Energy

BC NDP Premier Opposing a New Oil Pipeline to Tidewater

Shipping in Canada: Jurisdiction, Interprovincial Relations and the Case of British Columbia Examinied

Canada’s unique geography gives several provinces access to the Atlantic, Pacific, and Arctic oceans, making coastal shipping a vital part of the country’s economic infrastructure. For provinces without direct access to tidewater—most notably Alberta and Saskatchewan—gaining access to ports in coastal provinces is critical for exporting goods, especially resources such as oil and gas. The role of coastal provinces, their jurisdiction over ports, and their political stances, particularly in British Columbia, have shaped national debates about energy transport and interprovincial cooperation.

Why Is Tidewater Access Important?

Provinces like Alberta depend on tidewater access to export oil, gas, and other commodities to global markets. Without pipelines or other transport infrastructure reaching a coastal port, these provinces are limited to domestic markets or reliant on the goodwill and cooperation of coastal neighbours. Tidewater shipping is essential for Canada’s overall economic competitiveness and for provinces whose economies are resource-based.

Jurisdiction Over Coastal Shipping and Ports

Under the Canadian Constitution, ports and shipping fall under federal jurisdiction, particularly when it comes to interprovincial and international trade. However, provincial governments exercise significant regulatory authority over land use, environmental approvals, and infrastructure within their borders—such as pipeline routes and terminal developments. This can give coastal provinces practical leverage to delay, alter, or oppose projects they find objectionable, even if the final decision rests with federal authorities.

Can Coastal Provinces Deny Access?

Legally, provinces cannot outright deny another province access to tidewater for interprovincial trade, as this would contravene the principle of free movement of goods within Canada. The federal government has the constitutional authority to regulate trade and transportation that crosses provincial boundaries. However, provincial governments can impact the process through environmental reviews, local permitting, and political opposition, which can significantly delay or even halt projects. In practice, the cooperation of coastal provinces is essential for the smooth operation of tidewater shipping and the development of infrastructure such as pipelines and terminals.

The NDP Government in British Columbia and Opposition to Oil and Gas Projects

British Columbia, as a coastal province, has played a pivotal role in debates about oil and gas transportation, particularly under New Democratic Party (NDP) governments. The NDP in B.C. has often taken strong positions against large-scale oil and gas projects, citing environmental risks, Indigenous rights, and local opposition.

One of the most prominent examples is the opposition to the Trans Mountain pipeline expansion. The B.C. NDP government, elected in 2017, made the project a focal point of its environmental policy. The government raised concerns about the risk of oil spills, the impact on coastal ecosystems, and the lack of adequate consultation with Indigenous communities. It used its regulatory authority to launch court challenges, tighten environmental standards, and delay provincial permits, even as the federal government asserted its jurisdiction over the project.

Other projects, such as the Northern Gateway pipeline and various LNG (liquefied natural gas) proposals, have faced similar opposition from the B.C. NDP and allied groups. The provincial government has argued that the long-term environmental risks outweigh the short-term economic benefits and has sought to position B.C. as a leader in climate action and sustainable development. Now, British Columbia’s Premier David Eby has stated that any new oil pipeline from Alberta to BC’s west coast should not be allowed and is not in the national interest of Canadians.

Implications for Interprovincial Relations and National Policy

The tension between provincial and federal jurisdiction over tidewater access and energy transport highlights broader questions about Canadian federalism. Coastal provinces have a responsibility to recognize the economic needs of landlocked provinces but also have legitimate interests in protecting their environments and meeting local expectations. The history of B.C.’s NDP government illustrates how provincial politics can shape, challenge, or even block national infrastructure projects, making intergovernmental cooperation and negotiation essential.

Access to tidewater shipping is crucial for Canada’s resource-rich inland provinces, and while federal jurisdiction generally prevails over interprovincial trade, coastal provinces have significant influence over the practicalities of infrastructure development. The NDP government in British Columbia has demonstrated how provincial opposition—grounded in environmental, social, and political concerns—can affect national projects like Trans Mountain. This ongoing dynamic underscores the need for respectful, collaborative approaches to balancing economic development with environmental protection and Indigenous rights in Canada.

