Business

BC voters ditching climate crisis for promise to unlock natural resource development

From Energy Now

The LNG Canada facility under construction in Kitimat, British Columbia

Climate Goals Face B.C. Election Backlash in Home of Greenpeace – B.C. Conservatives Have Upended Race With Focus on Unlocking Natural Resource Development

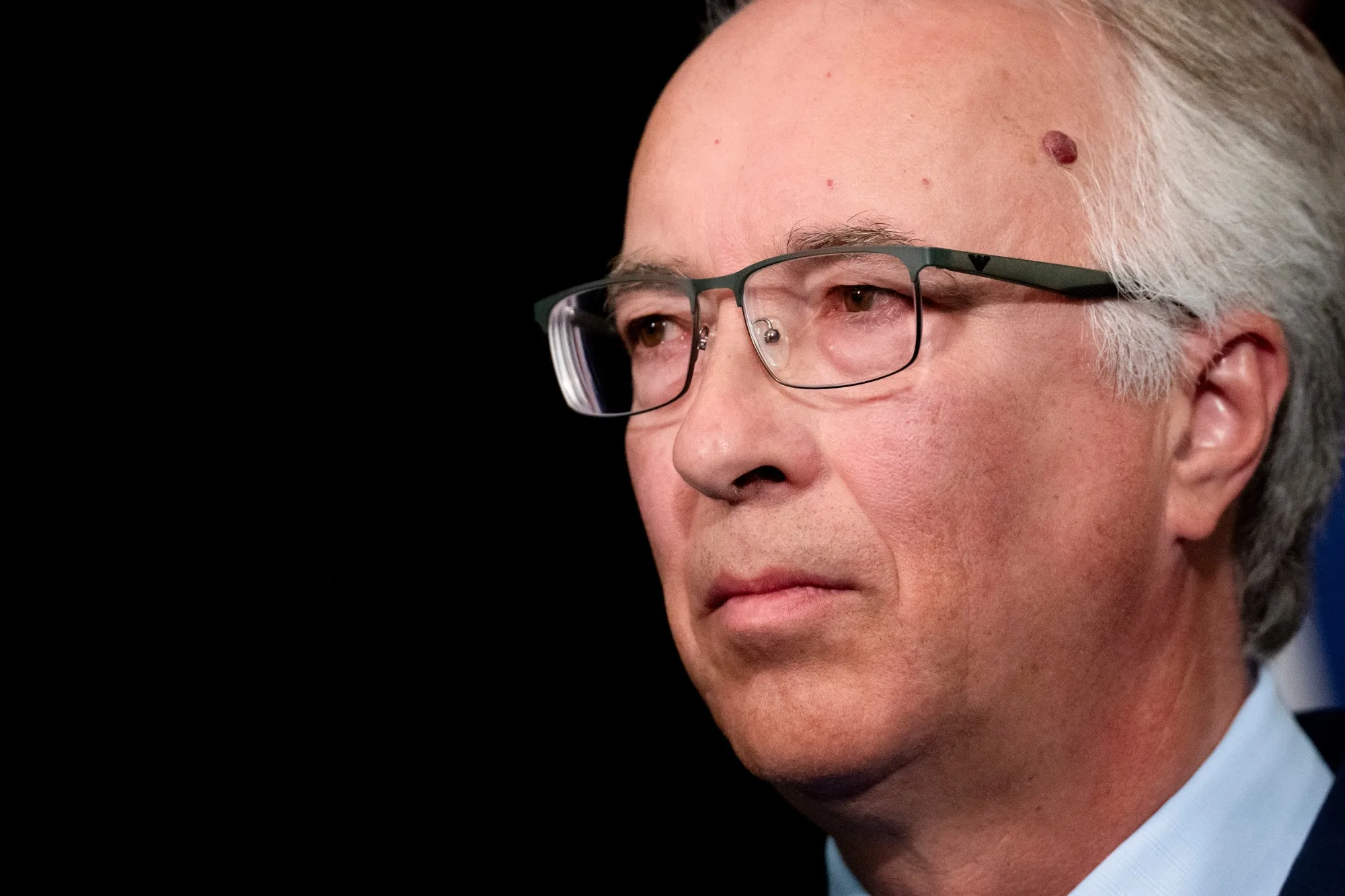

An unlikely political upstart in Canada’s third-largest province, expelled from his previous party for climate science skepticism, is within striking distance of winning power with promises to ditch environmental targets and unleash natural-resources development.

