Alberta

Break the Fences, Keep the Frontier

Note: This post was written from notes prepared for a panel at the Canada Strong and Free Conference in Calgary on Sept 6. I am grateful for the invitation and the opportunity to explore solutions to recognized interprovincial barriers and push further beyond.

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

Alberta is the number one destination for Canadians seeking a better life. In the last 5 years, 1 of 3 Canadians moving out of their provinces seeking a better life have come to Alberta. People come to Alberta to escape stagnant wages, unaffordable housing, and the bureaucratic chokeholds of central Canada. They come for work, for opportunity, and for the chance to get ahead. Alberta doesn’t just have oil and gas; it has policies and an entrepreneurial culture that reward hard work. (Every province, except for PEI, has hydrocarbon resources, but most chose not to exploit them). That’s why the province often draws more people than it loses.

But Alberta cannot assume it will always stay ahead. Prosperity, like liberty, is not automatic, and it can vanish if Albertans get complacent. To remain the country’s economic frontier, Alberta must keep moving. That means tearing down the barriers to trade and commerce we still have and fighting the new ones Ottawa and other provinces are busy inventing.

The costs of standing still are enormous. Economists estimate internal trade barriers drain Canada of up to $130 billion a year, as much as seven percent of GDP, a fraction of what the Trump tariffs would inflict. For Alberta alone, even a ten percent reduction in interprovincial barriers would be worth $7.3 billion annually. And when Quebec blocked the Energy East pipeline, Alberta lost the chance to ship crude worth as much as $15 billion a year — roughly one-fifth of its economy. That isn’t theory; that is lost paycheques, foregone tax revenue, and hospitals and schools that never got funded.

Alberta has worked to make itself freer than most provinces. Liquor was privatized decades ago—Ditto for property registries. The New West Partnership has opened labour mobility and procurement between Alberta, Saskatchewan, Manitoba and B.C. Alberta imposes no cultural or linguistic tests on newcomers. No PST. These are the reasons people come here — because it’s easier to find work, to start a business, to access pristine natural environments, to raise your children, and to get on with your life. Less bureaucracy and fewer people telling you what to do and how to live.

But there are still cracks in the foundation. Alberta’s liquor market is open on the retail side, but still congested at the warehouse level due to the AGLC monopoly. Professional guilds in law, teaching, and health care slow down credential recognition. Public procurement often tilts local in ways that make no sense. And like every province, Alberta still bows to Ottawa’s telecommunications rules, the banking oligopoly, the dairy and poultry cartels (supply management), even though it benefits Quebec farmers and hurts Alberta’s. These barriers cost real money and serve no useful purpose.

If those are the old barriers, new ones are emerging. The most notorious new barrier isn’t new at all. This is the recently resurrected protectionist reflex in the RoC. For a century and a half, Canadians have built a culture that is contrary to the dream of their founding fathers to have open trade within the country. Canadians like to mock Donald Trump’s tariffs, but their instincts are no different. When Trump tariffed Canadian steel, Ottawa’s immediate answer was “We’ll buy Canadian” as retaliation. The elbows-up, “buy local” campaigns are no different from the commercial nationalism Trump is using. And the “buy local” impetus precedes Trump. They prop up the cartels and marketing boards, the oligopolistic giants in telecoms, banking, groceries, and construction. Such reflexes are not based on free market ideas.

What makes this 21st-century mercantilism sting even more is the lack of any real appetite in Ottawa to defend free trade. When Mark Carney announced he would “help” canola farmers, it was a double insult. First, it signalled that in the Prime Minister’s Office, there is no courage to fight for open markets abroad — subsidies at home are easier than complicated negotiations. Second, those subsidies are no gift: they are paid for by the very farmers they are supposed to help, through taxes collected in Saskatchewan and Alberta, among others, laundered through Ottawa’s bureaucracy, and handed back with a smile. This is Canada’s oligopoly culture in miniature: no defence of free markets, more subsidies to placate, and more Ottawa bureaucrats to process the paperwork. All of these come at a price. Ottawa money is never free money.

