Business

As Ottawa meddles with pension funds, Albertans should consider

From the Frontier Centre for Public Policy

Who Should Control Canada’s Pension Wealth?

Ottawa wants to compel large pools of Canadian money to be invested in Canada, instead of allowing investment funds to find the best return for Canadian investors.

Last week, another scandalous and potentially corrupt string of federal activities popped up.

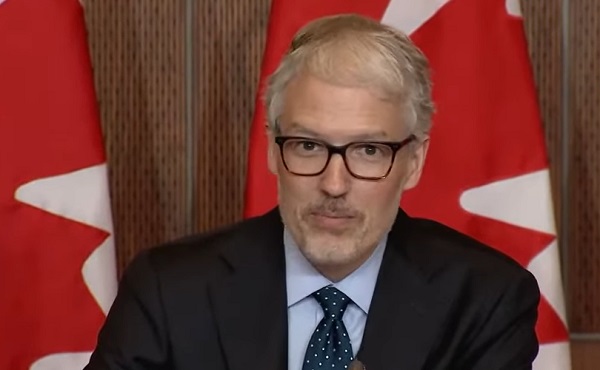

This one has deep implications for pension plans in Canada, including the debate about an Alberta Pension Plan. Mark Carney’s double game of politics and profit enhances the drive to patriate Alberta’s pension wealth.

At issue is a report in the media saying that Brookfield may be looking to raise a $50 billion fund with contributions from Canada’s pension funds and an additional $10 billion from the federal government.

This report has drawn significant attention for several reasons. Toronto-based Brookfield is one of the world’s largest alternative investment management companies, claiming about one trillion in assets under management. Their portfolio spans real estate, renewable energy, infrastructure, and private equity, making them a significant player in domestic and international markets. The magnitude of Brookfield’s investments places them at the forefront of global financial movements, giving considerable weight to any fund they propose to establish.

The second reason is that Finance Minister Chrystia Freeland and Prime Minister Justin Trudeau have voiced their ambitions to boost home-grown investments. One of the government’s strategies includes tapping into Stephen Poloz, the former Governor of the Bank of Canada. Poloz succeeded Mark Carney as the head of the bank. The Liberal government has tasked Poloz with leading a working group to identify “incentives” that would “encourage” institutional investors to keep their capital in Canada.

Moreover, Finance Minister Freeland has suggested implementing new regulations to ensure that more of Canada’s substantial pension fund reserves, which amount to an impressive $1.8 trillion, are allocated toward Canadian ventures. This comes when a staggering 73% of Canadian pension funds are invested abroad.

On its face, a plan to invest more Canadian wealth in Canada might sound reasonable. However, the plan avoids the crucial question of why money experts prefer investing outside Canada. Considering that question, one must consider the Trudeau government’s economic record.

Put differently, Ottawa is looking for ways to compel large pools of Canadian money to be invested in Canada instead of allowing investment funds to find the best return for Canadian investors. Those large cash pools typically belong to hard-working Canadians, such as teachers’ pensions. They would be forced to earn less for their pension money.

Forcing such large sums to remain in Canada would mask the continuous slump in productivity in the Canadian economy.

Given current economic policies and layers of taxation that do not exist elsewhere (such as the unpopular carbon taxes), Canadian companies are less competitive. Forcing pools of money to stay in Canada rather than seeking the best return for their clients offers an artificial boost that makes Ottawa policies seem less harmful.

It is, therefore, a politically motivated move. That level of government intervention historically always results in disastrous consequences. Politics directing traffic for the movement of capital rarely achieves good outcomes. The real issue is sagging productivity.

But that is only half the problem. The other significant issue is ethics.

Prime Minister Trudeau has recently named Mark Carney as his special economic advisor. Carney is the Chair of Asset Management and Head of Transition Investing at Brookfield. The Brookfield website shows Carney is responsible for “developing products for investors.” Carney is also the most mentioned name among people likely to succeed Justin Trudeau as leader of the Liberal Party of Canada.

