those U.S. jurisdictions.

Another obvious trend is that Canadian jurisdictions have higher income tax rates, at both the lower and top end of the income spectrum, than virtually all U.S. states. In other words, the provinces with the lowest rates are generally less competitive than states with the highest tax burdens in the U.S. That’s a big problem for a Canadian economy already struggling to increase productivity, innovation and living standards. These comparably high tax rates reduce the incentives to save, invest and start a business—all key drivers of prosperity—while deterring top talent from locating in Canada.

The problem then worsens when we look beyond taxes towards the multitude of regulatory barriers businesses must sift through, which scares away investors and entrepreneurs. According to the Canadian Federation of Independent Business, Canadian businesses spent an estimated $51.5 billion, and an average of 735 hours, on regulatory compliance in 2024. Imagine what business owners and entrepreneurs could do with their time and money spent on innovation instead. Add in relatively high housing prices and cold winter weather in many parts of the country, and it’s difficult to see why professionals, business owners and entrepreneurs would consider relocating to a Canadian city today.

Make no mistake, Canada has immense potential. We have an abundance of natural resources, a highly educated workforce and many young people clamoring for a better future. But we cannot realize that potential if our policymakers are not bold and daring enough to change course.

Creating an environment to foster higher living standards for Canadians means we must meaningfully reduce taxes to make us substantially more competitive with our American neighbours and other industrialized countries around the globe. Tinkering around the edges of our tax system with a small tax reduction here or there simply will not get it done. To attract and retain top talent, Ottawa and the provinces must give high-skilled people a robust reason to call Canada home. Why not start with making Canada the most competitive tax system in the world?

Autism

Autism – what we know

Malone News

Malone News

Science backs up President Trump’s statements

Big-pharma is big mad.

The Trump administration is challenging conventional medicine and science in making this a priority. They are searching deeper, going beyond big-pharma-funded studies that have distorted the concept of “evidence-based” medicine and science.

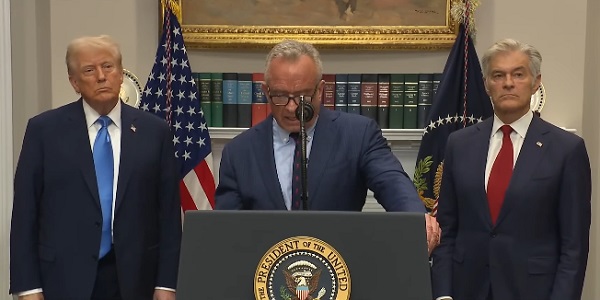

If you haven’t listened to the press conference from yesterday, please do so. At the very least, listen to the opening statements. For brevity, I cut out a few of the speakers that weren’t making policy statements and some of the “big, beautiful bill” questions towards the end of the press conference.

(Video starts at 50:20)

As President Trump delves into this press conference, he specifically states that:

“I’m making these statements from me.”

“I talk about a lot of common sense.”

“This will be as important as any single thing I’ve done.”

Read that last statement again. Secretary Kennedy and MAHA have President Trump’s full support! More than that, these issues are critically important to President Trump.

In this press conference, President Trump states explicitly that no drug should be recommended for pain in pregnant women. That pregnant women should try their hardest to avoid pain medications.

He also states that children should not be given vaccines in large combinations at a young age.

We all know that all vaccines have risks; some vaccines have much higher risks. The compounding effects of medicines are a real issue. Putting two and two together (or not…) is just common sense.

This is all common sense.

The President’s statement is one of the most responsible, pro-scientific process statements ever to come out of the White House, and I am proud to be associated with this movement.

So, what does the “scientific” establishment think about President Trump’s presser?

The greatest shill on earth for Big Pharma had this to say about the press conference.

Not a single mainstream media outlet called Dr. Proffit out on this outlandish statement.

In fact, none of the usual MSM outlets bothered to do any real research before attacking the press conference and its findings, with the exception of Politico, which published an “opinion” piece written by Dr. Jay Bhattacharya,, Dr. Marty Makary, and Dr. Mehmet Oz .

All of the mainstream media outlets attacked the position that taking drugs while pregnant was a bad idea.