And the irony deepens. Carney himself promised that interprovincial barriers would be gone by July 1, 2025. He did not deliver. And his latest announcement of a new “process” to expedite infrastructure risks does precisely the opposite — adding new layers of federal meddling, vetoes and Ottawa bureaucrats into what should be provincial decisions.

Haultain Research is a reader-supported publication.

If you enjoy our work and would like to support us and see more of it, please share our posts

and consider becoming a paid subscriber.

The enforcement of Diversity, Equity, and Inclusion (DEI) initiatives, along with the surrounding culture, is a recent development. What began as workplace training has evolved into a mechanism for bureaucrats and gatekeepers to extend their authority. In some regions, such as Ontario, DEI mandates have been codified into law, forcing individuals to think and act in ways that are not of their own choosing.

This kind of identitarian enforcement saps productivity, creates “bullsh*t jobs” focused on compliance, and categorizes people instead of promoting unity among them. Most concerning is the way it restricts mobility for workers who don’t fit ideological criteria, punishing those who refuse to conform. This system creates opportunities only for a select, tiny class of individuals.

Alberta has a distinct advantage in this context, as it has not fully embraced the DEI agenda—apart from federal agencies and affiliated organizations, sadly including our own ATB. However, it must remain vigilant against the encroaching imposition of these practices.

The third significant challenge we face on the horizon is “debanking.” In 2022, we witnessed how swiftly Ottawa could order banks to freeze accounts, and how readily banks complied. Since then, federal regulators have been extending their influence under the guise of anti-money laundering regulations. The reality is straightforward: industries or individuals that federal governments deem undesirable can be cut off from financial services. For Alberta, with its energy sector labelled as a threat to the planet, this poses a considerable risk. Entire industries—or even individuals who consume “too much” energy—could soon find themselves excluded from the marketplace by radicals in the PMO.

David Suzuki once called for criminally charging folks he considered environmental offenders, and the NDP has expressed a preference for criminalizing support for the oil and gas sector (The NDP, ostensible fond of books in schools and free speech, also wants to criminalize asking questions about non-existent mass graves and the fictional narrative of genocide in Canada). A free economy loses its meaning if citizens can be excluded from it through government decrees. Alberta must protect its residents by establishing ATB as a fortress for banking, addressing any divisive tendencies, and enshrining access to banking as a civil right. Alberta needs to protect its citizens when those federally chartered banks act as enforcers for Ottawa.

So what does moving forward look like? Alberta has a strong culture of enterprise, but it cannot rest on its laurels. Unless it works to keep ahead, others will eventually catch up. Alberta must double down on being the most desirable place in Canada to live and work. That means bold and greater transformational reforms.

Breaking the cartel-like influence of professional regulators—such as teachers, lawyers, doctors, and nurses—who have transformed their organizations into barriers is crucial. These groups often prosecute their members to enforce ideological beliefs that most Albertans do not support.

Additionally, we need to ensure that access to banking is protected in provincial law, regulating credit unions so that no Albertan can be denied banking services for political reasons. We should also consider breaking up large municipalities to encourage smaller communities to compete for residents and businesses.

Ending the equalization payments and replacing them with a Goods and Services Tax (GST) transfer to Ottawa is necessary to ensure that Alberta’s wealth benefits Albertans directly. Healthcare delivery must be reformed so that patients receive timely services and genuine choices.

Furthermore, we should deregulate trucking and housing construction to make life more affordable for families. Finally, we must tackle public service unions that operate like political monopolies, using examples from small towns like Coaldale to demonstrate how reform can begin at the grassroots level.

Canada advocates for free trade but often behaves like a medieval guild. Alberta has demonstrated that a more liberated approach is viable, but the province must continue to leverage its advantages. This involves resisting cartels, challenging the banks, dismantling outdated barriers, and preventing the emergence of new ones before they become too imposing.