Energy

Ottawa must eliminate harmful regulations to spur private investment in pipelines

From the Fraser Institute

By Julio Mejía and Elmira Aliakbari

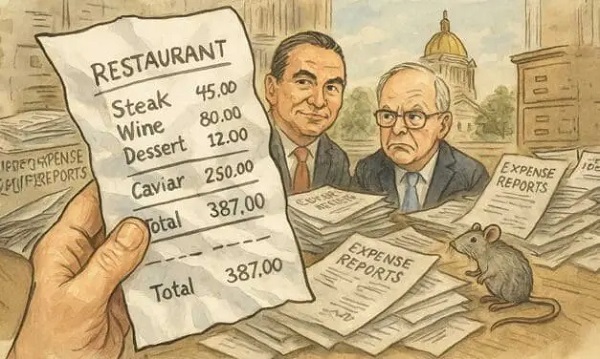

The Carney government recently revealed the first five major development projects it deems to be in the “national interest” for fast-tracked assessment and approval. The list includes a liquified natural gas plant expansion in Kitimat, British Columbia, a small modular reactor in Ontario, upgrades to the Port of Montreal, a copper mine in Saskatchewan, and the Red Chris Mine in B.C. But notably, no new oil pipelines made the list. While the government attributes this absence to a lack of private-sector proponents, this reasoning is disingenuous and overlooks how Canada’s regulatory regime creates uncertainty and deters investment in the energy sector.

For context, most of Canada’s energy is produced in the Prairies. Building pipelines to coastal terminals is key to increase access to global markets for oil and natural gas, which are our top exports. In 2024, nearly 96 per cent of oil exports and almost all natural gas exports were headed to a single trading partner, the United States.

In the wake of Trump’s tariffs against Canadian exports, Carney pledged to cut red tape and accelerate major project approvals to diversify our trade. But his government has repealed none of the regulations that create uncertainty, raise compliance costs and deter investment in the energy sector.

Instead, the government introduced Bill C-5, granting cabinet discretionary power to decide which projects undergo full regulatory assessments and which get fast-tracked, based on their perceived contribution to the “national interest.” So rather than providing predictable rules for all entrepreneurs and businesses, Ottawa created an opaque process where companies must lobby cabinet to prove their projects meet subjective criteria to circumvent the laws and regulations that apply to everyone else. This creates more uncertainty, not less.

Meanwhile, the regulatory barriers that discourage private-sector investment in the energy sector remain firmly in place. Take Bill C-69, which introduced vague criteria into the evaluation of major energy projects including the impact on the “intersection of sex and gender with other identity factors,” leading the legislation to be commonly known as the “no-more pipelines bill.”

Other regulations are similarly designed to reduce the demand for new pipelines either by restricting the use of coastal ports or forcing a curtailment of oil and gas production. Bill C-48, for instance, limits Canadian exports to Asia by banning large oil tankers from B.C.’s northern coast. And the 2023 methane emissions regulations targeting the oil and gas sector impose costs of more than $100 million to the industry, likely leading to reduced production.

Moreover, last year, Ottawa proposed to cap greenhouse gas (GHG) emissions exclusively for the oil and gas sector. Multiple studies from independent organizations indicate this emissions cap will effectively force a reduction in oil and gas production, consequently undermining the case for private investment in more pipelines. If our energy sector is forced to produce less, it’s not clear why more pipelines would be required.

Not surprisingly, Canada has gained a negative reputation for its regulatory barriers. According to a 2023 survey of oil and gas investors, 68 per cent of respondents said uncertainty over environmental regulations deterred investment in Canada. And 59 per cent said the cost of regulatory compliance deterred investment.

These investor concerns reflect a sharp decline in actual investment. Between 2014 and 2023, investment in the energy sector fell from $84.0 billion to $37.2 billion (inflation-adjusted), a drop of 56 per cent.

Rather than relying on a closed-door process where government picks winners and losers, the federal government should establish a transparent and competitive regulatory framework to attract investment. If the Carney government is serious about encouraging private proponents to build pipelines, diversifying exports and unlocking Canada’s potential as a global energy leader, it must eliminate the regulatory hurdles plaguing the energy sector.