Which means they endorse the idea that it is better to be without pain and cause risk of fetal harm… No words can express how disgusted I am by these propagandists.

Of note, Dr. Profit (above) must also believe that Harvard’s School of Public Health and it’s Dean, Andrea Baccarelli, are irresponsible, as they have largely endorsed the President’s statements:

And yet, this is the response by MSM.

With this in mind, as I prepared to speak on various news programs today, I conducted a literature search on recent peer-reviewed papers on the causes of autism.

Below, some of the more recently published papers on Autism are highlighted:

Evaluation of the evidence on acetaminophen use and neurodevelopmental disorders using the Navigation Guide methodology

Diddier Prada, Beate Ritz, Ann Z. Bauer & Andrea A. Baccarelli (Dean of the Harvard School of Public Health). Environmental Health volume 24, Article number: 56 (2025)

Abstract

Background

Acetaminophen is the most commonly used over-the-counter pain and fever medication taken during pregnancy, with > 50% of pregnant women using acetaminophen worldwide. Numerous well-designed studies have indicated that pregnant mothers exposed to acetaminophen have children diagnosed with neurodevelopmental disorders (NDDs), including autism spectrum disorder (ASD) and attention-deficit/

hyperactivity disorder (ADHD), at higher rates than children of pregnant mothers who were not exposed to acetaminophen. Methods

We applied the Navigation Guide methodology to the scientific literature to comprehensively and objectively examine the association between prenatal acetaminophen exposure and NDDs and related symptomology in offspring. We conducted a systematic PubMed search through February 25, 2025, using predefined inclusion criteria and rated studies based on risk of bias and strength of evidence. Due to substantial heterogeneity, we opted for a qualitative synthesis, consistent with the Navigation Guide’s focus on environmental health evidence.

Results

We identified 46 studies for inclusion in our analysis. Of these, 27 studies reported positive associations (significant links to NDDs), 9 showed null associations (no significant link), and 4 indicated negative associations (protective effects). Higher-quality studies were more likely to show positive associations. Overall, the majority of the studies reported positive associations of prenatal acetaminophen use with ADHD, ASD, or NDDs in offspring, with risk-of-bias and strength-of-evidence ratings informing the overall synthesis.

Conclusions

Our analyses using the Navigation Guide thus support evidence consistent with an association between acetaminophen exposure during pregnancy and increased incidence of NDDs. Appropriate and immediate steps should be taken to advise pregnant women to limit acetaminophen consumption to protect their offspring’s neurodevelopment.

The Dangers of Acetaminophen (APAP) for Neurodevelopment Outweigh Scant Evidence for Long-Term Benefits

Crit Rev Toxicol 2025 Feb;55(2):124-178., doi: 10.1080/10408444.2024.2442344. Epub 2025 Feb 21.

Based on available data that include approximately 20 lines of evidence from studies in laboratory animal models, observations in humans, correlations in time, and pharmacological/toxicological considerations, it has been concluded without reasonable doubt and with no evidence to the contrary that exposure of susceptible babies and children to acetaminophen (paracetamol) induces many, if not most, cases of autism spectrum disorder (ASD).

However, the relative number of cases of ASD that might be induced by acetaminophen has not yet been estimated. Here, we examine a variety of evidence, including the acetaminophen-induced reduction of social awareness in adults, the prevalence of ASD through time, and crude estimates of the relative number of ASD cases induced by acetaminophen during various periods of neurodevelopment.

We conclude that the very early postpartum period poses the greatest risk for acetaminophen-induced ASD, and that nearly ubiquitous use of acetaminophen during early development could conceivably be responsible for the induction in the vast majority, perhaps 90% or more, of all cases of ASD.

Despite over a decade of accumulating evidence that acetaminophen is harmful for neurodevelopment, numerous studies demonstrate that acetaminophen is frequently administered to children in excess of currently approved amounts and under conditions in which it provides no benefit.

Further, studies have failed to demonstrate long-term benefits of acetaminophen for the pediatric population, leaving no valid rationale for continued use of the drug in that population given its risks to neurodevelopment.