The surge in support for John Rustad’s Conservative Party of British Columbia ahead of the Oct. 19 election may have been helped by the popularity of the unaffiliated federal Conservatives. Victory would add to the roster of right-leaning premiers at odds with Prime Minister Justin Trudeau’s Liberal government in Ottawa.

A Conservative government in BC might mark a bigger shift than anywhere else in the country. The province is famous for environmentalism — Vancouver is the birthplace of Greenpeace and home to Canada’s most famous climate activist, David Suzuki. David Eby, the current premier, unsuccessfully opposed the expansion of the Trans Mountain oil pipeline, and back in 2008 the province brought in one of North America’s first carbon taxes.

Although polls favor Eby’s left-leaning New Democratic Party, it’s close, and a spread between pollsters suggests the result remains unpredictable.

The public has endured inflation and strained local services, slower growth in an economy dragged by higher interest rates and lower exports, and a government that’s gone from surplus to a record C$9 billion ($6.5 billion) deficit. British Columbia, once rated AAA by S&P Global Ratings, has suffered three credit rating downgrades in three years.

Conservatives Have Surged in BC Polls

British Columbia’s Conservatives vault official opposition in election surprise

The ruling NDP — whose origins lie in labor unions — is parrying criticism of its own mixed seven-year record in office. It’s running on blunting the cost of living with subsidies, tying the minimum wage to inflation, taxing home speculation, blocking Airbnb Inc.-style short-term rentals and using hydrocarbon revenues for a “clean economy transition fund.”

Rustad’s rise is also a stunning tale of revenge. The longtime representative of Nechako Lakes — a district 600 miles north of Vancouver in BC’s deep interior — was kicked out of the BC Liberal Party in 2022 on his birthday after sharing a social media post questioning carbon dioxide’s effect on the climate. He took over the BC Conservative Party, then a marginal force in provincial politics. Before long it had leapfrogged his old party in the polls.

Acrimonious talks to merge the two groups failed, and by August the previously formidable Liberals — which had rebranded as BC United — gave up, withdrawing from the election in an effort to unite voters against the NDP.

Unlocking Natural Resources

In an interview with Bloomberg, Rustad said he won’t cut social, health or education spending — a majority of the budget. He’s also promising tax cuts and plans to deepen the deficit to more than C$10 billion in his first year.

His plan to balance BC’s budget over eight years is based on an optimistic 5.4% average GDP growth rate to 2030 — more than double the average rate of the past five years — fueled by axing CleanBC, the NDP plan to cut BC’s emissions 40% by 2030. Rustad said that would save as much as C$2.5 billion in government spending, then bring in billions in extra revenue by unlocking industrial projects.

Foremost among them is LNG Canada, a new liquefied natural gas project in the remote north that the federal government said may be worth C$40 billion — possibly the largest private investment in the country’s history. There’s a plan to double its size, but it’s proving tricky to power with BC’s zero-emission hydroelectricity instead of fossil fuels, because it would need a new transmission line, with one previous cost estimate at C$3 billion.

Not a problem if looser rules let them burn gas.

“In British Columbia, we could stop everything we do, and by next year the increases from China and India will swamp anything that we’ve done,” Rustad told Bloomberg. “So my perspective is we need to make sure we’re looking after people. And so for a changing climate, we need to be able to adapt to it.”

When he appeared on climate-skeptic Canadian influencer Jordan Peterson’s podcast, Rustad said: “How is it that we’ve convinced carbon-based beings that carbon is a problem?”