In short, the man who closely advises the government of Canada on how to compel gargantuan pools of money to be invested in Canada conveniently oversees the development of the “product” for the private Toronto firm, through which that money would be forced to be invested in Canada. Furthermore, the same firm reportedly seeks (read lobbying) from the federal government an infusion of $10 billion for the new fund.

As a Liberal and a potential party leader, given Justin Trudeau’s fortunes, Mark Carney could become prime minister in the immediate future. This means that Carney would benefit from creating new rules forcing investment money to stay in the country in two ways: As a leading man at Brookfield, Carney and the firm stand to make tens of millions from the policy. Second, as a carbon tax enthusiast, once squarely in political office, Carney would benefit from masking the ill, underproductive effects of the radical green agenda and carbon taxes he supports.

When Alberta progressives oppose the desire of many Albertans to patriate Alberta pension funds to the province, they cite concerns that the province might use the funds for political purposes, undermining the maximum return. This is not an outlandish concern, in some respects, given the history of the Alberta Heritage Fund.

However, it is not an exclusive danger inherent to the Alberta government. It does not warrant the presupposition that the federal government is a better steward of Alberta’s pension wealth, as demonstrated by the developments above. All things being equal, and unless human nature is outlawed by federal statute, the risks are the same.

But if something goes wrong with Albertans’ pension wealth, would they rather deal with people in Alberta than people in Ottawa, half a continent away Raising Alberta voices in Ottawa when Ottawa has been bent on doing the opposite of what is good for Albertans has never produced good results or reversed the nefarious effects on Albertans.

Ottawa politicians will do what is best for Laurentians every single time. The history of the Dominion, from the national policy to Crow rates and the National Energy Policy to Carbon Taxes, shows Ottawa policies always favour vote-rich Laurentia first and foremost.

Mark Carney’s product development for Brookfield shows, at worst, that Alberta’s pension wealth is just as much as risk with federal policies driven by political motivations. This one would be doubly bad because it is meant to serve and benefit Carney and his Bay Street friends as much as it is designed to help his future colleagues in Ottawa. And on both counts, Carney would benefit as a financier and politician.

Albertans should take their money and run.

Marco Navarro-Genie is Vice President Research with the Frontier Centre for Public Policy. He is co-author, with Barry Cooper, of COVID-19: The Politics of a Pandemic Moral Panic (2020).

Automotive

Parliament Forces Liberals to Release Stellantis Contracts After $15-Billion Gamble Blows Up In Taxpayer Faces

After betting taxpayer billions on a green-industry deal that collapsed under U.S. tariffs, MPs move to expose what Ottawa promised Stellantis and what Canadians actually got for the money.

Parliament just blew the lid off one of the biggest corporate giveaways in Canadian history.

For years, Ottawa and Queen’s Park have bragged about “historic investments” in green manufacturing. What they didn’t say is that $15 billion of your money went to Stellantis, the Dutch auto conglomerate behind Chrysler, Jeep, and Ram, only for the company to announce it’s cutting 3,000 jobs in Brampton and shipping them south to the United States.

That betrayal is what triggered a heated meeting of the House of Commons Government Operations Committee on October 21. What started as routine procedure turned into a full-scale reckoning over how billions were handed to a foreign corporation with almost no strings attached.

Conservative MP Garnett Genuis opened with a blunt motion: produce every contract, memorandum of understanding, or side deal the government signed with Stellantis and its affiliates since 2015. Every page, every clause, in both official languages, “without redaction.” The demand wasn’t symbolic, it was about finding out if Trudeau’s government ever required the company to keep those Canadian jobs it was paid to “protect.”

Liberals scrambled to block it. MP Jenna Sudds proposed an amendment that would let bureaucrats black out whatever they deemed “sensitive.” In practice, that meant hiding anything embarrassing — from cabinet discussions to corporate fine print. Opposition MPs called it exactly what it was: a cover-up clause. It failed.

The committee floor turned into open warfare. The Bloc Québécois tried a softer sub-amendment giving the House Law Clerk power to vet redactions. Conservatives countered with their own version forcing departments to hand over unredacted contracts and justify any blackouts in writing. After a suspension and some backroom wrangling, a rare thing happened: compromise.