Table 1 from the paper:

Note the number of peer-reviewed papers that link vaccination and acetaminophen with the onset of ASD in this table. So there are abundant data out there.

Stay tuned.

Stress and Folate Impact Neurodevelopmental Disorders

Journal of Health Care and Research

ISSN: 2582-8967, Article Type: Review Article, DOI: 10.36502/2024/hcr.6228

J Health Care and Research. 2024 Feb 07;5(1):1-6

Kai Ahmavaara, George Ayoub

1Psychology Dept, Santa Barbara City College, Santa Barbara, California 93109 USA

Abstract

Autism Spectrum Disorder (ASD) is one of several developmental disabilities that can create significant communication and behavioral challenges in affected individuals. Several studies have found that children with ASD have high levels of Folate Receptor Antibody (FRA), which blocks the transport of folate across the Blood-Brain Barrier (BBB) and leads to Cerebral Folate Deficiency (CFD). Supplementation with folate in its reduced form, such as with folinic acid, has been found to improve communication in autistic children with folate receptor antibodies. Here, we provide an overview of the role of folate in nervous system development, effects of FRA on brain folate levels, and clinical trials that have examined the efficacy of folate supplementation in reducing the symptoms of developmental disabilities.

Further, we highlight the importance of prenatal folate supplementation in reducing the risk and severity of developmental disorders and the need for additional research to explore optimal dietary interventions to aid in managing them. The results suggest that supplementing with reduced folate may offer a promising treatment approach for individuals with neurodevelopmental disorders, particularly those with FRA.

One of the more interesting scientific questions to be answered that arises from the conclusions of this paper, is how Tylenol could affect the Folate Receptor Antibody (FRA) – as noted, several studies have found that children with ASD have high levels of Folate Receptor Antibody (FRA).

I posed this question, “How could tylenol impact the Folate Receptor Antibody (FRA)” to CHAT-GPT,

and this was the answer:

This is all hypothetical, of course, but this is how good science is done. One asks questions. A lot of questions.

So, I then asked CHAT-GPT if any studies were testing this theory. This was the response.

Fascinating and an example of how AI is rapidly changing our world.

Association of cord plasma biomarkers of in utero acetaminophen exposure with risk of attention deficit/hyperactivity disorder and autism spectrum disorder in childhood.

JAMA Psychiatry. 2019.

Abstract

Importance: Prior studies have raised concern about maternal acetaminophen use during pregnancy and increased risk of attention-deficit/

hyperactivity disorder (ADHD) and autism spectrum disorder (ASD) in their children; however, most studies have relied on maternal self-report. Objective: To examine the prospective associations between cord plasma acetaminophen metabolites and physician-diagnosed ADHD, ASD, both ADHD and ASD, and developmental disabilities (DDs) in childhood.

Design, setting, and participants: This prospective cohort study analyzed 996 mother-infant dyads, a subset of the Boston Birth Cohort, who were enrolled at birth and followed up prospectively at the Boston Medical Center from October 1, 1998, to June 30, 2018.

Exposures: Three cord acetaminophen metabolites (unchanged acetaminophen, acetaminophen glucuronide, and 3-[N-acetyl-l-cystein-S-yl]-

acetaminophen) were measured in archived cord plasma samples collected at birth. Conclusions and relevance: Cord biomarkers of fetal exposure to acetaminophen were associated with significantly increased risk of childhood ADHD and ASD in a dose-response fashion. Our findings support previous studies regarding the association between prenatal and perinatal acetaminophen exposure and childhood neurodevelopmental risk and warrant additional investigations.

and

NIH-funded study suggests acetaminophen exposure in pregnancy linked to higher risk of ADHD, autism

NIH Media Advisory, 2019

Although the study cited in this 2019 media advisory is not recent news, the fact is that NIH has been calling attention to the risks of Tylenol use during pregnancy for over five years. So, as MSM screams that there is no scientific evidence, the truth is that our government has been calling attention to this and the studies behind the warnings for a long time.