Rustad also talked up billions in extra revenue from streamlining mine permits — one of BC’s oldest industries and more prominent in the remoter parts of the province he hails from.

Asked about BC’s rural vote, Rustad says: “There’s no question, the NDP completely ignored it.”

Rustad also wants to ditch BC’s carbon tax to cut costs for businesses and consumers. That’s also the top rallying cry for federal Conservatives, who are trying to force a “carbon tax election” to topple Trudeau. Provincial carbon taxes are federally back-stopped, so to banish the tax Rustad would need the Conservative Party of Canada to take power.

“The top-of-mind issues that people are frustrated about are inflation and the cost of living, housing and health care,” Kathryn Harrison, a political science professor at the University of British Columbia, said in an interview. “And what we’ve seen is that the federal Conservative Leader Pierre Poilievre has been able to connect those public concerns with the carbon tax. It’s given them something that they can focus their frustrations on.”

Even the climate-conscious NDP has pivoted away from defending the carbon tax to pledging they would repeal it for consumers — but unlike the Conservatives, they would shift the burden to corporate “polluters.”

In his plan to speed up business, Rustad has also taken issue with BC’s Declaration on the Rights of Indigenous Peoples Act because it causes “friction”. It requires government to seek Indigenous people’s “free, prior and informed consent” to implement measures that may affect BC’s more than 200 Indigenous communities.

Rustad’s Conservatives include Indigenous candidates, and he talks about supporting economic reconciliation — the material, financial side of redressing Canada’s colonial injustices. But some First Nations leaders have called his platform “dangerous” for pitting British Columbians against each other.

Relentless Controversies

Rustad’s biggest weak point may be the controversial things said my members of his team, leading to relentless stories since they’ve been thrust into the spotlight.

Despite his dry, phlegmatic style, the same goes for Rustad himself. He’s said he regretted getting the “so-called” Covid-19 vaccine, and a clip showed him seeming to go along with an activist’s concept of “Nuremberg 2.0” — trials for officials who oversaw pandemic health measures. Rustad apologized and said he “misunderstood” the question.

Rival party staffers gave out BC Conservative-branded tinfoil hats after a candidate’s shared posts described 5G wireless signals as a weapon, according to local media. She was ousted, but another candidate who claimed vaccines can cause a type of AIDS remains part of the caucus.

Another apologized last week for posts including one in 2015 calling Palestinians “inbred walking, talking, breathing time bombs.”

In communities like Metro Vancouver, some of the most diverse in North America, that kind of thing may jeopardize Rustad’s path to power.

But Rustad is also being cheered on by what Harrison described as an “accidental collection of voters who share frustration with the cost of living, the cost of housing, emergency room closures” — which could span from suburban families who judge the economy isn’t working for them to BC’s wealthiest, including billionaire Lululemon Athletica Inc founder Chip Wilson.

If Rustad pulls it off, his unorthodox strategy to turn one of Canada’s progressive strongholds conservative will reverberate with those fighting federal politics in the nation’s capital 3,000 miles away.

Business

Deadlocked Jury Zeroes In on Alleged US$40 Million PPE Fraud in Linda Sun PRC Influence Case

A jury of New Yorkers will return to court Monday, heading into their second week of deliberations in a landmark foreign-agent and corruption trial that reaches into two governors’ offices, struggling to decide whether former state official Linda Sun secretly served Beijing’s interests while she and her husband built a small business and luxury-property empire cashing in on pandemic-era contracts as other Americans were locked down.

On Thursday — the fourth day of deliberations — the jury sent federal Judge Brian Cogan a blunt note saying they were deadlocked on the sprawling case, in which the federal government has asked jurors to accept its account of a complex web of family and Chinese-community financial transactions through which Sun and her husband allegedly secured many millions of dollars in Chinese business deals channeled through “United Front” proxies aligned with Beijing.

The defense, by contrast, argues that Sun and her husband were simply successful through legitimate, culturally familiar transactions, not any covert scheme directed by a foreign state.