Alberta has always been a frontier — a place where people come to build, take risks, and prosper. Frontiers are not maintained by standing still; they thrive by moving forward. If Alberta continues to push ahead, it can remain the engine of prosperity and the most desirable place to live and work. However, if it becomes complacent, it risks falling behind, becoming weaker, and Ottawa will be more than willing to take advantage of that.

The choice is simple: Alberta can either be fenced in by cartels and bureaucrats, or it can break the fences and keep the frontier open. That is the task, and it is one worthy of Alberta’s spirit.

For the full experience, and to help us bring you more quality research and commentary, please upgrade your subscription.

Alberta

Canada’s heavy oil finds new fans as global demand rises

From the Canadian Energy Centre

By Will Gibson

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices”

Once priced at a steep discount to its lighter, sweeter counterparts, Canadian oil has earned growing admiration—and market share—among new customers in Asia.

Canada’s oil exports are primarily “heavy” oil from the Alberta oil sands, compared to oil from more conventional “light” plays like the Permian Basin in the U.S.

One way to think of it is that heavy oil is thick and does not flow easily, while light oil is thin and flows freely, like fudge compared to apple juice.

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices,” said Susan Bell, senior vice-president of downstream research with Rystad Energy.

A narrowing price gap

Alberta’s heavy oil producers generally receive a lower price than light oil producers, partly a result of different crude quality but mainly because of the cost of transportation, according to S&P Global.

The “differential” between Western Canadian Select (WCS) and West Texas Intermediate (WTI) blew out to nearly US$50 per barrel in 2018 because of pipeline bottlenecks, forcing Alberta to step in and cut production.

So far this year, the differential has narrowed to as little as US$10 per barrel, averaging around US$12, according to GLJ Petroleum Consultants.

“The differential between WCS and WTI is the narrowest I’ve seen in three decades working in the industry,” Bell said.

Trans Mountain Expansion opens the door to Asia

Oil tanker docked at the Westridge Marine Terminal in Burnaby, B.C. Photo courtesy Trans Mountain Corporation

The price boost is thanks to the Trans Mountain expansion, which opened a new gateway to Asia in May 2024 by nearly tripling the pipeline’s capacity.

This helps fill the supply void left by other major regions that export heavy oil – Venezuela and Mexico – where production is declining or unsteady.

Canadian oil exports outside the United States reached a record 525,000 barrels per day in July 2025, the latest month of data available from the Canada Energy Regulator.

China leads Asian buyers since the expansion went into service, along with Japan, Brunei and Singapore, Bloomberg reports.

Asian refineries see opportunity in heavy oil

“What we are seeing now is a lot of refineries in the Asian market have been exposed long enough to WCS and now are comfortable with taking on regular shipments,” Bell said.

Kevin Birn, chief analyst for Canadian oil markets at S&P Global, said rising demand for heavier crude in Asia comes from refineries expanding capacity to process it and capture more value from lower-cost feedstocks.

“They’ve invested in capital improvements on the front end to convert heavier oils into more valuable refined products,” said Birn, who also heads S&P’s Center of Emissions Excellence.

Refiners in the U.S. Gulf Coast and Midwest made similar investments over the past 40 years to capitalize on supply from Latin America and the oil sands, he said.

While oil sands output has grown, supplies from Latin America have declined.

Mexico’s state oil company, Pemex, reports it produced roughly 1.6 million barrels per day in the second quarter of 2025, a steep drop from 2.3 million in 2015 and 2.6 million in 2010.

Meanwhile, Venezuela’s oil production, which was nearly 2.9 million barrels per day in 2010, was just 965,000 barrels per day this September, according to OPEC.

The case for more Canadian pipelines

Worker at an oil sands SAGD processing facility in northern Alberta. Photo courtesy Strathcona Resources

“The growth in heavy demand, and decline of other sources of heavy supply has contributed to a tighter market for heavy oil and narrower spreads,” Birn said.