Alberta

Alberta’s E3 Lithium delivers first battery-grade lithium carbonate

E3 Lithium employees walk through the company’s lithium pilot plant near Olds

From the Canadian Energy Centre

E3 Lithium milestone advances critical mineral for batteries and electrification

A new Alberta facility has produced its first battery-grade lithium carbonate, showcasing a technology that could unlock Canada’s largest resources of a critical mineral powering the evolving energy landscape.

In an unassuming quonset hut in a field near Olds, Calgary-based E3 Lithium’s demonstration plant uses technology to extract lithium from an ocean of “brine water” that has sat under Alberta’s landscape along with oil and gas for millions of years.

Lithium is one of six critical minerals the Government of Canada has prioritized for their potential to spur economic growth and their necessity as inputs for important products.

“The use for lithium is now mainly in batteries,” said E3 Lithium CEO Chris Doornbos.

“Everything we use in our daily lives that has a battery is now lithium ion: computers, phones, scooters, cars, battery storage, power walls in your house.”

Doornbos sees E3 as a new frontier in energy and mineral exploration in Alberta, using a resource that has long been there, sharing the geologic space with oil and gas.

“[Historically], oil and water came out together, and they separated the oil from the water,” he said.

“We don’t have oil. We take the lithium out of the water and put the water back.”

Lithium adds to Canada’s natural resource strength — the country’s reserves rank sixth in the world, according to Natural Resources Canada.

About 40 per cent of these reserves are in Alberta’s Bashaw District, home to the historic Leduc oilfield, where E3 built its new demonstration facility.

“It’s all in our Devonian rocks,” Doonbos said. “The Devonian Stack is a carbonate reef complex that would have looked like the Great Barrier Reef 400 million years ago. That’s where the lithium is.”

Funded in part by the Government of Canada and the Government of Alberta via Alberta Innovates and Emissions Reduction Alberta (ERA), the project aims to demonstrate that the Alberta reserve of lithium can be extracted and commercialized for battery production around the world.

E3 announced it had produced battery-grade lithium carbonate just over two weeks after commissioning began in early September.

In a statement, ERA celebrated the milestone of the opening of the facility as Alberta and Canada seek to find their place in the global race for more lithium as demand for the mineral increases.

“By supporting the first extraction facility in Olds, we’re helping reduce innovation risk, generate critical data, and pave the way for a commercial-scale lithium production right here in Alberta,” ERA said.

“The success from this significant project helps position Alberta as a global player in the critical minerals supply chain, driving the global electrification revolution with locally sourced lithium.”

With the first phase of the demonstration facility up and running, E3 has received regulatory permits to proceed with a second phase that involves drilling a production and injection well to confirm brine flow rates and reservoir characteristics. This will support designs for a full-scale commercial facility.

Lithium has been highlighted by the Alberta Energy Regulator (AER) as an emerging resource in the province.

The AER projects Alberta’s lithium output will grow from zero in 2024 to 12,300 tonnes by 2030 and nearly 15,000 tonnes by 2034. E3 believes it will beat these timeframes with the right access to project financing.

E3 has been able to leverage Alberta’s regulatory framework around the drilling of wells to expand into extraction of lithium brine.

“The regulator understands intimately what we are doing,” Doornbos said.

“They permit these types of wells and this type of operation every day. That’s a huge advantage to Alberta.”

-

Business2 days ago

Business2 days agoJobs Critic says NDP government lied to British Columbians and sold out Canadian workers in billion dollar Chinese ferries purchase

-

Alberta1 day ago

Alberta1 day agoJason Kenney’s Separatist Panic Misses the Point

-

Automotive1 day ago

Automotive1 day agoBig Auto Wants Your Data. Trump and Congress Aren’t Having It.

-

Business7 hours ago

Business7 hours agoLabour disputes loom large over Canadian economy

-

Energy6 hours ago

Energy6 hours agoOttawa must eliminate harmful regulations to spur private investment in pipelines

-

Business2 days ago

Business2 days agoDemocracy Watch Drops a Bomb on Parliament Hill

-

espionage16 hours ago

espionage16 hours agoStarmer Faces Questions Over Suppressed China Spy Case, Echoing Trudeau’s Beijing Scandals

-

Business7 hours ago

Business7 hours agoDaily Caller EXCLUSIVE: Chinese Gov’t-Tied Network Training Illegal Immigrants To Drive Big Rigs In US