Economy

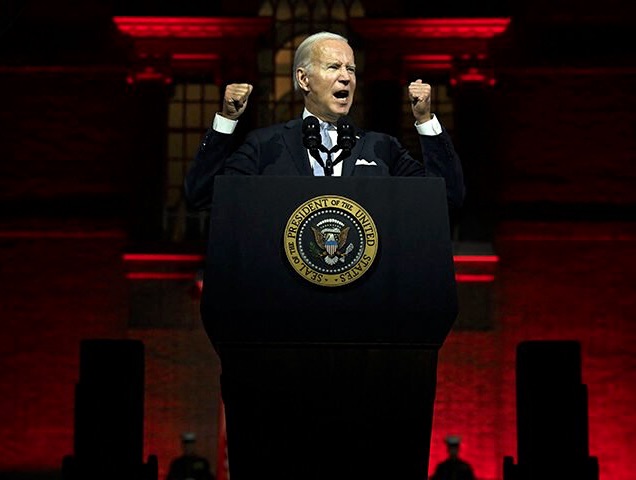

Biden Is Failing The World

You can see that in Poland people are actually burning trash to stay warm. Burning trash in your fireplace creates toxic smoke. It’s hazardous. The government’s considering handing out masks so people can breathe more safely when they’re outdoors.

Recall that natural gas is the reason the United States reduced its carbon emissions more than any other country in the world. Carbon emissions have been on the decline globally, in large measure, because of the transition from coal to gas. Natural gas is something that most reasonable people agree is a superior fuel to coal. Natural gas is the reason the United States reduced its emissions by 22% between 2005 and 2020, which is five percentage points more than the United States had agreed to reduce our emissions under cap and trade legislation, which nearly passed Congress in 2010 and under the UN Paris Climate Agreement.

The above is a graph that was produced by Matthew Yglesias, a well-known progressive blogger. He tweets it out whenever somebody points out that President Biden isn’t doing all he can to expand oil and gas production. It’s accurate. It does show that oil production increased on a daily average under Biden from under Trump. But it’s deeply misleading. You have to remember that under Trump, the Coronavirus pandemic, for several months, massively slashed oil production.

You can see from the below chart of the EIA data on crude oil production that we still haven’t gotten back to where we were before the pandemic. Now consider how the need is much greater for US oil now that Europe and the United States are rejecting Russian oil.Upgrade

The United States is the biggest liquified natural gas exporter, it’s true. But it takes five years to bring online new LNG capacity in the United States. So all of the new LNG that’s come online during Biden’s presidency was due to past presidents.

And Biden has leased less land than any President since World War II. It’s a shockingly small amount of land: 130,000 acres as opposed to seven million acres under Obama, four million acres under Trump, during the first 19 months of their administrations. It’s a huge reduction in the amount of land being leased.

You can see that in some particular cases, like a very large oil and gas sale in Alaska, the Department of Interior claimed there wasn’t any industry interest in the lease. This turned out not to be the case. The Senator from Alaska, Lisa Markowski said, “I can say with full certainty based on conversations as recently as last night, that Alaska’s industry does have an interest in lease sales and the Cook Inlet to claim otherwise is simply false, not to mention stunningly shortsighted.”

People point out the oil and gas industry does have many thousands of leases, and that’s true, but there’s a high degree of uncertainty about whether the leases they have will produce oil and gas at levels that make sense economically to produce from.

So increasing oil and gas leasing at a time of an energy crisis in Europe seems like a no-brainer, but the Biden administration is not doing that. In fact, it’s been preventing the expansion of gas in many other ways.

You can see the Biden administration denied a request to have a formaldehyde regulation exempted. All else being equal, you’d wanna reduce that pollution. But I think a little bit of formaldehyde is gonna be a less toxic airborne event than having people breathing toxic wood and plastic smoke in Europe. The right thing to do, in terms of aiding our allies, would be to wave that regulation. But the Biden administration refused.

You can see that the Biden administration is actively considering forgoing all new offshore drilling in the Atlantic and Pacific. It may do no offshore leases at all for oil and gas.

Instead, the Biden administration has sought to give sanctions relief to Venezuela in the hopes that Venezuela would produce more oil. And of course, most famously Biden went to Saudi Arabia to ask the Saudis to produce more oil in July. Now, everybody agrees that was a huge foreign policy failure. The Saudis announced they would be cutting production with the rest of OPEC+. The Biden administration’s pressure on the Saudis apparently annoyed them. Now, they’ve been pushed closer into the arms of Russia. This is a pretty significant setback for the Biden administration.