“We deeply feel that no progress can be made to change any jurors’ judgment on all counts,” the panel wrote Thursday. “There are fundamental differences on the evidence and the interpretation of the law. We cannot come to a unanimous decision.”

Cogan reportedly responded with a standard “Allen charge” — an instruction often used in deadlock situations, urging jurors to keep an open mind and continue deliberating. Because a juror had to be replaced due to travel commitments, the reconstituted panel will need to restart deliberations from square one on Monday.

According to a message the U.S. Justice Department sent to The Bureau on Wednesday, the panel had already asked for transcripts from four witnesses — Sean Carroll, Mary Beth Hefner, Karen Gallacchi and Jenny Low.

Those requests underline just how dense the case is — and how much money was at stake in the pandemic-era PPE deals at the heart of several key counts. Sun and her husband, businessman Chris Hu, face 19 counts in total, including Sun acting as an unregistered foreign agent for the People’s Republic of China; visa-fraud and alien-smuggling charges tied to a 2019 Henan provincial delegation; a multimillion-dollar pandemic PPE kickback scheme; bank-fraud and identity-misuse allegations; and multiple money-laundering and tax-evasion counts.

Carroll and Hefner’s testimony is central to the government’s key procurement-corruption allegation. Prosecutors say Sun used her influence to help steer more than US$40 million in PPE contracts to companies tied to her husband in China, with an expected profit of roughly US$8 million — money they allege was partly kicked back to Sun and Hu and funneled through accounts opened in Sun’s mother’s name and via friends and relatives.

Prosecutors say the clearest money trail in the Sun case runs through New York’s COVID PPE scramble and a pair of Jiangsu-linked emails.

“What was Linda Sun’s reward for taking official action to steer these contracts through the procurement process? Millions of dollars in kickbacks or bribes. It was money that she knew would be coming her way if she pushed these contracts through,” prosecutor Alexander Solomon told jurors in closing.

He argued that in March 2020, as the pandemic hit, a Jiangsu provincial official in Albany emailed state staff, including Sun, with information on four Chinese PPE and medical suppliers — and that the next day Sun forwarded herself a second email that copied the language about two of those vendors but added a new line claiming that “High Hope comes highly recommended by the Jiangsu Department of Commerce.”

A New York State IT specialist testified that this exact phrase appears only once in the state’s entire email system, in Sun’s self-forwarded message. Prosecutors urged jurors to see it as a fabricated email.

They suggest it is one of a number of frauds and forgeries, including claims that Sun repeatedly faked Governor Kathy Hochul’s signature on invitation letters used to bring Chinese provincial officials into the United States as part of plans to build a large education complex in New York.

On the PPE dealings, prosecutors say that during a period when Sun still had broad latitude to vet vendors, she sent procurement official Sean Carroll a proposal for High Hope to supply five million masks.

Prosecutors say she did not disclose that High Hope was tied to family associate Henry Hua or that she had a financial interest in the deal, but did repeat language that the company “came recommended” by Jiangsu authorities — phrasing Carroll testified he understood as an official validation from the Chinese side.

Prosecutors then linked the High Hope contracts that moved through Carroll’s office to alleged downstream cash flows laid out in a Chris Hu spreadsheet: PPE contract money Hu recorded as owed by Jay Chen, marked as wired into an account called “Golden” and then on to “HC Paradise,” the vehicle Hu allegedly used to pay for a Hawaii property.

In the government’s telling, that is how a doctored Jiangsu government “recommendation” for High Hope ultimately turned into New York taxpayer funds helping to buy a Hawaiian condo.

As The Bureau has reported in detail, prosecutor Alexander Solomon used his closing argument to give jurors one of the clearest open-court narratives yet of how the Chinese Communist Party’s United Front allegedly seeks to shape Western politics through diaspora networks — and to argue that Sun sat at the center of such a network in Albany.