The motion passed unanimously. Even the Liberals couldn’t vote against it once the light was on.

The debate itself revealed how badly Ottawa has lost control of its own economic agenda. Conservatives pressed officials on why Canadians were paying billions for “job creation” only to see Stellantis pack up for Illinois once U.S. tariffs came down. Liberals blamed Trump, tariffs, and “global conditions,” the excuses were almost comical. Liberal members blamed Donald Trump —yes, really— for Stellantis abandoning Canada. According to them, Trump’s tariffs and “America First” trade policy scared the company into moving production south.

But here’s what they didn’t say: Trump announced his 2024 presidential campaign on November 15, 2022, promising to rip up Joe Biden’s green industrial agenda and bring manufacturing back to U.S. soil. Everyone heard it. Everyone knew it. And yet, on July 6, 2023, more than half a year later, Ottawa proudly unveiled its $15-billion subsidy for Stellantis and LG Energy Solution — a deal built entirely on the assumption that Trump wouldn’t win.

So let’s be clear about what happened here. They didn’t just hand billions to a foreign automaker. They gambled that the next U.S. president wouldn’t change course. They bet the house —your tax dollars— on a political outcome in another country.

Think about that. Fifteen billion dollars of public money wagered on a campaign prediction. They bet on black, and it landed on red.

Even if the gamble had gone their way — even if Trump had lost and Biden’s green subsidy regime had survived untouched — the deal would still have been a terrible bargain.

During the committee meeting, the Bloc Québécois pointed to the 2023 Parliamentary Budget Officer’s report, which projected that the combined federal and Ontario subsidies to Stellantis and Volkswagen, roughly $28 billion total, including Stellantis’s $15 billion share, wouldn’t even break even for twenty years. That means taxpayers would have to wait until the mid-2040s just to recover what Ottawa spent.

So imagine the “best-case scenario”: the U.S. keeps its green-industry incentives, the plant stays in Canada, and production runs at full capacity. Even then, ordinary Canadians don’t see a financial return for two decades. There are no guaranteed profits, no guaranteed jobs, and no repayment. It was a long-odds bet on a global policy trend, financed entirely with public money.

In other words, whether the roulette wheel landed on black or red, the house still lost because the government put your chips on the table in a game it never controlled.

Behind the numbers, the story is brutally simple: Ottawa slid its chips across the table, wrote the cheques, and Stellantis walked away with the winnings. When MPs tried to see the receipts, the government grabbed for the cover of secrecy — no sunlight, no scrutiny, just “trust us.”

Now, for the first time, Parliament is about to peek under the table. The committee will finally see the real contracts — not the press releases, not the slogans, but the fine print that tells Canadians what they actually paid for. The review will happen behind closed doors at first, but the pressure to show the public what’s inside will be enormous.

Because if those documents confirm what MPs already suspect —that there were no job guarantees, no clawbacks, and no consequences —then this isn’t just a bad hand. It’s a rigged table.

Ottawa didn’t just gamble with taxpayer money; it gambled against the odds, and the dealer —in this case, Stellantis— already knew the outcome. Even if the wheel had landed on black, taxpayers were still stuck covering a twenty-year “break-even” fantasy, as the Bloc reminded everyone.

The next two weeks will show Canadians whether their government actually bought jobs or just bought headlines. One thing is certain: the high-rollers in Ottawa have been playing roulette with your money, and the wheel’s finally slowing down.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Business

Canada Revenue Agency has found a way to hit “Worse Than Rock Bottom”

From Conservative Part Communications

Last month, Carney’s Minister responsible for the Canada Revenue Agency (CRA) debuted their new slogan: “It can’t get much worse than it is now.” Today, the Auditor General reported that under the Liberals, it has.

Over the 2024/25 period, only 18 per cent of callers were able to reach a CRA agent within 15 minutes, a far cry from the target of 65 per cent of callers. In June, the numbers plunged to just 5 per cent of callers able to get through within the service standard of 15 minutes.