At the same time Biden was going to Venezuela and Saudi Arabia to produce more oil. Biden administration was refusing to even meet with oil and gas executives. That’s a pretty serious snub when you consider that it’s an industry you want to expand production.

An oil and gas analyst on Twitter criticized a Senator from Wisconsin for suggesting the Democrats are responsible for the lack of refining capacity. He said, “What — do you also blame a political party for a flat tire?”

I pointed out that a single oil refinery outage would have little impact if we had sufficient refinery capacity, and the reason we don’t is that politicians, mostly Democrats have used regulations to prevent their construction. When I interviewed executives one said to me, “If you were an oil company, why would you invest hundreds of millions of dollars into expanding refining capacity if you thought the federal government would shut you down in the next few years? The narrative coming out of this administration is absolutely insane.”

So you can see here that refinery capacity was increasing all the way through 2020. It then declined due to the pandemic. And it has not risen since then. When the analyst was asked, why don’t we get more refineries? He clearly didn’t know. Or at least he said he didn’t know. But it’s clear the Biden administration has not wanted more refineries.

There was a chance to retrofit a major refinery in the US Virgin Islands. It was a refinery that was older. It needed pretty significant upgrades. It was polluting. But these are machines that can be fixed. Several billion dollars of investment would’ve fixed it and it goes back many years. This is an article from 2008. It describes how, at that time, the Democrats in the Senate killed a proposal for refinery expansion.

Go back to 2006. The same thing happened. The House was in the hands of the Republicans who passed a piece of legislation to expand refineries. And it was the Democrats who killed it. And, incidentally, they’re using the exact same arguments today that they used back then.

More recently, we’ve seen an attack on expanded natural gas pipeline capacity, including from Pennsylvania to the Northeast, particularly to Boston. The result of not having pipeline capacity is that they’ve been burning more oil for electricity in New England. In fact, oil-fired power jumped to a four-year high earlier this year. And they’ve been having to import liquified natural gas to New England rather than just pipe it in, which is significantly cheaper. Probably half as expensive.

Grassroots advocacy and lawsuits have prevented pipelines from being built. You can see there’s a strong correlation between the price of natural gas and the ability to get pipelines built. We stop building pipelines and gas gets more expensive. Globally, the impact is that we’re gonna return to coal. This is the consequence of stifling oil and gas production.

One could argue that we just need more scarcity in order to accelerate the transition to electric cars. But it’s notable that the major figures in this, including President Biden, supporters of President Biden, and representatives of his administration aren’t defending a pro-scarcity position. They’re instead claiming that they’re doing all they can to bring down oil and gas prices and expand production.

I think this data, and the historical chronology, paint a picture that shows that there has, in fact, been a war on natural gas and oil United States and that it is impacting global supplies, and leaving Europe vulnerable.

Click to see the video presentation of this article. Additional slides and graphs are in the video.

Subscribe to Michael Shellenberger

Reporting on cities, energy, and the environment

Economy

Reconciliation means clearing the way for Indigenous leadership

From the Resource Works team.

On Truth and Reconciliation Day, Canadians are asked to honour residential school survivors and to support the families and communities who must live with that history.

It also calls for action, not mere commemoration. The Truth and Reconciliation Commission called for structural change in Canada, and that means clearing the way for Indigenous leadership across this country.

Economic reconciliation is a practical journey that shifts decision-making and ownership towards First Nations and Indigenous people more generally.

Throughout B.C., First Nations are already practicing what that looks like. The Osoyoos Indian Band has built a diverse economy in tourism, wine, and recreation that has sustained steady jobs and revenue.

“I think all Native leadership need to get the economic development focus going on and make the economy the number one issue. It’s the economy that looks after everything,” Chief Clarence Louie has said. That sense of mission, along with assets like Nk’Mip Cellars and Spirit Ridge, has helped to turn Osoyoos into a B.C. success story.

On the coast, the Haisla Nation is leading in innovation in the LNG sector. In 2024, the Cedar LNG facility was granted a positive final investment decision, along with the Haisla’s majority ownership of the $4 billion project.

“Today is about changing the course of history for my Nation and Indigenous peoples,” said Haisla Chief Councillor Crystal Smith during the long approval process. By seeing the project through, Haisla ownership has created the means to fund language, health care, and opportunity for generations that had found all of that out of reach.

In the Lower Mainland, the Squamish Nation’s Sen̓áḵw development is one of the biggest projects in the Vancouver real estate market, and will become an asset for decades to come.