Solomon walked the panel through a cast that ran from Sun’s family and business partners in Queens to United Front–linked association bosses in New York, provincial officials in Henan and Guangdong, and senior staff at China’s New York consulate. In his account, Sun — officially feted in Beijing as an “eminent young overseas Chinese” after a 2017 political tour — became a “trusted insider” who quietly repurposed New York State letterhead, access and messaging to serve Beijing’s priorities on Taiwan, Uyghurs and trade, while keeping that relationship hidden from her own colleagues.

Among the most striking elements of the government’s case, as The Bureau reported from Solomon’s summation, were that Sun allegedly forged Hochul’s signature on multiple invitation letters that Chinese officials then used to secure U.S. visas for provincial delegations — promising meetings in Albany that, Solomon said, no one in state government had actually approved — as part of a broader push by Henan Province to anchor a major education complex in the United States.

He then tied that influence narrative to money: millions in lobster-export deals for Chris Hu, allegedly greased by Chinese officials and New York-based United Front intermediaries; coded “apple” cash drop-offs funneled through third-party accounts; and the pandemic PPE contracts.

In Solomon’s formulation, all of that adds up to clandestine agency for Beijing.

He told jurors that while Sun was boasting to Chinese consulate officials that she could treat Hochul “like her puppet,” she was acting “like an agent,” treating PRC officials as her “real bosses,” and seeking and receiving benefits. Sun kept doing so, Solomon said, even after an FBI agent warned her about the Foreign Agents Registration Act and the risks of working too closely with the consulate.

Defense lawyers for Sun and Hu, in their own summations, urged the jury to reject that picture of a couple monetizing their access to senior American politicians in order to enrich themselves through clandestine business dealings facilitated by community leaders secretly working for Beijing’s United Front units. According to the Global Investigations Review summary and other accounts, they argued that prosecutors have overreached by criminalizing ordinary diaspora politics, networking and pandemic procurement.

On the defense view, much of what the government calls “direction and control” is better understood as routine back-and-forth involving a diaspora liaison in the governor’s office and community or trade groups with ties to China. None of the government’s evidence, they argue, amounts to an agreement to operate under the “direction or control” of a foreign principal — the core FARA requirement.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

Argentina’s Milei delivers results free-market critics said wouldn’t work

This article supplied by Troy Media.

Inflation is down, poverty is falling and Argentina’s economy is growing as Javier Milei pushes reforms many skeptics said would fail

Javier Milei recently passed the two-year mark as president of Argentina. While his personal popularity has been bumpy in recent months—the Americas Society/Council of the Americas suggested his approval rating was a little under 40 per cent this fall—the political climate is still very much in his favour.

His party, La Libertad Avanza, won almost 41 per cent of the vote in the October midterm elections, earning 13 of 24 Senate seats and 64 of the 127 contested lower-house seats.

Few would have expected a libertarian economist who supports small government, lower taxes, more individual rights and freedoms, private enterprise, trade liberalization and anarcho-capitalism to become a success in Argentine politics. The proof has been in the political pudding for quite some time, however.

“As of September, the economy is growing at five per cent on a yearly basis,” the Cato Institute’s Marcos Falcone wrote on Dec. 10. “Poverty, which exceeded 40 per cent before Milei took office and peaked at 52.9 per cent in the first half of 2024, is now down to 31.6 per cent. Monthly inflation, which often surpassed 10 per cent in the pre-Milei era and reached 25 per cent in December 2023, now hovers around two per cent. Both exports and imports are rising rapidly.”

These are all significant benefits for the Argentine economy. Milei wants to accomplish even more. Falcone noted that “the government has already called for special sessions in Congress for its new members to vote on labour, tax and criminal justice reform bills before the end of the year.” Some other legislative goals include “privatization of major state-owned enterprises, pension reform that allows for private retirement plans, the liberalization of education, and further deregulation of the economy, among others.”

Milei’s libertarian philosophy of anarcho-capitalism, which was largely the brainchild of the late American economist Murray Rothbard, rejects statism and socialism. He has worked hard to convince Argentines that free markets, private enterprise, open trade and more will lead to economic success for individuals, families and businesses alike.