Even the International Energy Agency, known for its bearish projections of future oil demand, sees rising global use of extra-heavy oil through 2050.

The chief impediments to Canada building new pipelines to meet the demand are political rather than market-based, said both Bell and Birn.

“There is absolutely a business case for a second pipeline to tidewater,” Bell said.

“The challenge is other hurdles limiting the growth in the industry, including legislation such as the tanker ban or the oil and gas emissions cap.”

A strategic choice for Canada

Because Alberta’s oil sands will continue a steady, reliable and low-cost supply of heavy oil into the future, Birn said policymakers and Canadians have options.

“Canada needs to ask itself whether to continue to expand pipeline capacity south to the United States or to access global markets itself, which would bring more competition for its products.”

Alberta

Gondek’s exit as mayor marks a turning point for Calgary

This article supplied by Troy Media.

The mayor’s controversial term is over, but a divided conservative base may struggle to take the city in a new direction

Calgary’s mayoral election went to a recount. Independent candidate Jeromy Farkas won with 91,112 votes (26.1 per cent). Communities First candidate Sonya Sharp was a very close second with 90,496 votes (26 per cent) and controversial incumbent mayor Jyoti Gondek finished third with 71,502 votes (20.5 per cent).

Gondek’s embarrassing tenure as mayor is finally over.

Gondek’s list of political and economic failures in just a single four-year term could easily fill a few book chapters—and most likely will at some point. She declared a climate emergency on her first day as Calgary’s mayor that virtually no one in the city asked for. She supported a four per cent tax increase during the COVID-19 pandemic, when many individuals and families were struggling to make ends meet. She snubbed the Dec. 2023 menorah lighting during Hanukkah because speakers were going to voice support for Israel a mere two months after the country was attacked by the bloodthirsty terrorist organization Hamas. The

Calgary Party even accused her last month of spending over $112,000 in taxpayers’ money for an “image makeover and brand redevelopment” that could have benefited her re-election campaign.

How did Gondek get elected mayor of Calgary with 176,344 votes in 2021, which is over 45 per cent of the electorate?

“Calgary may be a historically right-of-centre city,” I wrote in a recent National Post column, “but it’s experienced some unusual voting behaviour when it comes to mayoral elections. Its last three mayors, Dave Bronconnier, Naheed Nenshi and Gondek, have all been Liberal or left-leaning. There have also been an assortment of other Liberal mayors in recent decades like Al Duerr and, before he had a political epiphany, Ralph Klein.”

In fairness, many Canadians used to support the concept of balancing their votes in federal, provincial and municipal politics. I knew of some colleagues, friends and family members, including my father, who used to vote for the federal Liberals and Ontario PCs. There were a couple who supported the federal PCs and Ontario Liberals in several instances. In the case of one of my late

grandfathers, he gave a stray vote for Brian Mulroney’s federal PCs, the NDP and even its predecessor, the Co-operative Commonwealth Federation.

That’s not the case any longer. The more typical voting pattern in modern Canada is one of ideological consistency. Conservatives vote for Conservative candidates, Liberals vote for Liberal candidates, and so forth. There are some rare exceptions in municipal politics, such as the late Toronto mayor Rob Ford’s populistconservative agenda winning over a very Liberal city in 2010. It doesn’t happen very often these days, however.

I’ve always been a proponent of ideological consistency. It’s a more logical way of voting instead of throwing away one vote (so to speak) for some perceived model of political balance. There will always be people who straddle the political fence and vote for different parties and candidates during an election. That’s their right in a democratic society, but it often creates a type of ideological inconsistency that doesn’t benefit voters, parties or the political process in general.