Researchers analyzed data from the Boston Birth Cohort, a long-term study of factors influencing pregnancy and child development. They collected umbilical cord blood from 996 births and measured the amount of acetaminophen and two of its byproducts in each sample. By the time the children were an average of 8.9 years, 25.8% had been diagnosed with ADHD only, 6.6% with ASD only and 4.2% with ADHD and ASD. The researchers classified the amount of acetaminophen and its byproducts in the samples into thirds, from lowest to highest. Compared to the lowest third, the middle third of exposure was associated with about 2.26 times the risk for ADHD. The highest third of exposure was associated with 2.86 times the risk. Similarly, ASD risk was higher for those in the middle third (2.14 times) and highest third (3.62 times).

As the first trimester of pregnancy is when it is easiest to cause fetal damage, and many women are not aware that they are pregnant yet – this advisory should be taken seriously by any woman of childbearing age.

What is also important is that infant Acetaminophen is still on the market, recommended for both preterm and term infants. It is also recommended for pain relief after vaccination (which could compound neurological damage). Because of the known and unknown risks of Acetaminophen for infants, I advise parents to stop using Acetaminophen for their children or when a mother-to-be is experiencing pain – unless there are no other alternatives. Of note, ibuprofen can be used with infants after six months of age. This is a critical issue to discuss with your healthcare provider.

I am including the following paper because it shows how it took over thirty years for the scientific establishment to accept that vaccines cause Gulf War Illness (GWI). It is also important because it highlights the complex nature of compounding effects on vaccine injury, showing that both environmental factors and individual genetics may influence the severity of vaccine injury. The paper also documents that vaccine injury can persist for decades, if not for a lifetime.

These issues are all relevant to the understanding of ASD.

‘Anthrax Vaccination, Gulf War Illness, and Human Leukocyte Antigen (HLA)” Vaccines (Basel). 2024 Jun 4;12(6):613. doi:10.3390/vaccines12060613

GWI (Gulf War Illness) symptoms can last for decades and even longer, they often include persistent fatigue, muscle and joint pain, memory and concentration problems, headaches, gastrointestinal issues, skin rashes, and respiratory problems. In a recent study, they determined that vaccinated veterans were nearly 4 times more likely to develop GWI than non-vaccinated veterans, with symptom severity 1.6 times higher in those who had received the vaccine. Crucially, the study demonstrates that individual human leukocyte antigen (HLA) genetics determine susceptibility: veterans lacking specific protective HLA class II alleles could not mount an effective antibody response to the anthrax vaccine’s protective antigen (PA), leading to the persistence of this toxic antigen and the development of chronic illness.

Of note, when querying an AI (and I tried more than one), this was a typical response regarding what causes GWI:

“The weight of evidence points to neurotoxicant exposures—especially nerve agents, pesticides, and PB pills—as the primary drivers of Gulf War Illness, rather than psychological stress alone” -CHAT-GPT

Not a mention of vaccine-induced injury in their summary.

This is a prime example of how AIs cannot be trusted to provide evidence-based decisions about science and medicine.

People, we all need to dig deeper.

AI speaks with authority, but that doesn’t make it accurate or comprehensive.

So, there you have it —recent scientific evidence backing up President Trump’s statements regarding autism and Acetaminophen is significant. His remarks were responsible and entirely in line with current research.

All documented above for mainstream (dead) media to ignore.

Malone News is a reader-supported publication.

To receive new posts and support my work both here and elsewhere, consider becoming a paid subscriber.

Each of you make a difference.

Business

No Ministers, No Progress, Opposition Corners the Liberals in Ottawa

Conservatives and the Bloc demand cabinet face the hot seat before C-4 moves forward and open an investigation into offshore billions

Here’s the story. The Liberals jammed through their so-called affordability bill, C-4. And they didn’t wait for debate. Instead, they used a procedural shortcut called a Ways and Means motion. What does that mean? In Ottawa, a Ways and Means motion is the tool the government uses to make tax changes legally binding the moment the motion passes in the House of Commons even before the bill has gone through committee hearings or votes in Parliament.

So right now, the tax hikes, credits, and changes in C-4 are already in effect. Canadians are paying under these rules today. Yes, MPs on the Finance Committee are “studying” the bill, they’ll hold hearings, hear witnesses, and go through it line by line in what’s called clause-by-clause review. That’s normally the stage where MPs can debate and amend legislation. But with C-4, it’s happening after the fact.