That is why Milei remains a “breath of fresh air for Argentina,” as I wrote in a Nov. 20, 2023, National Post column, and “he’s exactly what the doctor ordered for this struggling and impoverished nation.”

He is also an eccentric fellow, to put it mildly. The Argentine president used to be a TV pundit known as El Loco, the madman, who was known for his “profane outbursts,” Time magazine noted on May 23, 2024. He also bragged about being a “tantric sex guru, brandished a chainsaw at rallies to symbolize his plans to slash government spending, dressed up as a superhero who sang about fiscal policy, and told voters that his five cloned English mastiffs, which he reportedly consults in telepathic conversations, are his ‘best strategists.’”

Milei even claimed to have met one of his beloved canines, Conan, in a previous life in the Roman Colosseum more than 2,000 years ago. He was a gladiator, and his four-legged companion was a lion.

Milei’s left-leaning critics have attempted to use these eccentricities to their advantage. They have also called Milei “far right” and claimed he was an Argentine version of U.S. President Donald Trump. None of this is true. Milei has always rejected fascism and totalitarian regimes. He is business-oriented and focused on getting Argentina back on the road to financial success. He wants his home country to be free from government interference, state control and the iron grip of Peronist fanatics. He is getting closer to this goal.

Falcone, the Cato Institute analyst, pointed out in his piece that “a key reform that is still part of Argentina’s unfinished agenda is dollarization.” Milei strongly “advocated” for this policy in 2023, and he has wanted to finish it off for some time. With his party in control of both houses, that time is now.

The Wall Street Journal reported on Dec. 15 that “Argentina’s central bank … would allow the peso to move more freely, responding to investors who have demanded President Javier Milei’s government correct an overvalued currency.” The new policy for the peso will “allow the band to expand at the rate of monthly inflation, which was 2.5 per cent in November, the central bank said. The band currently expands at a monthly rate of one per cent.”

This announcement has been met favourably. “The changes go in the right direction,” Pablo Guidotti, an economist at the Torcuato Di Tella University in Buenos Aires, told the Wall Street Journal. “If the economy expands, this will contribute to higher peso demand allowing Argentina, together with access to capital markets, to accumulate international reserves.”

The quest to achieve dollarization in Argentina has begun.

In summation, Milei’s economic program “is serious and one of the most radical doses of free-market medicine since Thatcherism,” The Economist noted in a Nov. 28, 2024, piece. While the political left “detests him” and the “Trumpian right embraces him,” he does not belong in either camp. “He has shown that the continual expansion of the state is not inevitable,” The Economist continued, and he is a “principled rebuke to opportunistic populism, of the sort practised by Donald Trump. Mr. Milei believes in free trade and free markets, not protectionism; fiscal discipline, not reckless borrowing; and, instead of spinning popular fantasies, brutal public truth-telling.”

There is much that world leaders can learn from the strange, quirky anarcho-capitalist president of Argentina. They should start to take note—and, more importantly, take notes.

Michael Taube is a political commentator, Troy Media syndicated columnist and former speechwriter for Prime Minister Stephen Harper. He holds a master’s degree in comparative politics from the London School of Economics, lending academic rigour to his political insights.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Crime2 days ago

Crime2 days agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Health1 day ago

Health1 day agoRFK Jr reversing Biden-era policies on gender transition care for minors

-

Business2 days ago

Business2 days agoTrump signs order reclassifying marijuana as Schedule III drug

-

Business15 hours ago

Business15 hours agoGeopolitics no longer drives oil prices the way it used to

-

Alberta1 day ago

Alberta1 day agoAlberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

-

Business14 hours ago

Business14 hours agoDeadlocked Jury Zeroes In on Alleged US$40 Million PPE Fraud in Linda Sun PRC Influence Case

-

Business1 day ago

Business1 day agoState of the Canadian Economy: Number of publicly listed companies in Canada down 32.7% since 2010

-

International1 day ago

International1 day agoDOJ fails to fully comply with Friday deadline for Epstein files release