Alberta

Alberta’s financial update one for the ages – Historical investments in savings and debt reduction on the way

Q1 update: Paying down debt and saving for the future

Strong economic activity this year will see Alberta make historic investments in savings and debt reduction.

High revenue forecast for bitumen royalties, other resource revenue and corporate income taxes have increased the province’s forecast surplus to $13.2 billion for 2022-23.

This year’s surplus enables the government to make the largest single-year debt repayment in Alberta’s history, repaying $13.4 billion in debt that comes due this fiscal year. The government will also allocate $5.2 billion to debt coming due in 2023-24.

The government will make the largest ever single-year investment in the Heritage Fund, retaining the fund’s remaining 2021-22 net investment income of $1.2 billion and allocating $1.7 billion, for a total investment of $2.9 billion. This is over and above the $705 million retained for inflation-proofing last year.

“Alberta’s commitment to fiscal discipline and our unrelenting focus on economic growth has helped bring about an extraordinary turnaround in our financial situation. We promised Albertans we would get our fiscal house in order and that’s exactly what we’ve done. Now, we’re paying down debt so future generations won’t have to, saving more for a rainy day, and putting more money in Albertans’ pockets.”

“For too long, governments in Alberta refused to exercise fiscal discipline during boom times. Those days are over. Alberta’s government is making the prudent decision to save and invest surplus revenues so future generations can benefit from the prosperity of today.”

Indexing personal income taxes

The province is fulfilling a commitment made in 2019 to index personal income taxes to inflation, retroactive to the 2022 tax year. The basic personal tax amount is rising to $19,814 and will rise again in 2023.

An additional 80,000 to 95,000 Albertans will pay no provincial personal income tax by 2023, on top of the approximately 1.3 million tax filers who already pay no provincial personal income tax.

Many Albertans will first see the benefit of indexation through lower tax withholdings on their first paycheques of 2023. In addition, since indexation will resume for 2022, Albertans will receive larger refunds or owe less tax when they file their 2022 tax returns in spring 2023. In total, resuming indexation for 2022 and subsequent years will save Albertans an estimated $304 million in 2022-23, $680 million in 2023-24 and $980 million in 2024-25.

Indexing personal income taxes to inflation will contribute further to Alberta’s strong tax advantage: Albertans already pay less in overall taxes, with no PST, no payroll tax and no health premiums.

Alberta’s government has already introduced some of the most generous measures to keep more money in the pockets of Albertans, committing $2.4 billion in relief for rising prices, inflation and cost of living, including:

- Providing $300 in relief for 1.9 million homeowners, business operators and farmers over six months through the Electricity Rebate Program.

- Eliminating the 13-cent-per-litre provincial fuel tax until at least the end of September.

- Helping school authorities cover high fuel costs for buses under the Fuel Price Contingency Program.

- Providing natural gas rebates from October 2022 to March 2023 to shield consumers from natural gas price spikes.

- Maintaining Alberta senior benefits for those over 75 years of age, exempting them from the Federal Old Age Security increase.

Other economic growth indicators

Momentum has picked up in Alberta’s labour market. The province has added 68,200 jobs since the beginning of the year and most industries have surpassed employment levels from early 2020, before the pandemic first took hold of the province. Alberta’s unemployment rate fell to 4.8 per cent, the lowest since early 2015. In response to these positive developments, the province has revised its forecast for employment growth to 5.3 per cent, up from 4.1 per cent at budget. The unemployment rate has also been revised down to 5.9 per cent in 2022 from the budget forecast of 6.6 per cent.

Business output has surged in the province on the back of higher demand and prices. While energy products have led the increase, there have been gains across most industries including chemical and forestry products, food manufacturing and machinery. Merchandise exports have risen more than 60 per cent so far this year, while manufacturing shipments are up over 30 per cent.

Higher energy prices are boosting revenues and spending in the oil and gas sector. Strong drilling activity has lifted crude oil production to 3.6 million barrels per day so far this year and is expected to reach a record high this year. Outside the oil and gas sector, companies are proceeding with investment plans, buoyed by solid corporate profits.

Real gross domestic product (GDP) is expected to grow by 4.9 per cent in 2022. This is down slightly from the budget forecast of 5.4 per cent, reflecting softer expectations for growth in consumer spending and residential investment as a result of higher inflation and interest rates. Even so, real GDP is expected to fully recover from the COVID-19 downturn and surpass the 2014 peak for the first time this year. Private sector forecasters are expecting Alberta to have among the highest economic growth in the country this year and in 2023.

Quick facts

- The surplus for 2022-23 is forecast at $13.2 billion, $12.6 billion more than what was estimated in Budget 2022.

- The revenue forecast for 2022-23 is $75.9 billion, $13.3 billion higher than reported in the budget.

- Non-renewable resource revenue is forecast at $28.4 billion in 2022-23, up $14.6 billion from budget’s $13.8 billion forecast.

- Corporate income taxes are up $2 billion from the budget, with a new forecast of $6.1 billion for 2022-23.