The average wait time took over half an hour, double what it was the year prior. And that was if you were even given the option of getting help. Nearly nine million calls were “deflected” by an automated voice telling Canadians to figure it out themselves, with no option to speak with an agent.

Wait times are so bad that over 7.6 million calls were disconnected before callers were able to reach an agent or be provided automated service. As wait times continue to get worse and worse, Canadians have just given up, evidenced by 2.4 million more abandoned calls over the previous year.

Even when Canadians manage to get hold of an agent, employees regularly fail to provide correct information about personal and business taxes. Auditors found the call centre gave incorrect information 83 per cent of the time when asked general individual tax questions.

Non-specific questions about benefits, including about eligibility, were wrong 44 per cent of the time. Meanwhile, the CRA’s automated chatbot “Charlie”, meant to relieve the call centre, answered only two of six tax-related questions correctly.

“How is it that an organization so important to the smooth functioning of the country is failing to serve Canadians and, as the Auditor General notes, places greater importance on adhering to shift schedules and breaks than on the accuracy and completeness of the information provided?” asked Gérard Deltell, Conservative Shadow Minister for Revenue.

It’s no surprise that complaints about the CRA’s contact centre increased 145 per cent from 2021/22 to 2024/25. Despite this, the Liberals announced they will begin auto-filing taxes for 5.5 million Canadians, automatically enrolling people in benefits the CRA is regularly unable to provide accurate information about.

Worse of all, the cost of the CRA’s call centre has ballooned from $50 million over 10 years in 2015 to $190 million. The total cost is projected to continue rising to $214 million over the next two years, a more than 320 per cent increase from the original contracted amount.

Meanwhile, Auditors found “there was no process documented or followed to ensure that amounts invoiced … were accurate and reflected the services received,” and that there was “little evidence that invoice details were appropriately reviewed and approved by … the Canada Revenue Agency prior to issuing payment.”

The Liberals have delivered higher taxes and higher costs with worse service for Canadians. We deserve better than continued Liberal failures. Conservatives will continue holding Carney accountable and fight to cut taxes and waste so Canadians keep more of what they earn.

-

Business6 hours ago

Business6 hours agoQuebecers want feds to focus on illegal gun smuggling not gun confiscation

-

Business6 hours ago

Business6 hours agoEmission regulations harm Canadians in exchange for no environmental benefit

-

Uncategorized1 day ago

Uncategorized1 day agoNew report warns WHO health rules erode Canada’s democracy and Charter rights

-

Courageous Discourse4 hours ago

Courageous Discourse4 hours agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears

-

Energy1 day ago

Energy1 day agoMinus Forty and the Myth of Easy Energy

-

Crime1 day ago

Crime1 day agoFrance stunned after thieves loot Louvre of Napoleon’s crown jewels

-

Frontier Centre for Public Policy2 days ago

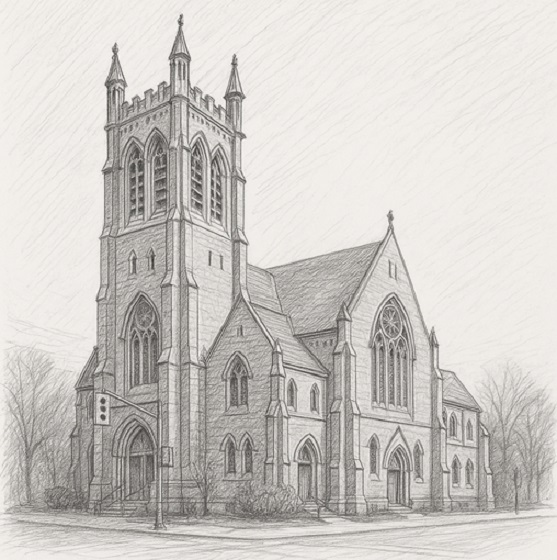

Frontier Centre for Public Policy2 days agoOttawa Should Think Twice Before Taxing Churches

-

Alberta2 days ago

Alberta2 days agoBusting five myths about the Alberta oil sands