“This project is not just about buildings, it’s about bringing the Squamish People back to the land, making our presence felt once again in the heart of our ancestral territory, and creating long term wealth for the Squamish Nation,” said Council Chairperson Khelsilem.

The Squamish recently restructured the partnership so Squamish holds half of phases one and two and all of phases three and four, while welcoming OPTrust to a 50 percent stake in the early phases. Indigenous leadership is not just transforming the rural resource economy, but the urban one as well.

Chief Ian Campbell of the Squamish Nation, former chair of the Indigenous Partnerships Success Showcase event in Vancouver, has said that economic reconciliation is essential to the future of Canada.

“To move forward and reframe that complex dynamic, and put the lens on economic reconciliation, to me, is the path forward to create mutual benefits and values that benefit all Canadians, which includes Indigenous people,” said Campbell.

For governments and industry, there is a duty to align policy, permitting, and capital flows with Indigenous-led priorities. Beyond benefits agreements, reconciliation requires listening both early and attentively, and ensuring cooperation every step of the way.

The Bank of Canada itself has noted that “tremendous untapped potential exists”, but only when private firms and public agencies commit to economic reconciliation.

Listening also means resisting the temptation to cast Indigenous peoples as either monolithic supporters or opponents of development. Figures like Ellis Ross, former Chief Councillor of the Haisla, and his successor Crystal Smith have challenged these narratives, pointing instead to Haisla and neighbouring Nations’ experience with real jobs, careers, and community services tied to LNG and related infrastructure.

The Haisla message is straightforward: the path to revitalized language and culture runs through sustained opportunity and self-determination.

Truth and Reconciliation Day is a reminder that the past matters, and this is evident in the inequities of the present and in the possibilities now being realized by Nations that are reclaiming jurisdiction and building enterprises on their own terms.

Our task is to ensure public policy and corporate practice do not get in the way. On September 30, we remember, and then on October 1 and every day after, we have work to do.

Alberta

Taxpayers: Alberta must scrap its industrial carbon tax

-

Carney praises carbon taxes on world stage

-

Alberta must block Carney’s industrial carbon tax

The Canadian Taxpayers Federation is calling on the government of Alberta to completely scrap its provincial industrial carbon tax.

“It’s baffling that Alberta is still clinging to its industrial carbon tax even though Saskatchewan has declared itself to be a carbon tax-free zone,” said Kris Sims, CTF Alberta Director. “Prime Minister Mark Carney is cooking up his new industrial carbon tax in Ottawa and Alberta needs to fight that head on.

“Alberta having its own industrial carbon tax invites Carney to barge through our door with his punishing industrial carbon tax.”

On Sept. 16, the Alberta government announced some changes to Alberta’s industrial carbon tax, but the tax remains in effect.

On Friday night at the Global Progress Action Summitt held in London, England, Carney praised carbon taxes while speaking onstage with British Prime Minister Keir Starmer.

“The direct carbon tax which had become a divisive issue, it was a textbook good policy, but a divisive issue,” Carney said.

During the federal election, Carney promised to remove the more visible consumer carbon tax and change it into a bigger hidden industrial carbon tax. He also announced plans to create “border adjustment mechanisms” on imports from countries that do not have national carbon taxes, also known as carbon tax tariffs.

“Carney’s ‘textbook good policy’ comments about carbon taxes shows his government is still cooking up a new industrial carbon tax and it’s also planning on imposing carbon tax tariffs,” Sims said. “Alberta should stand with Saskatchewan and obliterate all carbon taxes in our province, otherwise we are opening the door for Ottawa to keep kicking us.”

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoCanada To Revive Online Censorship Targeting “Harmful” Content, “Hate” Speech, and Deepfakes

-

Alberta2 days ago

Alberta2 days agoAlberta refuses to take part in Canadian government’s gun buyback program

-

Business1 day ago

Business1 day agoTaxpayers deserve proof of how politicians spend their money

-

Business1 day ago

Business1 day agoOttawa’s civil service needs a Chrétien-style reset

-

Alberta2 days ago

Alberta2 days agoOrthodox church burns to the ground in another suspected arson in Alberta

-

Fraser Institute1 day ago

Fraser Institute1 day agoAboriginal rights now more constitutionally powerful than any Charter right

-

Alberta1 day ago

Alberta1 day ago$150 a week from the Province to help families with students 12 and under if teachers go on strike next week

-

International1 day ago

International1 day agoTrump gives Hamas four days to choose: peace or obliteration