- Revenue from personal income taxes is forecast to be $13.3 billion in 2022-23, down $116 million from budget. Indexation of the personal income tax system, retroactive to Jan. 1, 2022, is forecast to lower revenue by $304 million. This is partially offset by increased revenue from rising primary household income.

- Total expense is forecast at $62.7 billion, up slightly from the $62.1 billion estimated at budget.

- Education is receiving an extra $52 million to support the new teachers agreement and to help school authorities pay for bus fuel.

- $279 million the province received from the federal government for the Site Rehabilitation Program is being spent this year instead of next year.

- $277 million is needed to cover the cost of selling oil due to higher prices and volumes.

- The Capital Plan in 2022-23 has increased by $389 million mainly due to carry-over of unspent funds from last fiscal year and an increase of $78 million for highway expansion.

- Taxpayer-supported debt is forecast at $79.8 billion on March 31, 2023, which is $10.4 billion lower than estimated in the budget.

- The net debt-to-GDP ratio is estimated at 10.3 per cent for the end of the fiscal year.

Alberta

Nobel Prize nods to Alberta innovation in carbon capture

From the Canadian Energy Centre

‘We are excited to bring this made-in-Canada innovation to the world’

To the naked eye, it looks about as exciting as baking soda or table salt.

But to the scientists in the University of Calgary chemistry lab who have spent more than a decade working on it, this white powder is nothing short of amazing.

That’s because the material they invented is garnering global attention as a new solution to help address climate change.

Known as Calgary Framework-20 (CALF-20 for short), it has “an exceptional capacity to absorb carbon dioxide” and was recognized in connection with the 2025 Nobel Prize in Chemistry.

“It’s basically a molecular sponge that can adsorb CO2 very efficiently,” said Dr. George Shimizu, a UCalgary chemistry professor who leads the research group that first developed CALF-20 in 2013.

The team has been refining its effectiveness ever since.

“CALF-20 is a very exciting compound to work on because it has been a great example of translating basic science into something that works to solve a problem in the real world,” Shimizu said.

Advancing CCS

Carbon capture and storage (CCS) is not a new science in Alberta. Since 2015, operating projects in the province have removed 15 million tonnes of CO2 that would have otherwise been emitted to the atmosphere.

Alberta has nearly 60 proposed facilities for new CCS networks including the Pathways oil sands project, according to the Regina-based International CCS Knowledge Centre.

This year’s Nobel Prize in Chemistry went to three of Shimizu’s colleagues in Japan, Australia and the United States, for developing the earliest versions of materials like CALF-20 between 1989 and 2003.

Custom-built molecules

CALF-20 is in a class called metal-organic frameworks (MOFs) — custom-built molecules that are particularly good at capturing and storing specific substances.

MOFs are leading to new technologies for harvesting water from air in the desert, storing toxic gases, and capturing CO2 from industrial exhaust or directly from the atmosphere.

CALF-20 is one of the few MOF compounds that has advanced to commercial use.

“There has been so much discussion about all the possible uses of MOFs, but there has been a lot of hype versus reality, and CALF-20 is the first to be proven stable and effective enough to be used at an industrial scale,” Shimizu said.

It has been licensed to companies capturing carbon across a range of industries, with the raw material now being produced by the tonne by chemical giant BASF.

Carbon capture filter gigafactory

Svante Inc. has demonstrated its CALF-20-based carbon capture system at a cement plant in British Columbia.

The company recently opened a “gigafactory” in Burnaby equipped to manufacture enough carbon capture and removal filters for up to 10 million tonnes of CO2 annually, equivalent to the emissions of more than 2.3 million cars.

The filters are designed to trap CO2 directly from industrial emissions and the atmosphere, the company says.

Svante chief operating officer Richard Laliberté called the Nobel committee’s recognition “a profound validation” for the entire field of carbon capture and removal.

CALF-20 expansion

Meanwhile, one of Shimizu’s former PhD students helped launch a spinoff company, Existent Sorbents, to further expand the applications of CALF-20.

Existent is working with oil sands producers, a major steel factory and a U.S.-based firm capturing emissions from other point sources, said CEO Adrien Côté.

“The first users of CALF-20 are leaders who took the risk of introducing new technology to industries that are shrewd about their top and bottom lines,” Côté said.

“It has been a long journey, but we are at the point where CALF-20 has proven to be resilient and able to survive in harsh real-world conditions, and we are excited to bring this made-in-Canada innovation to the world.”

Alberta

Thousands of Albertans march to demand independence from Canada

From LifeSiteNews

Thousands of Albertans marched upon the province’s capital of Edmonton this past Saturday in the “I Am Alberta Rally,” calling for the province to immediately secede from Canada in light of increasing frustration with the Liberal federal government.

The rally saw an estimated 20,000 to 30,000 people march on the steps of the Alberta legislative building, demanding that a referendum be held at once to allow Alberta to leave Canada.

“We can’t delay. We can’t slow down,” well-known freedom lawyer Keith Wilson said at the rally as he spoke to the crowd.

“This is our moment. This is our future. For our families, for our children, for Alberta. Alberta will be free.”