Think about that. Implementation first, scrutiny later.

But this week, the opposition finally said: enough. Conservatives and the Bloc forced a new rule: no clause-by-clause until the ministers show up. Finance, Housing, Environment. One hour each. Separate panels. No ministers? No progress.

Why did they have to do this? Because the government has been stalling for months, refusing to commit to dates. Instead of ministers showing up in person, Liberals kept offering up everyone but the actual decision-makers, deputy ministers, senior bureaucrats, even departmental staff. The excuse? The ministers were “busy” all summer on so-called budget consultations which mostly looked like taxpayer-funded travel and photo-ops. Bloc MPs literally laughed when Liberal MP Ryan Turnbull tried to pass that off as a defense. And they were right to laugh.

For once, bureaucrats don’t get to hide behind their bosses’ schedules. The ministers themselves now have to sit in the hot seat, face MPs directly, and explain their decisions.

And it gets better. The committee also voted to launch a probe into offshore tax havens, the globalist money-laundering operations where billions vanish every year while small businesses get crushed by CRA audits. Remember the Panama Papers? The Paradise Papers? We learned then that Canada’s so-called revenue agency cut sweetheart deals with the rich, let corporate giants off the hook for billions, while squeezing ordinary taxpayers for every penny. Well, now Parliament is going to drag this into the light. Six meetings minimum. Finance officials. CRA brass. The Parliamentary Budget Officer. Even law-enforcement experts in financial crime. Imagine that… accountability.

And of course, the Liberals tried to stall it. They buried language in the motion that said the tax-haven probe could only begin “after the conclusion” of the affordability study, code for months of delay while ministers played hide-and-seek with their schedules. Why would they want that? Think about it: this is the same government hinting at cuts, floating austerity, telling Canadian public sector to brace for restraint. Yet at the same time, they show zero urgency in chasing down up to approx. $50 billion a year leaking into offshore tax shelters. Why on earth wouldn’t they want to plug that hole before they slash programs or raise taxes? But the opposition caught it, ripped it out, and forced a rewrite: the tax-haven study runs at the same time as C-4. No more excuses.

So what does this tell you? It tells you two things. First, the Liberals will rig process any way they can to avoid scrutiny, implement first, answer questions never. And second, when opposition MPs actually use the tools at their disposal, the swamp can be forced to act. Billions are at stake. Billions that should be lowering your taxes, funding real infrastructure, protecting Canadians instead of vanishing into shell companies in Barbados.

So the question is simple: will this committee have the courage to follow through? Or will the Liberals and their media allies smother it in delay and jargon until the public forgets?

One thing’s for sure: the smell of panic is back in Ottawa. And for taxpayers who’ve been bled dry while watching global elites hide their fortunes offshore, that’s very good news.

Subscribe to The Opposition with Dan Knight

I’m an independent Canadian journalist exposing corruption, delivering unfiltered truths and untold stories.

Invite your friends and earn rewards

If you enjoy The Opposition with Dan Knight , share it with your friends and earn rewards when they subscribe.

-

Agriculture2 days ago

Agriculture2 days agoOttawa’s EV Gamble Just Cost Canola Farmers Billions

-

Business2 days ago

Business2 days agoCanadian gov’t spending on DEI programs exceeds $1 billion since 2016

-

Autism16 hours ago

Autism16 hours agoPresident Trump, Secretary Kennedy Announce Bold Actions to Tackle Autism Epidemic

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoChoking The Night Away: Can Blue Jays/ Tigers Recover?

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCharlie Kirk Fought A Progressive Ideology That Punishes Truth

-

Crime2 days ago

Crime2 days agoCharlie Kirk’s Widow Says She Forgives Her Husband’s Assassin During Memorial

-

Health16 hours ago

Health16 hours agoRFK Jr.’s immunization committee recommends against MMRV vaccine for toddlers

-

National1 day ago

National1 day agoCanada Recognizes Palestine, Allows Taiwan to Be Sidelined: A Tale of Two Standards in Ottawa’s Foreign Policy