Calgary goes against the grain in municipal politics. The city’s political dynamics are very different today due to migration, immigration and the like. Support for fiscal and social conservatism may still exist in Alberta, but the urban-rural split has become more profound and meaningful than the historic left-right divide. This makes the task of winning Calgary in elections more difficult for today’s provincial and federal Conservatives, as well as right-leaning mayoral candidates.

That’s what we witnessed during the Oct. 20 municipal election. Some Calgary Conservatives believed that Farkas was a more progressive-oriented conservative or centrist with a less fiscally conservative plan and outlook for the city. They viewed Sharp, the leader of a right-leaning municipal party founded last December, as a small “c” conservative and much closer to their ideology. Conversely, some Calgary Conservatives felt that Farkas, and not Sharp, would be a better Conservative option for mayor because he seemed less ideological in his outlook.

When you put it all together, Conservatives in what used to be one of the most right-leaning cities in a historically right-leaning province couldn’t decide who was the best political option available to replace the left-wing incumbent mayor. Time will tell if they chose wisely.

Fortunately, the razor-thin vote split didn’t save Gondek’s political hide. Maybe ideological consistency will finally win the day in Calgary municipal politics once the recount has ended and the city’s next mayor has been certified.

Michael Taube is a political commentator, Troy Media syndicated columnist and former speechwriter for Prime Minister Stephen Harper. He holds a master’s degree in comparative politics from the London School of Economics, lending academic rigour to his political insights.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

Business1 day ago

Business1 day agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

Business1 day ago

Business1 day agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

-

Environment1 day ago

Environment1 day agoThe era of Climate Change Alarmism is over

-

Automotive1 day ago

Automotive1 day agoCarney’s Budget Risks Another Costly EV Bet

-

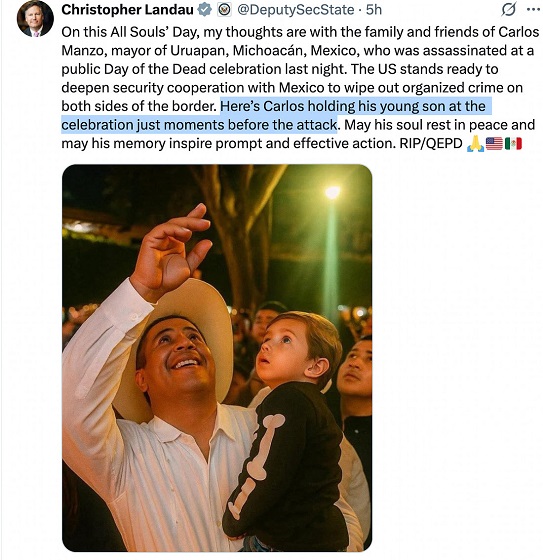

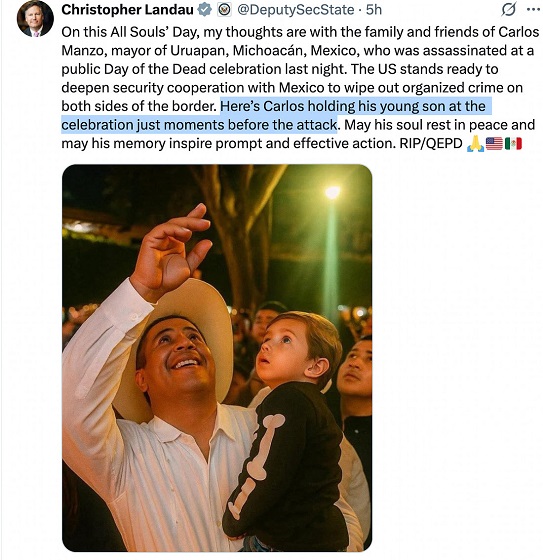

Crime20 hours ago

Crime20 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Aristotle Foundation20 hours ago

Aristotle Foundation20 hours agoB.C. government laid groundwork for turning private property into Aboriginal land

-

Justice19 hours ago

Justice19 hours agoA Justice System That Hates Punishment Can’t Protect the Innocent