The group behind the rally, the Alberta Prosperity Project (APP), bills itself as a sovereignty advocacy group. As reported by LifeSiteNews earlier this year, the APP wants to put Alberta independence to a question to the people via a referendum.

The rally also comes after certain members affiliated with the APP such as Jeffrey Rath and Dr. Dennis Modry earlier the month met in Washington, D.C. with cabinet-level U.S. politicians to discuss Alberta’s potential independence from Canada.

U.S. President Donald Trump has routinely suggested that Canada become an American state in recent months, often making such statements while talking about or implementing trade tariffs on Canadian goods.

The APP on July 4 applied for a citizen-led petition presented to Elections Alberta that asks, “Do you agree that the Province of Alberta shall become a sovereign country and cease to be a province in Canada?”

The group is hoping to have the referendum on the ballot as early as next year and has accused the Liberal federal government of encroaching on Alberta’s ability to manage its own affairs.”

The group says an independent Alberta would allow it to “keep our resources, grow our economy, and reinvest in Alberta families, businesses and infrastructure.”

As it stands now, the referendum question has been referred to the courts to see whether or not it can proceed.

Alberta Conservative Premier Danielle Smith does not support a fully independent Alberta. However, she does advocate for the province to have more autonomy from Ottawa.

As reported by LifeSiteNews, Smith said her conservative government will allow but not support a citizen-led referendum on independence.

Despite not advocating for an outright separate Alberta, Smith’s government has not stood still when it comes to increasing provincial autonomy.

Smith’s United Conservative government earlier this year passed Bill 54, which sets the groundwork for possible independence referendums by making such votes easier to trigger. The bill lowers the signature threshold from 600,000 to 177,000.

As reported by LifeSiteNews last week, Smith’s government introduced a new law to protect “constitutional rights” that would allow it to essentially ignore International Agreements, including those by the World Health Organization (WHO), signed by the federal Liberal government.

The calls for independence have grown since Liberal leader Mark Carney defeated Conservative rival Pierre Poilievre.

Carney, like former Prime Minister Justin Trudeau before him, said he is opposed to new pipeline projects that would allow Alberta oil and gas to be unleashed. Also, his green agenda, like Trudeau’s, is at odds with Alberta’s main economic driver, its oil and gas industry.

-

Business2 days ago

Business2 days agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

International1 day ago

International1 day agoStrongest hurricane in 174 years makes landfall in Jamaica

-

Business2 days ago

Business2 days agoFlying saucers, crystal paperweights and branded apples: inside the feds’ promotional merch splurge

-

Business2 days ago

Business2 days agoCanada’s combative trade tactics are backfiring

-

MAiD1 day ago

MAiD1 day agoStudy promotes liver transplants from Canadian euthanasia victims

-

Business1 day ago

Business1 day agoCanada has given $109 million to Communist China for ‘sustainable development’ since 2015

-

Internet1 day ago

Internet1 day agoMusk launches Grokipedia to break Wikipedia’s information monopoly

-

International2 days ago

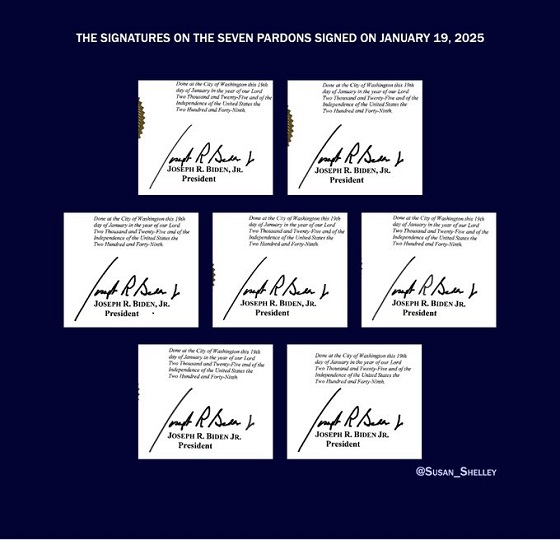

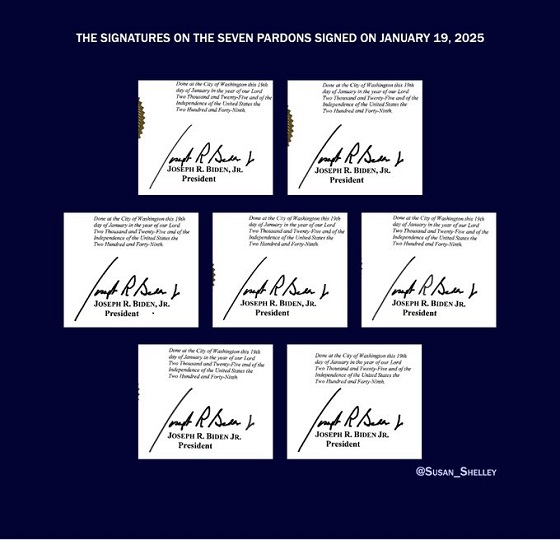

International2 days agoBiden’s Autopen Orders declared “null and void”